Almost US$3.5 billion has been wiped off from the market capitalization of Macau’s gaming operators since Friday as investors continue to exhibit caution over the sector.

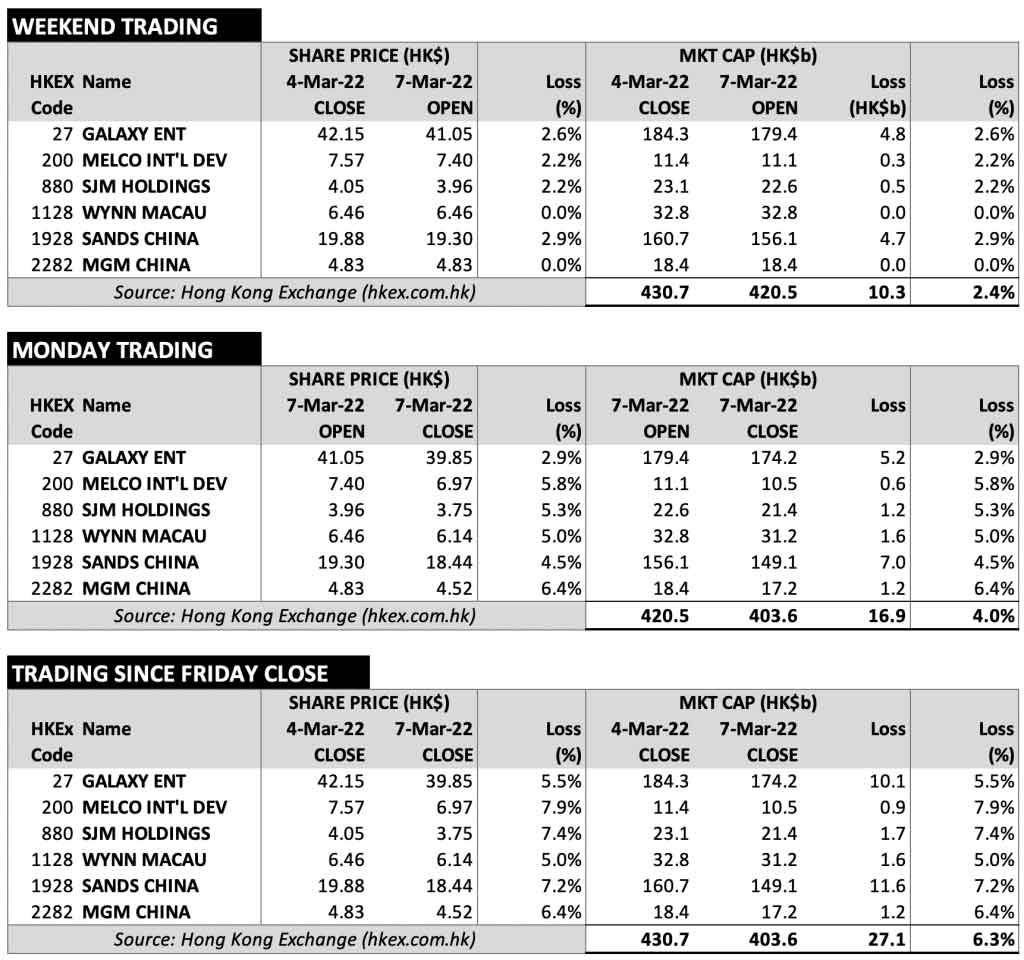

The Hong Kong-listed entities of all six Macau casino concessionaires have fallen substantially in the 72 hours between trading close on Friday and trading close on Monday, the most substantial being Melco International Development – the majority owner of Melco Resorts & Entertainment – which saw its share price fall 7.9% to HK$6.97.

SJM Holdings fell 7.4% to HK$3.75, Sands China by 7.2% to HK$18.44 and MGM China by 6.4% to HK$4.52, while Galaxy Entertainment Group dropped 5.5% to HK$39.85 and Wynn Macau by 5.0% to HK$6.14.

In total, the combined market cap of the six companies fell by 6.3% or HK$27.1 billion (US$3.47 billion) to HK$403.6 billion (US$51.6 billion).

It is not immediately clear what has caused the share prices to decline although it comes just days after the Macau SAR Government announced a six-month extension to the current 20-year licenses of all six concessionaires, from their previous expiration date of 26 June 2022 until 31 December 2022.

It is not immediately clear what has caused the share prices to decline although it comes just days after the Macau SAR Government announced a six-month extension to the current 20-year licenses of all six concessionaires, from their previous expiration date of 26 June 2022 until 31 December 2022.

It is expected that amendments to Macau’s gaming law will be finalized by the Legislative Assembly by June, with a re-tendering process for gaming concessions to be conducted in the second half of the year.

Macau’s gaming stocks had been gradually recovering since losing 26% of their value – HK$143 billion (US$18.4 billion) – in a single day last September in response to the Macau government first unveiling its draft revisions to the city’s gaming law.