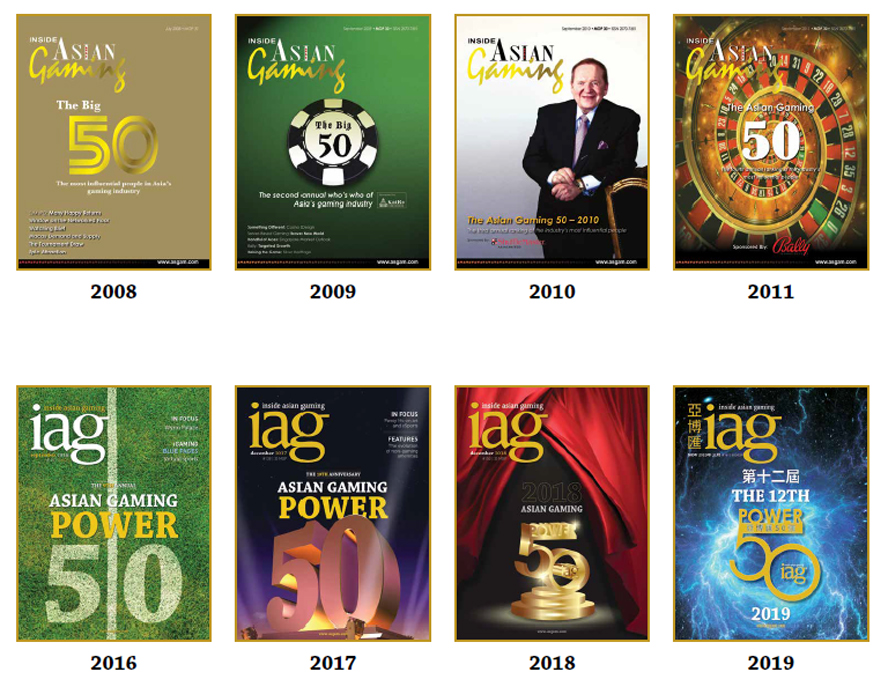

Long established as the definitive list of the most influential figures and personalities in the regional industry, IAG’s Asian Gaming Power 50 celebrates its 16th anniversary in 2023.

When the Asian Gaming Power 50 was first published in 2008, we could never have imagined that some 15 years later, it would have developed into one of the most anticipated releases on the Asian gaming calendar – with its very own glamorous black-tie dinner to boot.

After holding the Power 50 Black Tie Gala Dinner in Manila last year due to the pandemic – the very first time outside Macau – we’re back in Macau for 2023 now that China (and Macau) have finally dropped their zero-COVID policies. But the success of last year’s show in Manila has planted the seed, and we now intend to alternate between Macau in odd numbered years and outside Macau – the Philippines for the foreseeable future – in even-numbered years.

After holding the Power 50 Black Tie Gala Dinner in Manila last year due to the pandemic – the very first time outside Macau – we’re back in Macau for 2023 now that China (and Macau) have finally dropped their zero-COVID policies. But the success of last year’s show in Manila has planted the seed, and we now intend to alternate between Macau in odd numbered years and outside Macau – the Philippines for the foreseeable future – in even-numbered years.

The Power 50 began as a fun and innovative look at those who make our industry tick but it has now evolved into an important annual insight anxiously awaited by all. Compiling the Asian Gaming Power 50 list is an intriguing, demanding, educational and exhausting task yet one that comes with enormous responsibility, as the Power 50 has become the undisputed and definitive guide to the “big end of town.”

Ranking the big boys (and girls) from 1 to 50 is a difficult challenge at the best of times, but one made even more difficult given the enormous turmoil our industry has suffered during and since the pandemic. The economic impact of the pandemic has shifted the powerbase across much of the region, with Macau clearly the biggest loser while it rode out the COVID-zero storm. Of course, other jurisdictions also suffered during the pandemic, but Macau was undoubtedly the hardest hit. While the pandemic is clearly over, its after-effects are still being felt and it will probably be another 12 months before tourism patterns in Asia are fully settled and normalized.

Some of the biggest stories of the year, COVID aside, have included the “new Macau” under the 10-year concessions begun on 1 January this year, the booming Philippines, MGM’s approval in Japan, the rise of a UAE market and the ongoing regulatory storm in Australia. We’ve also seen the effective collapse of VIP and the rise of premium mass.

Some of the biggest stories of the year, COVID aside, have included the “new Macau” under the 10-year concessions begun on 1 January this year, the booming Philippines, MGM’s approval in Japan, the rise of a UAE market and the ongoing regulatory storm in Australia. We’ve also seen the effective collapse of VIP and the rise of premium mass.

As I’ve mentioned for the past few years, we’ve now seen the departure of Sheldon Adelson, Stanley Ho and Steve Wynn from our industry – the first two passing away after long lives and the latter well and truly removed from the company which still bears his name, and the industry as a whole. All three were moguls who shaped our industry. In the post Adelson-Ho-Wynn world, leadership and power is not quite so clear cut.

HISTORY AND INDUSTRY GROWTH

The birth of the Asian Gaming Power 50 in 2008 coincided with an evolution in the region’s land-based casino industry, coming 12 months after The Venetian Macao opened its doors in 2007.

Since then, a small parcel of land measuring just 7 square kilometres became the richest place on earth, now home to nine world-class integrated resorts: City of Dreams, Galaxy Macau, Grand Lisboa Palace, MGM Cotai, Studio City, The Londoner Macao, The Parisian Macao, The Venetian Macao and Wynn Palace.

This hugely successful Cotai integrated resort model spread like wildfire across the APAC region. In recent years the Philippines has been Asia’s fastest growing market, with its four Manila IRs – City of Dreams Manila, Solaire Resort & Casino, Okada Manila and Newport World Resorts (formerly Resorts World Manila) – along with Hann Casino Resort in Clark making it a clear number 2 on the Asian gaming scene.

In Singapore, Resorts World Sentosa and Marina Bay Sands are now world-renowned landmarks and amongst the most profitable IRs in the world.

Despite the regulatory problems the industry in Australia has suffered in recent years, the product offering has strengthened substantially, with the impressive Crown Sydney opening its doors for gaming last year and dominating the skyline of Australia’s largest city. Between them, the three major Australasian companies – Crown Resorts, Star Entertainment and SkyCity Entertainment – operate a significant stable of casinos and IRs.

In Cambodia, NagaWorld enjoys an effective monopoly, disregarding the multitude of small properties on the Thai and Vietnamese borders. However, its post-COVID recovery is slow, and the massive US$3.5 billion Naga3 expansion has been delayed for years.

Paradise City, Jeju Shinhwa World and Jeju Dream Tower have introduced the integrated resort concept to Korea, and we should see Inspire open at Incheon by the end of this year.

Meanwhile, Vietnam is home to the nation’s first casino at which locals are permitted to gamble, Corona Resort & Casino, as well as The Grand Ho Tram Strip and Hoiana, the latter welcoming its first guests in mid-2020.

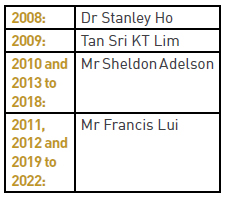

Despite such incredible development across the APAC region, only four people have sat atop the Asian Gaming Power 50 over the past 14 years. They are:

Despite such incredible development across the APAC region, only four people have sat atop the Asian Gaming Power 50 over the past 14 years. They are:

CHANGE IS PERENNIAL

The Power 50 list is not a place for people to rest on their laurels. While company longevity and/or executive tenure is a small factor, the list predominantly focuses on the activities of the prior 12 months. It’s all about “what are you doing now?” and “what have you done lately?” not “what have you done in the last 15 years?” As such the Power 50 list is very dynamic as people move up, and down, and on, for a multitude of reasons.

A persistent phenomenon during the making of the list each year is the “My business has grown therefore I should move up the list” fallacy. The truth is everyone lifts in a rising tide. COVID aside, most people on the list are managing businesses that grow each year, and just to maintain a spot on the list requires annual growth. Someone doing the same thing year after year and achieving zero-growth results will slowly slip down the list as the years roll by.

The glaring exception to this ongoing growth paradigm has been Macau, and this is reflected in the list. Many Macau leaders have fallen down the list due to COVID, with the average Macau power score (see explanation below) being perhaps half of what it was in 2019. But with the Macau recovery now in full swing, next year should see rising fortunes once more.

HOW DOES THE JUDING PANEL DETERMINE THE RANKINGS?

We have been asked this over and over across the years – and continue to be asked. Despite the fact we’ve explained it many times – let’s explain yet again!

Even though the judging panel has become quite adept at putting this list together over the years, the task of ranking industry leaders seems to get more complex as the Asian gaming industry matures and becomes more nuanced. How on earth does one compare the sole owner of a smaller property to the brand new “hired help” COO of a much larger one? How about comparing a large property that is still in pre-opening to a smaller one that has been active for years? The CEO of the Hong Kong Jockey Club versus the head of a private casino company versus the President of a casino chain in Korea that doesn’t have locals gaming? And how should online and offline gaming be compared? These are the types of tough questions the selection panel of the Asian Gaming Power 50 wrestles with every year.

As with any such ranked list, there are always criticisms and objections, usually from those who feel slighted. We often hear claims of not reading the list or not caring about it, but we are often sent messages, sometimes directly but more often through surrogates, bemoaning the injustice of a perceived lowly position and lobbying for the following year. Some lobby us to not be on the list as they feel it raises their profile too much. But no one ever contacts us to complain about being ranked too high!

The rankings include a numerical “Power Score” for each person on the list. The calculation of this score is a mix of science and art. Points arise from a number of factors including the GGR and Adjusted EBITDA of the person’s organization, a weighted dissection of those points between the top senior executives with key policy control of that organization, adjustments for whether the person is hired or has a major equity position, their length of tenure, how active in business initiatives the person has been in the prior 12 months, the long-term gaming pedigree of the person, the jurisdiction in which he or she operates, and many more. Some factors are necessarily subjective, but we’ve always assigned a points value to strive for as much objectivity as possible.

We do all this without any predetermined idea of where any person should or should not be ranked.

At the end of the day, in our industry the concept of “power” generally comes down to direct or indirect control of money. The greater the GGR and EBITDA controlled, the greater the power. But it’s not all about those factors, many other factors also come into play in adjusting the final power score.

And what, exactly, is control? It’s about influence, it’s about who is the ultimate decision maker, and sometimes it’s simply about who is the person everyone in the room looks to for answers. In the same way that a country is a country because other countries say it is, some people are powerful simply because other people say they are.

Finally, I’d like to take this opportunity to thank my fellow judging panel members for their tireless work and excellent insights. And so, without any further ado, we present the 16th edition of the Asian Gaming Power 50. Enjoy!

Here are some other questions that have arisen during the selection process:

What countries count as Asia?

The Power 50 list covers the entire IAG APAC coverage region, which we define broadly as approximately one-third of the globe – from the Middle East to the International Date Line.

What about non-operators who have a strong voice in the industry, like regulators, media commentators, analysts, academics, suppliers, consultants, gaming lawyers and so on?

Over the years we have carefully considered the power wielded by leaders in these industry sectors and concluded firstly that it was impossible to include regulators (PAGCOR’s Alejandro Tengco earned his position on the list purely as an operator, not a regulator). Likewise, even taking the power of people in all the other sectors into account, it was only direct operators who made it into the top 50.

How do you pick between the owner/CEO and the COO of a company?

Many gaming companies have a charismatic and entrepreneurial owner/CEO and a perhaps more seasoned and level-headed gaming professional in charge as President and/or COO. By default, being an owner necessarily ranks many more Power Score points. After all, the owner can always force an appointed COO out of his job. But in some instances, a hired COO can effectively wield more power than their “boss” when the owner delegates a very large proportion of decision-making responsibility. The answer is decided on a case-by-case basis.

For the full list of 2023 Asian Gaming Power 50 winners, click here.