The decline of Macau’s junket industry means operators need to rethink their credit decisions as they focus more on premium direct.

A character in Ernest Hemingway’s novel The Sun Also Rises was asked how he went bankrupt, to which he replied, “Two ways. Gradually and then suddenly”. That’s an apt description of the decline of Macau’s junket industry, which changed irrevocably after new gaming regulations were adopted in January following years of ever more draconian restrictions.

With the gradual and then sudden demise of the Macau junket industry, casino concessionaires are confronted with a stark choice: migrate junket players to in-house premium direct programs or rethink their Macau operations in fundamental ways.

With the gradual and then sudden demise of the Macau junket industry, casino concessionaires are confronted with a stark choice: migrate junket players to in-house premium direct programs or rethink their Macau operations in fundamental ways.

THE CHALLENGE OF ENGAGING JUNKET PLAYERS

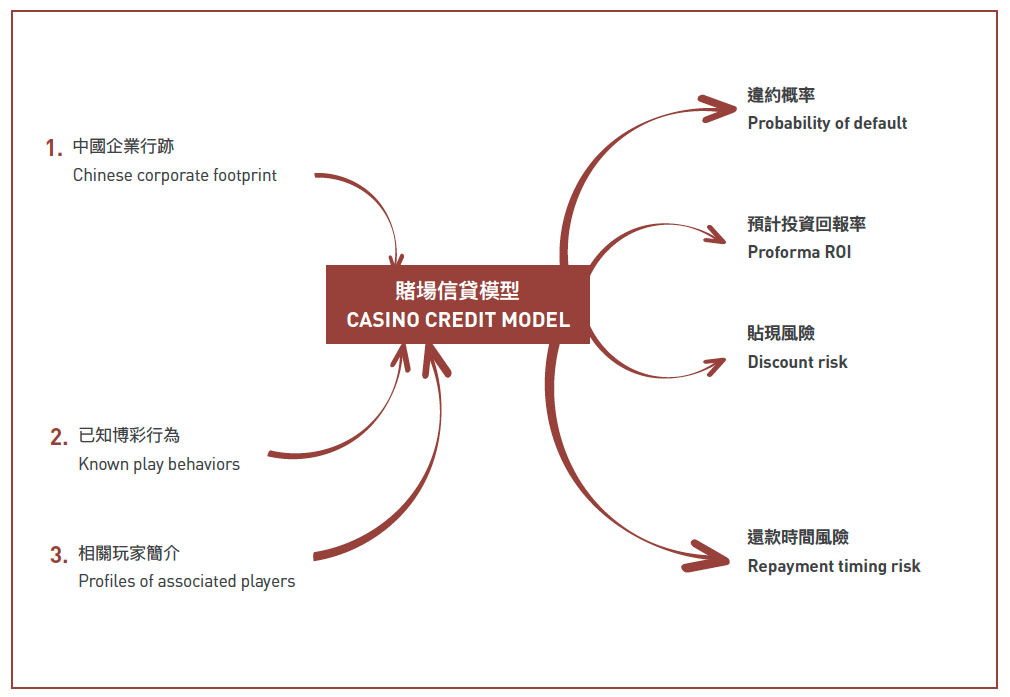

Migrating programs from junket to in-house programs requires reimagining casino credit: no small feat in Macau. The challenge of extending credit in Macau is multi-faceted. First, casino credit is not a valid credit instrument in most Asian jurisdictions, including the People’s Republic of China (PRC). Second, many – if not most – junket patrons have few assets in markets where casino credit is enforceable. Third, unlike many other major markets, winnings are taxable even if those winnings are derived from credit which subsequently goes bad. Last, strict know-your-customer (KYC) regulation constrains engaging with many patrons in emerging markets. We recently analyzed a junket receivables database and highlighted some interesting takeaways from this analysis, which proposes a novel approach to understanding these patrons’ creditworthiness.

PROFILE OF JUNKET NON-PERFORMING LOAN PATRONS

PROFILE OF JUNKET NON-PERFORMING LOAN PATRONS

The junket patrons we reviewed are meaningfully different than similar-value premium direct patrons. In general, the junket players we reviewed received larger credit lines than premium direct patrons. For instance, the average junket player with bad debt in our database received a HK$5.9 million (US$750,000) credit line, while similar premium direct patrons received 32% less, or HK$3.9 million (US$500,000).

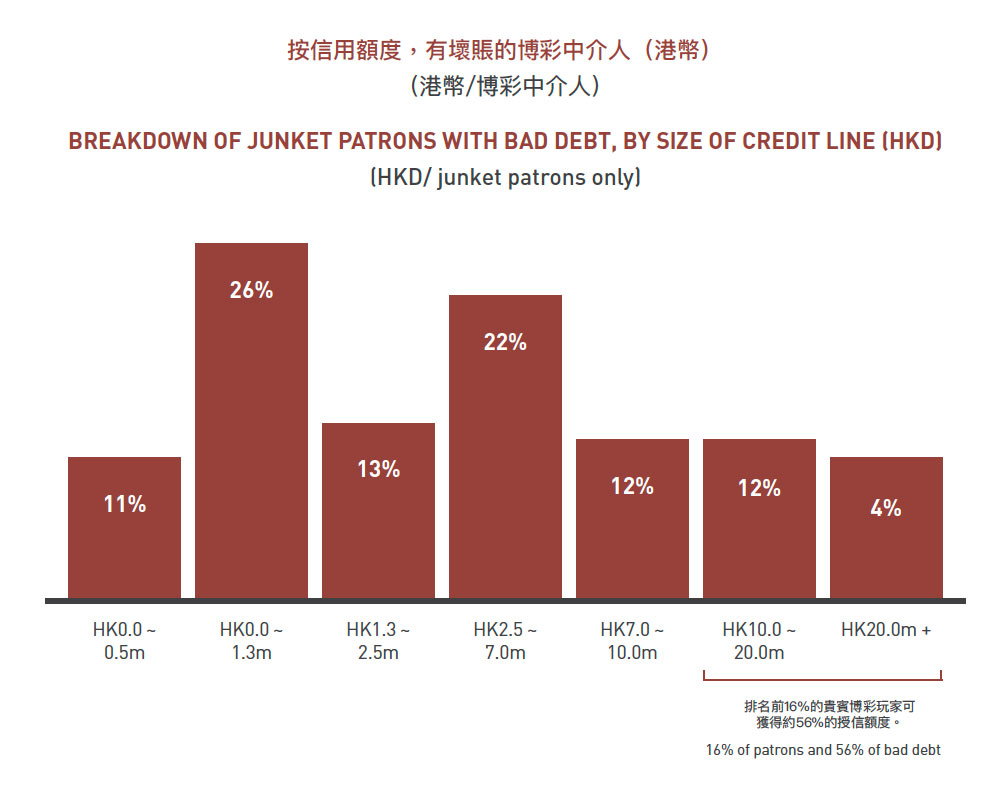

While the average premium direct patron has a smaller credit line than a similar junket patron, the junket database is less dependent on a few large patrons, in contrast to our experience with premium direct databases. As an example, with our junket database the top ~16% of junket patrons have 56% of the issued default credit. While this result is skewed towards larger players, that skew is less steep than in premium direct databases. For instance, some premium direct databases we are familiar with are so skewed that the top 15% of patrons represent 70% to 80% of debt.

While the average premium direct patron has a smaller credit line than a similar junket patron, the junket database is less dependent on a few large patrons, in contrast to our experience with premium direct databases. As an example, with our junket database the top ~16% of junket patrons have 56% of the issued default credit. While this result is skewed towards larger players, that skew is less steep than in premium direct databases. For instance, some premium direct databases we are familiar with are so skewed that the top 15% of patrons represent 70% to 80% of debt.

Junket players not only receive larger credit lines on average, but this inflation exists broadly across the value spectrum. As such, there may be a pervasive and wide-spread discrepancy between what these junket players expect in terms of credit and what the operator is willing to extend.

CREDIT WORTHINESS AND CHINESE CORPORATE PROFILE

CREDIT WORTHINESS AND CHINESE CORPORATE PROFILE

Concessionaires often particularly struggle with understanding Chinese players’ assets and financial resources. This misunderstanding when addled by cross-city competition has led to aggressive credit decisions. Please recall the opening of the two Singapore casinos, where competition led to a double-digit bad debt expense which took years to unwind.

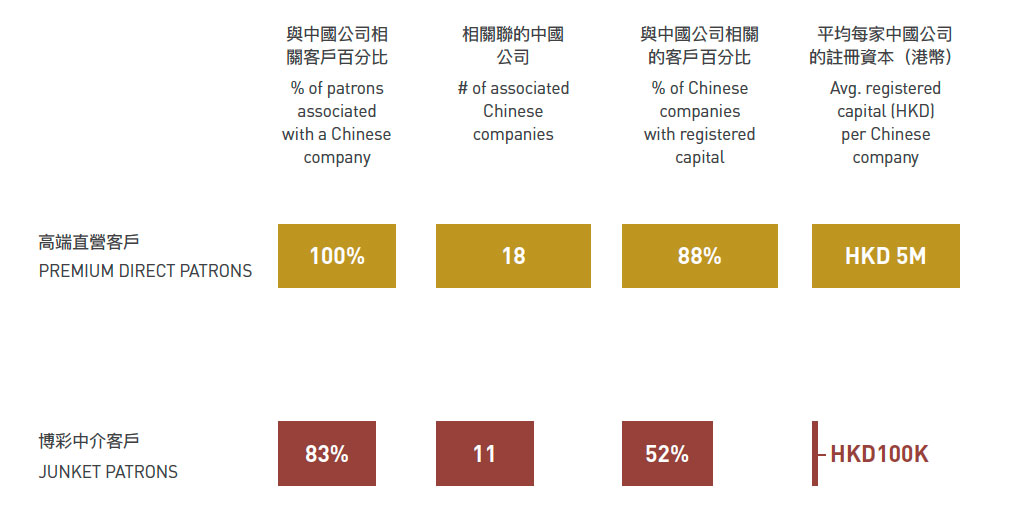

In reviewing the junket database of non-performing loans, we cross-referenced these players against a registry of Chinese registered companies. This registry includes details about a company’s formation including founding date and the start-up capital and, crucially, the founding directors or owners. We found that junket bad debt players differ from existing premium direct players in several notable ways. All of the premium direct players we reviewed are associated with a company in China while only 83% of junket bad debt patrons are likewise associated with a company.

Existing premium direct patrons are more prolific than junket players; on average associated with 18 different companies while the junket players are associated with only 11. The companies associated with premium direct players are much more likely to be funded. For instance, premium direct associated companies are funded 88% of the time versus 52% for companies associated with junket players. And the companies associated with premium direct players are funded much more substantially (RMB$5 million) than companies associated with junket players (~RMB100,000 to RMB500,000). Please note the conclusions above are based on a small sample and may not be verbatim representative of every database, but we expect the results to be directionally correct.

Existing premium direct patrons are more prolific than junket players; on average associated with 18 different companies while the junket players are associated with only 11. The companies associated with premium direct players are much more likely to be funded. For instance, premium direct associated companies are funded 88% of the time versus 52% for companies associated with junket players. And the companies associated with premium direct players are funded much more substantially (RMB$5 million) than companies associated with junket players (~RMB100,000 to RMB500,000). Please note the conclusions above are based on a small sample and may not be verbatim representative of every database, but we expect the results to be directionally correct.

JUNKET THINKING

JUNKET THINKING

Junket operators have left indelible clues about how they think about a particular player’s risk profile in the concessionaires’ databases. Over the last 20 years, operators will have collected at least player particulars but sometimes exquisitely detailed information. From this data, operators can assess which players to pursue but also recreate the junket operator’s risk assessment. For instance, if a player visited multiple times over a long period, the junket operator is likely funding multiple trips and the player is more likely to have repaid previous markers. Metrics like a player’s play preferences, inclining status and credit velocity all should influence the operator’s credit calculus.

IMPLICATIONS

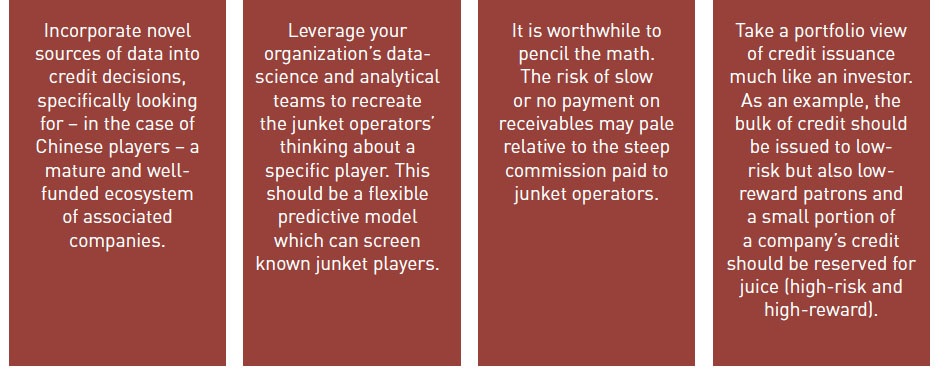

Moving forward we have some specific recommendations for credit managers, as below.