The road to recovery is well and truly underway as the Philippines gaming industry resumes its rapid growth trajectory.

In an August note, investment bank Morgan Stanley described Manila’s Bloomberry Resorts Corp – owner and operator of Solaire Resort, Entertainment City – as having one of the best recovery rates in ASEAN as it emerges from the ravages of the COVID-19 pandemic.

In an August note, investment bank Morgan Stanley described Manila’s Bloomberry Resorts Corp – owner and operator of Solaire Resort, Entertainment City – as having one of the best recovery rates in ASEAN as it emerges from the ravages of the COVID-19 pandemic.

With Bloomberry’s hold-adjusted EBITDA reaching 73% of pre-COVID levels in 2Q22 – the first full quarter since the Philippines government reopened international borders in February and eased capacity restrictions on local establishments in March –Morgan Stanley analysts stated, “This is one of the fastest recoveries among Asian gaming markets … in line with Singapore.”

While the pace of recovery slowed somewhat in Q3, Bloomberry’s story is reflective of the Philippines market as a whole. Despite suffering one of the harshest lockdowns in Asia at the height of the COVID-19 pandemic, and with daily infections peaking at 38,867 on 18 January 2022, the Philippines is well and truly back, with GGR figures through the June and September quartet in many cases exceeding those recorded in 2019, prior to the pandemic.

In Entertainment City, Okada Manila – buoyed by increased hotel room capacity – reported gross gaming revenue of Php8.3 billion (US$144 million) in 3Q22, up from Php8.1 billion (US$141 million) in the same period in 2019.

Newport World Resorts, formerly known as Resorts World Manila, reported Q3 gaming revenues of Php8.0 billion (US$139 million), 63% higher than the same quarter in 2021 and up from Php7.3 billion (US$127 million) in 3Q19.

Solaire, the long-time market leader among Entertainment City’s quartet of integrated resorts, has yet to return to 2019 levels when Q3 GGR reached Php17.1 billion (US$298 million), but 3Q22 gaming revenues of Php13.9 billion (US$242 million) were still 89% higher year-on-year and 2% up on the June 2022 quarter.

Solaire, the long-time market leader among Entertainment City’s quartet of integrated resorts, has yet to return to 2019 levels when Q3 GGR reached Php17.1 billion (US$298 million), but 3Q22 gaming revenues of Php13.9 billion (US$242 million) were still 89% higher year-on-year and 2% up on the June 2022 quarter.

City of Dreams Manila, the smallest of Manila’s IRs, does not directly report gaming revenues, but its parent Melco Resorts revealed gaming revenues at its Manila casino of US$74.1 million in 3Q22, up from US$42.7 million a year earlier.

What’s most telling about these numbers is that they have been achieved with international visitation still tracking at only a third of 2019 levels. According to figures published by the Department of Tourism, total visitor arrivals into the Philippines, since a mandatory quarantine requirement was scrapped in February, had reached 2.0 million as of 14 November compared with 8.2 million arrivals through all of 2019.

Visitation from China, which accounted for 21% of all arrivals pre-COVID, numbered just 22,236 between January and September compared with 1,743,309 through 2019.

All of which means it is the domestic mass market currently driving the Philippines’ impressive resurgence – a view supported by Maybank Securities analyst Miguel Sevidal.

Following a recent tour of all four Entertainment City IRs, Sevidal wrote in an October note, “We observed that the mass tables and slot machines of Solaire and City of Dreams Manila were almost fully utilized, whereas those of Newport Manila and Okada Manila were operating at closer to 60-70% capacity.”

This, he added, validated his positive view of domestic demand-driven growth at Bloomberry’s Solaire, for which Maybank provides coverage.

There is movement north of Manila, too, where the unique golf and gaming destination of Clark continues its rapid expansion via the recently launched Hann Casino Resort, previously known as Widus, and a similar expansion project set to open at nearby Royce Hotel and Casino.

Calculating the individual recovery trajectory of Clark’s seven casinos is challenging given none are publicly listed, but Hann Philippines Inc Chairman and CEO Daesik Han told IAG during a recent visit that August 2022 GGR was tracking 150% higher than August 2019.

Like Okada Manila, Hann’s growth when compared with 2019 has been boosted by significant capacity enhancement, with the new-look property’s 147 gaming tables and 868 electronic gaming machines up from 67 tables and around 370 EGMs at the old Widus.

Yet Hann is a perfect example of the development explosion that has the Philippines pegged as the single most exciting growth market in all of Asia-Pacific over the next five years. At least four new major integrated resort projects are scheduled to open in the coming years, including two new additions to Bloomberry’s Solaire portfolio. Solaire Resort North, located in Quezon City, is expected to launch in late 2023 while development on a third Solaire-branded resort will begin in 2024 in Cavite, south of Manila. Bloomberry is also set to purchase an unspecified, but potentially controlling stake in PH Resorts Group – the gaming and hospitality arm of Philippines business conglomerate Udenna Group. That investment would in theory provide the funds for PH Resorts Group to resume development on its Cebu integrated resort project, The Emerald Bay, which has stalled due to financial concerns. The Emerald Bay will become Cebu’s second five-star integrated resort following the recent soft launch of NUSTAR Resort and Casino.

According to details of the proposed transaction filed with the Philippine Stock Exchange in May, Bloomberry’s pending investment will include a stake in Clark Grand Leisure Corp, the PH Resorts Group subsidiary that had been planning development of another new casino, The Base Resort Hotel and Casino, in Clark.

According to details of the proposed transaction filed with the Philippine Stock Exchange in May, Bloomberry’s pending investment will include a stake in Clark Grand Leisure Corp, the PH Resorts Group subsidiary that had been planning development of another new casino, The Base Resort Hotel and Casino, in Clark.

The project, touted as offering 600 electronic gaming machines, 100 gaming tables and 400 hotel rooms plus retail space and restaurants, is currently on hold after PH Resorts Group last year received approval from Philippines gaming regulator PAGCOR to voluntarily suspend its provisional license in order to focus all of its resources on The Emerald Bay in Cebu.

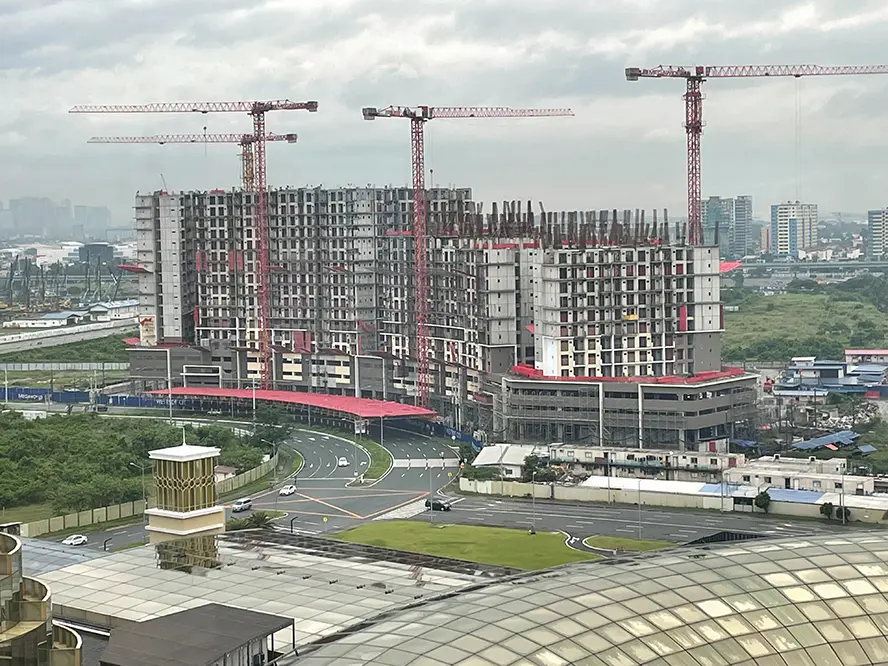

Meanwhile, Manila’s Entertainment City will welcome a fifth integrated resort in the coming years with development of Westside City now well and truly underway.

Covering 31 hectares of land, the township style project is linked to Alliance Global Group (AGI), owner and operator of Newport World Resorts, and will comprise residential condominiums, office buildings, hotels and a lifestyle mall among other facilities.

It will also boast a new hotel-casino with 450 rooms, 400 gaming tables and 1,200 slot machines, being built by Suntrust Resort Holdings Inc, which counts Hong Kong-listed LET Group Holdings – previously known as Suncity Group – as its controlling shareholder. Opening is scheduled for 2024 although analysts believe 2025 is more likely.

The impending launch of Westside City will split Entertainment City’s operators down the middle, with Solaire and City of Dreams to continue focusing on the “higher-margin mass and slot machine segments”, according to Maybank analysts (although Solaire also has strength in VIP), while Westside City and Okada Manila will lean towards the premium gaming segments.

This is in line with AGI’s strategy at Newport World Resorts, located just outside of the Entertainment City precinct alongside Ninoy Aquino International Airport (NAIA), where VIP accounts for around 60% of Newport’s GGR and is driving GGR recovery for the firm.

“According to AGI, almost half of Newport’s VIP GGR is driven by video streaming, which is not unexpected given the slow recovery of foreign fly-in business to the Philippines,” Maybank said in a note.

“Management likewise shared that the new Suntrust Resorts property [at Westside City] will likely cater to the VIP and premium mass segments.”

“Management likewise shared that the new Suntrust Resorts property [at Westside City] will likely cater to the VIP and premium mass segments.”

Importantly, Maybank’s Sevidal says of the upcoming Solaire Resort North and Westside City developments that “any new capacity is beneficial for the industry as a whole, as it attracts more players and translates to higher industry GGR.

“When City of Dreams Manila and Okada Manila opened in FY15 and FY16, respectively, industry-wide GGR growth accelerated from 11% in FY12-14 to 17% in FY15-19.”

To put that into perspective, Philippines industry-wide GGR grew from US$1 billion in 2010 to US$2.8 billion in 2015 and US$5.3 billion in 2019.

“Prior to the pandemic, the Philippines was the fastest-growing gaming market in the world,” Sevidal continues.

“Casino GGR in the Philippines posted a 13% CAGR in FY14-19, faster than the GGR growth recorded by Macau, Singapore, Korea and Las Vegas. GGR growth in the Philippines was driven by both domestic demand and foreign fly-in business. Philippine GGR grew 18% year-on-year in FY19 amid slowdowns in Macau (-4%), Singapore (-6%) and Korea (-0.2%).”

Maybank doesn’t provide any industry-wide predictions but estimates that Solaire Resort North will contribute GGR of Php101 billion (US$1.77 billion) by 2026, boosting Bloomberry’s group-wide GGR by 75%.

Solaire Resort already holds a dominant 34% of market share among its Entertainment City peers, with Newport World Resorts at 25%, Okada Manila 22% and City of Dreams Manila at 19%.

Solaire Resort already holds a dominant 34% of market share among its Entertainment City peers, with Newport World Resorts at 25%, Okada Manila 22% and City of Dreams Manila at 19%.

Perhaps the most interesting transformation, however, is the one taking place further north in Clark. Best known as the long-time home of the US military’s Clark Air Base, the area has since been designated as a Special Economic Zone with the Clark Main Zone, an area covering 4,400 hectares, designated a Freeport Zone in 2007.

Covering more than half of that space is the old Clark Air Base, now Clark International Airport, which at 2,400 hectares is four times larger than Manila’s NAIA. And it is the existence of this airport – complete with a brand new US$250 million passenger terminal – that has facilitated Clark’s emergence as the Philippines’ latest gaming tourism hub.

Among the early movers in this space was Mr Han, who first visited the area as a tourist in 2005 and immediately recognized its potential. He opened the hotel Widus three years later, added a casino in 2009 and has since invested around US$600 million into what is now Hann Casino Resort, featuring the Philippines’ first Swissôtel – opened earlier this year – plus specialty dining options, retail outlets, a swimming pool, an executive lounge and MICE facilities.

But it’s his next move that is his most ambitious.

But it’s his next move that is his most ambitious.

Envisioning Clark’s future as a golfing and gaming “millionaire’s paradise”, the company recently announced two new projects – Hann Lux, which will be located nearby the existing Hann Casino Resort with a casino, two hotels, fashion stores, French-inspired cafés, convention facilities, residences and commercial areas; and Hann Reserve, an ambitious luxury golf resort on 450-hectares at nearby New Clark City.

When complete sometime in the next decade, Hann Reserve will feature three 18-hole, PGA- affiliated championship golf courses, development facilities, an array of luxury hotels and resorts plus clubhouses, a mixed-use commercial center, premium villas and residences, and a 10-hectare public park.

The three golf courses to be built will include a mountain course designed by Nicklaus Design, a valley course by South Korean professional golfer KJ Choi, and a Sir Nick Faldo Signature river course designed by the six-time Major winner himself.

“The thing about Clark is it has a lot of space,” Han told IAG recently. “There are three golf courses here now, and outside, nearby, there are quite a lot of them … plus I’m building another three of them and there are a lot of known Korean companies coming here to build golf resorts. So in five years’ time there will be quite a lot more golf courses, and this is going to be a golfing destination.”

It is this unique opportunity that has led Clark’s growth in recent years, and Hann is not alone. D’Heights, located a short five-minute drive away on 309 hectares of land, opened in 2019 with two 18-hole golf courses at its Clark Sun Valley Golf & Country Club, a 310-room Hilton Hotel, a Singapore School offering Singaporean education standards for students between Kindergarten and Year 12, five towers of condominium and a world-class casino.

And Royce Hotel & Casino, a modest property with 54 gaming tables and around 300 slot machines, will soon become the largest gaming floor in Clark with its Phase 2 expansion to cover 27,000 square meters with space for 150 gaming tables and 1,500 slot machines.

And Royce Hotel & Casino, a modest property with 54 gaming tables and around 300 slot machines, will soon become the largest gaming floor in Clark with its Phase 2 expansion to cover 27,000 square meters with space for 150 gaming tables and 1,500 slot machines.

Proof positive that the Philippines is positioning itself as Asia’s ultimate gaming destination.