Malaysian gaming giant Genting Berhad will steadily deleverage from 4.0x net debt/EBITDA in 2021 to 2.8x by 2024, aided by robust recovery in Malaysia and Singapore and lower capex requirements, according to ratings agency Fitch. Genting Malaysia will also deleverage from 4.2x to 3.2x over the same period.

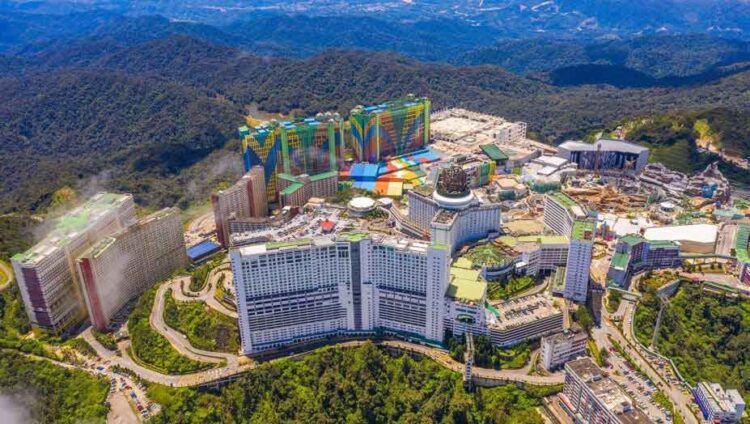

In a Wednesday note, Fitch outlined its revenue and EBITDA estimates for Genting Berhad’s two key subsidiaries: Genting Malaysia – operator of Resorts World Genting (RWG) – and Genting Singapore, which operates Resorts World Sentosa (RWS).

In each case, the ratings agency said, “Our revenue growth estimates … incorporate receding COVID-19 risks and the easing of preventive restrictions.

“EBITDAR margins have also benefitted from a sharp cut in the workforce in Malaysia to mitigate the pandemic’s impact.

“We expect a slower – but steady – EBITDAR recovery in Singapore than in Malaysia and the US, due to a higher dependence on foreign visitors and the hit from an increase in gaming tax from 2Q22.”

In Malaysia, Fitch estimates revenue to recover to 75% of 2019 levels this year and 95% in 2023 – aided by minimal reliance on foreign visitation at RWG and new additions to the Genting SkyWorlds theme park in Q4.

Complimenting this will be higher EBITDAR margin due to lower staff headcount, with Fitch anticipating margins to remain above 2019 levels “despite the impact of wage inflation and higher spending on marketing and promotional activities.”

Average spending of around MYR800 million (US$170 million) per year between 2022 and 2024 will primarily consist of maintenance capex and minor upgrades and additions, with mist major development projects now completed.

In Singapore, Fitch forecasts a slower recovery to 65% of 2019 levels this year, climbing to 90% in 2023 and full recovery by 2024.

Genting Singapore is impacted by a greater reliance on foreign tourists than its Malaysian cousin, the agency noted, with tourist inflow still at just 55% of 2019 levels as of 3Q22. This, too, is expected to fully recover by 2024.

While Singapore revenues will keep rising, EBITDAR margin for Genting Singapore is tipped to average 43% between 2022 and 2024, lower than the pre-pandemic level of 47% due to a higher gaming tax introduced in 2Q22.

Similarly, a SG$3.6 billion (US$2.57 billion) capex commitment announced by Genting Singapore in 2021, mainly linked to its upcoming RWS 2.0 expansion project, is expected to be back-ended with spend of SG$2 billion (US$1.43 billion) through 2024.

Nevertheless, parent Genting Berhad will benefit from both subsidiaries over the next two years as dividends quickly increase.

The agency estimates Genting Singapore, of which Genting Berhad holds a 52.7% stake, will increase dividend payments from around SG$240 million (US$172 million) in 2022 to SG$420 million (US$300 million) in 2024, while Genting Malaysia – 49.5% owned by Genting Berhad – will increase payments from MYR850 million (US$180 million) this year to MYR1.1 billion (US$233 million) in 2023.

Both instances would see dividend payments return to pre-pandemic levels.