The NSW Independent Liquor and Gaming Authority (ILGA) has outlined several agreements it has reached with Crown Resorts that it says provide a genuine pathway for the company to achieve suitability, including an agreement for both Crown and its Sydney rival Star Entertainment Group to transition towards cashless gaming.

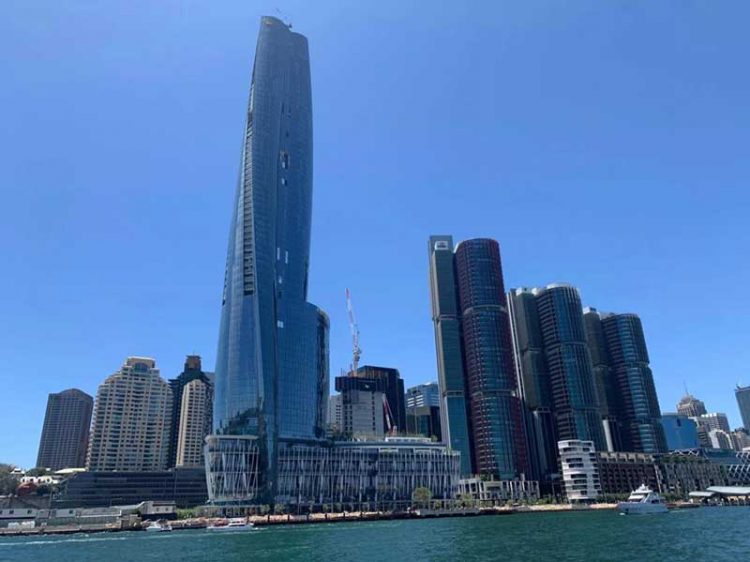

An update on Crown’s progress was provided by ILGA Chairman Philip Crawford at a press conference on Thursday in the wake of a report handed down by Commissioner Patricia Bergin in February that found the company unsuitable to hold a state casino license for its AU$2.2 billion (US$1.6 billion) Crown Sydney development.

According to ILGA, Crown has now agreed to pay AU$12.5 million towards the costs of the Bergin Inquiry and to immediately commence payment of an annual AU$5 million Casino Supervisory Levy it had allegedly been previously reluctant to pay.

The company also reiterated its commitment to cease all international junket operations and to phase out indoor smoking at its Australian resorts by December 2022.

The most notable agreement, however, relates to cashless gaming with the regulator outlining plans to implement cashless card technology linked to each individual’s identity as well as to a recognized financial institution.

“The onus there is being able to trace where the money is coming from,” said Crawford. “It is very consistent with the KYC technology and regulations that our banks operate under.”

Star, which has reached the same agreement with ILGA, told IAG, “Customers are demanding alternatives to cash across all sectors and it’s inevitable gaming will move in the same direction.

“The Star has previously discussed with ILGA the prospect of building and trialing solutions. We’ve also invested in technology to develop the scenarios that will enable future cashless gaming.

“This will be a gradual transition with the customer in mind, with an implementation timeline still to be determined.”

There is still some work to be done before Crown can reach suitability, with ILGA awaiting the results of independent audits into the company’s accounts to ensure there have been no breaches by organized crime. Two Crown accounts found to have handled criminal funds by the Bergin Inquiry, as well as the Crown subsidiaries that operated them, have already been shut down, Crawford said.

An independent monitor has also been appointed to report on Crown’s culture, AML controls and corporate governance.

Despite this, Crawford said he expects the company to achieve suitability – likely sometime in Q3 – based on their current progress under Executive Chairman Helen Coonan. He did, however, fire a parting salvo at the company’s previous board and executive team for their “adversarial and aggressive” approach to negotiations before the release of the Bergin Report in February.

Five Crown board members – Guy Jalland, Michael Johnston, Andrew Demetriou, Harold Mitchell and John Poynton – plus CEO Ken Barton and General Counsel Mary Manos have stepped down in recent months.

“All the auspices are that [Crown] will achieve [suitability] but I didn’t know in February whether they would,” Crawford said.

“They had to have the will to do it and I reckon it was on the line there. The old management I reckon wanted a fight. I suspect they wanted to take us on with further litigation and I just think that’s a nil sum game for someone to take on a regulator. That’s just silly and would have had the immediate financial consequence of never being able to guess when the casino would open and when they would have their license.

“I think Helen Coonan realized commercially that they needed to work with us. She listened to Bergin who identified some very serious issues and attitudes. I’m pretty amazed she has achieved what she has in four months.

“A lot of the directors realized they had to go and some of the senior management had to go. “That was so obvious from what Bergin had to say.

“So Crown is going to be quite a different company to the one you saw a year ago.”