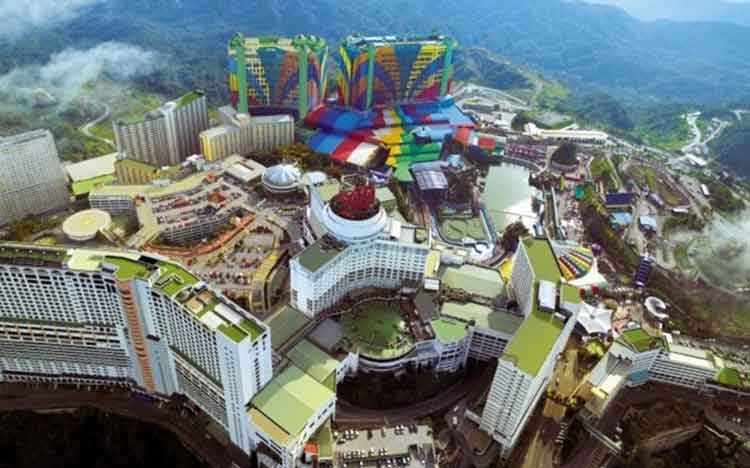

A strong recovery at its Malaysian integrated resort, Resorts World Genting (RWG), is expected to drive Genting Malaysia’s accelerated recovery in 2023, with local EBITDA tipped to grow by 38% to MYR2.2 billion (US$498 million) according to Nomura Research.

Outlining their thoughts on the gaming and leisure industry on Thursday, Nomura analysts Tushar Mohata and Alpa Aggarwal said Genting Malaysia had underperformed in 2022 due to limited tourism from China plus still-depressed net income as a result high interest and depreciation charges after years of capex, even though revenue and EBITDA have recovered materially post-reopening.

However, RWG should see continued earnings improvement in 2023 as visitor arrivals continue growing, while there is also increased optimism on Chinese border reopening.

“We expect Malaysia operations’ EBITDA to grow from MYR1.6 billion (US$362 million) in 2022 to MYR2.2 billion (US$498 million) in 2023, mainly due to further visitor growth, helped by the openings of additional attractions at Skyworlds theme park,” the analysts wrote.

“Resorts World New York City and UK operations are likely to remain stable as they have already reached pre-COVID levels of visitation [while] losses from Empire Resorts should continue diminishing, [although] the possibility of further [share] purchases by Genting Malaysia] remains.”

On the sector as a whole, Nomura said it is Overweight with Genting Malaysia its top pick [over parent Genting Berhad] “due to expected recovery from Malaysia operations, shrinking losses from Empire, Genting Malaysia’s prospects in bidding for the downstate New York casino license, and possibility of Miami land disposal for US$1 billion+ which can generate a gain of ~MYR3 billion+ for Genting Malaysia.”