A civil lawsuit launched against 11 former and current directors of Australia’s Star Entertainment Group will highlight the challenges directors can face in appropriately aligning their “business judgement”.

Last month’s announcement that the Australian corporate regulator, ASIC, has initiated civil proceedings against 11 former and current executives and directors of ASX-listed Star Entertainment was hardly a surprise, given the earlier findings of the Bell Inquiry into the licensee of the company’s Sydney casino. ASIC has alleged that each defendant has, on multiple occasions, failed to exercise a reasonable level of care and diligence in the discharge of certain of their functions, thereby contravening section 180 (1) of the Corporations Law.

The so-called “business judgement” rule contained within section 180 (2) is a defense to any action alleging a breach of the statutory duty imposed upon directors and officers of a company. A business judgement may be either a decision to do something (for example, to contract with an offshore junket operator), or not to do something (such as terminate an association with a junket operator when it would be reasonable to do so).

The so-called “business judgement” rule contained within section 180 (2) is a defense to any action alleging a breach of the statutory duty imposed upon directors and officers of a company. A business judgement may be either a decision to do something (for example, to contract with an offshore junket operator), or not to do something (such as terminate an association with a junket operator when it would be reasonable to do so).

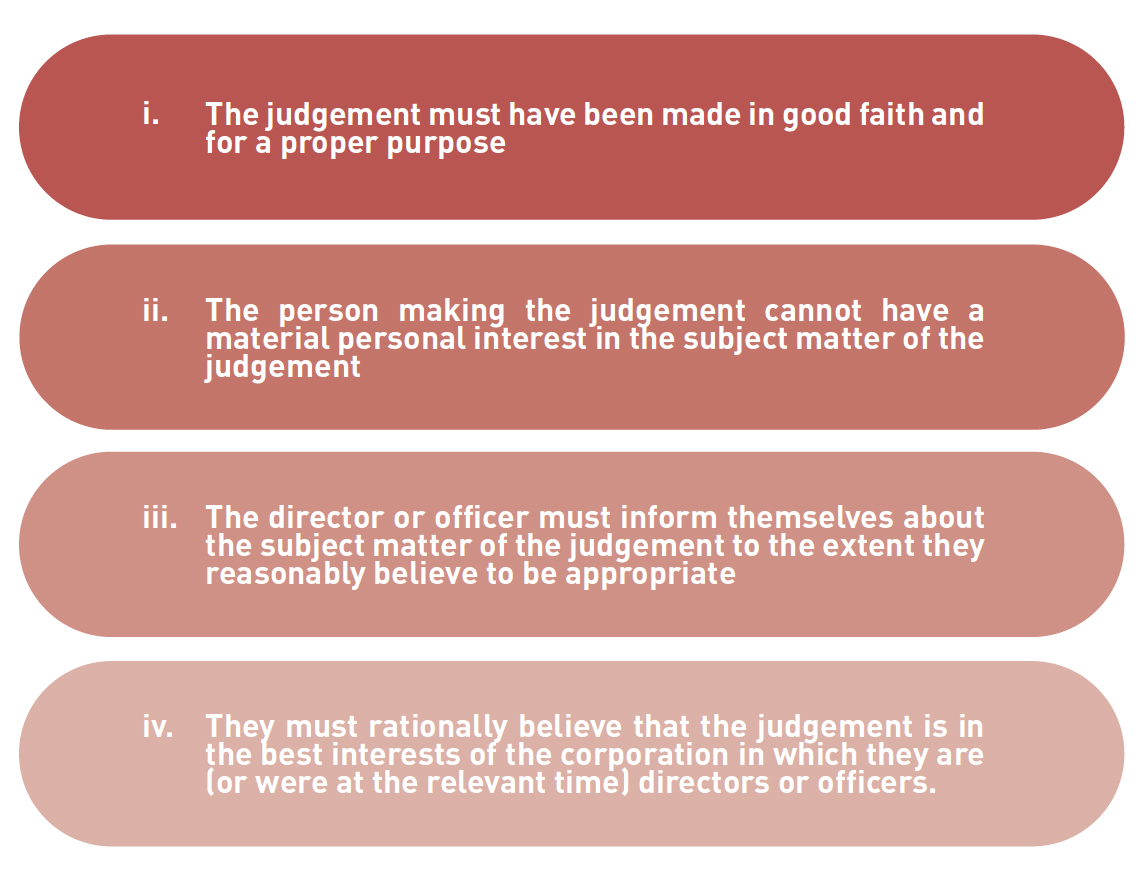

In order to successfully mount the business judgement defense, there are four criteria which must be satisfied, as follows:

Of the four criteria, the first two are essentially questions of fact, and therefore particular to the individual raising the defense. The third and fourth criteria are however clearly subjective, hence the terms “reasonably believe” and “rationally believe”. Taken together, judicial authority suggests the two criteria require any judgement complained of as constituting a breach of the statutory duty of care and diligence to be evaluated in the context of factors such as the importance of the decision (whether financial, reputational or otherwise), the information available to inform the decision, the time and expense involved in obtaining further information, and the skills and capabilities of the individual exercising the judgement.

Of the four criteria, the first two are essentially questions of fact, and therefore particular to the individual raising the defense. The third and fourth criteria are however clearly subjective, hence the terms “reasonably believe” and “rationally believe”. Taken together, judicial authority suggests the two criteria require any judgement complained of as constituting a breach of the statutory duty of care and diligence to be evaluated in the context of factors such as the importance of the decision (whether financial, reputational or otherwise), the information available to inform the decision, the time and expense involved in obtaining further information, and the skills and capabilities of the individual exercising the judgement.

Without prognosticating as to the outcome of the business judgment defense in this case, a Federal Court decision in 2015 has aided an understanding of the likely judicial approach to deciding that issue. Mr Justice Beach remarked as follows in regard to criteria (iv) above: “…relevant to the question of breach of duty is the balance between, on the one hand, the foreseeable risk of harm to the company flowing from the contravention and, on the other hand, the potential benefits that could reasonably be expected to have accrued to the company from that conduct.”

In the context of the Star Entertainment Group, engaging with junket operator Suncity certainly boosted gaming revenue at The Star, as did the facilitated use of China Union Pay cards to provide funds for gambling, but both carried a risk of harm in the form of adverse regulatory intervention by the gaming regulators in both New South Wales and Queensland.

An empirical study by the academics Ramsay and Saunders published in 2019 found that in the period 1993-2017 ASIC achieved an 83% success rate in actions brought for breach of the statutory duty contained in section 180 (1). A total of 46 such actions were litigated between 1998 and 2017. Penalties have included disqualification from serving as a director, and hefty fines. It is a moot point whether directors and officers who are fined can rely on any indemnity they may have received from the company, or upon Directors and Officers insurance to cover their monetary penalty and defense costs.

An empirical study by the academics Ramsay and Saunders published in 2019 found that in the period 1993-2017 ASIC achieved an 83% success rate in actions brought for breach of the statutory duty contained in section 180 (1). A total of 46 such actions were litigated between 1998 and 2017. Penalties have included disqualification from serving as a director, and hefty fines. It is a moot point whether directors and officers who are fined can rely on any indemnity they may have received from the company, or upon Directors and Officers insurance to cover their monetary penalty and defense costs.

There are actions which directors can take to mitigate the prospect of being successfully sued for breach of their statutory duty to exercise care and diligence. The first is to ensure that risks are properly dimensioned and prioritized, and that they are constantly reviewed in conjunction with management accountable for the activity within which the risk arises. Directors cannot simply “set and forget”.

Secondly, all internal processes giving rise to material risks (materiality may be measured quantitatively, or qualitatively, such as regulatory, legal or reputational risk) should be process-mapped. This enables vulnerabilities to be isolated (for example, where access, personnel or documentary controls might be required to provide a robust internal control environment), and decision points, requiring the exercise of judgement, noted.

Process maps are an invaluable tool not just for directors, but also for internal and external auditors, who can develop their respective audit plans to focus resources on the most material risks and controls.

Thirdly, Board committees should be structured with clear, mutually exclusive remits, and should be chaired by directors with relevant experience and skill sets. The private sector could learn something from the public sector here … co-opting independent skilled members to Board committees is relatively common in statutory authorities and publicly funded organizations. Insurance and “shadow director” concerns have constrained the adoption of the same approach in companies, but there are workarounds.

Thirdly, Board committees should be structured with clear, mutually exclusive remits, and should be chaired by directors with relevant experience and skill sets. The private sector could learn something from the public sector here … co-opting independent skilled members to Board committees is relatively common in statutory authorities and publicly funded organizations. Insurance and “shadow director” concerns have constrained the adoption of the same approach in companies, but there are workarounds.

Fourthly, document the background to all key decisions, including dissenting opinions. It is often difficult for busy directors to recall what may have attended a decision made months or years earlier; contemporaneous notes and advice are invaluable evidentiary records, as well as aides-memoir.

Finally, be prepared to ask management hard questions. No unity of interest between directors and management should be presumed; management is incentivized generally to meet articulated targets. No matter how well short-term and long-term incentive packages are designed, there is invariably a dominant orientation to the achievement of financial metrics, particularly for publicly listed companies. Ideally management’s risk appetite will align with the Board, but that should never be assumed.

It may be about to get even harder to be the director of a publicly owned gaming company, and not just in Australia. Australia has simply codified an aspect of director negligence, a concept well known in other common law countries.