Genting Malaysia Berhad has reported net profit of MYR158.3 million (US$33.8 million) for the three months to 30 September 2023, reversing an MYR8.2 million (US$1.75 million) loss from a year earlier on improved revenues across all of its gaming operations in Malaysia, the UK and Egypt, and the US and Bahamas. The Q3 result also improves on the narrow MYR30.3 million (US$6.5 million) in profit Genting Malaysia recorded in 2Q23.

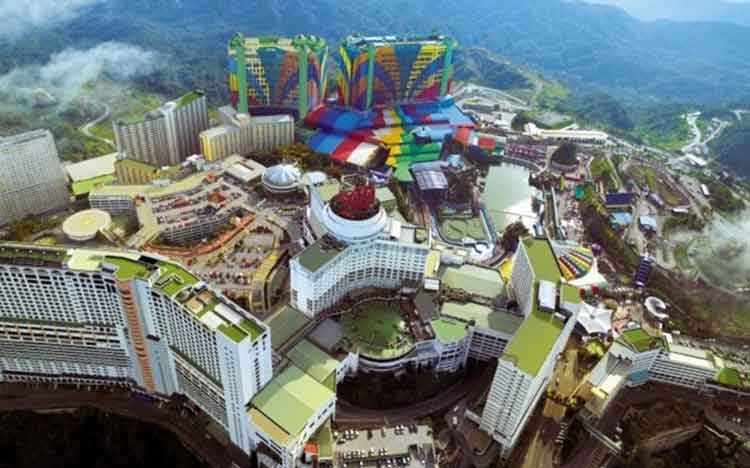

The latest result comes on the back of a 19% increase in group-wide revenue to MYR2.71 billion (US$579 million), up 19% year-on-year, of which the company’s flagship Malaysian IR Resorts World Genting (RWG) booked a 20% improvement to MYR1.68 billion (US$359 million). The company’s UK and Egypt properties grew by 26% to MYR494.9 million (US$106 million) and its US and Bahamas properties by 11% to MYR473.7 million (US$101 million).

Group-wide Adjusted EBITDA was up 27% year-on-year to MYR747.6 million (US$160 million), including a 27% rise in Malaysia to MYR563.9 million (US$120 million).

For the first nine months of 2023 combined, Genting Malaysia recorded a 21% increase in revenues to MYR7.47 billion (US$1.60 billion) and 9% increase in Adjusted EBITDA to MYR1.79 billion (US$382 million), of which RWG booked a 27% increase in revenues to MYR4.62 billion (US$987 million) and a 31% increase in Adjusted EBITDA to MYR1.53 billion (US$327 million).

In a note, Nomura analysts Tushar Mohata and Alpa Aggarwal pointed out that all 10,000 hotel rooms at RWG are now operational, highlighting strong visitation despite the fact that Chinese tourists have not yet returned in pre-pandemic numbers.

“Overall, 3Q23 adjusted EBITDA was close to its all-time highs recorded in 3Q18, a sign that visitation improvement is slowly but surely translating to steady profitability improvement,” they wrote. “Overall, a sequential uptick in profitability was driven by the Malaysia and UK businesses, and lower losses from Empire.”

In assessing its results, Genting Malaysia said it “continues to drive productivity improvements to strengthen the resilience of the business amid an increasingly challenging operating environment.

“The Group will continue to place emphasis on operational excellence and effective cost management, positioning the Group to capitalise on the long-term growth trajectory in travel from the wider region. At the same time, the Group will optimise yield management and database marketing efforts to grow business volumes and visitation at RWG.”