The exterior of Stanley Ho’s new Grand Lisboa is comprised of the world’s largest LED screen – a beacon proclaiming his company’s intention to court the mass market gamblers it has neglected for so long.

At the February 11 opening of his new Grand Lisboa casino, Macau gaming mogul Stanley Ho boasted that his company, Sociedade de Jogos de Macau (SJM), still commanded a 63% share of Macau’s casino revenue in 2006 – four years after the official ending of his 40-year casino monopoly.

Dr Ho proclaimed: “Imagine, there are six gaming concessionaires [in Macau], meaning our share should be 16%. But at 63%, it means that SJM does better business than the others in Macau.” That is debatable, however, given the first non-SJM casino – the Las Vegas Sands Corp (LVS) owned Sands Macau – only opened in 2004, and until the September 2006 opening of Wynn Macau, SJM only had two competitors operating hurriedly-opened properties in Macau.

Two more license holders – the joint ventures between MGM and Dr Ho’s daughter Pansy, and the one between Australia’s Publishing and Broadcasting Ltd and Melco International Development, headed by Dr Ho’s son Lawrence – have yet to open their first casino properties. All the concessionaires will also open more ambitious casino resorts over the coming years, including LVS’ US$2.6 billion Venetian Macau (slated to open in mid- 2007) and Melco PBL’s US$2.1 billion City of Dreams (opening 2008).

While SJM’s market share averaged 63% in 2006, analysts estimate it had declined to close to 50% at the end of the year, as the glitzy new Wynn Macau joined the fray, largely at the expense of SJM. Furthermore, JP Morgan forecasts SJM’s market share will decline to 25% by 2009, while Citigroup forecasts it will have fallen to just 20% by then.

SJM’s market share has declined faster than analysts had originally predicted, with the US-based operators, LVS and Wynn, having managed to lure significant business from junket agents and VIP room operators, even though many believed the relationships Stanley Ho had forged with them over the years would be difficult to penetrate.

During the monopoly era, Stanley Ho was content to concentrate on the VIP business, with the main floors of his casinos, including the flagship Casino Lisboa, left to decay. When Sands Macau opened, it offered non- VIP gamblers a plush, comfortable environment for the first time, and since 2004, the mass market in Macau has made much greater gains than the VIP market. The VIP market accounted for 77.3% of the city’s gross casino revenue in 2003, but its share had declined to 64.9% by 2006.

The VIP segment showed a noticeable uptick in the fourth quarter of 2006, growing 62% year-on-year, compared to 17% growth for the whole year (the mass market grew 16% in the fourth quarter and 31% in full-year 2006). According to Deutsche Bank’s Karen Tang, the fourth quarter VIP market growth was driven by the opening of Wynn Macau in September, with Wynn’s brand as a premium property attracting a lot of high-end customers. Furthermore, there was a “strong wealth effect in Greater China,” with the surging stock markets of Hong Kong and Shanghai translating “into higher discretionary spending for mainland China on leisure related activities, in our view.”

Nevertheless, Ms Tang regards the surge in the VIP market in the fourth quarter as both unexpected and likely to be short-lived. “Over the medium to long term, we expect this trend to reverse, with the mass market continuing to capture an increasing share of the pie and the VIP stake declining over time.”

Shifting focus

The mass market has exploded, in large part thanks to the Chinese central government’s easing of travel restrictions on mainlanders wishing to visit Hong Kong and Macau. SJM has been working to improve its mass market appeal in order to capitalise on the resultant visitor boom. The HK$5 billion (US$640 million) Grand Lisboa opened just in time for the Chinese New Year influx of mainland Chinese visitors to Macau. At the opening, Stanley Ho emphasized his new mass market focus: “VIPs are still important – they make up 70% of our business – but there are difficulties in that sector,” he said, adding the mass market was more predictable.

The opening was marked by a giveaway of HK$10,000 (US$1,280) to a random visitor every fifteen minutes, which, in addition to the novelty factor, had brought over a million visitors to the property by February 28. The Grand Lisboa, located next to the old Lisboa, is the 18th SJM-controlled casino in Macau, which now has 25 casinos.

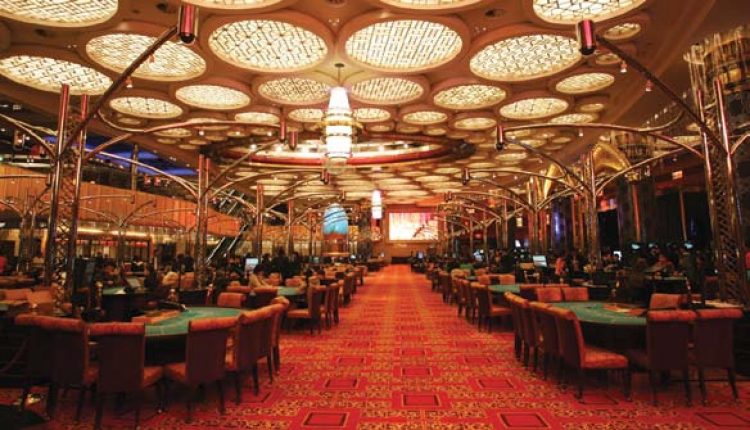

Only the nine-storey golden egg-shaped podium – dubbed the “Starsphere” – of the 52-storey complex has been opened, with the 430-room hotel tower, in the shape of a lotus flower, scheduled to open later this year. The Grand Lisboa is Macau’s tallest building after the Macau tower, and features five floors of gaming with 240 tables and 484 slot machines.

Alternative pursuits

The exterior surface of the Grand Lisboa podium – inspired by a Fabergé egg – is comprised of 1.2 million light emitting diodes (LEDs), which have been projecting an increasingly sophisticated kaleidoscope of images since the property opened. As columnist Octo Chang points out on page 27 of this issue, with the monumental LED, SJM has the potential to turn the open space in front of the Grand Lisboa into Macau’s de facto town square.

In addition to its regular casino facilities, the Grand Lisboa features a Sports Bar offering live betting on football, horse racing and other sports. There is a large stage next to the first floor gaming area featuring live music and dance performances throughout the day.

A variety of dining options are also on offer at six dining venues, including high-end Italian cuisine at Don Alfonso 1890, which shares its wine cellar with the old Lisboa’s Robuchon a Galera, holder of Wine Spectator’s Grand Award for the last two year. There is also Chinese fine dining at The Eight, a sumptuous Grand Buffet, a Round-the-Clock Coffee Shop, international deli and Noodle and Congee Corner.

Comparisons have been drawn between the Grand Lisboa’s gaming area and that of Sands Macau. Grand Lisboa offers more space than the increasingly cramped Sands, and is more mindful of feng shui. Still, although the interiors of the Grand Lisboa are adorned with thousands of Swarovski crystals and large decorative crystal balls, its furnishings are generally of a cheaper feel than at Sands.

Not ready for non-gaming

SJM is also consciously not moving away from its gaming focus, with dining the only major non-gaming draw offered at Grand Lisboa – adhering to the view that mainlanders coming to the property will only want to take breaks from gambling in order to eat. The coming mega resorts of the other Macau casino licensees, meanwhile, will provide extensive entertainment, retail and convention and exhibition facilities, with their development proceeding on the “build it and they will come” supply-creates-demand philosophy.

In November, SJM hired Frank McFadden, the former chief operating officer of LVS’ local subsidiary, Venetian Macau, as its new president of joint ventures and business development. Mr McFadden says SJM will retain its gaming focus until it sees clear demand for other expensive Las Vegas-style attractions. “We may build a US$3 billion resort one day, but it’s not in my immediate plan to invest that amount of money because the more equity you spend, the more revenue you have to generate to cover that equity. ROI [return on investment] is very important.”

Mr McFadden adds: “Why would you build a convention centre when there’s already a convention centre. If there are seven international shows not sold out, why would you build an international show stadium? You’d look at how the market is evolving before you commit to it.”

Agent of change

Mr McFadden views himself as an agent of change at SJM, but emphasizes the change had begun prior to his arrival – after all, he only came aboard nearing the completion of the mass market focused Grand Lisboa. “Obviously, if you go back to the design phase, which was a couple of years ago, they were already in change mode.” Commenting on his hiring, Mr McFadden says: “They [SJM] recognised that they needed an injection of different thinking. They’d already taken that step. They’d identified it, and they’re brave enough to bring in someone like me. It was a bit of a risk.”

One of Mr McFadden’s main initiatives will be to elevate the standard of service at SJM casinos. “Service can always be improved throughout Macau. I think the modern business practice is the more you invest in equity, the more you need to invest in your people, so that the aspirations that are encouraged by the visitor through the equity are matched by the level of service. So there is more focus on training customer service skills and training technical skills other than gaming.”

“The team members now are the management of the future,” continues Mr McFadden. “They need to be encouraged to work as a team. So mutual respect for each other, and solving problems together. There’ll be a lot more of that sort of training. I think you’ll see a benefit of that not immediately, but when it’s put into practice and after a period of time. Then you get a reputation for service. You have to start somewhere.”

|

Listing to Proceed As for the mooted HK$15 billion (US$1.9 billion) SJM listing, Dr Ho announced at the Grand Lisboa opening that it “will surely happen this year, and it will happen before September.” The IPO had been delayed by a lawsuit filed by Dr Ho’s sister, Winnie, who claims SJM’s parent company, STDM, owes her about HK$3 billion (US$386 million) in dividends for the past five years for her 8% stake in the company. Winnie Ho has filed over 30 lawsuits against her brother over alleged debt, defamation, and the shareholding structure of the companies. In January, however, a Macau court ruled that a shareholder meeting that approved the float was legal, and Dr Ho announced “there’s nothing she can do that can stop us.” |

Revenue sharing revisions

SJM is in the process of altering the revenue sharing arrangements with its joint venture partners, reducing its share of revenue in exchange for the partners assuming labour costs (as discussed in Revenue Sharing Revealed, on page 26). “It makes perfect sense for the partners, because if they don’t pick the dealer, and they don’t train the dealer, they won’t be happy with the dealer. So they will now have more control over them. They have more control over the quality of their day-to-day operations, which is what they want,” explains Mr McFadden.

“You can understand that it would make for a smoother relationship,” says Mr McFadden. “[The property owner] is more in control of his domain and his operating costs, and the quality of his staff. And therefore we can devote more of our management time on our wholly owned properties, because management time is something that will be very important. In most businesses, you spend 80% of your time looking after 20% of your revenue. You really want to spend 80% of your time looking after 80% of your revenue. And this was started before I arrived as part of their [SJM’s] engineering process.”

Once the new arrangements are settled on, Mr McFadden will work on building SJM’s wholly-owned business. “We have a whole strategic plan, though it’s not been passed by the board yet. We’ll need the plan for when we go for an IPO. The strengths of SJM are 1) experience, and 2) their assets. We will be applying best practices to develop those assets.”

Assets aplenty

Those assets include dominant interests in Macau’s infrastructure, transport, property and hospitality industries. SJM’s parent company, STDM, owns major stakes in the city’s top hotels (the Mandarin Oriental and Westin), several other hotels, flag carrier Air Macau, as well as the airport, jetfoil and helicopter services by which over 40% of visitors arrive in Macau.

The property assets in particular are become increasingly valuable. Stanley Ho is still the largest landowner in Macau. “So while he might lose some gaming revenue,” says Morgan Stanley analyst Rob Hart, “the rest of his land bank portfolio is worth a huge amount. The land costs are going up in Macau, so he’s worth more and more.”

Stanley Ho himself, and his network of relationships, is a major asset of SJM. In a further move to strengthen his position in the mass market, Dr Ho announced a deal in late January to buy a HK$274 million (US$35 million) stake in Malaysia’s Star Cruises. The investment was done via Dr Ho’s private vehicle, Profit Boom Investment. It gives Star access to Macau, while Dr Ho gains a strong brand ally with which to take on the western competition (as discussed in Brand Change, in the February 2007 issue of Inside Asian Gaming).

“It’s another strategic move by Stanley Ho, and reflects his strength in terms of his network of contacts and people,” says Mr Mc- Fadden. “Stanley’s a prime asset for SJM. He knows his relationships – both business and personal – across Southeast Asia, and that’s why the deal was done between him and Star Cruises. It’s a personal deal with him. Not a company. But one of the fallouts of that is we [SJM] will be managing the Star Cruises operation here.”

At times, Dr Ho comes across as resentful of the competition, especially when he recently decried the “cutthroat competition” characterised by rising junket commissions, which he claimed could drive a third of VIP room operators associated with SJM out of business. He was more cheerful at the Grand Lisboa opening though, saying that the investments of his competitors had made Macau a better place. “You see more and more improvement in Macau, thanks to fair competition,” he said.

The bottlenecks

Two major concerns surrounding the massive casino resort development in Macau are the worsening shortage of labour and the city’s underdeveloped infrastructure, which is already straining under the load of the visitor influx.

Macau has a ban on imported casino dealers, meaning all dealers must be recruited from the rapidly shrinking local labour pool, driving dealer salaries ever higher. “I understand why the policy is there. In order to ensure that Macau people benefit from the liberalisation,” says Mr McFadden. “But when you get to a mature market like Las Vegas where only 40% of the population are employed in gaming, and 60% are involved in horticulture, design, architecture, engineering, electricity, irrigation, accounting, marketing, advertising, and so on,” he argues, that by restricting dealer jobs to locals, “you’re basically almost denying the local people from going into the career, because you won’t be encouraged to go into those careers outside gaming. Economically they’re discouraged from doing that. That’s something society will have to address in the future.”

Mr McFadden says, however, that “I have no complaints about infrastructure. The border at Cotai has been completely refurbished and tripled in size. The border at Zhuhai is already doubling in size. You’re getting the high-speed rail coming down from Guangzhou, and they’re expanding the airport.”

Mr McFadden believes complaints about traffic congestion and long queues at the borders are perhaps overdone. “People complain they can’t get a taxi in the rain. You try to get a taxi in London when it’s raining.”