In this in-depth deep dive into the evolution of the Asian gaming landscape, David Bonnet argues that many regional jurisdictions have been sucked into believing they can replicate the Macau or Singapore IR model – without access to those cities’ sustaining financial ecosystems.

Regional gaming markets have yet to achieve the lofty revenue expectations set by the performance of integrated resorts in the Asian heavyweight hubs of Macau and Singapore. In these jurisdictions, wagering has been amplified by a broader gaming ecosystem that has provided deep access to financial liquidity. Newer properties in more distant locales may not benefit from those same fundamentals and will therefore be challenged to replicate those major-market-style economic returns.

The mirage of regulatory incentives

Many governments have introduced seemingly attractive frameworks to lure operators into large-scale IR investments. In practice, however, these efforts have often been driven by overestimated market potential, leaving behind underperforming assets amid shaky economic foundations.

Macau’s success in the early 2010s prompted a wave of jurisdictions to actively implement new regulatory frameworks in hopes of “super-charging” their economies through casino liberalization. Many operated under the assumption that transplanting a Macau- or Singapore-style integrated resort into their markets would naturally attract the same high-net-worth punters who once defined Asia’s gaming boom – and, in turn, drive large gaming turnover and associated tax revenue.

The examples are numerous. From ventures on remote Pacific islands, to liberalization efforts in Russia’s Far East, to the belief that a major integrated resort near Korea’s primary international airport could thrive, each was driven by the notion that a favorable regulatory framework, coupled with either infrastructure or strategic positioning to attract Chinese play, would be sufficient to anchor a billion-dollar business.

Business model: Macau, Singapore or Las Vegas?

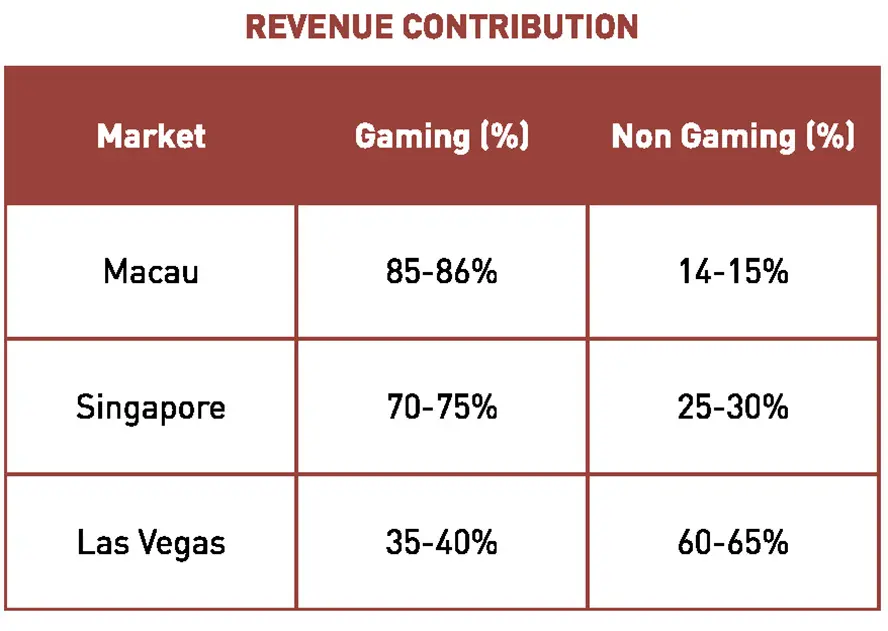

Numerous economic architectures have emerged across the IR landscape, each offering a distinct mix of revenue segmentation and margin differentiation. Investors can evaluate and select the framework that best aligns with their risk profiles and return thresholds for capital deployment. In practice, however, the realities of market size, competitive positioning and regulatory friction ultimately dictate which archetypes are feasible, fundable and scalable.

IRs in these markets typically feature thousands of hotel rooms, requiring massive upfront capital investments. With construction costs ranging from US$2 million to US$3 million per room, even the smallest resorts need strong macroeconomic fundamentals to drive the billions of dollars in associated revenue required to justify their economic viability.

And today, there are only three jurisdictions where economic conditions allow a property to generate more than US$1 billion in annual revenue:

Macau

Macau operates a high-volume, high-frequency model driven by dense regional populations and efficient cross-border transport. Patron visitation occurs weekly – or even daily – and gaming floors are optimized for throughput and recurring play. The model depends on liquidity, scale and operational speed to sustain performance.

Singapore

Singapore follows a prestige-oriented hybrid model where gaming is integrated into a broader ecosystem of luxury products amidst a financial economy noted for private wealth. Non-gaming components function as pricing levers: hotel rooms command premium cash rates, with comps tightly aligned to verified gaming spend. Scarcity, national branding and global positioning, amplified by events like the Formula 1 Grand Prix, reinforce the perception of exclusivity and pricing power.

Las Vegas

Las Vegas exemplifies a market with significant repeat customer visitation. The model is underpinned by high per-capita spend and strong occupancies, supported by diversified revenue streams including gaming, hotel, F&B, entertainment, retail and large-scale conventions.

Malaysia

While Genting Highlands does generate revenue of more than US$1 billion, we are not including it in this analysis due to the uniqueness of its business and associated location, operating more than 10,000 rooms atop a really high mountain.

As we’ve seen, it is arguably very difficult for a regional property to replicate the scale and economics of Macau – or even Singapore. The fundamentals that made those markets work are not easily duplicated and require billions of dollars in investment. The Las Vegas model, however, could potentially resonate in Japan – a topic we’ll examine further below. Let’s now look at a few other examples to understand how different regimes have attempted, and often struggled, to reach similar levels of performance.

Addressable demand

Addressable demand

Many jurisdictions now exist globally that provide an indication of what types of business models can succeed under specific conditions. However, others have not fared as well, often due to missing enablers or flawed assumptions about addressable demand.

India: With its 1.4 billion population and rising middle class, India should theoretically support large-scale capital investment for IR development. Yet, despite this potential, none exist in India, Sri Lanka or even Goa – like Macau, another former Portuguese enclave with a legal framework similar to the SAR yet located within India itself. Instead, these markets are dominated by small-scale operations such as riverboat gambling and boutique casinos, with no large-scale resorts in place. The Macau model – which benefits from adjacency to a massive Chinese population – may not apply to Sri Lanka or Goa, as investors have not been compelled to make big bets on those markets. Additionally, Hindu religion and broader Indian culture view gambling as conditionally permissible – acceptable within specific festivals yet cautioned against when it becomes excessive or harmful. As a result, industry products may not naturally gain traction, potentially dampening demand and associated revenue.

Europe: The European landscape is characterized by smaller gaming salons and regional casinos. This fragmented structure is further challenged by the stringent regulatory frameworks which have curtailed growth opportunities. In particular, the UK’s gaming market has been impacted by over-regulation, including tighter advertising restrictions, increased taxation and stricter licensing requirements. These factors have contributed to declining revenues and reduced investment, underscoring the difficulty of scaling casino operations there.

Situated at the crossroads of Europe, Africa and the Middle East – and with a long history as a center of trade and commerce – Cyprus should be well-positioned to capture gaming demand from nearby source markets such as Russia and the Gulf. However, resorts in the south have struggled to gain meaningful market share, constrained by a small domestic base, stringent regulation and competition from established casinos in the north, as well as nearby hubs like Greece and Malta, as well as online platforms.

Cambodia: A market that’s struggled to rebound

One such property in Cambodia successfully crossed the US$1 billion GGR threshold in the years prior to COVID. But that performance was heavily reliant on a junket-driven model, underpinned by cross-border liquidity and opaque capital flows amid a permissive regulatory environment. Once those enablers came under pressure – from reduced Chinese visitation, heightened scrutiny and the broader collapse of the junket ecosystem – the economics quickly unraveled. Post-COVID performance has yet to regain those earlier highs, raising broader questions about the durability of billion-dollar scale in jurisdictions that depend on fragile or informal financial infrastructure.

Can a post-COVID, post-junket business model still deliver alpha-style returns – those outsized profits once driven by structural or regulatory advantages? With opaque capital flows now reduced through banking compliance programs that promote transparency – and with regulatory scrutiny intensifying – the conditions that enabled such outperformance may no longer be in place.

Breaking the US$1 billion barrier

To generate US$1 billion in revenue, an enterprise must participate in an economy that exceeds that threshold – and then capture a meaningful share of it. The structure and dynamics of that market are critical in determining how much revenue can be captured and how efficiently it can be converted into profit. In the most successful cases, entire industries have been established, allowing stakeholders to benefit from scale. More isolated operations have lagged, constrained by limited critical mass.

Critical Mass: Industry vs property

One of Macau’s key advantages is its fully integrated gaming sector, underpinned by a wide range of ancillary services and on-the-ground suppliers. This creates a self-reinforcing customer ecosystem that enables critical mass: customers benefit from greater choice, while the broader market becomes more attractive and operationally efficient.

Similarly, in Singapore, the duopoly structure has helped ensure the market is calibrated to a government-supported level of gaming turnover. The planned expansion of both ventures signals a clear intent to increase capacity, supporting a magnitude of activity that would not be viable under a standalone model.

By contrast, more isolated ventures in distant locations have demonstrated lower gaming productivity, reflecting the limitations of operating as single-site enterprises without broader market support.

MGM Osaka’s breakout potential

MGM Osaka is slated to open in 2030 on Yumeshima Island in Osaka Bay, marking Japan’s first foray into casino gaming. The project will deliver large-scale premium hospitality assets – including approximately 2,500 luxury hotel rooms, retail, entertainment and MICE facilities – to a wide and diverse addressable market. The resort aims to attract high-spending domestic and international travelers by leveraging Japan’s dense population, direct access via Kansai International Airport and strong cultural tourism appeal to justify its multi-billion-dollar investment.

While MGM Osaka may ultimately hold a monopoly within Japan’s casino sector, it may not initially benefit from a critical mass of visitation due to Yumeshima Island’s relative isolation within Osaka and limited surrounding tourism infrastructure. Even so, several structural factors support the view that revenue could exceed US$1 billion.

Japan’s pachinko market functions as a US$130 billion domestic liquidity engine, generating around US$20 billion in operator revenue. It provides a proxy wagering benchmark unmatched in any other regional jurisdiction. Additional advantages include a population with a high propensity to save, sizable resident Chinese and Korean groups, and strong regional connectivity. Unlike other regional markets, Osaka can draw on cultural alignment and infrastructure to sustain multi-billion-dollar scale. The project is positioned as a top-tier destination – comparable in scope to Singapore – rather than a mid-market development, and is well-positioned to exceed the US$1 billion revenue mark.

Tiering behaviors: Casino-ready patrons

Osaka has a diverse Asian demographic, making it uniquely positioned to attract a broad regional customer base familiar with gaming culture. Asian patrons may be inherently more casino-ready than their Western counterparts due to a combination of cultural familiarity with gambling (mahjong, card games), a strong entrepreneurial spirit and a higher-than-average tolerance for financial risk. These tendencies are often reinforced by social norms that accept wagering and a mindset that views gambling as a strategic or skill-based activity. Taken together, these factors make Asian customers more naturally aligned with the behavioral economics of casino play than other segments.

Strategic deployment of tourism assets

Only Las Vegas–style economics can power IR concepts that successfully drive a majority non-gaming business. This model depends heavily on providing casino customers access to premium tourism assets – including luxury hotel accommodations, popular entertainment offerings, upscale retail, fine dining and convention space for group functions. Their scale and positioning are strategically deployed to create a compelling environment that attracts high-value customers and maximizes total spend.

What makes this model effective is not just the availability of non-gaming amenities, but their desirability. When customers are genuinely willing to pay cash for these experiences – whether a luxury suite, a headline show or fine dining – the perceived value of comps increases significantly. This creates a powerful lever for operators to reinforce pricing power, unlock cross-selling opportunities and stimulate wagering through targeted rewards.

The ability to deliver curated non-gaming experiences, paired with the flexibility to comp across the full product portfolio, allows the resort to drive total customer “theo”. However, achieving this requires substantial upfront capital investment to develop these offerings, along with access to a mature market capable of sustaining high visitor volumes across multiple spending categories.

MGM Osaka is positioned to deliver products with a high perceived value. This credibility allows the property to deploy these offerings strategically, using comps, upselling and targeted incentives to stimulate gaming spend. In a market without a deeply embedded casino culture, the ability to lead with non-gaming becomes a critical tactical advantage.

Lessons from large-scale liquidity

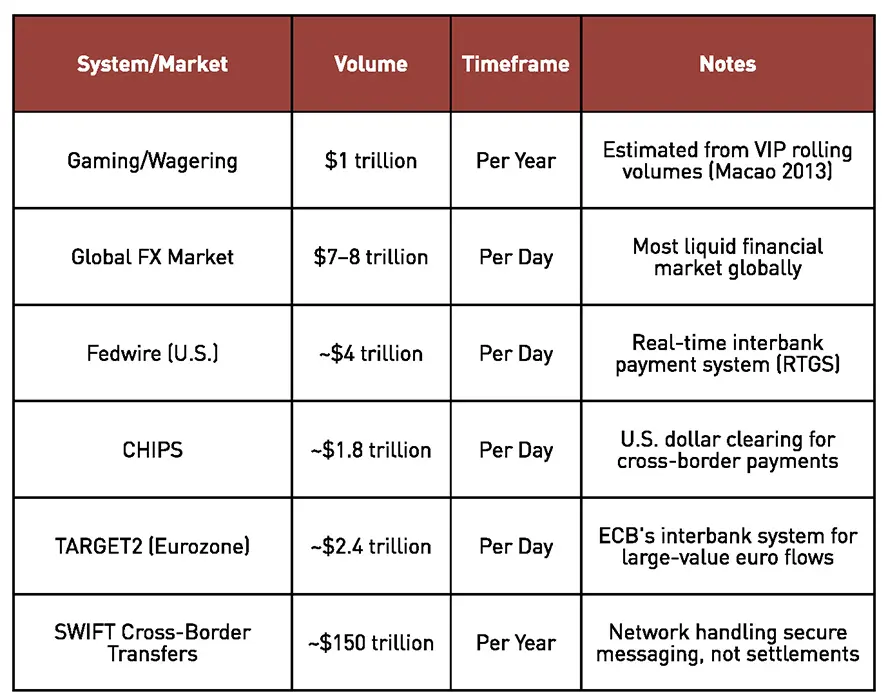

At its peak in 2013, Macau generated US$45 billion in gross gaming revenue (GGR). Of that, roughly two-thirds came from VIP play, which operates on a mathematical ~3% win rate, implying over US$1 trillion in notional wagering.

Think about the financial ecosystem that upheld the level of gambling. Junkets were primarily facilitators, but they were also underpinned by the prevalence of jewelry stores and pawnshops, an active credit and collection system, and reduced ATM withdrawal limits, amongst others. While US$1 trillion of wagering volume represents an annual figure, it is still comparable in scale to the daily volumes transacted through global FX markets or settled via major interbank payment systems like Fedwire.

The sheer excess of liquidity within the gaming ecosystem enabled even fringe business models to launch – and, in some cases, secure full funding. This capital overhang, largely driven by the junket system, created what can now be understood as a credit-fueled bubble: an environment where financial flow obscured fundamental weaknesses and fostered unrealistic assumptions about exportability. That dynamic led stakeholders to believe the Macau template could be imitated in emerging markets such as the Philippines, Cambodia and even Vietnam, as well as in mature jurisdictions like Australia. In retrospect, many of these conclusions ignored the specific conditions that underpinned Macau’s performance – namely, its scale, proximity to China and access to underground financial channels.

The sheer excess of liquidity within the gaming ecosystem enabled even fringe business models to launch – and, in some cases, secure full funding. This capital overhang, largely driven by the junket system, created what can now be understood as a credit-fueled bubble: an environment where financial flow obscured fundamental weaknesses and fostered unrealistic assumptions about exportability. That dynamic led stakeholders to believe the Macau template could be imitated in emerging markets such as the Philippines, Cambodia and even Vietnam, as well as in mature jurisdictions like Australia. In retrospect, many of these conclusions ignored the specific conditions that underpinned Macau’s performance – namely, its scale, proximity to China and access to underground financial channels.

The success of Macau was rooted in an exceptional convergence of macroeconomic acceleration and policy reform. Rapid income growth in China, expanding cross-border mobility and the liberalization of gaming regulations coalesced to create a historic window for the casino sector. The introduction of foreign operators in the early 2000s unlocked latent demand, channeling it through a system maintained by aggressive credit issuance and informal capital transfer mechanisms.

Today, it is unlikely that any future model predicated on these same fundamentals – particularly the junket ecosystem, unconstrained money flows and China-led VIP demand – can be truly workable, because the underlying conditions that once enabled them have largely disappeared.

As a result, the Macau-style IR – optimized for velocity, liquidity and VIP dependency – has become structurally obsolete. Regulatory headwinds, financial controls and the dismantling of the junket network have removed its economic foundation. The framework is misaligned with today’s market realities and it no longer offers a viable blueprint for future IR development.

Can crypto replace the lost junket liquidity?

I discussed crypto a few years back as a potential mechanism to unlock sector stimulus in an article for IAG titled “A decade of differentiation”. My views haven’t necessarily changed but perhaps evolved. It’s clear the junket ecosystem is gone, and crypto isn’t necessarily replacing it for one clear reason: junkets, through large commission structures and expansive sub-agent networks, cultivated players and significantly expanded the market. While the crypto market provides an alternative pool of capital, it doesn’t foster patron growth in the same way the junket model once did. Over time, crypto may serve as a convenient mechanism to facilitate gaming transactions – but not at the scale Asia experienced during the junket era.

Closing odds

A regional property can achieve US$1 billion in revenue only if structural enablers are in place. These include access to liquidity, regulatory clarity, sufficient airlift and the ability to offer high-perceived-value products. Diversified revenue segmentation across gaming and non-gaming must be designed into the model from inception. Crypto may be the catalyst that helps lift regional developments out of the doldrums left by the collapse of the junket industry, but it’s no panacea, at least not yet. MGM Osaka may be the property that sustainably demonstrates how to unlock over US$1 billion in revenue. Few, if any, others are likely to come close.