In this regular feature in IAG to celebrate 18 years covering the Asian gaming and leisure industry, we look back at our cover story from exactly 10 years ago, “High-End Anxiety”, to rediscover what was making the news in October 2014!

If only we knew what was to come. In October 2014, Inside Asian Gaming’s cover story, titled “High-End Anxiety”, detailed the worrying decline of VIP gaming revenues in the global gaming hub of Macau.

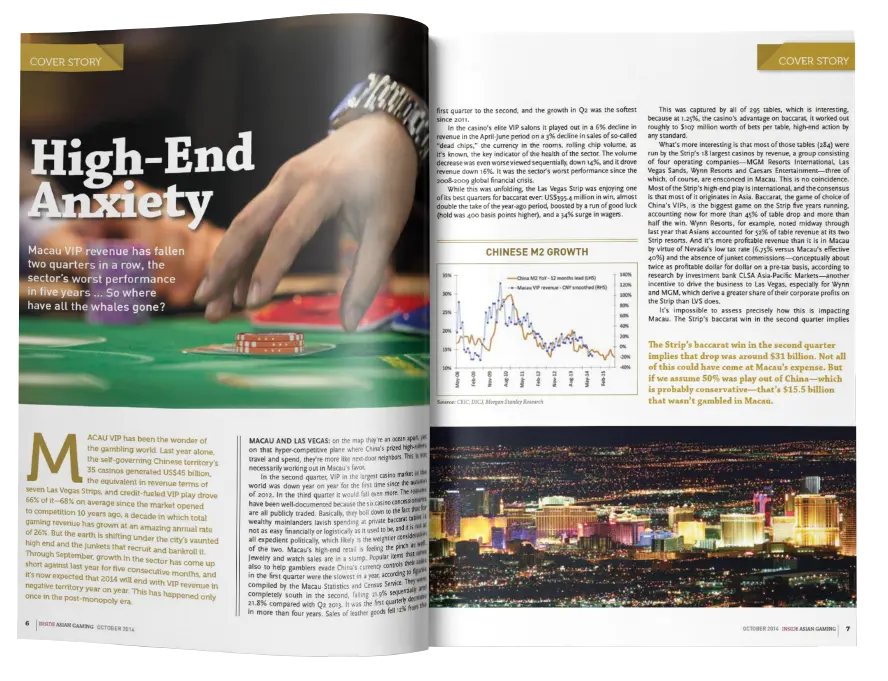

As we wrote at the time, the prior year – 2013 – had seen Macau generate an all-time high of US$45 billion in gross gaming revenues, continuing a string of year-on-year increases since liberalization and primarily driven by junket VIP.

But for the first time, this upward trajectory looked to be coming to an end – the start of what we now know would signal the eventual demise of the junket heyday, even if the industry’s crushing halt wouldn’t come until more recently.

But for the first time, this upward trajectory looked to be coming to an end – the start of what we now know would signal the eventual demise of the junket heyday, even if the industry’s crushing halt wouldn’t come until more recently.

“The earth is shifting under [Macau’s] vaunted high-end and the junkets that recruit and bankroll it,” IAG wrote in our October 2014 feature.

“Through September, growth in the sector has come up short against last year for five consecutive months, and it’s now expected that 2014 will end with VIP revenue in negative territory year on year. This has happened only once in the post-monopoly era.”

The big question at that time was: why? One reason, we pondered, might have been evidenced in the growth of VIP baccarat revenues in Las Vegas which, given its more favorable tax regime and the absence of junket commissions, may have been led by the likes of Las Vegas Sands, Wynn and MGM funneling their players away from Macau. Then again, that didn’t account for such a substantial decline in volumes in a city whose annual GGR had by this time reached seven times that of the Las Vegas Strip.

Another possibility was that Chinese gamblers had tired of Macau, or were perhaps just becoming more worldly, and were increasingly preferring to be seen travelling to Singapore or Australia or South Korea for their “holidays”. Certainly, there was less appetite to be observed by China’s central government to be making frequent trips to the Macau SAR.

Another possibility was that Chinese gamblers had tired of Macau, or were perhaps just becoming more worldly, and were increasingly preferring to be seen travelling to Singapore or Australia or South Korea for their “holidays”. Certainly, there was less appetite to be observed by China’s central government to be making frequent trips to the Macau SAR.

Most likely however, IAG suggested, was the combination of a slowing Chinese economy, which had also seen luxury retail spending on the way down, and China’s anti-graft campaign which targeted a segment of society that undoubtedly contributed significantly to Macau’s gaming sector.

In fact, Macau has never again come anywhere near that US$45 billion mark, when there were a record 235 licensed junkets in operation bloating the city’s revenue figures.

Our 2014 story also saw this trend start to wane, stating, “Morgan Stanley estimates that more than 30 junkets have folded, individuals and companies, since the end of 2012, victims of the liquidity crunch and competition from larger, better-capitalized rivals.

“Dore Holdings, one of the largest, threw in the towel this year. SunCity, the largest, is diversifying into non-gaming investments. Others are pursuing casino projects abroad. Others are working existing markets from Australia to the Philippines to Indochina to take advantage of more relaxed environments where tax rates are lower and better deals can be had on comps and commission rates. They are, of course, taking their players with them.”

Could anyone back then have predicted what was really to come? The arrest of Macau’s junket supremos Alvin Chau and Levo Chan, combined with changes to Macau’s gaming laws that significantly weakened the ability of junkets to drive revenues, predicated the near-complete collapse of the industry.

Licensed junkets as of 2024 number just 18 and only a handful of those are operating at any sort of scale. Casino junket rooms and revenue-share agreements are but distant memories. And for a segment that once contributed more than 80% of Macau’s gaming revenues, VIP now accounts for less than a quarter thanks to the rise of the premium mass segment and increased focus on direct VIP.

And what may have been toughest to grasp during those days, had they been offered a portal into 2024? That the new-look Macau has never been in better shape.