CLAIMS TO FAME

- Assumed global leadership in 2021 following passing of Sheldon Adelson

- Oversaw disposal of company’s Las Vegas assets

- Pursuing IR developments in New York, Thailand, Texas

It’s been a big year for Las Vegas Sands. Now a fully-fledged Asia-facing company following the US$6.25 billion sale of The Venetian Las Vegas in early 2022, LVS has enjoyed a stunning return to form in 2024, with its iconic Singapore resort Marina Bay Sands setting new revenue and profit records and Macau subsidiary Sands China positioning itself for similar accomplishments in the years ahead.

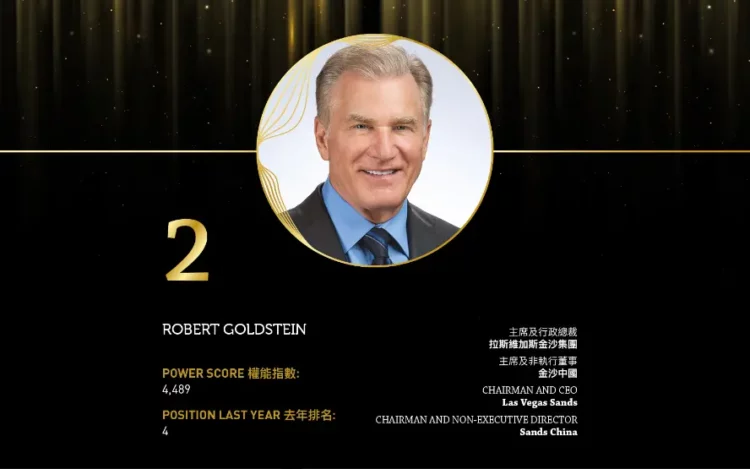

That’s in no small part due to Robert Goldstein, the long-time right-hand man to founder Sheldon Adelson who took over as Chairman and CEO when Adelson passed away three-and-a-half years ago. It was under Goldstein’s leadership that LVS ultimately sold off its Las Vegas assets to focus on Asia, and with a healthy war chest to work with, the company has wasted no time in expanding its Asian asset base.

In Macau, the multi-billion transformation of Sands Cotai Central into The Londoner Macao is almost complete, save for the finishing touches on a revamp of the former Sheraton Grand Macao hotel – to be renamed Londoner Grand.

Much has been made of the impact these Londoner renovations, which have also included a comprehensive reworking of the recently reopened Pacifica Casino, have had on Sands China’s bottom line this year, with the company losing some market share to rivals.

Yet for all the disruption, revenues have remained healthy. In 2Q24 alone, Sands China reported net revenues of US$1.75 billion – up 7.7% year-on-year – and Adjusted Property EBITDA of US$561 million. EBITDA margins of 23% highlighted the impact of renovation works but Goldstein noted during the company’s Q2 earnings call that the goal once fully operational again is to achieve margins closer to 40%.

It’s an ambitious target, but LVS’s efforts in Singapore suggest he knows what he’s talking about.

It was only last year that Goldstein outlined his expectation that Marina Bay Sands would soon achieve an annual EBITDA run-rate in excess of US$2 billion. In the first two months of this year, Adjusted EBITDA at the Singapore IR has easily exceeded US$500 million per quarter including an all-time record of US$597 million in Q1 – prompting Goldstein to recently adjust upwards his annual EBITDA target to US$3 billion. Who knows just how high that might climb once a revamp of MBS’s existing towers and the addition of a fourth – part of a US$3.3 billion expansion – is complete.

LVS, meanwhile, continues to seek opportunities where and when they present themselves. The company has already this year increased its controlling stake in Sands China, now sitting at almost 72%, while back home it is actively pursuing an IR license in New York and longer-term in Texas.

Just as enticing, however, is the potential Thailand opportunity, suggesting it is indeed Asia that will determine the long-term growth story of Las Vegas Sands.

For the full list of 2024 Asian Gaming Power 50 winners, click here.