The moment of truth is finally here. As the clock ticked over from 2019 to 2020, we entered what almost all industry pundits believe will be the most important year in determining the shape of the Japanese IR industry for decades to come. The Japanese market is the hottest issue across the globe for our industry right now, and 2020 will be the year in which the two biggest questions – which operators will partner up with which locations, and which locations will house the first three Japanese integrated resorts – will be largely answered.

In this two part series, Inside Asian Gaming CEO Andrew W Scott takes a deep dive into the candidate locations and the candidate operators.

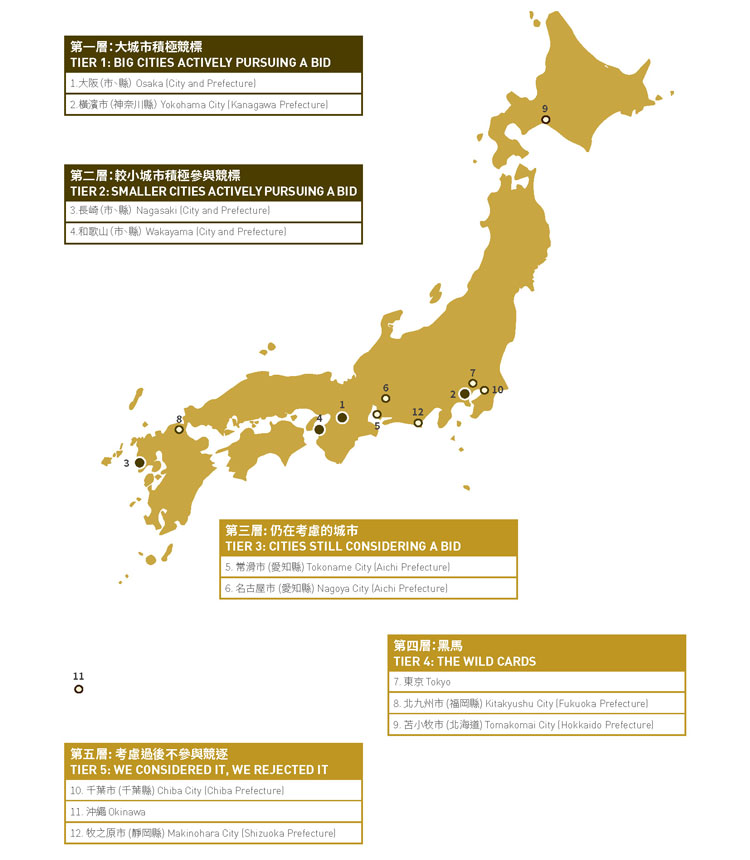

In part 1, Andrew discusses 12 candidate locations across the length and breadth of Japan. As at the time of writing, eight of these locations have formally declared that they are actively pursuing an IR bid. The remaining four are either yet to formally declare their intentions but are widely considered possible candidate locations, or formerly expressed interest and have withdrawn, at least for the time being. Andrew ranks them from most likely to win an IR bid to least likely, in his opinion, and offers his commentary on the pros and cons of each.

In part 2, to run in our March issue, Andrew will discuss approximately 20 operators that have thrown their hat in the Japan IR ring. Again, he will rank them in order from most likely to win to the least likely, in his opinion. He’ll commentate on the strengths, weaknesses and leadership of each, and analyze their strategies thus far in the Japanese IR process.

Watching the to and fro over the question of Japanese IRs for the past two decades has been simply fascinating. We saw plenty of false starts through the 2000s and early 2010s. Depending on how you look at it, the Japanese are either masters of planning, studying and debating minutia for years, or they are masters of procrastination and delay, always finding an upcoming election or some other justification to kick the can down the road “just one more time.”

Watching the to and fro over the question of Japanese IRs for the past two decades has been simply fascinating. We saw plenty of false starts through the 2000s and early 2010s. Depending on how you look at it, the Japanese are either masters of planning, studying and debating minutia for years, or they are masters of procrastination and delay, always finding an upcoming election or some other justification to kick the can down the road “just one more time.”

But Japanese Prime Minister Shinzo Abe’s Liberal Democratic Party has resolutely stuck to the task year in and year out, finally seeing the passage of the Integrated Resort Promotion Act in December 2016, followed by the Integrated Resorts Implementation Act in July 2018. The slow grinding machine of Japanese politics and bureaucracy is inexorably crawling its way to the finish line.

The truly big decisions – where the IRs will be, and who will run them – can no longer be delayed or ignored. The national government has determined that the Japanese regulator, currently in the form of the Casino Administration Committee, will at long last come into existence on 7 January this year. And in November the Ministry of Land, Infrastructure, Transport and Tourism proposed 4 January to 30 July 2021 as the period for local governments, hand in hand with their then-partnered up private sector IR operators, to submit their IR applications to the national government. The result of those applications will determine the three locations, and the three operators, of Japan’s first round of integrated resorts. Should those resorts be deemed a success, there is provision for a second round of IR licenses to be issued, many years in the future.

That leaves 2020 as the calendar year in which this long dating game between candidate operators and potential Japanese locales will finally come to a head. The “boys” in this dating game are the candidate operators, some trying to dance with every girl in the room, others with eyes for just one girl, unless and until she rejects him, or, in some cases, she rejects all the boys. The “girls” in this game are the locations (some are cities, some are prefectures), each being courted by a group of boys which waxes or wanes depending on how attractive the girl is, or becomes, as she reveals her demands and conditions.

INITIAL INTEREST TEPID

Let’s start with the “girls” in this dating game, the candidate locations. As a starting point, candidate locations need the political will to enter the game. Historically, that has not been easy to come by. This is because of strong negative public attitudes towards gambling in Japan.

Gambling, mainly in the form of pachinko, is highly prevalent in Japanese society, grossing tens of billions of US dollars in revenue annually. There are around 10,000 pachinko parlors throughout the nation. Despite this, or perhaps because of it, gambling as a general concept is fiercely unpopular in Japanese society. The prevailing image is of a seedy, noisy, smoky pachinko parlor, populated by men you wouldn’t want your daughter to date, and run by Zainichi Japanese of Korean descent – and usually North Korean descent at that! There are zero non-gaming offerings, and zero attention is paid to responsible gambling measures. Gamblers are seen as addicts. Or worse, gambling is linked to the criminal underworld, as it’s so often portrayed in movies. People fear what they don’t understand, so the general populous rejects IRs. They don’t really understand what IRs are, but they know gambling is involved, and they know “gambling is bad.”

Japanese governments realize that today’s multi-billion dollar modern IRs are very different. They know the Japanese IRs will be particularly different, with 97% of their floor area devoted to non-gaming, stringent addiction countermeasures in place, and the enormous capital investment giving rise to a dazzling array of F&B, entertainment, hotel, MICE, architectural and cultural offerings. And don’t forget the stupendous economic and social benefits with the potential to jump-start the Japanese economy and society into a new era.

Japanese governments have done a poor job explaining all this to their constituents. Most Japanese are blissfully ignorant regarding the IR revolution about to sweep across their land. With the people by and large against the introduction of IRs, it has been politically unpopular for cities or prefectures to raise their hands, and especially difficult to get a city mayor and corresponding prefectural governor to raise their hands in unison.

Osaka is the only major city in Japan which has openly and consistently embraced the IR opportunity for many years, with the tag-team pair of Hirofumi Yoshimura and Ichiro Matsui, who both support an IR for Osaka, swapping places as the Mayor of Osaka City and the Governor of Osaka Prefecture early last year.

As the end game for locations has neared, more candidate locations have emerged from the woodwork as serious prospects.

MEET THE GIRLS – THE CANDIDATE LOCATIONS

At a press conference in September, Japan’s Minister of Land, Infrastructure, Transport and Tourism, Kazuyoshi Akaba, listed eight locations “definitely” considering IRs: Chiba City, Hokkaido, Nagasaki, Nagoya City, Osaka, Tokyo, Wakayama and Yokohama City. To that list we have added Kitakyushu City (Fukuoka Prefecture), Makinohara City (Shizuoka Prefecture), Okinawa and Tokoname City (Aichi Prefecture). Each is discussed below. We list them in tiers, which approximately order them in likelihood of success, in our opinion, as at the time of writing.

TIER 1: BIG CITIES ACTIVELY PURSUING A BID

1. OSAKA (CITY AND PREFECTURE)

- City population: 3 million

- Prefecture population: 9 million

- Kansai region population: 23 million

- Known suitors: Galaxy Entertainment Group, Genting Singapore, MGM Resorts

- Leading the race amongst all locations across Japan

As previously stated, Osaka is the only major city in Japan which has openly and consistently embraced the IR opportunity, with strong agreement and coordination between the prefectural and city governments. Public sentiment started negatively, but over the past few years the candidate operators, especially MGM and to a lesser extent Galaxy, have done a serviceable (but costly) job in moving the public sentiment needle.

Osaka Prefecture and Osaka City announced the implementation policy draft last year, with Osaka Governor Hirofumi Yoshimura and Osaka City Mayor Ichiro Matsui holding a press conference on 22 November.

With Yokohama entering the race and drawing away the likes of Sands, Wynn and Melco, and Caesars withdrawing from the Japan race altogether as a result of its Eldorado Resorts merger in the US, Osaka finds itself left with just three suitors remaining at their Request For Concept (RFC) stage – Galaxy, Genting Singapore and MGM.

MGM has a long history with Osaka, announcing its “Osaka first” policy 12 months ago and investing millions into a wide range of community engagement initiatives over many years. It rightfully sees itself as the front runner in Osaka but this is no lay down misère. Galaxy and Genting Singapore both offer serious challenges, and can claim significant advantages over MGM (see separate Osaka article in this issue).

Osaka’s Request for Proposal (RFP) process, which began in December, is set to run to April this year, with the final operator decision planned for June.

The Prefecture and City hope to open the IR in time for the 2025 World Expo in Osaka, however operators have expressed concern that the construction period is too short and will overlap with Expo construction.

With the national government accepting IR certification applications only from January 2021, and making decisions on them later in 2021, getting the doors of an IR open by 2025 looks challenging, given the years of construction likely needed.

2. YOKOHAMA CITY (KANAGAWA PREFECTURE)

- City population: 4 million

- Greater Tokyo area population: 38 million

- Known suitors: Galaxy Entertainment Group, Genting Singapore, Las Vegas Sands, Melco Resorts and Entertainment, Sega Sammy Holdings, Wynn Resorts

- The one the big boys want

Kanagawa Prefecture officially entered the race when Yokohama City Mayor Fumiko Hayashi, after years of silence on the matter, fronted the press on 22 August 2019, announcing, “Yokohama’s future is in crisis … I’ve come to the conclusion that in order to achieve growth and development, we need an integrated resort.”

The city claims the economic ripple effect of a Yokohama IR could be up to JPY 1 trillion (US$9.2 billion) annually. It identified Yamashita Wharf on Yokohama’s waterfront as a suitable location.

With Tokyo itself not officially in the race, Yokohama is seen as a more than acceptable surrogate by the world’s largest IR companies. Part of the Greater Tokyo metropolis consisting of nearly 40 million people, and under an hour by train from Tokyo station, Yokohama immediately stole Osaka’s thunder when it announced itself “on the market.”

Las Vegas Sands, infamous for honing in on the largest population center of any country it seeks to operate in, started touting “Tokyo-Yokohama” as its preferred location, dropping any interest it had in Osaka. It was not alone. Wynn announced a “Yokohama focus,” and Melco a “Yokohama first” strategy, with both companies opening offices in Yokohama around two kilometers from the proposed IR site in the last two months.

The city has wasted no time, passing a supplementary budget for IR related expenses in September, launching its RFC process in October and closing proposals in December. City officials have said they plan to finalize their implementation policy and start the selection process for an operator in 2020, and that they hope to select their operator by 2021.

In November, Yokohama announced it had received seven registrations for the RFC process. While the names of the registered parties were not released, the identities are mostly already well known with Galaxy, Genting, Melco, Sands, Sega Sammy and Wynn having all pointed to Yokohama as an attractive location.

A major issue in Yokohama is the persistent strong opposition to IRs. This opposition is most likely what had Mayor Hayashi sitting on the fence for so long. Citizens remain concerned regarding the area surrounding the casino becoming dangerous and a potential increase in problem gambling. Mayor Hayashi has responded to these concerns, stating, “I have many concerns myself. I firmly believe that if strict regulations of the highest standard are in place, then it will be fine … as long as we continue to explain thoroughly, I believe the citizens will understand.”

Mayor Hayashi also appears to have incurred the wrath of Yokohama Harbor Transport Association Chairman Yukio Fujiki. Known as the “Don” of Yokohama, he controls a small part of Yamashita Wharf and has taken a strongly anti-IR stance, vowing, “I shall not be evicted.”

In September Mayor Hayashi announced plans to personally hold briefings for residents in all 18 city wards, aiming to convince a skeptical public of the benefits of IRs, and allay their concerns. On 4 December she attended the first of these briefings, which was held in Naka Ward, the very ward containing the proposed IR site at Yamashita Wharf. Opposition groups vocally protested in front of the venue and the very same day the Kanagawa Citizen Ombudsman filed a lawsuit at Yokohama District Court demanding all information the city holds on integrated resorts be made public including a list of the operators who have registered to participate in the RFC process. Representative Secretary Takashi Okawa said the fact that the names of operators had been redacted in information releases contradicted the Diet’s resolution regarding fairness and transparency in the process.

TIER 2: SMALLER CITIES ACTIVELY PURSUING A BID

3. NAGASAKI (CITY AND PREFECTURE)

- City population: 430,000

- Prefecture population: 1.3 million

- Kyushu island population: 13 million

- Known suitors: Casinos Austria, Get Nice Holdings, NagaCorp, Peermont Global

- Arguably becomes the most likely regional location given Hokkaido’s apparent withdrawal

In June the Kyushu Governor’s Association confirmed their intention to focus on Nagasaki as the sole IR bid location on Kyushu, Japan’s westernmost main island. The Governor’s Association encompasses all seven prefectures on the main island of Kyushu.

In September, Nagasaki Prefecture announced its Fundamental Plan Proposal for an IR bid, setting the expected capital expenditure between US$3 billion and US$5.1 billion. The proposed Nagasaki site has long been agreed – a 31-hectare plot of land currently owned by Dutch-inspired theme park Huis Ten Bosch in Sasebo City.

Nagasaki conducted an RFC process from 2 October to 22 November 2019. It aims to have its Fundamental Plan finalized by March, an operator selected by the upcoming fall and their IR doors open by 2024.

NagaCorp, Casinos Austria, Hong Kong-listed Get Nice Holdings, South Africa’s Peermont Global and a handful of Japanese firms have expressed an interest in Nagasaki. Huis Ten Bosch has confirmed it will not seek to participate as an operator.

4. WAKAYAMA (CITY AND PREFECTURE)

- City population: 360,000

- Prefecture population: 940,000

- Kansai region population: 23 million

- Known suitors: Barrière, Bloomberry Resorts and Suncity Group

- IR bid has enjoyed the eager support of Governor Nisaka for many years

Yoshinobu Nisaka, Governor of Wakayama for the past 13 years, is a true believer of the potential of the Japanese IR industry. He made his intentions known years ago, and has been resolute in his advocacy for a Wakayama IR. Originally he promoted a foreigners-only concept, which he has long since dropped.

He doesn’t see the likelihood of an Osaka IR as a problem, despite the fact the two cities are only 75 minutes apart by car. He cites numerous advantages of Wakayama, including proximity to Kansai International Airport, the Kansai region population base and the already agreed candidate site of Wakayama Marina City. Nisaka also highlights the stability of his administration and of Wakayama politics in general. The IR site is on an artificial island created around 25 years ago, so construction could begin as soon as a license is awarded. Wakayama Marina City has an established yacht harbor and a national training center for marine sports.

The Wakayama local government has even gone so far as to strike a deal with the current owner of the proposed 20.5 hectare IR site to buy the land for US$70 million should Wakayama’s IR bid be successful. The reason? So that Wakayama can re-sell the land to their eventual IR partner at the same price, thus locking in the land cost for the operator, freeing them from the burden of any future price fluctuations.

In December, Wakayama announced that if the national basic policy for IR bids is finalized in January 2020, as is hoped, it will begin operator recruitment by the Spring and select an operator in the Fall. Just like Nagasaki, their goal is to have the IR doors open by 2024.

So far, three companies have shown interest in a Wakayama IR: Barrière, Bloomberry Resorts and Suncity Group.

Governor Nisaka brims with confidence. In a May 2019 interview with IAG, he said, “In my personal opinion, objectively speaking, Wakayama is sure to win one of the licenses. And I strongly believe that the (national) government will have the same opinion. This project is very promising and that’s why we are so keen.”

TIER 3: CITIES STILL CONSIDERING A BID

5. TOKONAME CITY (AICHI PREFECTURE)

- Tokoname City population: 57,000

- Nagoya City population: 2.3 million

- Prefecture population: 7.6 million

- Chukyo metropolitan area population: 10 million

- Suitors: unknown

- IR would be right next to Chubu Centrair International Airport, which services Nagoya, Japan’s third largest metropolitan region

- Land is immediately available

Tokoname City is home to Chubu Centrair International Airport, about 45 minutes by train south of Nagoya. Chubu Centrair not only serves Nagoya, but is the main international gateway for Japan’s central region, known as “Chubu.” However, since opening in 2005, a number of airlines have withdrawn service from the airport due to lack of business. In 2017 the airport was the eighth busiest in Japan, after the four airports in Tokyo and Osaka combined, and the airports in Fukuoka, Sapporo and Okinawa.

Aichi Prefecture is considering bidding for an IR on the island on which Tokoname’s Chubu Centrair International Airport sits. On 10 December Governor Hideaki Omura confirmed his stance that he preferred the Tokoname City bid to one based in the city of Nagoya itself (which is also in Aichi Prefecture), because of the location right next to the airport.

It should also be noted that the land next to the airport is immediately available, whereas land for an IR in the heart of Nagoya may take time to develop.

6. NAGOYA CITY (AICHI PREFECTURE)

- City population: 2.3 million

- Prefecture population: 7.6 million

- Chukyo metropolitan area population: 10 million

- Suitors: unknown

- Aichi Prefecture says it will decide by April 2020 whether to make an IR bid – and it remains to be seen whether such a bid would be based in Tokoname City or Nagoya City

Nagoya City Mayor, Takashi Kawamura, said in January 2019 Nagoya would decide “by summer” on an IR bid, but no such decision has been forthcoming. In September last year Mayor Kawamura’s official position remained that Nagoya was “considering it positively.”

On 19 December last year Aichi Governor Hideaki Omura announced a public comment period from 20 December 2019 to the end of March 2020. He says a decision on whether Aichi Prefecture will bid or not will be made in April. It remains to be seen whether any Aichi Prefecture IR bid would be based in Nagoya City or Tokoname City, but as mentioned above Governor Omura expressed a preference for the Tokoname City location as recently as December.

TIER 4: THE WILD CARDS

7. TOKYO

- 23 wards population: 9.6 million

- Greater Tokyo area population: 38 million

- Suitors: The world’s largest IR companies

- Status unknown and likely to remain so until after the Summer Olympics closing ceremony on 9 August 2020

Given its status as the most populated urban agglomeration on the planet, with close to 40 million people, the prospect of a Tokyo IR would have any of the world’s tier one IR companies salivating. However, the conventional wisdom over the past few years has been that Tokyo is too busy focusing on the 2020 Summer Olympics to consider bidding for an IR. But all that might be about to change, with the Tokyo Metropolitan Government quietly meeting with potential operators over the next few weeks.

Governor Yuriko Koike faces an election on 5 July, and there’s the small matter of the Olympics to get through in late July and early August. But assuming she survives both (or even if she doesn’t), there’s still enough time for Tokyo to find a willing partner operator to go to the national government with in early 2021.

And you can bet your bottom dollar that is the scenario a gentleman named Mr Adelson, who happens to have friends in high places, will be pushing for.

8. KITAKYUSHU CITY (FUKUOKA PREFECTURE)

- City population: 960,000

- Prefecture population: 5 million

- Kyushu island population: 13 million

- Suitors: Two operators known of including one from Hong Kong

- Seems unlikely given the Kyushu Governor’s Association agreement to focus on Nagasaki as the sole IR bid on Kyushu island

In November, IAG reported that long-time Kitakyushu Mayor Kenji Kitahashi had received an IR proposal from “a Hong Kong operator,” and he intended to “properly consider and study” it as much as possible. IAG understands at least one more proposal has been received by Kitakyushu City. Two sites have been proposed, the most likely of which is the JR Sanyo Shinkansen Kokura Station North Exit. Despite his positive comments, Mayor Kitahashi officially maintains a neutral stance, stating, “Citizens and industries have differing opinions. Our neutral position on an IR bid hasn’t changed, but we will listen carefully to operators who are excited to make proposals.”

Another factor to consider is the Kyushu Governor’s Association agreement to focus on Nagasaki as the sole IR bid on Kyushu. The Governor’s Association encompasses all seven prefectures on the main island of Kyushu, including the prefecture of Fukuoka, which is home to the city of Kitakyushu.

9. TOMAKOMAI CITY (HOKKAIDO PREFECTURE)

- City population: 175,000

- Prefecture population: 5.3 million

- Suitors: Clairvest Group, Hard Rock, Melco Resorts and Entertainment, Mohegan Sun, Rush Street Gaming, SJM Holdings

- Governor Suzuki announced effective withdrawal on 29 November but a chorus of local voices is calling for a rethink

The city of Tomakomai in Hokkaido Prefecture had been the subject of intense speculation as a potential IR location for years, enjoying strong support from local business groups who saw their IR dream as the panacea to the island of Hokkaido’s economic woes. Despite the city council of the preferred IR site passing a resolution just the month before to promote an IR bid, Hokkaido Governor Naomichi Suzuki made a shock announcement on 29 November which seemed to kill any chance of a Hokkaido IR, at least in the foreseeable future.

Addressing the Hokkaido assembly, Governor Suzuki stated, “As a result of careful consideration, I had reached the conclusion that I would like to give an IR bid a shot, however the candidate site is likely to be a habitat of rare animals and plants, and the appropriate environmental considerations would be impossible in the restricted schedule.”

Since Governor Suzuki’s announcement a chorus of voices calling for a rethink has emerged, not least of which being Tomakomai City Mayor Hirofumi Iwakura, who said, “I can only say that it is a real shame. Frankly, I just have this feeling of ‘why?’”

That chorus also includes local government members and the Hokkaido business community. At least one candidate operator, Hard Rock Japan, has vowed to continue pursuing a Hokkaido IR.

Given that other candidate locations seem unbothered by the “environmental considerations” Governor Suzuki cited for his decision, and that Hokkaido’s own regulations may allow for a quicker environmental study to be completed, we may not have heard the end of Hokkaido as a potential location. Watch this space.

TIER 5: WE CONSIDERED IT, WE REJECTED IT

10. CHIBA CITY (CHIBA PREFECTURE)

- City population: 1 million

- Prefecture population: 6.3 million

- Greater Tokyo area population: 38 million

- Suitors: eight suitors currently not known but likely to be similar to Yokohama suitors

- Announced decision to withdraw in early January

Like Yokohama, Chiba City is part of the Greater Tokyo area. Its proposed IR location lies just 45 minutes by train from Tokyo station. In December Chiba City Mayor Toshihito Kumagai revealed the city had received eight IR project proposals in response to their October Request For Information (RFI) process. All eight listed Makuhari New City as the candidate location.

Mayor Kumagai stated, “The content of the proposals demonstrate that an IR in the Makuhari New City area is achievable.”

As it turns out, there won’t be an IR in Chiba anytime soon with the Mayor announcing in early January, “We have been conducting surveys while considering the trends of the country, but due to circumstances, including last year’s typhoon, we have decided that the current schedule would not allow enough time for coordination with stakeholders, such as the prefecture, and for us to complete those procedures required by law.”

Chiba had previously estimated construction investment at between US$4.6 billion and US$6.4 billion, with between 20 and 40 million visitors expected annually. Annual tax revenue was estimated at around US$460 million.

11. OKINAWA

- Population: 1.5 million

- Any hope for an IR in the foreseeable future was dashed with Governor Tamaki’s gubernatorial victory in September 2018

Research was conducted on the potential for an IR in Okinawa for many years, but was halted by Governor Takeshi Onaga after he took office in December 2014. After Onaga’s untimely death in office, an election was held between pro-IR Atsushi Sakima and anti-IR Denny Tamaki in September 2018. Any hope for an IR in the foreseeable future was dashed with Tamaki’s victory.

12. MAKINOHARA CITY (SHIZUOKA PREFECTURE)

- Population: 46,000

- Prefecture population: 3.6 million

- No longer pursuing an IR bid

After enjoying the support of some local business organizations and making a January 2019 announcement of its intention to pursue an IR bid, Makinohara City announced in August it would no longer pursue an IR bid as it was unable to achieve a consensus of local support.

Stay tuned for part 2 of our “2020: Japan IR Decision Time” series, to run in our March issue. Andrew will discuss approximately 20 operators who have thrown their hat in the Japan IR ring. Again, he will rank them in order from most likely to win to least likely, in his opinion. He’ll commentate on the strengths, weaknesses and leadership of each, and analyze their strategies thus far in the Japanese IR process.