Hong Kong-listed Shin Hwa World, operator of Jeju Shinhwa World in Jeju, South Korea, has proposed a bonds issue in the amount of no more than HK$200 million (US$25.7 million) for the purpose of business development.

In a filing, the company said the proposed bonds – to be issued to investors – would come with a maturity date of 96 months (8 years) from date of issue with an expected interest rate of between 5% and 8%. They will, it added, “constitute direct, unconditional, unsubordinated and unsecured obligations of the company and shall at all times rank pari passu and without any preference among themselves.”

The company added that it was of the view that the proposed issue of bonds would provide it with an opportunity to raise long-term funds for its business development while broadening its source of funds.

Shin Hwa World, which has struggled to come anywhere close to reporting a profit in recent years, reported in June a loss of HK$231.5 million (US$29.7 million) for the six months to 30 June 2024, narrowed from a HK$394.3 million (US$50.5 million) loss a year earlier due to significant improvement in its gaming business. However, the gaming business itself still fell to a segment loss HK$55.8 million (US$7.2 million).

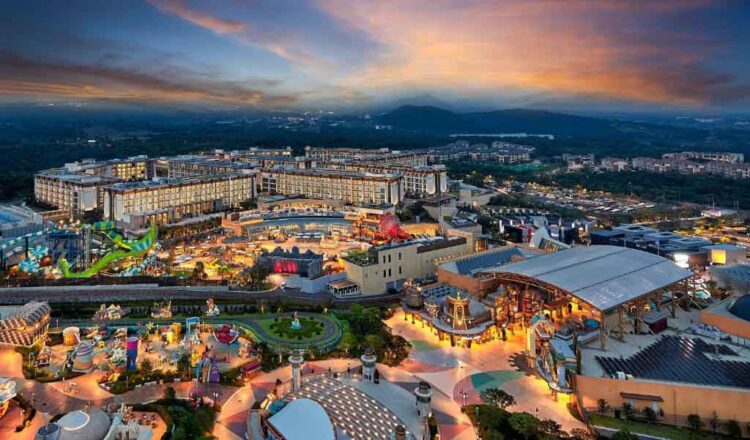

Jeju Shinhwa World’s offering include the foreigner-only Landing Casino, various hotels, a convention and exhibition centre, a retail mall, food and beverage outlets, a leisure and entertainment complex, a theme park and a water park.