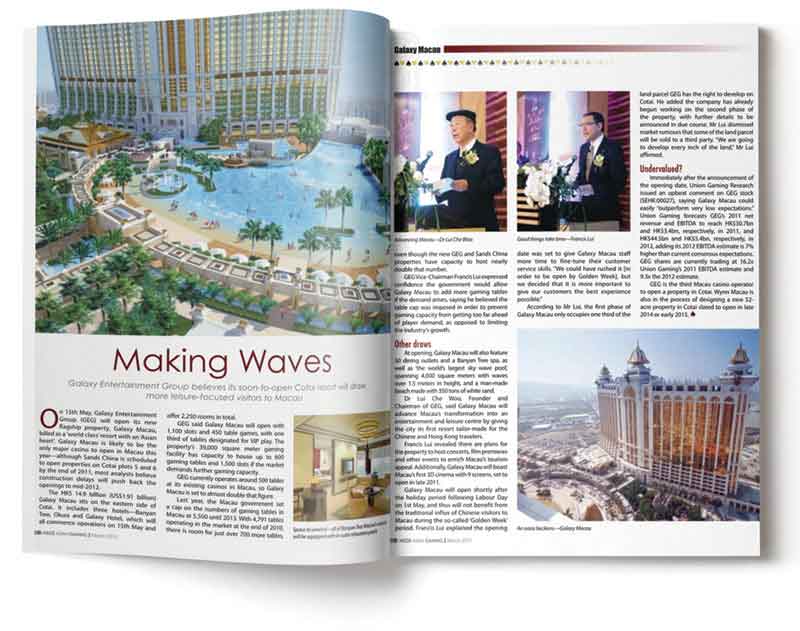

In this new regular feature in IAG to celebrate 16 years covering the Asian gaming and leisure industry, we look back at one of our cover stories from exactly 10 years ago, titled “Making Waves,” to rediscover what was making the news in March 2011!

Hindsight is a wonderful thing. Inside Asian Gaming’s March 2011 issue featured a fascinating deep dive into the prospects of Galaxy Macau – at that time just a few short months away from opening its doors for the first time – including investor sentiment that was far from complimentary.

In particular, the article highlighted comments by Union Gaming, one of the more upbeat brokerage houses, which observed “very low expectations” for Galaxy Entertainment Group’s HK$14.9 billion (US$1.92 billion) Galaxy Macau development.

Union Gaming tipped GEG to outperform consensus, but still estimated a relatively moderate HK$30.7 billion in revenue and HK$3.4 billion in EBITDA in 2011, rising to HK$44.5 billion and HK$5.4 billion in 2012.

Union Gaming tipped GEG to outperform consensus, but still estimated a relatively moderate HK$30.7 billion in revenue and HK$3.4 billion in EBITDA in 2011, rising to HK$44.5 billion and HK$5.4 billion in 2012.

But while 2011 proved a slow burner for GEG, it was a very different story by 2012 as revenue soared to HK$56.7 billion and EBITDA to HK$9.8 billion.

Of course, the Galaxy success story is now well known. Sitting alongside Sands China’s The Venetian Macao as the most successful properties in Macau (and therefore in most of Asia), Galaxy Macau helped push GEG to net revenues of HK$51.9 billion and Adjusted EBITDA of HK$16.5 billion in 2019, before COVID-19 came along to suppress the entire market.

Galaxy Macau’s success has also ensured GEG is the best placed of all six Macau gaming concessionaires to ride out the COVID-19 pandemic with a HK$43.2 billion (US$5.57 billion) stockpile of cash as of late 2020.

Galaxy Macau’s success has also ensured GEG is the best placed of all six Macau gaming concessionaires to ride out the COVID-19 pandemic with a HK$43.2 billion (US$5.57 billion) stockpile of cash as of late 2020.

So profitable has Galaxy Macau proved to be that GEG announced in February 2021 that it would fund development of Galaxy Phase 4 entirely from its own coffers.