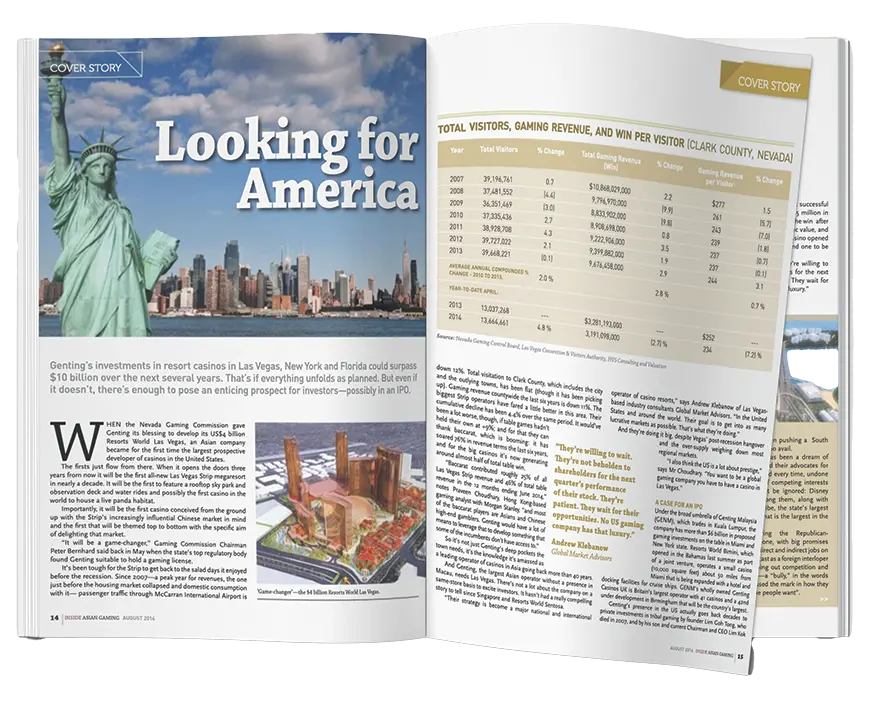

In this regular feature in IAG to celebrate 18 years covering the Asian gaming and leisure industry, we look back at our cover story from exactly 10 years ago, “Looking for America”, to rediscover what was making the news in August 2014!

If one ever needed evidence that Malaysia’s Genting Group is playing the long game in its quest to be a major player in the US gaming market, they need only look back at IAG’s cover story from a decade ago, “Looking for America”, in our August 2014 issue.

If one ever needed evidence that Malaysia’s Genting Group is playing the long game in its quest to be a major player in the US gaming market, they need only look back at IAG’s cover story from a decade ago, “Looking for America”, in our August 2014 issue.

In this in-depth exploration of Genting’s US aspirations, we examined the company’s sus-tained and successful efforts to establish a presence in the state of New York, its then plans to develop Resorts World Las Vegas and its longer-term push to build an integrated resort in Miami, the latter requiring significant changes to state legislation.

But most importantly we observed that, even a decade ago, Genting had shown its willing-ness to dig its heels in and wait, with the company clearly under no illusions as to the challenges an Asian-based company would face in cracking the lucrative American market.

As we noted at the time, Genting’s presence in the US dates back decades to private in-vestments in tribal gaming by founder Lim Goh Tong, who died in 2007, and by his son and current Chairman and CEO Lim Kok Thay. But it wasn’t until a GENM subsidiary won the license for the racino at New York City’s famed Aqueduct Racetrack in the borough of Queens that the company burst onto the US scene, seemingly out of nowhere.

“Aqueduct established Genting in America,” IAG wrote in 2014. “It was a notorious political football, years in coming together, and it took a prodigious combination of patience, finesse and financial muscle on Genting’s part to secure it. It would cost more than $800 million when all was said and done, and that’s without the table games the company had sought or the convention center that was to be the centerpiece and which disappeared in a hail of political infighting and controversy.”

Andrew Klebanow of Global Market Advisors also said of Genting at the time, “They’re willing to wait. They’re not beholden to shareholders for the next quarter’s performance of their stock. They’re patient. They wait for their opportunities. No US gaming company has that luxury.”

Fast forward a decade and that patience has borne some fruit. In Sin City, all expectations were that the then US$4 billion Resorts World Las Vegas would open its doors by 2017, when in fact it took another four years to become a reality and at an inflated cost of US$5 billion. It’s true that RWLV hasn’t quite lived up to earlier predictions by the Nevada Gaming Commission that it would be a “game changer” for the Las Vegas Strip, but revenues and profits have been slowly climbing, buoyed by the city’s post-COVID recovery and a growing cluster of properties at the Strip’s northern end.

Promising far greater returns is a full downtown New York casino license, where Genting Malaysia’s Resorts World New York City is considered a favorite to win one of three licenses on offer in the coming years. Such a license would allow RWNYC to add gaming tables to its current slots-only inventory and provide substantial rewards for the groundwork it laid all those years ago.

As for Miami, lobbying for legislative change has proven a far tougher task, with Genting now looking to sell off its substantial land parcel in part to fund its New York exploits. But when it comes to Genting, never say never.