Genting Berhad has announced that it has made a lodgement with the Securities Commission Malaysia via its wholly-owned subsidiary, Genting RMTN, for the establishment of a MYR10 billion (US$2.4 billion) medium-term notes (MTN) program.

The company, which holds controlling stakes in Genting Malaysia, Genting Singapore and Genting Hong Kong, said the proceeds raised from the notes will be used for the “operating expenses, capital expenditure, investment, refinancing, working capital requirements, general funding requirements and/or other general corporate purposes of Genting Group.”

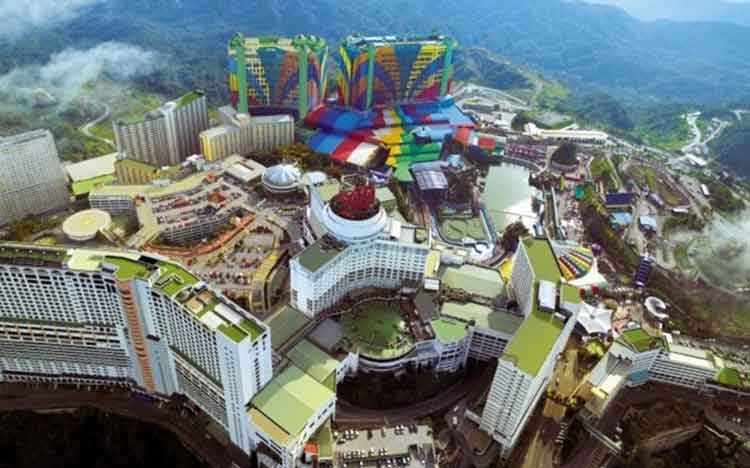

Genting is currently developing the US$4 billion Resorts World Vegas, while both Genting Singapore’s Resorts World Sentosa and Genting Malaysia’s Resorts World Genting are undergoing multi-billion dollar expansions.

In its announcement, Genting said the MTNs shall have a tenure of at least one year and will constitute direct, unconditional and unsecured obligations of the issuer, to be redeemed at 100% of their nominal value on their respective maturity dates.