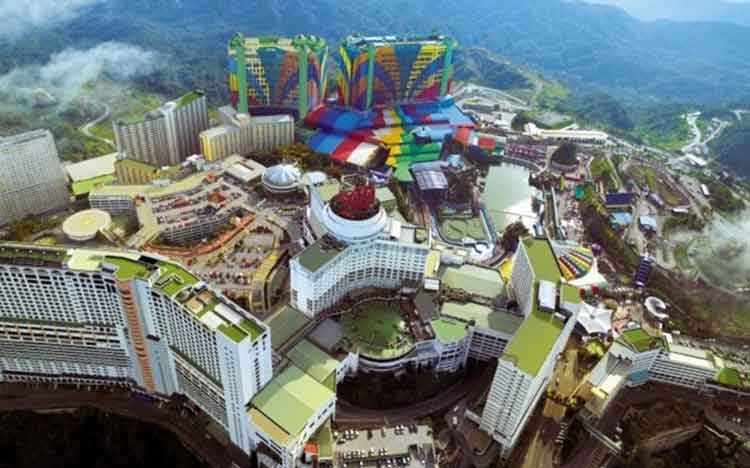

Maybank Investment Bank has cut its 2023 earnings estimates for Genting Malaysia by 27%, citing the slower than expected return of international visitors to the company’s Malaysian integrated resort, Resorts World Genting (RWG), post-pandemic.

According to a note from analyst Samuel Yin Shao Yang, current visitation trends suggest that although domestic and Singaporean visitor arrivals to RWG have recovered to 2019 levels, those from key markets like Indonesia, Hong Kong and China having not returned en masse due to low flight capacity.

With international visitation not expected to recover until end-2024, Yin has lowered his earnings estimates down by 27% for the current year and by 8% for next year. This puts his 2023 revenue forecast at MYR9.72 billion (US$2.11 billion), EBITDA at MYR2.78 billion (US$603 million) and net profit at MYR667 million (US$145 million). In 2024 he expects revenue to climb to MYR11.02 billion (US$2.39 billion) with EBITDA of MYR3.32 billion (US$720 million) and net profit of MYR984 million (US$213 million).

The slower than expected recovery in visitor arrivals to RWG has been impacted by the Batang Kali landslide in December, with Yin citing “lingering fears” for an 11% quarter-on-quarter decline in arrivals to 4.7 million in 1Q23. Since then, visitor arrivals have recovered to be tracking at 5.2 million in Q2 although this is still 15% below 2019 levels. Yin’s revised earnings estimates are therefore based on a predicted 20.8 million arrivals in 2023, down from his previously stated 23.7 million.

On the recovery trajectory, he stated, “Malaysian [airline] carriers carried two-thirds of international passengers pre-COVID . Thus, we examine their fleet strategies. The number of aircraft operated by Malaysian carriers will reach FY19A levels by end-FY23E – implying RWG visitor arrivals should hit FY19 levels in FY24 – and exceed FY19 levels by end-FY24.”

Visitor arrivals to RWG will exceed 2019 levels in FY25, Yin added.