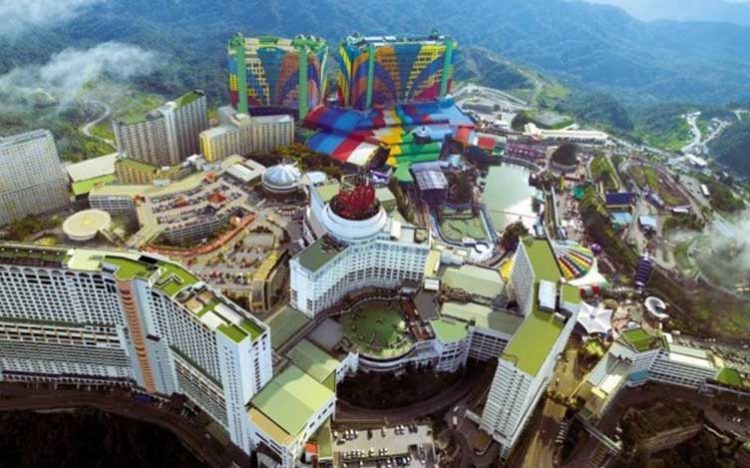

Resorts World Genting (RWG), the long-time flagship of Malaysian casino giant Genting Malaysia, should see its earnings increase by 60% year-on-year in 2024, aided by the recovery of visitor arrivals back to pre-COVID levels.

The outlook, provided in a weekend note from investment bank Maybank, comes after Genting Malaysia previously reported a net profit of MYR158.3 million (US$33.8 million) for the three months to 30 September 2023, reversing an MYR8.2 million (US$1.75 million) loss from a year earlier primarily thanks to the performance of RWG.

According to Maybank analyst Samuel Yin Shao Yang, visitor arrivals will recover to 24 million this year, up from 21 million last year as international tourists return in greater numbers.

“While Malaysian and Singaporean visitation (around 85% of total visitation pre-COVID) has recovered to pre-COVID levels, Indonesian (around 10% during pre-COVID) and Chinese visitations (around 4% during pre-COVID) have not,” Yin wrote.

“We are hopeful that air connectivity from the latter two source markets will be fully restored this year. It also helps that Malaysia recently granted 30-days visa free entry to Chinese visitors.

“Thanks to the above and despite the service tax hike to 8% from 6% effective 1 March 2024, we expect Genting Malaysia’s FY24E earnings to recover 60% year-on-year.”

Yin also outlined his expectation that such a recovery would allow Genting Malaysia to pay dividends of 15 sen per annum, a “decent” yield of at least 5.4%.

Notably, however, both earnings and share price estimates would increase significantly should the company prove successful in winning a full casino license in New York.

“We hope results for Resorts World New York City’s bid for a downstate commercial casino license will be made known before year end,” he said.

“Should Resorts World New York City be successful, we expect this to spur foreign interest in Genting Malaysia shares. Note that the current foreign shareholding in Genting Malaysia is at a multi-year low (of 15% as of 30 September 2023).”