[1-10] [11-20] [21-30] [31-40] [41-50]

Sheldon Adelson isn’t one of the industry’s own. He made his fortune producing and selling trade shows. He’s the great casino showman he is, one of only a handful, because he is never content merely to exploit markets, he’s driven to envision new ones, and like all great entrepreneurs he must continually challenge himself to summon them into existence.

It was conventions, not gambling, that brought him to Las Vegas. He had the Sands Expo, the largest privately owned convention center in the world, and he wondered if it was possible, with the right product, to change how Las Vegas hotel rooms were marketed. So he set about inventing a resort for transforming rooms from comps into machines for printing money. It would redefine commerce on the Strip.

When he came to the other side of the world and they pointed him to a swath of reclaimed marsh land between the two small Macau islands of Taipa and Coloane, which the government thought might be suitable for a fireworks factory, he saw the one thing Macau, for all of its action and money, didn’t have – the space to create a cluster of resorts on a Las Vegas scale.

This is what you do when you’re from the outside, as Mr Adelson is, and you look at things as he does – from the outside. He creates resorts that change the way people think about markets. They set new standards. They are icons. He has built them in Vegas, in Singapore, in China twice: with Macau’s first Western-style casino for the masses and its first themed megaresort.

Macau, as we know, has never been the same.

The Venetian Macao was the seventh-largest building in the world when it opened in August 2007. The immensity of it – 3,000 rooms and suites, 3,400 slot machines, 800 table games, 150,000 square meters of retail, 110,000 square meters of meetings and convention space, a 15,000-seat arena – opened everyone’s eyes. There was the Cotai Strip, just like that. And suddenly it was possible to imagine a market liberated from the claustrophobia of those smoke-filled baccarat rooms, the remorselessness of them, their inherent limitations. Macau could be someplace fantastical, magical, where you could spend a lot of money but you could have fun, a place to bring the kids and take pictures to send back home, where casinos could make money in ways that didn’t exist in Macau before.

Does he do it again with The Parisian Macao? It’s not a fair question anymore. Not even at US$2.7 billion. It’s a different world. The unbridled gambling demand, that’s gone, probably for good.

But maybe that’s as much as saying that Mr Adelson may be closer than he’s ever been to getting it precisely right. There is nothing in the market like The Parisian and should it outshine The Venetian he will have surpassed himself. He will have come full circle. His greatest feat.

As he said recently, “Our goal to create a large-scale leisure and business destination in Macau, which started with the opening of The Venetian nearly 10 years ago, will be fully realized when The Parisian opens its doors. It’s unlikely another tourism development with the size and scope of the Cotai Strip will ever be achieved again.”

There is no gaming operator in Macau other than Sands China with the assets to make a greater impact on the territory’s future than Francis Lui’s Galaxy Entertainment Group.

Galaxy has committed HK$100 billion to that future. It has spent more than HK$40 billion to date and it has the largest land bank on Cotai with a store of cash and liquid investments exceeding $11 billion to bring off the rest. Plans are to break ground this year on Galaxy Macau Phase 3, which will position the company as a major player in meetings and conventions. A fourth and final phase will begin taking shape in 2017. And real estate has been amassed on Hengqin Island for development of a non-gaming resort on the scale of Chimelong.

At Galaxy Macau and its adjoining Broadway Macau, GEG has spent HK$43 billion to date to assemble a sparkling 3,700-room resort complex on Cotai that was first in the market to deliver on the natural synergies between luxury hotel brands – Okura, Banyan Tree, Ritz-Carlton – and the aspirations of the mainland Chinese consumer. The total package – now encompassing some 120 restaurants, bars and lounges, more than 200 shops, an expansive rooftop area with a white sand beach and wave pool and waterthemed amusement rides – finds the company five years into its investment ensconced as the market leader in VIP and possessing the scale and diversity to ensure it stays aligned with Macau’s evolution as a tourist destination for the masses.

Best-known as a purveyor to the high end, GEG is pivoting skillfully with the collapse in VIP demand orchestrated by Beijing to build up its share of citywide mass gaming revenue to record levels. This is thanks to the steady ramp-up of 2015’s Galaxy Macau Phase 2 expansion and a skillful repositioning of StarWorld that has seen mass table drop at the resort on the Macau peninsula soar by doubledigits this year. Significantly, the company also has achieved the cost cuts it budgeted for the entire year, HK$800 million worth, with no discernible impact on its vaunted service levels, and it expects to realize HK$300 million more before 2016 is over.

What all this speaks to is planning and execution of the highest order. These have been the hallmarks of Mr Lui’s administration. What’s unique about that is the 61-year-old scion of Hong Kong construction magnate Lui Che Woo was educated as a civil and structural engineer, not a gambling operator. But the family was extremely prudent in its approach to entering Macau, partnering initially with Las Vegas Sands then taking a full two years to learn all it could as licensor of the City Clubs casino group before taking the plunge with StarWorld as both operator and owner.

Clearly, Mr Lui is making the most of his schooling.

When Macau does finally rebound, maybe sooner rather than later if August’s return to the black is any indicator after 26 straight months of year-on-year declines, Mr Lui and co will be there with the depth and quality of product to pursue an oversized share.

Lim Kok Thay has taken the family business global. In 1965, his father Lim Goh Tong began building the road from the Malaysian town of Genting though the jungle to what’s now Resorts World Genting, a road Genting Group has extended under the Resorts World brand to Singapore, London, Manila, New York, Bimini and Birmingham. Jeju and Las Vegas are also in the works and perhaps Massachusetts and Miami as well.

Critics note one big name missing from that list: Macau. Without an outpost in the world’s largest casino hub, Genting can never be a first tier player, some say. That’s fair fodder for parlor debate but cold, hard figures place Genting and its 65-year-old boss at the forefront of Asian – and global – gaming.

By the numbers, Genting is massive, with five interlocking listed companies in Malaysia, Singapore and Hong Kong with private family vehicles such as Kien Huat Realty ensuring control. In 2015, the group had US$4.2 billion in revenue, US$1.2 billion in EBITDA and US$762 million in net profits, plus a cash pile of US$5.5 billion – all deflated by a 23% fall in the Malaysian ringgit. For all its breadth, including Crockfords in London’s plush Mayfair district, dozens of UK regional casinos, a 6.6% stake in Australia’s Star Entertainment (formerly Echo) – with approval from regulators to buy up to 23% of the Sydney and Queensland operator – Genting still relies on Singapore and Malaysia for 75% of EBITDA and 72% of revenue. Neither operation looks likely to grow much or fast, spurring diversification in earnest.

In the Philippine capital, Genting Hong Kong is completing a US$650 million expansion of its Resorts World Manila joint venture that also holds a plot for RW Bayshore in Entertainment City, unlikely to open before the end of this decade. In South Korea, the US$1.8 billion RW Jeju joint venture opens in phases from next year.

Genting HK also aims to make a bigger splash in the cruise business, where Mr Lim reportedly cut his company teeth. Last year, it completed swapping its share of Norwegian Cruise Lines for full ownership of Crystal Cruises, a luxury specialist, and announced Dream Cruises, “the first-ever Asian based premium cruise line brand.” They join Star Cruises, with gaming revenue of around US$300 million, Genting’s “contemporary” market entry. Genting has purchased a shipyard to support its sailing ambitions.

Amid these big plays in Asia, Mr Lim – who succeeded his father in 2007 – is directing a multi-pronged growth offensive in America, recalling the family history as a key lender to tribal casino Foxwoods in the early 1990s. On the Strip, construction of US$4 billion Resorts World Las Vegas heads toward a 2019 opening. In Florida, Genting has a 30 acre waterfront land bank from which it hopes to create Resorts World Miami, despite opposition from Disney and tribal casinos. Slots parlor Resorts World New York, near Kennedy Airport, keeps pushing to add hotel and convention facilities. Through Kien Huat, Mr Lim won a gaming license two hours north of New York City. In Massachusetts, Genting is in a race with Wynn Resorts and MGM to open the state’s first casino, tapped to run the Mashpee Wampanoag tribe’s US$1 billion First Light in Taunton, south of Boston, a plan facing legal hurdles.

It’s a vast empire and Mr Lim holds it together.

More than ever, Lawrence Ho stands alone at the top of Melco Entertainment and at the confluence of several key currents in Asian gaming. The spotlight burns even brighter on the eldest living son of legendary casino kingpin Stanley Ho, brought into the gaming business from banking as his father sensed liberalization of the casino market might demand fresh ideas. The son displays his father’s diplomatic and political skills, but times may demand more of Stanley Ho’s business instincts and the iron fist inside that velvet glove.

Crown Resorts’ sell-down of its stake in the NASDAQ listed joint venture has made Mr Ho Melco Crown’s sole Chairman. But he was already the CEO and former co-Chairman James Packer has always explicitly asserted his cohort’s primacy in the company.

Under Mr Ho’s leadership, Melco Crown has developed a clear style for its resorts. City of Dreams in Macau and Manila plus the 60% owned Studio City, opened at the south end of Cotai last October, all have strong entertainment components. CoD Macau has the US$250 million House of Dancing Water spectacle and Club Cubic, a big name locally. CoD Manila has international clubs Pangea and Chaos plus the world’s first DreamPlay indoor adventure park based on DreamWorks characters. Studio City has a Batman ride, Warner Bros Fun Park and famed Ibiza nightspot Pacha.

Melco Crown’s inclinations fit Macau and Beijing government prescriptions for diversification beyond gaming, as well as the company’s penchant for experimentation. CoD Macau is adding Cotai’s first street front retail, plus a dramatic new hotel tower with nearly 800 rooms designed by the late Zaha Hadid. Studio City’s shock decision to open with no VIP tables seemed like another bold experiment, keeping with CoD’s pioneering focus on premium mass play. But the plan to upgrade some of those tables to VIP to enable smoking was quickly scuppered when regulators revealed their table grant was for mass market only.

Entertainment and non-gaming haven’t necessarily been immediate money spinners but they do create an identity and loyalty. Melco Crown’s Macau properties, including Altira and Mocha Slot Clubs, improved EBITDA by 8% in the second quarter to US$209 million while CoD Manila nearly tripled to US$36.5 million. That’s all good.

However, Sanford Bernstein points out that Studio City faces a potential breach of bond covenants without a substantial uplift in business – bond prices for the property’s 40% partner New Cotai fell to alarming levels in August. In response, Studio City is now planning to add VIP tables while the opening of next door neighbor the Parisian this month will help get traffic moving in its direction. Analysts say the simplest fix for Melco Crown would be to buy out its partner and get the full benefit of the property. New Cotai, albeit with different leadership, held up development of Studio City for the better part of a decade by insisting on getting its price for its asset.

Through Melco International, his Hong Kong listed side of Melco Crown, and other entities, Mr Ho has a casino in Vladivostok’s Primorsky Integrated Entertainment Zone and ambitions to operate in Cyprus and Spain. By different measures, each is a far tougher market than Macau. No doubt Mr Ho has the pedigree for grit and strength. The time to show them is now.

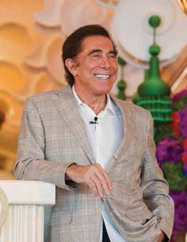

When Wynn Palace opened last month, the man who was so important to Las Vegas’ transformation into a world destination put the finishing touches on a legacy in Macau that time will show to be every bit as unique.

There are no thrill rides at Wynn Palace – no Disney characters, no superheroes, no booming, rumbling IMAX theater, no mock-up of some wonder of the world, no obvious “theme.”

“Casinos are not for children,” Steve Wynn told Bloomberg on the eve of its debut. “This is an adult resort, this city of Macau. There are better places for kids than Macau or Las Vegas.”

As he put it, it’s not about stuffing a place with attractions geared to perceptions about the mass market. He said, “I’m trying to appeal to everybody in the world, and make them say, ‘You gotta go to Macau and stay in this hotel. It’s the greatest experience you can imagine.’ That is the definition of diversification.”

Six years and US$4.2 billion in the making, Wynn Palace is what Steve Wynn the master hotelier and designer has always longed to build.

It cost him too. When the Macau government decided how many new to market tables to grant within the limits of an official cap on new supply of 3% a year, Wynn Palace received 150 tables – the smallest initial allocation yet of the new resorts in Cotai and 100 fewer than those awarded to Galaxy Macau Phase 2 and Studio City 12 months earlier.

“We spent, without exception and without any possibility of contradiction, more money on non-casino attractions in Wynn Palace than has ever been spent on any facility of that sort on planet Earth,” Mr Wynn said on Wynn Resorts’ second-quarter earnings call.

Just not the right ones, from the government’s point of view.

As it stands Wynn Palace has been awarded 100 tables immediately with 25 more tables next year and another 25 in 2018. Until then, it will take 250 tables from Wynn Macau on the Macau peninsula. So nobody with the requisite bankroll will fail to find a game.

And bankroll is the operative word – for not only will Wynn Palace enhance the cachet the Wynn name has long enjoyed among VIP gamblers at its Forbes Five Star resorts on the peninsula, it positions the company as it has never been positioned before to compete for an outsized share of the high-rolling cash play known as “premium mass,” which is where the real money is.

It is “arguably the most beautiful hotel in the world,” Mr Wynn boasted on opening night with the unabashed pride of a man who in the fullness of age finds himself a father again.

Factor in the other hallmarks of the brand – the accomplished management, the deep training at all staff levels, the legendary customer service – and you have to figure they’re holding aces. Even in the midst of a market slide as protracted and painful as Macau’s you’d be hard-pressed to find many willing to bet against that.

She’s been profiled in The Wall Street Journal, interviewed by Bloomberg, has graced the cover of Forbes Asia, is one of the world’s richest women, one of the 50 wealthiest individuals in Hong Kong and one of the most powerful people in the largest casino market on the planet. But her influence extends well beyond that to the larger commercial life of the Pearl River Delta and to government and community affairs. Angela Leong really is in a league of her own.

A Guangzhou native, army officer’s daughter and the last of Dr Stanley Ho’s wives, Ms Leong emerged five years ago from a bruising family battle over the ailing tycoon’s fortune as the largest individual shareholder of Hong Kong-listed SJM Holdings – effectively, the heir to Mr Ho’s casino empire.

She was already wealthy by then. And she’s a lot wealthier now. The real estate portfolio she’s amassed over the years, mostly in Hong Kong, Macau and close-in mainland China, was recently valued by Forbes at nearly US$3 billion. The magazine says she’s worth more now than when SJM’s stock price was peaking in 2014.

It’s a measure of her stature that she has been thrice elected to the Macau Legislative Assembly, where she’s been a forthright voice for the industry and its employees. She is a member of the elite committee of 400 that elects the Macau chief executive. She also holds seats on the Jiangxi Provincial and Zhuhai Municipal committees of the Chinese People’s Political Consultative Conference. Her position as head of a trade group representing junket promoters is but one acknowledgement of the value other people of power assign to her friendship.

Her gaming holdings include a significant stake in SJM’s operating subsidiary, Sociedade de Jogos de Macau, where she serves as Managing Director, and she controls one of the largest personal stakes in STDM, the conglomerate that ran Stanley Ho’s casinos in the monopoly days and is still SJM’s largest investor. She is vice chair of the Macau Jockey Club. She owns gaming bricks and mortar, too: the 56-story L’Arc Macau, which houses one of 14 casinos that operate independently under the SJM umbrella; and the Jai Alai complex near the Macau Ferry Terminal adjoining SJM’s fairly sizable Casino Oceanus (200 table games, 440 slots). Jai Alai, with SJM as the lessee, is slated to open later this year after a lengthy reconstruction, providing the company with 130 sorely needed hotel rooms, a welcome complement of restaurants and shops and more mass-market tables.

Count on Ms Leong’s impact to continue to be profound as SJM moves forward, especially as the company gets ready to make its mark on Cotai with the 2,000-room Grand Lisboa Palace, scheduled to open in late 2017 at a projected cost of US$3.8 billion. She owns land adjoining the under-construction resort which SJM wants to acquire. The 70,500 square meters allotted the Palace is the smallest granted to the six gaming concessionaires on Cotai. Ms Leong’s parcel measures 200,000 square meters. There was talk at one time of an amusement park at the site and she has said she’d still like to see something of a family nature there. SJM’s negotiations with her are reported to be ongoing.

On the surface at least, there appears to be somewhat of a logjam of power inside the MGM bubble, with MGM Resorts boss Jim Murren wielding ultimate control and key shareholder Pansy Ho also voicing her well-earned opinion. But on the ground there is no doubt it is MGM China CEO Grant Bowie making the day to day decisions that truly impact the company’s direction in Macau.

And while MGM may comprise the smallest piece of the puzzle when it comes to Macau’s six concessionaires, it’s no mean feat that Bowie stands tall and proud as the ranking non-Chinese among them – owners aside.

The respect the 58-year-old commands comes on the back of his two decades of experience in the casino industry in Australia. An Adjunct Professor in Tourism and Leisure Management at the University of Queensland, he has also played a key role in Macau’s development. He first arrived in 2003 where he spent five years as President of Wynn Macau – overseeing Wynn’s opening in September 2006 before eventually joining MGM China in 2008.

Bowie’s tourism background has been there for all to see in the wake of declining Macau revenues. While some of his industry peers have, at various stages, expressed exasperation at the government’s push for diversification, MGM’s intrepid leader has long taken a different tack.

“This change in market conditions is the best thing that could have happened to Macau,” he said last year. “It’s going to create the greatest opportunity we’re ever going to have to actually be able to respond to the changing nature of the Chinese consumer and therefore be price setters rather than just order takers.”

At the time, Bowie noted that Macau’s current retail offerings had grown stale, suggesting the company’s under-construction MGM Cotai resort – due to open in 2Q17 – would look for alternatives to the same old luxury brands found in pretty much every other Macau property. That proposal seems in line with last month’s revelation that MGM Cotai would me mass only.

“We’ve already made the decision that we’re … opening with only mass tables and that’s obviously the basis of where we see the future of Macau. That’s the decision we’ve taken at this time and we’re going to walk forward as being a mass-only property,” he told reporters in early August.

Yet for all of Bowie’s business acumen, MGM remains stifled by its size and space limitations with the company’s Peninsula property boasting just 582 rooms. Its cause hasn’t been helped by twice having been forced to push back the launch date for MGM Cotai from late 2016 to 1Q17 and now 2Q. MGM China’s revenue for the first six months of this year fell 22% year-on-year despite a hotel occupancy rate of 95%.

At least MGM Cotai will quadruple the number of rooms, however the figure that really matters will likely be the property’s table allocation. Bowie has certainly been saying all the right things by positioning MGM Cotai as mass market only. If the government likes what they see, that might be enough to match the 250 new tables offered Galaxy Phase 2 and Melco Crown’s Studio last year.

If not, the 150 tables recently allocated to Wynn Palace and the Parisian is likely to be the mark. Until then, breath will remain bated.

There are few leaders of Macau gaming who know the market better than Ambrose So. There are fewer still who have wielded the influence he has in the market for as long as he has.

His involvement with Stanley Ho’s casino empire spans four decades. He joined SJM Holdings’ monopoly predecessor, STDM, in 1976 and was a long-time director of the Hong Kong-based conglomerate. He’s been in senior management at SJM since its founding in 2002 and was named an executive director in 2006. He also chairs the company’s casino operating subsidiary, Sociedade de Jogos de Macau. Corporate-wide, the responsibility for overall management and strategic execution is his.

And it’s been tested mightily the last couple of years.

None of the six gaming concessions has felt the ravages of the VIP decline more acutely than the house that Ho built. This is in part because SJM inherited from STDM a business model one might characterize as traditionally Chinese – the largesse gets spread among a host of loyal subcontractors, which these days finds SJM dependent for more than half its gaming revenue on casinos (14 currently) that are managed independently. The three casinos the company operates, which include Grand Lisboa – the corporate flagship and the largest and most lavish of the group – are confined to the Macau peninsula and burdened with space limitations that prevent them from competing to full effect against the new megaresorts opening in Cotai. Compared with a year ago, gaming revenue was down 20.7% company-wide in the six months through 30 June. At this pace the company will end 2016 with gaming down a dizzying 52% from its peak in 2013.

Of course, everybody else is way down, too, and SJM has held its own, consistently finishing in the top three in total gaming revenue and second in VIP. This will be difficult to maintain as more competition comes on line on Cotai. But you can bet that between now and 2018, when SJM unveils its own Cotai extravaganza with Grand Lisboa Palace, Mr So and his team will continue to do what they’ve done so well: evaluating and re-evaluating the game mix (mass-market table revenue actually surpassed VIP in the first half), expanding player loyalty programs, reinvesting in the physical plant and exploiting efficiencies in costs.

And as a protégé of the revered Dr Ho, Mr So can be counted on to ensure SJM remains a good corporate neighbor in the best traditions of the culture. In this respect, his personal and professional roots run deep. He is a founding honorary director of The University of Hong Kong Foundation for Educational Development and Research. He founded the Association of Chinese Culture and Art of Macau. He is also a member of the Macau government’s Cultural Consultative Council. He sits on the boards of more than a dozen companies in Macau, Hong Kong and mainland China. He is a member of the National Committee of the Chinese People’s Political Consultative Conference, a member of the Economic Development Council of the government of Macau and he chairs the city’s ports administration.

In just over a year, James Packer has stepped down as Crown’s Chairman, resigned as a company director, backed a reorganization plan to separate Crown’s Australian assets from holdings in Macau and Las Vegas and last month sold down his stakes in Crown from 53% to 48.2% for AU$448 million. Additionally, as a consequence of Crown selling down its stake in Melco Crown from 34.3% to 27.5% (for US$801 million), Mr. Packer was demoted from co-Chairman with CEO Lawrence Ho to the newly created post of Deputy Chairman. That’s his only remaining gaming post in the region. But Mr Packer’s status goes well beyond titles.

As the son of legendary publisher and punter Kerry Packer, he is Australian business royalty (the Crown sale reportedly helped Mr Packer pay for a settlement of their father’s estate with sister Gretel).

Mr Packer raised his status by pivoting out of media to raise his bet on casinos, an instrumental move in building Crown into an AU$9 billion company atop the Australian casino business. Most recently, his force of will enabled Crown to break rival Star Entertainment’s monopoly in Sydney, Australia’s largest city. The AU$2 billion resort at Barangaroo on Sydney Harbor, featuring a 71 story tower and due to open in 2021, promises to reinforce Crown’s position as Australia’s leading casino operator. Mr Packer’s presence and presumed influence made Crown the favorite for the Brisbane Queen’s Wharf redevelopment, even though it was competing on Star’s home turf; Star’s win rated as a major upset.

Crown’s early recognition of the potential impact of Asian markets helped fuel its growth. In Melco Crown, though, Mr Packer has played a secondary role. Asked last October at Studio City’s opening how he’s benefited the joint venture, Mr Packer replied, “I think I was helpful getting the sub-concession from Steve Wynn” in 2006, adding that Crown had provided financial stability during the global crisis of 2008-09. That’s all relatively ancient history.

Where does Mr Packer go from here? When he quit the Crown board, he declared he remains “passionate” about Crown, aiming to focus on the Barangaroo project, Crown’s online platforms and its 73% owned Alon on the Las Vegas Strip. Mr Packer is co-Chairman of the US$2 billion project on the site of the former Frontier hotel, seeking to reverse his record of Sin City failures. Two years after its announcement, Alon is still in search of funding, with Crown believed to be keen to reduce its stake.

Consolidated Press Holdings, the private vehicle that holds Mr Packer’s Crown shares, stated in announcing the sale in August, “Consolidated Press remains deeply committed to Crown Resorts and is excited about the future of the company” with Mr Packer’s chosen leadership in place.

Using these conflicting signs to plot Mr Packer’s path may prove pointless. After all, he’s 48-years-old, living in Los Angeles and by Forbes’ count worth more than US$4 billion. He is also a Hollywood producer via RatPac Entertainment – which for Studio City’s opening created short film The Audition starring Robert De Niro, Leonardo DiCaprio, Brad Pitt and director Martin Scorsese for an estimated US$70 million – not to mention the fact that he is engaged to Mariah Carey. In Asian gaming and just about anything else he surveys, James Packer’s next move will be whatever he wants it to be.

Sands China President and COO Wilfred Wong has been everything the company could have hoped for in the run-up to the opening on Cotai this month of the US$2.7 billion Parisian Macao.

A seasoned, politically connected construction and property executive, he was appointed last September and when he formally took over on 1 November – succeeding Las Vegas Sands President Rob Goldstein, who was filling in after Ed Tracy retired – it marked the first time LVS had given the keys to its biggest money-maker to someone from outside the industry. Perhaps more significantly, it was also the first time the job of managing its Chinese subsidiary had gone to someone Chinese.

But LVS and Mr Wong were far from strangers. Hong Kong based Hsin Chong Construction Group, whose board of directors he chairs, has had a hand in the construction of every LVS casino in Macau, according to Hsin Chong, and its Hsin Chong Engineering (Macau) unit has been an important contractor on the Parisian.

Mr Wong has held positions in top management at Sands rival Lui Che Woo’s K. Wah International Holdings; in Henderson China Holdings, a privately owned, Hong Kong-based company engaged in property development and management in the PRC; in Shui On Group, whose holdings include property development, construction and construction materials in Hong Kong and on the mainland; and in Synergis Holdings, a Hong Kong-listed subsidiary of Hsin Chong specializing in property management and maintenance. He also chairs the Pacific Basin Economic Council, an influential alignment of corporations advising governments in the region on ways to improve their business environments and reduce trade barriers.

As LVS Chairman and CEO Sheldon Adelson noted in a statement at the time of his appointment, “Wilfred has a unique combination of private and public-sector experience we think will be invaluable to the company at this point in our history.”

LVS and Sands China have suffered a few dings to their public image over the years. LVS has faced US government investigations (the Las Vegas operation was heavily fined at one point for significant lapses in its AML compliance) and has endured more than one high-profile lawsuit casting a shadow on its dealings in China. As it seeks a smooth path to the renewal of its Macau gaming concession in 2022 and government support for future developments it’s not going to hurt to have a mover and shaker of Mr Wong’s caliber advancing the cause with the powers that be locally and in Beijing.

It’s a role to which the Harvard graduate brings a career in public service that is as distinguished as it is long. He served as Hong Kong’s Deputy Secretary for the Civil Service and Deputy Director General of Industry. He was intimately involved in the restructuring of the territory as a Special Administrative Region of the PRC as a member of The Basic Law Consultative Committee, a member of the Preliminary Working Committee for the Hong Kong SAR Preparatory Committee and a member of the Preparatory Committee. When the SAR was founded in 1997 he was one of its deputies to the National People’s Congress and held the seat for 15 years.