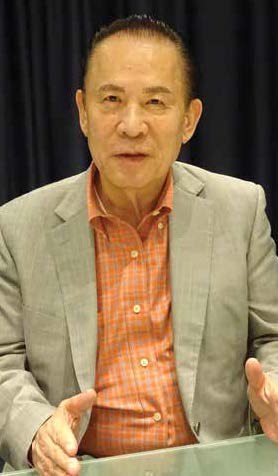

Gaming machine visionary, former Wynn Resorts vice chairman and creator of Okada Manila, Kazuo Okada says he will overcome foes and regain what he believes is rightfully his.

Universal Entertainment founder and Aruze Gaming owner Kazuo Okada spoke for more than three hours with Inside Asian Gaming Editor-at-Large Muhammad Cohen about his ouster from Wynn Resorts and Universal, his plans to regain his positions and his vision for Japanese integrated resorts. He also presented IAG with a document outlining an alleged Universal plot to frame him (see accompanying article).

Universal Entertainment founder and Aruze Gaming owner Kazuo Okada spoke for more than three hours with Inside Asian Gaming Editor-at-Large Muhammad Cohen about his ouster from Wynn Resorts and Universal, his plans to regain his positions and his vision for Japanese integrated resorts. He also presented IAG with a document outlining an alleged Universal plot to frame him (see accompanying article).

Okada’s decades making gaming machines for Japan’s pachinko market and global casino floors, plus his experience as Wynn Resorts vice chairman and mastermind of Okada Manila – conceived as the Philippines’ largest integrated resort – make a compelling entry in Japan’s IR sweepstakes. But Okada remains the focus of legal actions initiated by Universal in three jurisdictions and in late July was questioned by the Hong Kong Independent Commission on Corruption, an event publicized by a Universal news release. Okada and daughter Hiromi are also pursuing legal actions against Universal.

Hiromi and Aruze Gaming Group CEO Takahiro Usui were present during our interview.

Muhammad Cohen: It seems like your dreams have come true – there’s a casino resort with your name on it in Manila and, finally, casino gambling has been legalized in Japan – but somebody wrote you out of your dream.

Kazuo Okada: I have realized many of my dreams. I was on my way to achieving more dreams, but I was rudely disrupted and sent away from my dreams. But my intention is to make my way back and fulfill my dreams.

If this coup d’etat had not taken place, I foresaw being in three locations: Macau, Japan and the current Philippines. Of all locations, one would need to be successful in Macau in order to brag to the world that you were successful – Macau being the biggest casino market. And I’d feel that [being] Japanese, I’d have to do something in Japan.

MC: Where does your legal situation stand?

KO: I believe I’ll be vindicated. I believe that law enforcement has been misled by faulty or purposely erroneous information from Universal. It seems they’re just blindly moving upon it. But as mentioned and shown in the documentation that we [have given you], which turns around everything they have stated and explained to the authorities. We have conclusive evidence that what they’re saying is either fraudulent, wrong, lies or deceit and it will be shown that law enforcement was basically investigating the wrong party, that they themselves were duped, and I expect to be vindicated in court.

Please understand, I love Universal, I created Universal and I’m trying to protect it. The person who loves the company the most, the one that has nurtured it for 50 years, is that one person going to do something as stupid as what they are claiming I did? That one person who protected it and made it what it is, is he going to do these petty, minor actions or in the way that they described them? That owner, the founder, is he going to do that to his own company? It’s ridiculous.

Please understand, I love Universal, I created Universal and I’m trying to protect it. The person who loves the company the most, the one that has nurtured it for 50 years, is that one person going to do something as stupid as what they are claiming I did? That one person who protected it and made it what it is, is he going to do these petty, minor actions or in the way that they described them? That owner, the founder, is he going to do that to his own company? It’s ridiculous.

Universal management is using every method to twist stories and facts into making it look as though I’ve committed a crime. It’s because they need me to be a criminal in order for me not to be part of the company. They need to use elements, even police, to facilitate their goals, to make me look as though I did something wrong. But I’ve done nothing wrong.

I only ask that people take a step back and look at this with a calm state of mind and a neutral view, to try and really break down what is truly going on. And once they understand, I think they will see the truth.

MC: In March Universal accepted US$2.6 billion for its 20% stake in Wynn that was seized in February 2012, when Wynn removed you as vice chairman. You’re a major shareholder in Universal, why didn’t you participate in the settlement?

KO: The problem lies in the fact that Universal removed me from the company. There was a director’s meeting that took place on 23 May 2017 where they suspended my powers and then there was a shareholders’ meeting that took place on 29 June [where Okada was not reelected as a director].

Let me go back one step – 18 May was when I learned for the first time that my son and daughter were getting together [to oppose Okada]. That was regarding the movements within Okada Holdings.

The first thing I wanted to do was get hold of my daughter and son to discuss this issue. But I could not get hold of them. I had no idea what was really, truly going on, no one informed me. How it happened, why it happened … I had to ask myself, “Did I do something that horrible or mean, that unforgivable, to my son?” We’re family, so I had a place within my heart that I’m going to discuss this through.

And then in the extraordinary directors’ meeting on 23 May, I brought up issuing new shares. The Okada Manila project was progressing, it needed additional funding.

I wanted to purchase those additional shares. If my son and daughter combined themselves they would have about 52% [of Okada Holdings], so the difference from the amount that I’m holding right now which is 46.4% … if enough shares were bought to increase [my total to more than theirs], then the situation would resolve itself.

MC: You’re talking about a new issue of shares by Universal, rather than buying shares on the market which you could do without anybody’s approval?

KO: That’s a good point. But again the discussion was that the Okada Manila project was going to be requiring additional funds and it would be a capital infusion to bring in more funds. It would be better to issue more stock and to bring in new funds instead of buying existing stocks. There was discussion of a possible resolution and settlement with Wynn, but at that time it wasn’t really set or understood when that would happen. So given doubt over when the additional money would come in, it’s just natural to think that it would be best for additional shares to be issued and for additional money to be put into the company.

So I was very confident that if this were to have been raised in the agenda at the shareholder’s meeting, I would have been able to pass that. Why? Because this is my company that I built up over all the years. I’d been on the ground level in this Okada Manila project getting dirty with all the employees, including [then-Tiger Resorts COO Takahiro] Usui here, who’s everyday covered in dust, basically looking like a snowman all white in cement dust, always on site. I think the other people you see have never really been hands-on involved, they never really had an idea as to what’s going on. I could explain to everyone – the other shareholders – that I know what’s going on and I can make this project work, I would be able to convince them.

As I was getting fully involved with the Okada Manila project, I bought a residence there, I was there most of the time. If I were to go back to Tokyo, it would be two or three days out of one month.

The majority of my time was spent in Manila and my attention was completely on the Philippine project. While I was away, I believe people were taking advantage of the fact that I was not in Tokyo to be hands-on, to be looking at what’s going on in Tokyo. I suspect people behind my back started working on these intricate plans.

What was particularly frustrating and angering about the 23 May directors’ meeting was that at that time, another director basically stated to me that “You can’t issue additional shares or ask for authority for issuance of additional shares at a directors’ meeting.” Now, I had run this company for over 50 years, I have attended many of these directors’ and shareholder meetings. I understand that there are these corporate protocols and other reports that are necessary, and the fact that you need a shareholders’ agreement for some large investments to take place. But it’s also normal to first take authority of the board and to bring that up as a matter to be agreed upon by the shareholders. But [this director] had the audacity to say, “No, chairman, you can’t do that, you can’t raise that in a board meeting. That can only be agreed to by the shareholders.” I believe what was going on was that [Jun] Fujimoto, at the time of the 23 May directors’ meeting, was already gathering his forces to start his move to push me out.

It was also surprising that during that directors’ meeting, Fujimoto summoned a corporate internal auditor, [Nobuyoshi] Ichikura – not something that I could anticipate. He came up and started laying all these allegations of wrongdoing. He laid out many of these issues that, first of all, I had no knowledge of or expectation that they would even be discussed at this meeting.

I believe the resulting release to the media [issued by Universal, announcing Okada’s suspension and investigation] was very biased and incomplete. What happened to my initial discussion of new shares? This auditor’s report was the only thing that was being discussed, not even taking into account [what] I had wanted to do regarding infusing additional funds into Universal.

Of course I got frustrated. Here was this person that I had never met – I’m the founder, the chairman of this company and also a director – and this person comes into a directors’ meeting and starts laying down all these allegations. He would not listen to the initial board agenda – my agenda. So I increasingly got frustrated and raised my voice at him, too. But in the end, the happenings at the board meeting made their way to the media and the media painted me as an unreasonable, demanding person – not in the sense of trying to increase the available funds for Universal but as the person that was trying to grab more shares.

Of course I got frustrated. Here was this person that I had never met – I’m the founder, the chairman of this company and also a director – and this person comes into a directors’ meeting and starts laying down all these allegations. He would not listen to the initial board agenda – my agenda. So I increasingly got frustrated and raised my voice at him, too. But in the end, the happenings at the board meeting made their way to the media and the media painted me as an unreasonable, demanding person – not in the sense of trying to increase the available funds for Universal but as the person that was trying to grab more shares.

I basically yelled at him and said, “Listen, you come here with allegations. Where’s the investigation? Has this been fully investigated? If you’ve done a full investigation, the result of that investigation is something you raise. But now you’re saying that there’s [only] a possibility of these actions taking place. This is not the time to just talk about things that may have taken place. You should have done the investigation first and then talked about it.”

I basically scolded the board members, saying that it’s my first time hearing about these issues and allegations. I haven’t seen any supporting evidence that would even facilitate some of these allegations.

And at that time Fujimoto banged the table and said, “I’m suspending your powers now.”

I was utterly flabbergasted at the fact that he would state that he could suspend my powers without basis. He didn’t have grounds for it. I’m bewildered to think that one can claim to have the power to suspend me based on unsubstantiated claims.

So I said, “I can’t work with people like this, there’s no way I can stay with people like you, I’m going to have to fire all of you.” I said that and I left. I went back two days later to try to get my personal belongings from the office, but I was accosted by security officers and they prevented me from entering.

MC: But Universal did do a full investigation and reported three cases of inappropriate transactions. What’s your response?

KO: What was contained there is an absolute sham. My personal thought was, “How could someone write something like this? This is just terrible, how could anyone go so low as to try to do this?” And they started throwing out libel and slander in waves.

MC: Why do you believe Universal shareholders, employees and stakeholders would be better off with you in charge as opposed to the current team?KO: Because I believe the current management only sees the short- term profits and what’s right in front of them. I develop and better raise the employees for long-term. I envision projects three, four, five years ahead.

Everything has to be built up from solid foundations. You can’t just gain instant success in a flash. If you gain something like that, there’s no grounds for it. Without a foundation, it’s always shaky. Fujimoto is not leadership material, he doesn’t have a long-term vision.

Making money is not the only goal for a company, rather it should not be. Making something that interests the clients and customers is the number one goal. If you cannot maintain the interest of customers in the long run, they will leave you.

MC: I understood Fujimoto was your protégé…

KO: In the sense of pachinko, yes, he does have abilities in that and he can build up on the foundation that I have already built up until this point. In that sense yes, if you want to use that word protégé … more in the plans that if and when Okada Manila would be on track and successful, at that time whatever happens with Universal, he can deal with it. It was going to be one or two years into realizing I can concentrate on Okada Manila, he can do what he wants – but before that, he did this coup d’etat.

MC: What do you think of the current leadership at Okada Manila?

KO: I believe the current leadership in Okada Manila doesn’t have any know-how in operating a casino. If they maintain control, this is certainly going to lead to failure.

The person that’s supposed to be the central figure in there probably doesn’t have the true vision of how to run, operate and move forward and implement that vision for Okada Manila.

Fujimoto is basically in way over his head. A person like that and a person like [Universal President Hajime] Tokuda, who’s basically just a yes man … those guys have no know-how or vision of running a casino long term.

He’s already a failure. One can see that from the settlement he took with Wynn. They took away [Universal’s] 20% of Wynn Resorts. If one looks at the value of the shares, it should be about US$4 billion. Basically, they took an innocent man who didn’t do anything wrong, made him look like a criminal and then made me go through all this. For the pain and suffering that they caused me, in tormenting an innocent man … I deemed those as grounds to ask for damages, which I estimated to be US$2 billion. So I should be asking for US$6 billion. Again, even with the shares’ present value at US$4 billion, these guys settled at US$2.6 [billion], which is unthinkable.

In Part 2 of our interview, to appear in the November edition of IAG, Okada gives his side of his ouster from Wynn Resorts and his relationship with Steve Wynn.

He said, They said

Kazuo Okada, Universal Entertainment trade accusations of financial misconduct

Kazuo Okada claims that rogue Universal Entertainment employees orchestrated alleged legal and ethical violations that led to his ouster from the company he founded. He singles out Universal President Jun Fujimoto as the ringleader of a multiyear, multilevel plot against him. Universal denies the conspiracy allegations, refusing comment beyond a spokesperson asking Inside Asian Gaming, “Did Mr Okada show you any evidence for his claims? We do have many for our complaints.”

Universal removed Okada as chairman in June last year, citing three financial transactions it claims benefited him at the expense of the company. Okada calls those charges “a sham” and traces his ouster to Universal turning his children against him. To back those claims, Okada’s public relations team provided a 2,940 word document of allegations against Universal but did not make its Hong Kong legal team available for questions or explanations.

“Enough mud has been thrown to ensure that some of it sticks,” Newpage Consulting Principal David Green, a former Australian gaming regulator, says of accusations against Okada. “As a regulator, you would need to ensure procedural fairness in any hearing regarding suitability. That doesn’t just involve giving Okada a chance to tell his story; it also involves giving those accused of conspiring against him the opportunity to tell theirs.”

Here’s a rundown of Okada and Universal’s competing claims and ongoing battles.

UNIVERSAL’S INTERNAL INVESTIGATION OF OKADA

The 30 August 2017 report on the results of Universal’s internal investigation, following Okada’s May suspension as chairman, claims he committed “three acts of fraudulence … for his own personal benefit … an extreme intermingling of private and pubic affairs and … [there was] a serious lack of ethics that one should naturally have as a director of a listed company.”

Universal alleges unauthorized loans of US$135 million to Goldluck Technology and US$80 million through a Korean subsidiary, as well as an unauthorized withdrawal of US$16 million, all via Philippine subsidiary Tiger Resorts Asia. Universal is suing Okada in Tokyo over these alleged acts. Tiger also is suing Okada in Hong Kong, seeking US$17.4 million in compensation. Okada’s summons for questioning by Hong Kong’s Independent Commission Against Corruption in July reportedly stemmed from these allegations.

Okada claims company minutes show that Tiger’s board authorized the loan to Goldluck. He adds that a Universal director introduced him to Goldluck executive Li Jian, contending Universal set him up to make the loan then blamed him for making it.

Regarding Korea, Okada says, “If you look at my passport, I don’t have any travel records going to Korea, I wasn’t involved in anything there.”

He contends it’s another facet of Universal’s plot against him: “Again, those things were also done behind my back. Basically some things happened which were completely paid back and these guys are coming back trying to make an issue over something that was already settled.”

UNIVERSAL SUES OKADA IN PHILIPPINES

Universal’s Philippines subsidiary Tiger Resort Leisure and Entertainment has filed a trio of legal actions there against Okada. It claims an Okada-owned company delivered faulty LED materials to Okada Manila and seeks to recover the equivalent of US$7 million. Separately, Tiger seeks more than US$3 million in wages and fees paid to Okada. Additionally, Tiger has filed suit against Okada and former Tiger President and COO Takahiro Usui – now Aruze Gaming America Group CEO – alleging fraud in their fight against removal from Tiger.

UNIVERSAL SUES ARUZE GAMING AMERICA

Aruze Gaming America began as the casino gaming machine – or non-pachinko – arm of Universal. Okada bought 100% personal ownership of it in 2009. Universal has filed a ¥100 million lawsuit in Tokyo against Aruze over unpaid licensing fees for Universal patents.

OKADA HOLDINGS LTD CONTROLLING STAKE

To avoid high Japanese estate taxes, Kazuo Okada established Okada Holdings Ltd as a Hong Kong company in 2010 to pass son Tomohiro Okada and daughter Hiromi Okada his 67.9% stake in Universal, with a current market value of US$1.75 billion. Corporate papers installed Okada Sr as sole director of OHL, retaining his ownership of all Universal shares and included a pledge that other shareholders would not vote against him. Okada controls 46.38% of OHL, Tomohiro 43.48%, Hiromi 9.78% and Okada’s second wife Sachiko (also known as Takako) 0.36%.

According to Hong Kong court filings, on 12 May 2017 Tomohiro and Hiromi, representing more than 50% of OHL shares, appointed two new OHL directors, Atsunobu Ishida and Makoto Takada, who removed Okada as director. Okada’s camp contends Universal’s Fujimoto “brainwashed” Tomohiro, who “tricked” Hiromi, using their close relationship to seize control of his majority shareholding. “These discussions would be sudden and it would not be in a private setting. It would not only be Tomohiro, but Tomohiro’s attorney would always be present,” recalls Hiromi, who sat beside her father while speaking to IAG. “I only found out afterwards that documents I signed were not in fact what was stated or what I had intended. I had no idea it was going to be used to drive my own father out of his company.”

In August last year, Hiromi granted her father power of attorney over her OHL shares, giving him majority control that he wants to use to restore himself as sole director, removing Ishida and Tokada. But Hong Kong’s Companies Registry has refused to accept Okada’s paperwork, leading father and daughter to each file lawsuits. Hiromi has also lodged complaints with Hong Kong’s Commercial Crime Bureau about the tactics used to convince her to oppose her father.

In August last year, Hiromi granted her father power of attorney over her OHL shares, giving him majority control that he wants to use to restore himself as sole director, removing Ishida and Tokada. But Hong Kong’s Companies Registry has refused to accept Okada’s paperwork, leading father and daughter to each file lawsuits. Hiromi has also lodged complaints with Hong Kong’s Commercial Crime Bureau about the tactics used to convince her to oppose her father.

“In general, I am suspicious when I read words like ‘brainwashed’ and ‘tricked’ to describe the behavior of Okada’s children,” Global Market Advisors Senior Partner Andrew Klebanow says. “I have to believe that Okada’s children are very well educated and are capable of critical thinking. Perhaps Hiromi was gullible in following her brother’s instructions in signing over her shares without outside counsel, but I am not buying that Tomohiro was brainwashed.”

US$43 MILLION TRANSFER TO ARUZE USA

Okada claims that Fujimoto directed a US$43 million transfer in May 2012 to Aruze USA, a Universal subsidiary established as a vehicle for receiving Wynn Resorts dividends. Okada alleges the transfer is part of a multiyear scheme to discredit him through fraudulent financial transactions.

US$40 MILLION TRANSFER TO PHILIPPINE CONSULTANT

In November 2012, Reuters reported three payments totaling US$40 million during 2010 to Rodolfo “Boysee” Soriano, a close associate of then-Pagcor Chairman Efraim Genuino. Universal, then chaired by Okada, took legal action against Reuters and against Universal employees it claims made the payments without authorization, legal actions which continued following Okada’s ouster. Last year, a Tokyo judge, ruling in the case of an employee suing for defamation, declared Okada ordered the payments.

Reuters reported in 2013 that Universal Director Hajime Tokuda altered minutes of a 2009 meeting to indicate executive officers approved the US$25 million payment. Tokuda, who did not stand for reelection as a director after the report, now serves as Universal’s chief operating officer and a director.

Okada denies approving the payments and notes that the transfers of US$25 million, US$10 million and US$5 million were all made through Aruze USA, also the funding source for alleged excessive hospitality that Wynn Resorts seized on to remove Okada from its board and redeem Universal’s shares at a US$900 million discount. Okada claims a rogue employee linked to the US$43 million transfer to Aruze USA participated in this transfer.