Sands China has invested heavily to transform Sands Cotai Central into The Londoner Macao, which opened its first phase in February. Inside Asian Gaming takes a deeper look at The Londoner and its prospects for success.

Far removed from the international fanfare that greeted the launch of The Venetian Macao in 2007 and The Parisian Macao in 2016, Sands China’s latest Macau integrated resort concept, The Londoner Macao, quietly opened its doors in February to a relatively small gathering of staff and local industry guests.

While somber might be an overstatement, the atmosphere was certainly subdued given the ongoing impact of COVID-19 on international travel, not to mention the passing of founder, Chairman and CEO Sheldon Adelson just four weeks earlier.

But Sands China Ltd and its US parent, Las Vegas Sands Corp, have high hopes that The Londoner Macao will shine brightest in years to come, lifting the largely underwhelming performance of its predecessor, Sands Cotai Central, to the same dizzying heights as its Cotai Strip brethren.

Coming at a cost of around US$2 billion, The Londoner will become Sands China’s third themed resort in Macau, with its distinctly British features designed specifically to resonate with Chinese tourists: multiple studies conducted both within China and abroad in recent years pinpoint France, Italy – already covered by Sands’ Parisian and Venetian resorts – and the UK among the top European destinations for Chinese travelers.

“From a branding perspective, The Londoner makes sense because they’re creating thematic worlds,” explains independent consultant and board advisor Kevin Clayton, a former Executive Vice President – Marketing Operations for Sands China and more recently Chief Marketing Officer for Galaxy Entertainment Group.

“They’ve got Venetian thematic world, Parisian thematic world and now they are matching that with Londoner. And having done a little bit of research for Sands very early on, back in about 2010 when Parisian was being considered, London as a thematic destination ranked very highly in some of that research.

“Without question the most successful resorts are those that provide photo opportunities on a regular basis back into China and other parts of Asia. That means either having a heavily themed resort or continuously spending money on activating your resort so there is something new and fresh as a headline attraction.

“Sands does have that benefit as regards to having multiple photo opportunities throughout its resorts, plus these three worlds are all interconnected now and I think that’s an important aspect too. You can easily navigate between three worlds that each have somewhat of a different quality, so it’s now multiple worlds in a single destination.”

The transformation of Sands Cotai Central into The Londoner Macao has been no simple task. Phase 1, launched on 8 February, includes the new 600-suite Londoner Hotel – formerly Holiday Inn Macao – which raises the bar for Sands China’s premium hotel offerings with standard suites ranging from 75 to 113 square meters and highlighted by 14 Suites by David Beckham.

Covering the top two floors of The Londoner Hotel, Suites by David Beckham range from 113 to 298 square meters in size and provide a uniquely luxurious experience, Sands says, designed by Beckham himself in collaboration with leading London interior design firm David Collins Studio.

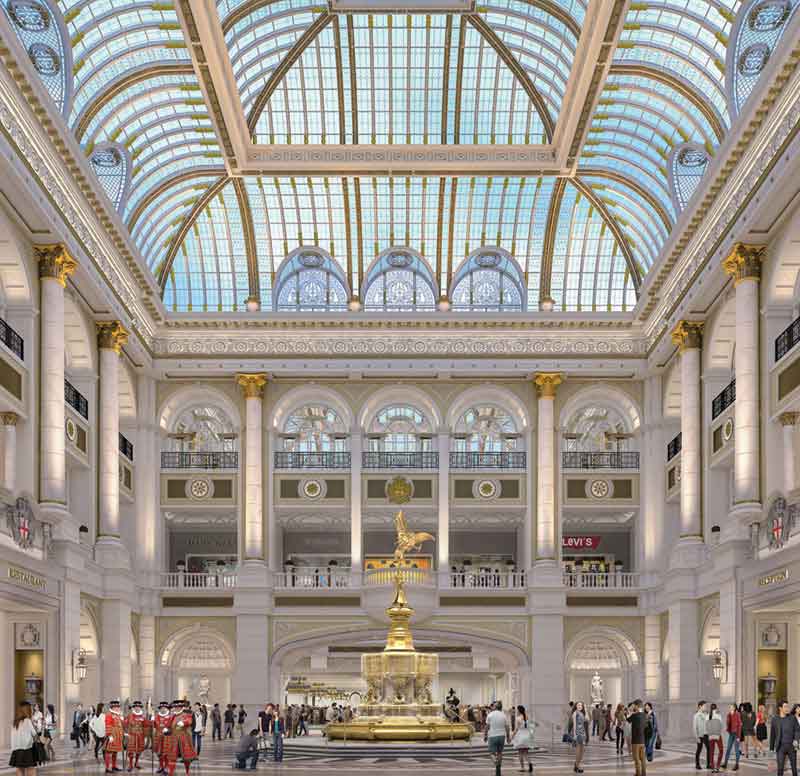

Also part of the initial opening is a new main lobby dubbed Crystal Palace, featuring a 33-meter high glass and iron atrium in classic Victorian style and full-scale Shaftesbury Memorial Fountain as the centerpiece. A “Changing of the Guard” will take place at regular intervals throughout the day in Crystal Palace, replicating the famous Buckingham Palace attraction in London.

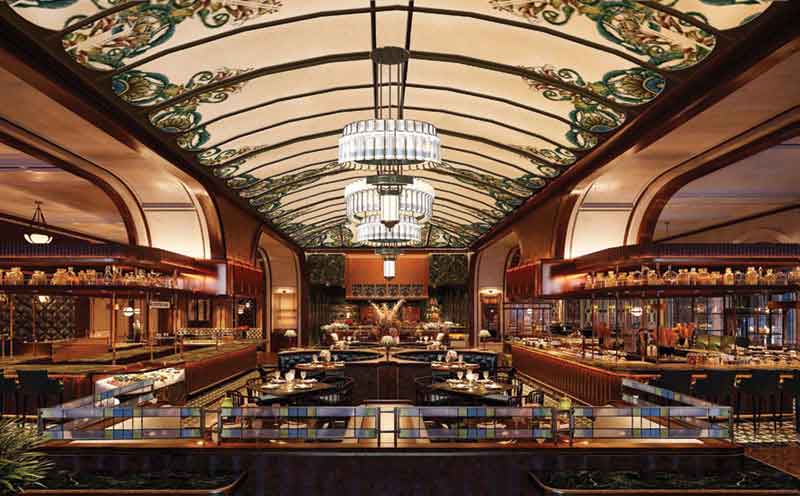

New food and beverage offerings include northern Chinese restaurant North Palace, Churchill’s Table which is said to reflect a classic Victorian-era food hall offering international breakfast and all-day Mediterranean lunch and dinner, and the reopening of St Regis Bar.

Soon to follow will be fine Thai restaurant and bar The Mews, and authentic British gastropub Gordon Ramsay Pub & Grill with a menu put together by the celebrity chef.

By the end of 2021, The Londoner Macao will also welcome a new 6,000 seat Londoner Arena, expanded Shoppes at Londoner retail space with over 150 high-end stores, and the 370-room residential-style all-suite hotel Londoner Court, formerly St Regis Tower Suites, before unveiling its brand-new exterior, featuring detailed replicas of some of Britain’s most famous landmarks – the Houses of Parliament and Big Ben among them.

It’s a massive project with a price tag to match, which begs the question – is The Londoner Macao worth the hefty investment?

Rob Goldstein, the long-time Las Vegas Sands President and COO who replaced Adelson as Chairman and CEO in January, certainly thinks so.

“We had Sands Cotai Central for years and it was not a great product. It didn’t deliver,” he told analysts during the company’s 3Q20 earnings call last year.

And yet, for a property that didn’t deliver, Sands Cotai Central was still Macau’s fourth most successful IR by total EBITDA at the end of 2019 – behind only Galaxy Macau, The Venetian Macao and City of Dreams – with Adjusted Property EBITDA of US$180 million and net revenues of US$505 million in 4Q19.

“Sands Cotai Central is some eight years old now, but you can’t go beyond the fact that it was generating about HK$5 billion in revenues per quarter and HK$1.5 billion in EBITDA per quarter in 2019,” observes Clayton.

“I think the strategy is right to upgrade the product and rebrand the property, but it was already a performing business and far outperforming The Parisian (with Adjusted Property EBITDA of US$122 million and net revenues of US$401 million in 4Q19 – placing it seventh among Macau’s IRs behind both Wynn properties).

“The Londoner is costing the better part of US$2 billion, and that will call for a return on investment over and above the investment they had previously made on SCC, so the challenge for Sands is how do they make these thematic worlds really work for them?”

Where Sands Cotai Central undoubtedly fell short was on the gaming floor. Although it ranked fourth among all Macau casinos for both mass table GGR (gross gaming revenue) and slot machine revenue in FY2019, it came in a distant 14th in the VIP segment – leaving it in seventh place overall for total GGR and last among those on the Cotai Strip.

Ultimately however, this US$2 billion transformation into The Londoner Macao is really predicated on hotel rooms.

When first conceived back in the late 2000s, around the same time Adelson was celebrating the hugely successful launch of The Venetian Macao, Sands Cotai Central was envisioned as Macau’s pathway to becoming Asia’s convention hub, much like Sands had done for Las Vegas in the United States and would soon do for Singapore via Marina Bay Sands.

But a severe lack of hotel inventory was a major problem. Reluctant to take on the entire financial risk of developing another 6,000 hotel rooms himself, Adelson devised a plan to bring in a collection of international hotel brands instead to bear some of the burden. Those brands would get their slice of the pie thanks to Macau’s high occupancy and room rates, leaving Sands to focus on casino operations.

The idea was to provide a mid-tier hotel option for the business traveler, and after early discussions with Traders Hotels fell through, it was InterContinental Hotels Group that would eventually come to the party, bringing with it four internationally renowned hotel brands in Sheraton, Conrad, St Regis and the 4-star Holiday Inn.

Fast forward to 2017 and Sands China was facing a dilemma. A year earlier it had opened The Parisian Macao as a 4-star hotel product targeted towards mainland China’s mass market, but it was becoming increasingly apparent that what the company really needed was more high-end suites like the ones selling out every week at neighboring Venetian. They simply couldn’t keep up with demand in the rapidly growing premium mass segment.

In response, Sands spent US$250 million converting 600 hotel rooms into 300 suites, with the finished product hitting the market in late 2018. Yet it was immediately clear that Sands faced a near identical problem just a few hundred meters further up the Cotai Strip. It was this lack of premium hotel room inventory and inability of Sands Cotai Central to attract high-end customers that ultimately led to The Londoner Macao and its two core features: Londoner Hotel, the result of Holiday Inn’s 1,200 hotel rooms being converted into 600 suites, and Londoner Court, a brand new hotel adding another 370 suites into the mix.

“It’s a way of pulling back inventory and bringing higher-end product back into circulation,” explains Niall Murray, Founder and Chairman of IR operations consultancy specialist Murray International Group and former Vice President of Operations Development at The Venetian Macao.

“What was the benefit of turning Sands Cotai Central into The Londoner? Well, if you look at Sands Cotai Central, it wasn’t a brand and it wasn’t an attractive brand. It was just a hodge-podge of international hotel chains thrown together. It didn’t have an identifier and it didn’t have anything that really drew in people for any particular reason.

“But they believe The Londoner Macao will turn heads for the Chinese and give them a unique experience rather than a generic shopping mall experience.

“They’ve dropped the lower-end economy brand and turned it into their own high-end brand, and when you look around at the rest of the market and what the others are all doing, this makes the property competitive again.”

Alidad Tash, Managing Director of Hong Kong and Macau-based gaming and IR consultancy firm 2NT8 Ltd, says London, like Paris and Venice, represent tangible destinations to the Chinese consumer – unlike the quasi-Polynesian theme that felt out of place inside the old Sands Cotai Central.

“That was not nearly as attractive to the Chinese as Paris and Venice are,” Tash explains. “By converting to Londoner, they’ll be able to provide three of the most sought after destinations in Europe, which matches up with the typical aspirations for Chinese.

“Now they can go to Venice, Paris and London rather than Venice, Paris and Polynesia.”

The financials add up too, Tash adds, noting that a better property means higher room rates and more revenue across the board.

“They could charge an extra HK$120 (US$15) more per room per night, which is nothing, but at 85% occupancy yields more than HK$220 million (US$29 million) in extra hotel revenue each year,” he says. “Then add in extra F&B spend and all the other components. It will generate more bodies, more demand, higher rent at the mall and all the various spends at the casino. So I think a return on investment of four or five years is not an unreasonable expectation.”

According to Clayton, the success or otherwise of The Londoner Macao will ultimately come down to brand building: can Sands generate the same affiliation with quality at The Londoner Hotel and Londoner Court as The Ritz-Carlton or Marriott – both located at rival Galaxy Macau – or its own Four Seasons, located alongside The Venetian Macao and which recently completed an upgrade of its own to become the world’s largest all-suite hotel (with the biggest of its 649 suites measuring a massive 455 square meters)?

“Brands like Ritz Carlton and the Marriott rank very highly in Chinese perception of quality because of their global recognition,” Clayton says.

“While The Londoner as a brand strategy is a good one, they’ve really got to make sure it is positioned as a premium product and therefore they are going to have to build that brand into China. It doesn’t carry the cachet of some of the other hotel brands that are globally recognized.

“Sands is an incredibly successful business, and it has an incredibly successful property in The Venetian Macao, but if they consider Sands Cotai Central to have been an underperforming product, that means The Londoner really needs to outperform the market now.

“Ironically if there is a property that is underperforming right now in their portfolio it is likely to be The Parisian, relative to the investment that they’ve made. The Venetian has certainly performed, so the question now is whether a second thematic product, either Parisian or Londoner, can really perform as well as The Venetian.”