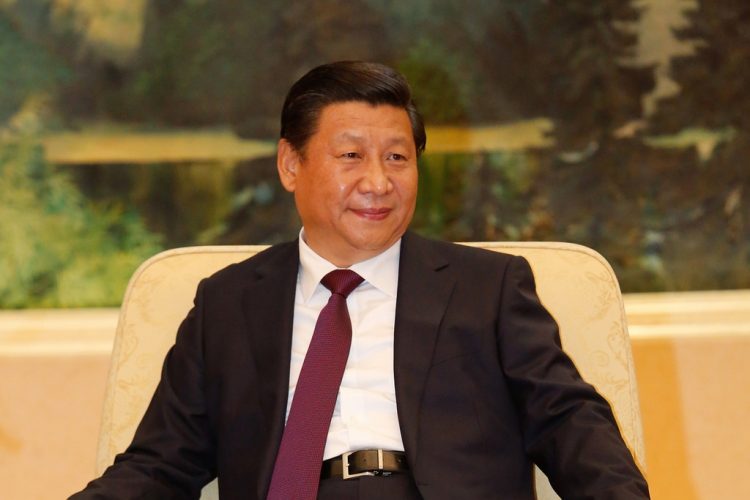

Financial services firm Fitch Ratings says it expects China’s economy to slow during the second half of the year, creating a potential policy dilemma for President Xi Jinping.

In a Tuesday newsletter, Fitch said data from the past few months, including figures on production and fixed asset investment as well as manufacturing purchasing managers’ indices, suggests that growth peaked in Q1.

“The impact of stimulus measures implemented during 2016 has begun to wane, while tighter regulatory scrutiny of shadow banking and higher borrowing costs will continue to filter through into slower credit growth,” said Senior Analyst Dan Martin. “The People’s Bank of China’s (PBOC) latest monetary policy report showed that average lending rates rose to 5.63% in 1Q17, up by 19bp from the previous quarter.”

China’s policy response, says Martin, will likely remain unchanged through the remainder of 2017, however the threat of growth slowing too rapidly in 2018 could force President Xi to “relax financial regulations, loosen monetary policy or resume a step-up in fiscal spending.

“Indeed, the last time policymakers faced this dilemma – when tighter restrictions on local government financing put the growth target under threat in 2015 – the response was to relax the restrictions,” Martin says.

“Any policy reversal this year is almost certain to be more measured, given President Xi Jinping’s statement in April equating financial security with national security, but balancing growth and financial stability will present an increasing challenge for economic policy as the year progresses.”