Will Macau’s casinos put its horse and dog racing tracks to the sword?

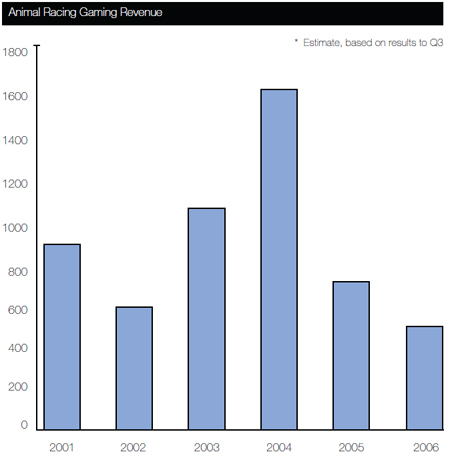

The success of Macau’s casinos has masked an alarming decline in the fortunes of the Macau Jockey Club and the Macau Canidrome. Both operations are on track to record their lowest gaming revenues since the commencement of the casino liberalization process in 2001. The table shows the combined gaming revenue of the two since 2001.

The share of total gambling revenue generated by Macau’s casinos has increased in every year since 2001, and is likely to exceed 98% in 2006. When the market share of the basketball and football concession held by Macau Slot is added, it is clear that fixed odds betting products account for about 99% of all gambling revenue lawfully generated in Macau this year. It is somewhat facile to conclude that it is the more competitive offerings of the casinos alone which are responsible for this; pari-mutuel products the world over are losing out to fixed odds operations, large pool lotteries, and instant and quick draw lottery products. Indeed, it has been the decline in the attractiveness of horse racing , and on-course pari-mutuel betting, in particular, which has resulted in the “racino” concept, which has re-vitalised race track operations in a number of US States and Canadian Provinces.

The Racino Concept

By establishing large scale slot machine operations on racecourses, tracks have achieved better attendances, better utilization of their facilities, and a better balanced portfolio of gaming product. The racino concept is not new; its genesis can be traced back to 1990, when the State of West Virginia allowed video lottery terminals to be installed at Mountaineer racetrack. Today, Mountaineer has more than 3,200 slot machines, making it one of the largest slot operations in North America. In the context of Macau, the concept is a virtual “no brainer”; the casinos cannot offer pari-mutuel products, but it seems there is, and has been, nothing to stop either the Macau Jockey Club or the Canidrome from offering slots under the umbrella of, say, the SJM gaming concession. Indeed the Canidrome did have slots for a time, but they were poorly located and promoted, and offered superseded games and technology.

Other Handicaps

Aside from the casinos, there are three other fundamental reasons why Macau’s animal racing concessions are performing so poorly. First, the take out from the betting pool distributable amongst winners has remained more or less constant since 2001. In the case of the Jockey Club, that take out has been maintained in the 19% to 22% range; the Canidrome’s has been between 20% and 25%. The take-out has to cover operating costs, purses and taxes, with any surplus required to be re-invested in the business of the two clubs. This compares unfavourably with the “hold”, or win, of Macau’s casinos. The casinos typically hold 2.6%-2.8% on baccarat, and perhaps as much as 10% on slots; what they lose on hold, they make up for in drop…total amounts bet in Macau annually now exceed the drop recorded in all of the casinos in Nevada, the world’s largest gaming jurisdiction (measured by revenue). Even the other fixed odds offerings of Macau Slot, on football and basketball, have current holds of 5.75% and 7.97%, respectively, which may help account for them maintaining their niche in the market.

Secondly, there are concerns about product integrity. The Clubs essentially self-regulate, within the terms of their respective concession contracts. They appoint their own stewards, establish their own rules of racing, and the qualifications for jockeys, trainers and animals who are involved in their activities. How well animals race depends on many factors, including how they are handicapped, whether they are fully fit to race, the class of the field, and so on. Predicting winners is problematic, because the probability of winning associated with a particular animal is not able to be calculated with mathematical precision. This contrasts with casino games, where the theoretical house advantage can be determined. In truth, racing punters are taking a greater risk (the unknowns are not objectively quantifiable) for potentially less reward, since the size of the reward depends on how many others (unknown at the start of a race) the available betting pool must be shared with.

Thirdly, the size of the betting pools themselves is considerably smaller than, say, Hong Kong. This means that exotic bets, such as tierce and quinella bets, are unlikely to offer the same return to winning punters as bets into larger pools can. Moreover, low pools mean that the capacity of the Clubs to offer prize money sufficient to support feature races is diminished. The attractiveness of the racing product suffers accordingly.

Slipping Away

Certainly the Clubs, and particularly the Jockey Club, were hurt by the introduction of Hong Kong’s Offshore Gambling Ordinance, in 2002. The subsequent tax relief given by the Macau Government to the Jockey Club resulted in a year-on-year growth in Club gaming revenue of 75% in 2003, and 53% in 2004…the year in which the first non SJM casino opened. Since then, Club revenues have declined to a level lower than they were in 2002, when the Hong Kong Ordinance made it illegal for the Clubs to solicit business in the SAR. On the face of it, both Clubs seem to have taken little action to arrest their declining fortunes. It is anticipated that the Jockey Club will begin installing slot machines this month, under the umbrella of the SJM gaming concession. Will this have the same impact as, say, racinos have had in the USA, in reversing the declining fortunes of animal racing? Almost certainly not; the racinos have been adopted in US states which do not have commercial casinos. Here, full service casinos, operating 24/7, are at most a 5 minute cab ride from either Club. With the advent of Wynn, and the opening next year of Crown and the Venetian, the competition will not be limited to gambling spend; it will extend to dining, entertainment and retail spending as well.

It remains to be seen how the two Clubs position themselves going forward; the casinos are category killers in many of the areas in which they operate. Perhaps the Clubs will slip quietly from view, allowing the development of the prime real estate on which they are situated.