In this new regular feature in IAG to celebrate 16 years covering the Asian gaming and leisure industry, we look back at our cover story from exactly 10 years ago, titled “Many happy returns,” to rediscover what was making the news in February 2011!

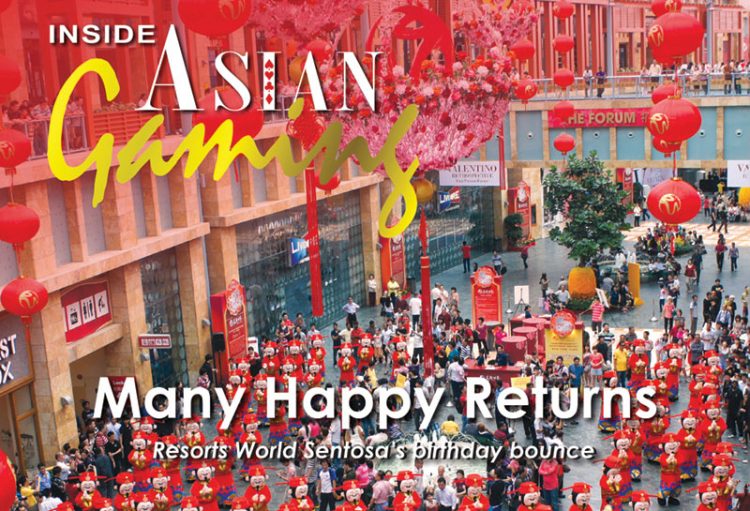

February 2011 marked the one-year anniversary of the opening of Singapore’s first integrated resort, Resorts World Sentosa, and Inside Asian Gaming marked the occasion by featuring the already hugely successful operation on the cover of its February 2011 edition.

While still very early on in the Singapore growth story that RWS and its cross-city rival Marina Bay Sands helped inspire, the early numbers at that time were already hugely encouraging. As reported by IAG at the time, the first calendar year of operations for the two IRs (MBS opened in April 2010) saw Singapore’s tourist numbers grow 20% in 2010 to a record 11.6 million visitors – reversing declines in the previous two years – including an all-time monthly record at the time of 1.13 million arrivals in December 2010.

Accordingly, RWS itself welcomed 15 million visitors in its first year with occupancy of around 70% at its original four hotels. There were also two million visitors to the theme park despite some rides not yet being operational.

Accordingly, RWS itself welcomed 15 million visitors in its first year with occupancy of around 70% at its original four hotels. There were also two million visitors to the theme park despite some rides not yet being operational.

Ten years on and RWS attracts around 18 million visitors per year (as of 2019) while Singapore itself attracted 19.1 million foreign visitors in 2019 before COVID-19 decimated travel in 2020.

One interesting stat from those days that has reversed, however, is market share. RWS took 51.9% of Singapore’s casino market share in the fourth quarter of 2010, rising to 55.8% in 1Q11, with IAG quoting analysts at the time who suggested, “While we think Marina Bay Sands is undoubtedly a far more spectacular property, we believe the US operator has shown itself to be a relatively underwhelming competitor so far … we think Genting may have a more appealing casino product to Asian gamblers.”

Those predictions proved well off the mark: MBS has long since assumed the role of dominant player in Singapore with around 64% of market share in 2019.