Once known only for its status as home to a major US military base, the Philippines’ region of Clark is quickly making a name for itself as a hub for regional gaming tourism. And it’s only just begun.

Located around two hours north of Manila, Clark doesn’t fit the typical mold of a rising regional tourism hub. Rewind the clock to as little as a decade ago and its claims to fame were just two-fold: one, it was home to a military base run by the US air force for 88 years, and two, there was a catastrophic eruption of nearby Mount Pinatubo in 1991 that devastated the region and drove the US to abandon its long-held presence in the area.

But times have changed.

As part of efforts to rebuild the region, which spans a total of 32,000 hectares – about half the size of Singapore – in the province of Pampanga, the Philippines designated the area as a Special Economic Zone. The Clark Main Zone, an area covering 4,400 hectares including the former Clark Air Base, was designated a Freeport Zone in 2007.

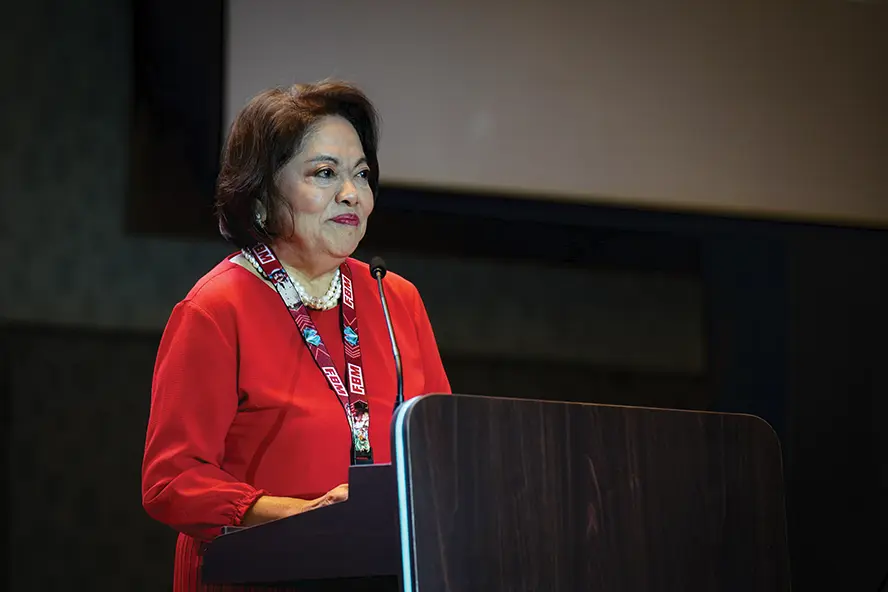

“The interesting thing about the law that created Clark is that it was principally intended to be an investment destination, meaning it should be an industrial park,” explains Atty Agnes Devanadera, the former Mayor of Sampaloc and Solicitor General of the Philippines who was appointed President and CEO of Clark Development Corporation (CDC) last year.

“But Clark has emerged with two faces – as an investment destination and as a tourism destination.

“For example, our locators now number 1,137 with more than US$5 billion invested, but due to a combination of the facilities left by the Americans and the natural features like the century-old trees and the parade grounds, it has naturally emerged as a tourism destination.”

Qualified locators setting up inside the Freeport pay just 5% tax on gross income earned, less allowable deductions, in lieu of all national and local taxes, and are not required to pay property tax. They also face far less red tape than may be expected elsewhere due to the CDC holding absolute governance of the broader Clark area.

It is this combination of Clark’s Freeport status, a simpler governance system and its wide expanses of green space that has opened the door for tourism investors to devise a unique model for the area, with gaming and golf working hand in hand to attract clientele looking for something different from the large-scale glitz of Manila’s integrated resorts, or its regional peers in jurisdictions like Macau and Singapore.

It is this combination of Clark’s Freeport status, a simpler governance system and its wide expanses of green space that has opened the door for tourism investors to devise a unique model for the area, with gaming and golf working hand in hand to attract clientele looking for something different from the large-scale glitz of Manila’s integrated resorts, or its regional peers in jurisdictions like Macau and Singapore.

It also explains why Clark has become a favorite escape for travellers from South Korea – the area’s number one source market – and for those from emerging markets like Taiwan and Japan.

In the mid 2000s, a handful of savvy investors recognized Clark’s tourism potential – largely due to the international-sized airport the Americans had left behind. Among them was Korean-born Dae Sik Han, today the Chairman and CEO of Clark’s market-leading casino operator Hann Resorts, and local businessman Rodolfo Pineda, owner of nearby Royce Hotel and Casino, who identified the unique opportunities that having a world-class international airport presented to the area and who have played a major role in the region’s rise since.

When Inside Asian Gaming visited Clark in late November 2019, shortly before the COVID-19 pandemic, both Hann and Royce were in the early stages of major expansion projects they said were designed to elevate their properties to the standards seen at Manila integrated resorts like Solaire and Okada. Another, D’Heights Resort & Casino, was still applying the finishing touches of paint, having opened its casino to the public just months earlier and with more ambitious plans in the works.

Fast forward four years and those visions have started to become a reality.

In 2021, Hann unveiled its US$250 million expansion of the old Widus Hotel and Casino, adding 130,000 square meters including a world-class gaming space, the Philippines’ first Swissôtel, specialty dining options, retail, a swimming pool, an executive lounge, and event venues such as a ballroom and function rooms.

Earlier this year Royce followed suit with a similar unveiling that includes Clark’s largest gaming floor covering 27,000 square meters, a new hotel with 297 rooms, plus dining, retail, MICE space and a pool.

And there is more on the horizon. D’Heights, famous for the sweeping views it offers from the clubhouse serving its two world-class golf courses as part of Sun Valley Golf & Country Club, has ambitions to match anything its neighbours in the Clark Freeport Zone might be planning. Covering a massive 309 hectares, or 8% of the entire freeport, D’Heights is already home to a 310-room Hilton Hotel, a Singapore School offering Singaporean education standards for students between Kindergarten and Year 12, a business park, five towers of condominium towers with 936 condominiums, and 52 villas.

In the works are another 47 high-end villas located along the property’s mountaintop, a shopping arcade and commercial district, a water park, separate amusement park and an extension to the business park operations.

And while the existing casino is already one of Clark’s largest with 124 gaming tables, five poker tables and 520 electronic gaming machines, construction is well underway on a new building that will double casino capacity while adding another 300 hotel rooms.

The property’s owner, Korean-run developer Donggwang Clark Corporation, says it will invest an additional Php20 billion (US$357 million) for these projects in the next 15 years.

“We have a lot of land here although the land is rolling and steep, so the total build will be about 60 or 70 hectares,” explains Marketing Director, Bernie Angeles. “The long-term plan is to become a major player in the hotel and casino industry. We expect that upon completion of these development projects, D’Heights Resort and Casino will be the landmark tourism destination in the Clark Freeport Zone.”

Just five minutes away by car is Hotel Stotsenberg, home of Casino Plus – formerly known as Casablanca Casino and more recently Fortunegate Clark Casino – which also has major development plans on its radar to bring it in line with its newly high-end neighbors. While the final investment amount will depend on the outcome of ongoing negotiations with Clark Development Corporation (CDC), the expansion project will see most of the current property torn down and replaced with a new five-star hotel and convention hall, while the main casino space will grow by “two to three times what you see here today,” according to Evan Spytma, the recently appointed CEO of Hotel Stotsenberg Leisure Park and Hotel Corporation.

Just five minutes away by car is Hotel Stotsenberg, home of Casino Plus – formerly known as Casablanca Casino and more recently Fortunegate Clark Casino – which also has major development plans on its radar to bring it in line with its newly high-end neighbors. While the final investment amount will depend on the outcome of ongoing negotiations with Clark Development Corporation (CDC), the expansion project will see most of the current property torn down and replaced with a new five-star hotel and convention hall, while the main casino space will grow by “two to three times what you see here today,” according to Evan Spytma, the recently appointed CEO of Hotel Stotsenberg Leisure Park and Hotel Corporation.

“We have very strong roots in the community here but as time passes, everything needs to be upgraded,” Spytma explains. “We have been very much focused on the mass market, the Filipino market, and not so much on the VIP side of things.

“But as Clark has continued to expand, we’ve seen more foreigners coming into Clark and the demands from a casino perspective, an integrated resort perspective, continue to change.

“We’ve got a lot of plans for the property. We’re going to essentially start anew, so all of what you see today will be renovated, completely torn down and a five-star hotel added. The convention hall will also be enlarged, the main casino space is going to expand probably to about two to three times its current size – we’re going to put in a massive amount of investment here in Clark.”

As for Hann itself, the company isn’t resting on its laurels, having recently begun works on 450 hectares of land in nearby New Clark City where it will develop three golf courses and more hotels from Accor and Marriott International as part of a new integrated development called Hann Reserve. Coming at a cost of US$3 billion once fully realized over the next decade, Hann Reserve is described as an “integrated leisure and lifestyle development”, not only providing a luxury experience for local and international tourists but adding a mixed-use commercial center, retail, residences, an international school, and a casino, among other facilities.

The three 18-hole golf courses – to comprise a “valley course” designed by South Korean professional golfer KJ Choi, a “river course” designed by Nick Faldo and a “mountain course” designed by Nicklaus Design – will include PGA-accredited player development facilities as part of Mr Han’s vision of positioning Clark among the world’s top golf tourism destinations.

All of this means that four of the six casinos in Clark – the other two being Midori Clark Hotel and Casino and Fontana Leisure Parks and Casino (and not counting PAGCOR-run Casino Filipino Capital at Xenia Hotel) – have either recently completed or are embarking on major expansion projects. It is even rumored that the CDC is seeking investors to help rejuvenate Fontana, which has largely fallen into disrepair in recent years.

Despite all of this, demand remains far from satisfied. At the IAG Academy Summit held at Hilton Manila, Newport World Resorts in September, Devanadera told attendees during her Keynote Address that the agency was “managing” the number of casino developments it will allow despite having “many applicants” awaiting approval. It is believed that up to half a dozen companies have been granted provisional gaming licenses to operate in the Clark Freeport by gaming regulator PAGCOR, however of greater concern to the CDC right now is the lack of high-end hotel rooms to cater to the region’s long-term ambitions.

These ambitions, the CDC has previously explained, are to move the manufacturing investors in Clark to New Clark City – a newly planned community covering 9,450-hectares located 30km to the north and set to be linked to Clark by highway – therefore allowing the freeport to focus its energies on pure tourism and MICE (Meetings, Incentives, Conferences, Exhibitions).

It is with this in mind that the CDC bid for, and won, rights to host the Philippines’ MICE Con 2024 in partnership with the Tourism Promotions Board and the Department of Tourism.

“MICE is something we are working for and that’s really by design,” Devanadera tells IAG. “We have about 4,000 hotel rooms [in Clark] already and we have the international airport.”

While Clark does need more hotel rooms and more convention space if it is to become a MICE hub – weekend hotel occupancy rates average around 98% – the CDC chief notes that local and national government officials are increasingly holding their strategic planning meetings in the area as they look to escape the Manila rat race.

So what’s the broader appeal of Clark?

“It’s a very unique culture here,” offers Spytma. “Clark has this opportunity to be unlike any other gaming area in the world. It’s unlike Singapore or Macau – this whole environment is much more relaxed. It’s safer, with all of the fun but none of the hassle of what you would find in Manila, for example.

“The airport in Manila is operating at double its capacity right now as opposed to Clark, which is at 50% capacity. Airlines are opening up new routes every single month and the government is already focused on expansion to plan for future growth. It’s the same with the streets, so you’re still going to have that ’All the fun, none of the hassle’ type of culture where, if I want to go down the street, it’s not going to take me an hour to get there. If there’s a nice restaurant, it’s not going to take an hour to get there and an hour to come back.

“We want the players to be playing, having fun and not thinking about all the other hassles that come along with the location.”

Infrastructure has been key to Clark’s rise. Last year, the first of four new passenger terminals planned for the former air base – now Clark International Airport – was opened, tripling the annual passenger capacity from its previous level of 4.2 million to 12.2 million. By the time the fourth terminal opens in the years ahead, annual capacity will be a massive 110 million people.

Complementing the air access is better road and rail infrastructure, most notable being the US$15 billion North-South Commuter Railway connecting Clark and Manila, including a link between Clark International Airport and Manila’s Ninoy Aquino International Airport. Construction began earlier this year.

Complementing the air access is better road and rail infrastructure, most notable being the US$15 billion North-South Commuter Railway connecting Clark and Manila, including a link between Clark International Airport and Manila’s Ninoy Aquino International Airport. Construction began earlier this year.

Operators that IAG spoke to said greater airlift is still needed, particularly to expansion markets such as Malaysia and Vietnam which currently have no direct connection. However, flights to and from Korea are now at seven per day, and Eva Air became the first Taiwanese airline to launch a Taipei-Clark route back in April. A second, STARLUX, inaugurated the same route in August.

“We can definitely see more and more improvement in terms of air travel,” notes Hann Resorts Assistant Vice President for Casino Marketing, Ryi Lim. “In the past, even six months ago, would I see any Chinese walking in saying, ’I want to be a member’? I would say no, but recently we started to see Taiwanese coming in and saying, ’I want to be part of your rolling program.’”

Devanadera says the CDC is actively targeting Taiwan as a key growth market, while Japan has potential too.

The benefit of Clark’s growth can be seen in figures released by gaming regulator PAGCOR.

Clark casinos generated gross gaming revenues of Php8.66 billion (US$153 million) in 2018, but this has grown rapidly to Php12.17 billion (US$215 million) in 2019 and to Php20.64 billion (US$364 million) in 2022. GGR for the first six months of 2023 was already nearing that FY22 figure at Php16.15 billion (US$285 million).

According to Devanadera, future growth in the gaming industry will be prompted by the addition of more high-end integrated resorts like those seen at Hann and Royce.

“But aside from that, we also would like to encourage investments in things like hotels and even theme parks,” she said. “That’s the new challenge, to increase investment and to increase tourists. But this is a problem that we welcome.

“Hopefully in 10 years’ time we will be able to attain what we want to have, which is to transform this to a regional hub – regional from the point of view of ASEAN, not just from the point of view of the domestic region.”