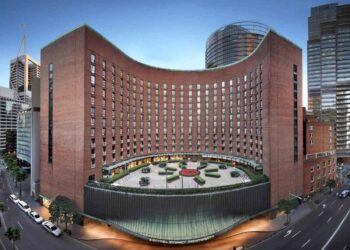

Resorts World Las Vegas, the US flagship of Malaysian gaming giant Genting Berhad, saw its revenue decline by 1.5% and EBITDA by 51.4% quarter-on-quarter in 3Q22, impacted by lower casino hold percentage and lower hotel occupancy.

According to the company’s financial results for the September quarter, published late Thursday (Asia time), revenue US$200 million was slightly down on the US$203 million recorded in Q2, although improved on US$175 million a year earlier. Adjusted EBITDA of US$18 million was down on both US$37 million in 2Q22 and US$27 million in 3Q21.

Genting said that RWLV’s non-gaming revenue was higher than 3Q21 on the back of a record hotel and food and beverage revenue in the month of September 2022.

September also saw the highest monthly amount of group business nights achieved to-date, with hotel occupancy in 3Q22 reaching 86% compared with 55% a year earlier – albeit down from 90% in Q2.

However, “Casino hold percentages were below expectations impacting quarterly results,” it said.

In a note, Nomura analysts Tushar Mohata and Alpa Aggarwal said RWLV’s EBITDA remains below expectations, “especially as we estimate RWLV also has quarterly interest charges of US$25 million and depreciation charges of US$60 million, which will drag EBITDA into losses at the net income level.

“Furthermore, given the occupancy is already ~85% to 90%, more improvement in EBITDA needs to come from yield improvement, which is arguably harder to achieve than capacity-led growth.

“Our EBITDA expectations for RWLV are US$119 million for FY22 and US$160 million FY23 versus its 9M22 EBITDA of US$69 million.”

Genting Berhad said in its earnings release that its booked group business for the remainder of 2022 is stronger than the number of bookings in the first half of the year, with new performances at the Resorts World Theatre and future projects expected to drive significant foot traffic in the remainder of 2022 and beyond.

“RWLV intends to continue building on its strong momentum by leveraging the Hilton branding partnership with over 146 million Hilton Honors members and capitalising on the return of the convention business and the property’s proximity to the newly expanded Las Vegas Convention Center,” it said.

“In addition, RWLV’s guests can now utilise The Boring Company’s underground transportation system which transports guests between RWLV and the LVCC in minutes. This added convenience is a unique experience at present, with RWLV’s passenger station being the first of over 55 stops anticipated to form the Vegas Loop.

“As international travel continues to resume and with strong demand for domestic travel to Las Vegas, RWLV remains focused on growth opportunities, including ongoing efforts to build RWLV’s database for casino and resort marketing.”

Genting Berhad, whose interests also include controlling stakes in both Genting Malaysia and Genting Singapore, reported a 75% year-on-year increase in revenue in 3Q22 to MYR6.12 billion (US$1.36 billion) while Adjusted EBITDA more than doubled to MYR2.06 billion (US$458 million).

Profit of MYR358.9 million (US$79.8 million) reversed a loss of MYR326.5 million (US$72.6 million) recorded in 3Q21.