Malaysia’s Genting Berhad has realized a long-held American dream with the opening of US$4.3 billion Resorts World Las Vegas in June. But can this ambitious project become the spark Las Vegas – and Genting – need?

It’s absolutely vital,” fires Bo Bernhard, Vice President of Economic Development and Executive Director of the University of Nevada, Las Vegas Gaming Institute, when asked about the significance of Resorts World Las Vegas to the city’s recovery.

“Las Vegas is very much like an amusement park in that if you don’t continue to build new roller coasters, the product gets stagnant and folks stop coming. In many ways, each of the resorts on the Las Vegas Strip are like individual rides of the amusement park. They offer a different kind of thrill. Some are newer and faster and more technologically advanced, while others are old, rickety roller coasters offering a sense of nostalgia.

“Las Vegas is very much like an amusement park in that if you don’t continue to build new roller coasters, the product gets stagnant and folks stop coming. In many ways, each of the resorts on the Las Vegas Strip are like individual rides of the amusement park. They offer a different kind of thrill. Some are newer and faster and more technologically advanced, while others are old, rickety roller coasters offering a sense of nostalgia.

“That’s the Las Vegas Strip. It’s the adult amusement park where grown-ups go to play, and the moment Las Vegas stops innovating is the moment customers stop coming.”

At a cost of US$4.3 billion, Resorts World Las Vegas (RWLV) is the first integrated resort built from ground up to open on the Las Vegas Strip in a decade, and it is the only significant addition to the North Strip since Wynn’s Encore Las Vegas opened in 2008.

It also represents a major milestone for the owner and operator, Malaysian gaming giant Genting Berhad, which has long held US ambitions but whose exposure has until now been mostly limited to the state of New York. Needless to say, neither Genting’s EGM-only Resorts World New York City nor Resorts World Catskills boast the scale or vast range of features of their new Las Vegas counterpart.

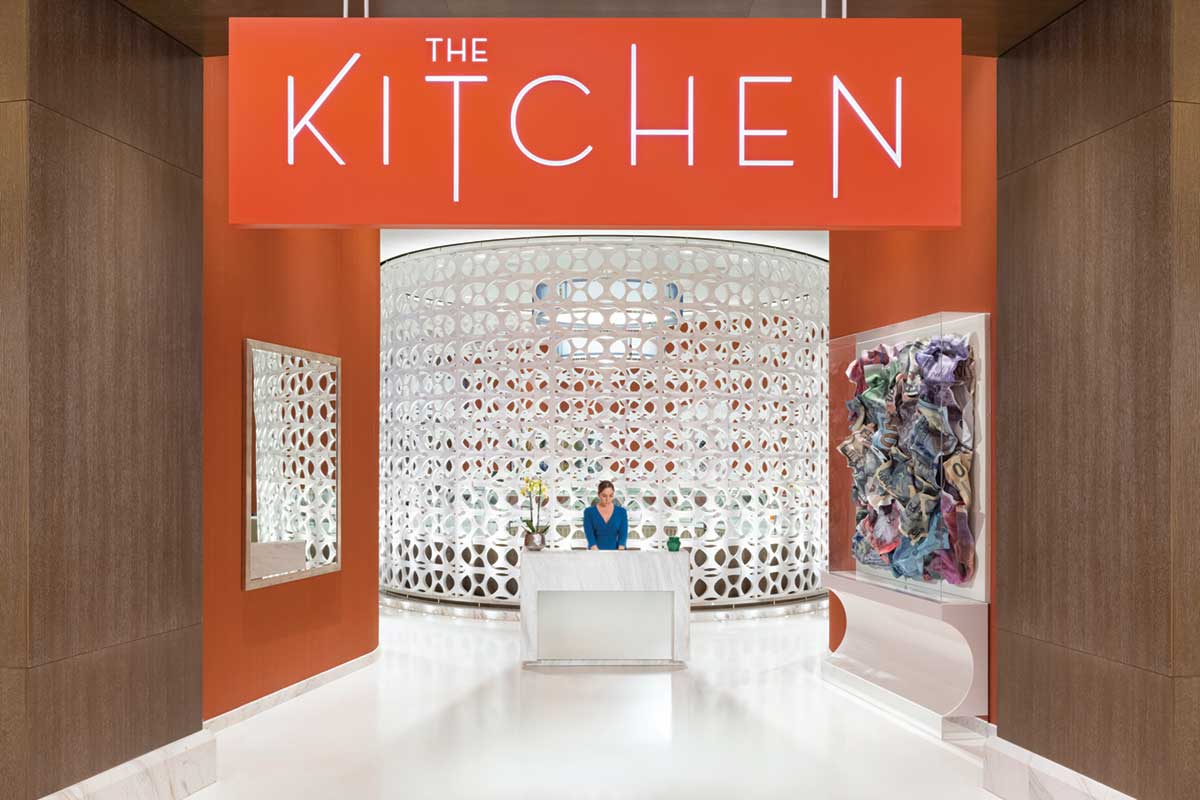

Measuring 8 million square feet (740,000 square meters), RWLV offers 3,500 rooms across three Hilton Hotels brands – Las Vegas Hilton at Resorts World, Conrad Las Vegas at Resorts World and Crockfords Las Vegas – plus 70,000 square feet (6,500 square meters) of retail space and more than 40 F&B outlets.

The casino itself covers 170,000 square feet (10,870 square meters) with 1,400 slot machines, 117 table games, a poker room with 30 poker tables, high limit areas and a sportsbook. Notably, RWLV becomes the first Las Vegas Strip casino to offer a fully cashless gaming experience for both slots and table games via a digital wallet with cardless log-in for loyalty members.

The casino itself covers 170,000 square feet (10,870 square meters) with 1,400 slot machines, 117 table games, a poker room with 30 poker tables, high limit areas and a sportsbook. Notably, RWLV becomes the first Las Vegas Strip casino to offer a fully cashless gaming experience for both slots and table games via a digital wallet with cardless log-in for loyalty members.

A Resorts World Mobile App allows guests to pay for any gaming, entertainment or hotel offerings with their mobile device, ensuring cashless technology is available property-wide.

Other features of the resort include a 5,000-capacity concert and entertainment venue, 250,000 square feet (23,225 square meters) of MICE space, a 5.5-acre pool complex with infinity-edge pool, a 27,000-square foot (2,500 square meter) spa experience plus Zouk Nightclub and Ayu Dayclub.

According to Bernhard, RWLV shines a blinding light on just what the best operators in Asia can bring to the Las Vegas Strip.

“Las Vegas needs more than innovation and a refreshed product, it needs new minds, and I think during this particular historical period we’re very fortunate to benefit from new minds who happen to operate in Asia,” he says.

“So while it used to be that Las Vegas exported its product to places like Macau and Singapore, now it’s a healthy thing to have a little bit of the reverse process, whereby information sharing, best practice sharing and information comes from the East to Las Vegas. I think that’s huge.”

“So while it used to be that Las Vegas exported its product to places like Macau and Singapore, now it’s a healthy thing to have a little bit of the reverse process, whereby information sharing, best practice sharing and information comes from the East to Las Vegas. I think that’s huge.”

Scott Sibella, the former MGM Grand President and COO who was appointed President of RWLV in May 2019, says Genting brings “international perspective and family-owned culture to Las Vegas,” having developed Asia’s first real integrated resort in 1965 (Malaysia’s Genting Highlands property, Resorts World Genting) and upped the ante in 2010 with the opening of its hugely successful Singapore IR, Resorts World Sentosa.

“They have mastered the creation of fully integrated properties, and that is evident with Resorts World Las Vegas. The goal was to make our resort the most technologically advanced property in the market and to add something truly unique to the Strip with three Hilton brands under one roof, an outstanding food and beverage portfolio, global entertainment partners and much more. Our chairman (Lim Kok Thay) is very hands-on and a true visionary.”

The property is also transformational for the northern end of the Strip, until recently home to a series of failed or unrealized projects.

RWLV is built on the site of the famous Stardust Resort and Casino, which was demolished by US casino company Boyd Gaming in 2007 to make way for a new US$4.8 billion project called Echelon Place. When the Global Financial Crisis hit in 2009, Boyd put its IR plans on hold and eventually sold the land to Genting in 2013 for US$350 million.

Another planned IR project, Crown Resorts’ Alon, was also shelved when the Australian casino giant sold the 35-acre plot of land located directly to the north of RWLV to Wynn Resorts for US$300 million in 2018. That plot remains empty to this day.

However, there are hopes that the opening of RWLV and the nearby Las Vegas Convention Center will spark a new development boom up north, perhaps starting with the long-stalled Fontainebleau, whose current owner has announced plans to open in 2023 as the JW Marriott Las Vegas Blvd.

However, there are hopes that the opening of RWLV and the nearby Las Vegas Convention Center will spark a new development boom up north, perhaps starting with the long-stalled Fontainebleau, whose current owner has announced plans to open in 2023 as the JW Marriott Las Vegas Blvd.

The convention center itself is key to the area’s resurgence, having recently completed a US$890 million expansion that includes a revolutionary underground transportation system, built by Tesla founder Elon Musk, connecting the center with both RWLV and Wynn Las Vegas. The complex tunnel system sees passengers transported from one destination to the next in one of 62 Tesla 3s and Xs.

“This means the north end of the Strip is now the spot for innovation,” says Bernhard. “You’ve got this convention center that people will actually visit as a tourist attraction and to try those underground tunnels, which is then connected to RWLV.

“Las Vegas is somewhere that has always struggled desperately with transportation and has never quite figured it out. Suddenly we’re about to get the coolest subway in the world connecting the North Strip with the Wynn–convention centre–RWLV triangle.

“So yes, I think we are in a renaissance for that part of the strip.”

There were, of course, plenty of obstacles along the way for Genting’s Las Vegas project, not least the COVID-19 pandemic which shut the city down just as construction was nearing completion.

But recovery has been encouraging. Since restrictions began lifting earlier this year, Nevada has recorded four consecutive months with revenues above US$1 billion, including an all-time record of US$1.23 billion in May – beating the US$1.17 billion mark set in October 2007. The May figure was also 25% higher than May 2019, particularly impressive given the absence of international visitors. It was amid this pent-up demand that RWLV opened its doors on 24 June.

But recovery has been encouraging. Since restrictions began lifting earlier this year, Nevada has recorded four consecutive months with revenues above US$1 billion, including an all-time record of US$1.23 billion in May – beating the US$1.17 billion mark set in October 2007. The May figure was also 25% higher than May 2019, particularly impressive given the absence of international visitors. It was amid this pent-up demand that RWLV opened its doors on 24 June.

There were other benefits from the COVID-19 pandemic too.

“Being the first resort to be built on the Strip in over a decade, we had a natural advantage to create the cleanest, safest resort experience in Las Vegas, chock full of new experiences simply because today’s technology and advancements didn’t exist 10 years ago,” explains Sibella.

“Our team worked diligently to evaluate the infrastructure and review every touchpoint across the resort through a new lens that is hyper-focused on sanitation and safety.

“Although 2020 brought unprecedented hurdles that no one could have predicted, my team remained focused on our goals and unified to overcome any roadblocks.”

Aesthetically, RWLV treads that fine line between highlighting its Asian roots and falling into the trap of tacky misrepresentations – a fate that ultimately befell the Chinese-themed Lucky Dragon, which opened in December 2016 only to shut down 14 months later.

There is “undeniably an Asian influence” at RWLV, says Bernhard, with subtle nods to world-leading integrated resorts in Singapore and Macau, “but not in a way I think many anticipated at the outset, when we were talking about the possibility of having a panda display and the resort being over-the-top Chinese.

“Clearly they boomeranged away from that and back to something more Asian-inspired.”

Sibella insists such talk is a common misconception about RWLV.

“We never planned to be a themed hotel,” he explains. “The property is a new luxury hotel experience that combines traditional and modern architecture and progressive technology while also paying homage to Genting’s roots with subtle Asian touches throughout, including in the art and décor.”

Despite its Asian touch, the success or otherwise of RWLV looks likely to rely upon – initially at least – the American customer, although that domestic focus may be able to pivot somewhat in the coming years.

“It is definitely targeting local Americans more than, say, Chinese tourists,” offers Samuel Yin Shao Yang, Associate Director, Research – Equity Markets for Maybank Investment Bank Berhad.

“Genting originally intended to target Chinese tourists when it bought the land in 2013, but when the Las Vegas baccarat and mini-baccarat market started heading south after 2013 due to the anti-corruption drive, tightening monetary policy and capital controls in China, Genting pivoted RWLV back to local Americans.

“That said, I don’t think it will do RWLV any harm in relation to Chinese tourists if it pivots to local Americans. Look at Wynn Las Vegas – it does not overtly pivot to Chinese tourists but is the casino of choice for Chinese tourists visiting Las Vegas.”

The big question, according to Bernhard, is when the Chinese high roller will return.

The big question, according to Bernhard, is when the Chinese high roller will return.

“Genting knows a thing or two about that patron, and we’ve catered to that patron arguably as well as anybody on the Las Vegas Strip,” he says.

“If you look at the baccarat numbers on the Strip over the past 20 years, they’ve shot northwards.

And they are not coming from Middle America or Philadelphia, they are coming from China and specifically from exposing that population to the product that is Macau. It is those players who have said to themselves, ‘There is another version of this with an entirely different set of rides at the amusement park that is Las Vegas’, so the baccarat numbers have shot through the roof.

“With the opening of RWLV, the centrality of the baccarat player may well be that north end of the strip with RWLV, Wynn and The Venetian … and with the departure of Las Vegas Sands (currently in the process of selling The Venetian and The Palazzo) Genting has an even more powerful argument.

“But until we start to see those baccarat numbers return, I think it will be really tough for RWLV to be fully functional, fully robust and fully realising its promise.”

According to a June note from boutique brokerage Bernstein, gaming will only account for around 30% of RWLV revenue, and it boasts a key advantage via its relationship with Hilton which provides access to Hilton’s substantial global database.

This, in turn, includes the ability to access groups, described as a “critically important visitor segment to Las Vegas that generally makes up 20% to 25% of business.”

RevPar, Bernstein’s analysts add, should be at the higher end of the scale in Las Vegas, with further scope for expansion on site if required in the future.

RevPar, Bernstein’s analysts add, should be at the higher end of the scale in Las Vegas, with further scope for expansion on site if required in the future.

Nevertheless, gaming remains critical to the property’s success or failure.

“The property should comp well with the top five properties in Las Vegas in terms of revenue and profit,” they wrote. “We see the competition as being largely Wynn, Venetian, Bellagio, Aria and The Cosmopolitan. Each of those properties generated in excess of US$350 million in EBITDA in 2019. Once ramped, we would expect RWLV to be able to generate EBITDA of between US$250 million (conservative) and the high-US$300 millions.”

Maybank’s Yin is also forecasting annual EBITDA of around US$275 million, although “we’re not very sure if the EBITDA can cover costs like depreciation and interest expense,” he says.

“If our reading of its filings is correct, RWLV was effectively 100% debt financed. Imagine 4.5% interest on US$4.3 billion of debt – that’s around US$200 million of interest expense to clear every year. The profitability threshold is high, in our view.

“On the outlook, we are not too sure what it will take for RWLV to reach profitability. The recent streak in Las Vegas GGR is encouraging, of course. That said, one has to wonder just how long it will last.”

This profitability challenge raises questions over Genting’s plan – outlined by Chairman Lim himself during an interview with Bloomberg on opening day – to pursue a US listing. Such a listing would, presumably, bring all of Genting’s American assets (RWLV, the New York casinos and the entities that own a plot of land in Miami) together under the one umbrella.

“As the numbers pick up and when investor confidence returns, that is something we will seriously look at in terms of consolidating our US investment and then seeking a listing,” Lim said at the time.

“Now that we are open, we are eagerly waiting for the first 30 days’ results which will bring us to the end of the quarter, and that will give us tremendous clarity on the timing of an IPO.”

Yin believes the special-purpose acquisition company (SPAC) route could provide an opportunity as RWLV will not need to furnish a track record of profitability.

The company itself, however, remains optimistic about Resorts World’s prospects, insisting the recent resurgence in Las Vegas activity is just the beginning for Sin City and the North Strip in particular.

“The developments around us will play a major part in the next evolution of the Strip,” says Sibella.

“The developments around us will play a major part in the next evolution of the Strip,” says Sibella.

“Resorts World Las Vegas is just one page in the next chapter for the north corridor. We anticipate that our sizeable investment in the north corridor, in addition to the many exciting developments around us, will in time drive business to this side of Las Vegas Boulevard.

“But we can’t wait for everyone to come experience our beautiful resort. Resorts World Las Vegas is designed to be a truly integrated resort with everything guests need. From casual experiences and attractions to high-end fine dining and some of the city’s most luxurious suites, plus incredible entertainment, of course.

“I recommend you come take a walk around, dine at one of our incredible restaurants, maybe have a few bites from Famous Foods, listen to live music at Dawg House and enjoy a drink and take in breathtaking Strip views at Starlight on 66.

“The pure magnitude and design of the resort alone is something to see.”