Just weeks after securing an AU$300 million bailout package, Australia’s Star Entertainment Group is fighting to stave off a multi-million fine from AML watchdog AUSTRAC that it says would again bring into question its financial viability.

AUSTRAC’s case against Star headed to the Federal Court this week with the regulator looking to impose a fine of at least AU$400 million, possibly more, for AML and responsible gambling failures outlined across multiple inquiries in the two states in which Star operates.

This, it argued, was not an “oppressive penalty” given the scale of Star’s transgressions with counsel for AUSTRAC Simon White SC describing it as “an appropriate penalty for specific and general deterrence purposes,” according to a report by the Australian Financial Review.

For its part, Star said a fine of just AU$100 million would be enough to threaten its financial viability – essentially arguing for a penalty in line with what it is capable of paying. However, such a fine would be significantly lower than the AU$450 million fine issued to Crown for similar offenses in 2023.

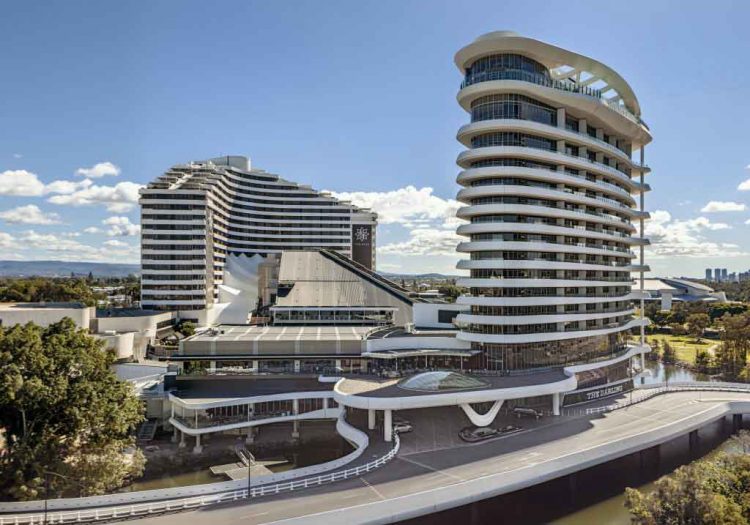

AUSTRAC’s case is largely centered around Star’s dealing with now defunct junket giant Suncity Group, whose VIP rooms within Star’s Sydney and Gold Coast casinos generated turnover of more than AU$70 million a week pre-COVID. The regulator is alleging Star welcomed 117 high-risk VIP customers into its casinos with 350 junket tours organize through Suncity alone over four years at The Star Sydney alone.

Star recently confirmed that it would, pending shareholder approval, accept an AU$300 million investment from Bally’s Corp and local pub baron Bruce Mathieson’s Investment Holdings Pty Ltd as it looks to stave off insolvency due to rising costs and diminishing revenues.

The company had been running on fumes before Bally’s injected an initial AU$100 million into the embattled firm in April.