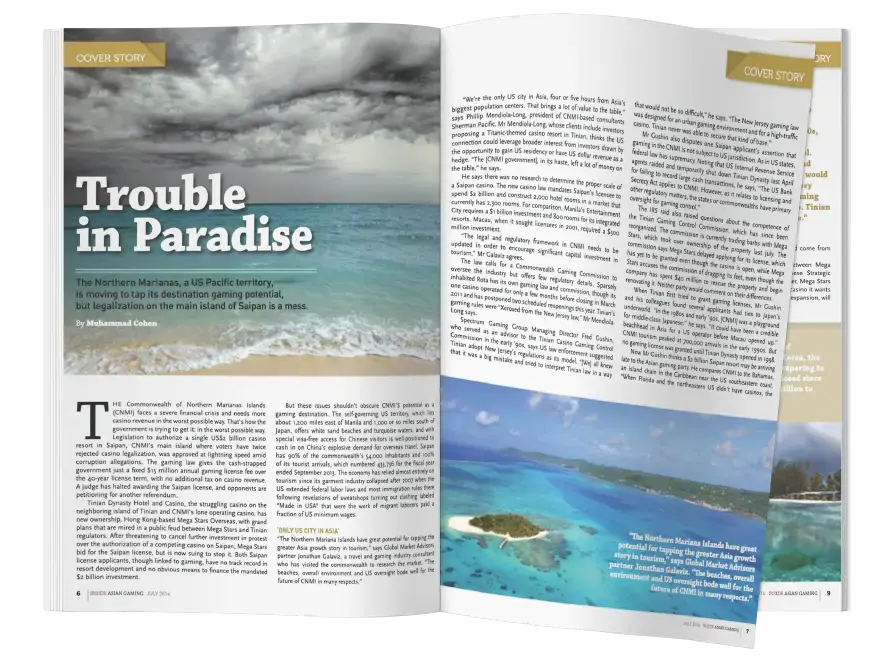

In this regular feature in IAG to celebrate 18 years covering the Asian gaming and leisure industry, we look back at our cover story from exactly 10 years ago, “Trouble in Paradise”, to rediscover what was making the news in July 2014!

Saipan’s integrated resort dream is on life support. Some four years after the never-completed Imperial Palace • Saipan closed its doors due to COVID – and three years after operator Imperial Pacific International (CNMI) LLC had its casino license suspended for failure to pay its annual fees, it seems the writing is on the wall for a full license revocation.

Recent years have seen dozens of claims filed against IPI in local courts by former contractors, IPI assets auctioned off by liquidators, a high-profile legal dispute initiated by IPI against the local regulator, and most recently a delisting from the Hong Kong Stock Exchange of IPI’s parent company, Imperial Pacific International Holdings Ltd.

Only a series of stalling efforts by IPI, the most recent being its decision to file for Chapter 11 bankruptcy, have prevented the Commonwealth Casino Commission from finally pulling the trigger on a license revocation decision.

Only a series of stalling efforts by IPI, the most recent being its decision to file for Chapter 11 bankruptcy, have prevented the Commonwealth Casino Commission from finally pulling the trigger on a license revocation decision.

But was all of this already written in the cards? Certainly, IAG thought so when we outlined real doubts over the prospects of Saipan’s casino plan in the cover story of our July 2014 issue, aptly titled “Trouble in Paradise”.

“The Commonwealth of Northern Marianas Islands (CNMI) faces a severe financial crisis and needs more casino revenue in the worst possible way,” we wrote at the time. “That’s how the government is trying to get it: in the worst possible way.

“Legislation to authorize a single US$2 billion casino resort in Saipan, CNMI’s main island where voters have twice rejected casino legalization, was approved at lightning speed amid corruption allegations. The gaming law gives the cash-strapped government just a fixed $15 million annual gaming license fee over the 40-year license term, with no additional tax on casino revenue. A judge has halted awarding the Saipan license, and opponents are petitioning for another referendum.”

There were undoubtedly worrying signs already surrounding the Saipan casino plan back then, even if the prospect of building a destination resort on a tropical island boasting crystal clear waters and white sand beaches suggested some allure. That Saipan itself was home to 90% of the CNMI’s residents and accounted for 100% of tourist arrivals made it a better choice than neighboring Tinian, for example – home to a struggling casino that has endured multiple closures over the years.

But the government’s outlandish investment requirements – a minimum US$2 billion spend with at least 2,000 hotel rooms – was highlighted at the time as being unrealistic, particularly given the absence of any research into what a more appropriate expectation might be. As IAG noted at the time, Manila’s Entertainment City required only a US$1 billion investment and 800 rooms for its integrated resorts, while Macau only required a US$500 million investment when it liberalized in 2001.

But the government’s outlandish investment requirements – a minimum US$2 billion spend with at least 2,000 hotel rooms – was highlighted at the time as being unrealistic, particularly given the absence of any research into what a more appropriate expectation might be. As IAG noted at the time, Manila’s Entertainment City required only a US$1 billion investment and 800 rooms for its integrated resorts, while Macau only required a US$500 million investment when it liberalized in 2001.

Perhaps this was why Saipan’s list of applicants was missing any sign of experienced IR operators and instead favored firms with direct links to Asian junket operators – among them eventual winner Best Sunshine International, whose parent company IPI had known ties to Macau junket promoter Hengsheng Group.

It was suggested back in 2014 that at least one interested party had stated the CNMI was not subject to US jurisdiction, potentially making it more attractive to junket-linked investor groups. Fred Gushin, Managing Director of Spectrum Gaming Group, was quick to dispute that, noting in our 2014 cover story that, as in US states, “federal law has supremacy”.

For its part, Best Sunshine – which ultimately won the island’s sole casino license – had outlined plans to make Saipan “the Monaco of the Pacific” by way of an “iconic” resort with four hotels, shopping and entertainment. A temporary facility would be used to launch casino operations while the IR was developed.

This part, at least, turned out to be true, with Best Sunshine opening its temporary casino in a local shopping mall in 2015 and seemingly reporting good numbers as well. Some might say these were too good, given that reported VIP volumes at one stage were outstripping those of Macau’s largest integrated resorts.

IPI moved its casino operations into Imperial Palace • Saipan in 2018, even though construction of the hotel wasn’t even close to being finished, and while curiously impressive volumes continued on, keen observers also noted significant impairment on trade receivables in the lead-up to the property’s COVID-induced closure in early 2020.

In the words of Nicholas Niglio, then CEO of Macau junket promoter Neptune Group, “Outbound tourism among mainland Chinese is soaring, they are looking for options beyond Hong Kong and Macau, and Saipan could be one of them … [but] whether this particular project is successful remains to be seen. So much depends on the quality of the product and transportation issues.”