Genting Malaysia reported a net loss of MYR147.9 million (US$33.6 million) in the three months to 31 March 2022, down from a profit of MYR124.0 million (US$29.5 million) in 4Q21 due to costs associated with reopening and weakened demand associated with the Omicron variant.

However, the result was vastly improved on the March 2021 quarter when the company reported a net loss of MYR501.3 million (US$121 million).

Group-wide revenue in 1Q22 was MYR1.72 billion (US$391 million) – almost three times higher than the same period last year but slightly down on MYR1.89 billion (US$450 million) in the December quarter. Adjusted EBITDA of MYR414.4 million (US$94 million) compared with an EBITDA loss of MYR110.4 million (US$25.1 million) in 1Q21 and Adjusted EBITDA of MYR738.1 million (US$176 million) in Q4.

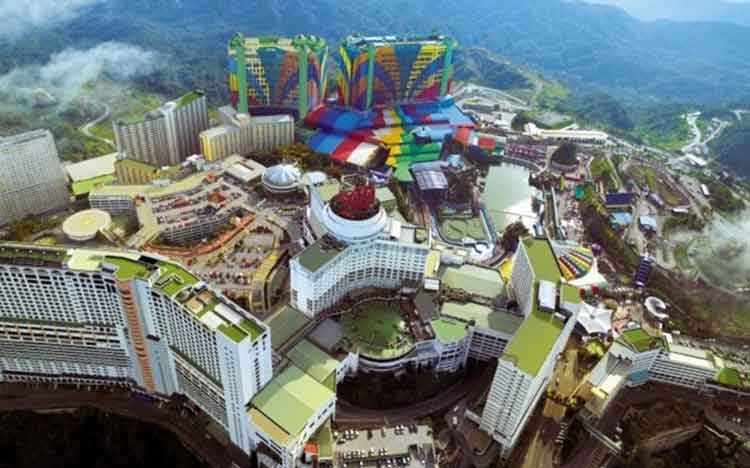

The 1Q22 results included strong revenue increases across the board, with Malaysia’s Resorts World Genting recording revenue of MYR920.0 million (US$209 million), up from MYR299.0 million (US$68 million) a year earlier. UK and Egypt properties recorded revenue of MYR395.3 million (US$90 million) versus MYR40.2 million (US$9.1 million) in 1Q21 while the USA and Bahamas saw revenues up from MYR256.3 million (US$58 million) to MYR357.9 million (US$81 million).

Discussing the short-term outlook, Genting Malaysia said, “International tourism is expected to continue its gradual recovery although weakening economic sentiments may delay the return of confidence in global travel.

“Nevertheless, the progressive reopening of borders and continued easing of COVID-19 restrictions will improve optimism surrounding the tourism, leisure and hospitality industries, including the regional gaming sector. Therefore, the Group is positive on the longer-term outlook of the leisure and hospitality industry.”