VIP-free Chinese New Year is a great time to market to the masses in Macau

Chinese companies and Chinese consumers spend a lot of time, effort and money celebrating Chinese New Year. But in Macau at least, it seems they’re not splashing much of the cash on gambling.

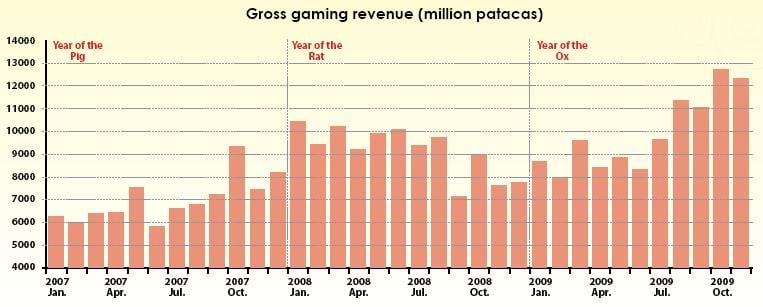

Data show that visitor numbers to Macau tend to peak during the month of Chinese New Year compared to the month either side of the lunar holiday. But gambling revenues commonly fall during the holiday month.

This appears at first sight to be counter-intuitive. The greater the number of people visiting a resort in holiday mood, the more those people will spend, logic would suggest. But that doesn’t take account of cultural factors and a number of economic ones.

Chinese people traditionally regard the run up to the lunar New Year as a time for settling outstanding debts. They take this responsibility seriously, despite their reputation as fearless and dedicated gamblers. The reason may be as much self-interest as for the protection of their reputation. There’s a pervasive belief in Chinese culture that doing good or meritorious deeds can actually be of benefit to one’s fortunes in the future.

Culture versus cash

Even if one discounts this cultural factor as too airy-fairy a contribution to Macau’s bottom line to be worthy of analysis, there are other structural issues that might negatively affect gambling revenue during Chinese New Year. One is the rather lopsided nature of Macau’s gaming market. Year after year, statistics show that more than 60% of all gambling revenues in Macau come from VIP baccarat. And it seems that during Chinese New Year at least, the high rollers stay away, or stop spending so much money.

The evidence to support this proposition is that in the four years from 2006 to 2009, only once did Macau punters gamble more on VIP baccarat in the first quarter of the year than in the second. That’s according to figures from Macau’s gambling regulator, the Gaming Inspection and Coordination Bureau.

Perhaps the Macau VIPs are all in Las Vegas during the holiday. Sin City recorded a more than 100% rise in its annual take from baccarat between 1996 (when it stood at US$455.6 million) and 2008 (when it topped US$1 billion), according to the Las Vegas Convention and Visitors Authority.

Family is particularly important in Chinese culture, and most VIP baccarat players are likely to be heads of extended families as well as heads of businesses. That may mean their presence is required elsewhere during Chinese New Year. In any case, most VIPs that visit the Macau high limit rooms don’t seem keen on crowds, and the lunar New Year in Macau definitely brings in crowds.

In February 2007 (the Year of the Pig), when the Chinese New Year was on 18th February, there was a 14% increase on visitor numbers entering Macau via the Macau Maritime Ferry Terminal compared to January that year. Yet in February ’07, gaming revenue actually fell 4.4% compared to January ’07.

Trend

There was a similar pattern in 2008 (the Year of the Rat) when Chinese New Year was on 7th February. Figures from Macau’s Statistics and Census Service (DSEC) show that in February 2008, 787,500 people arrived in the territory via the main ferry terminal. That was a 14.9% increase on visitor numbers via the terminal compared to January. Yet in February ’08, gaming revenue actually fell 9.5% compared to January ’08. And that was despite the fact that 2008 was a leap year, meaning there was an extra day in February.

In 2009 (the Year of the Ox), when Chinese New Year was on 26th January, the pattern of the previous two years was disrupted. A total of 801,500 people arrived at the main ferry port—a drop of 7.8% on the previous December. Yet gambling revenue was up 10.3% compared to December ’08. A possible explanation for the fall in visitor numbers but rise in the gross is that the Chinese government was rationing visitor visas for its citizens, but those people who did come were feeling more confident about the economic outlook post global credit crisis.

If high rollers aren’t coming to Macau during Chinese New Year in the usual numbers (or at least not spending so much), then who is coming? Anecdotal evidence from observation and from speaking to marketing executives at the casinos is that it’s mass-market visitors. What the available statistics show is that in raw numbers terms (and without indicating socio-economic status), it’s mainly people from Greater China (the Mainland, Hong Kong and Taiwan). In 2007, for example, when the lunar holiday was in February, the percentage of visitors coming from the People’s Republic to Macau rose 24.9% compared to the previous month. The pattern was similar with Hong Kong and Taiwan, with increases of 19.6% and 41.6%, respectively. (The Taiwan figures were probably skewed by air passengers en route to family reunions on the Mainland being forced to transit via Macau. At that time, China was still banning direct flights between Taiwan and the Mainland).

Given that mass-market tourists have families just like VIPs, there’s a strong possibility that many of the 2007 CNY visitors to Macau were day-trippers making a quick foray to the casino jurisdiction before returning at night to the bosom of their families. DSEC figures for the whole year indicated 52% of all tourist arrivals were day visitors staying on average 0.2 days (i.e., approximately five hours).

If Macau has a higher than average cohort of day visitors during Chinese New Year than at other times, it’s reasonable to assume that casino marketing strategies may have to be tweaked accordingly during the holiday period. This is to account for both seasonal factors—such as goodwill and good luck) and also to grab visitors’ attention and dollars at a time when there are plenty of other distractions to empty their wallets, such as banquets, family games of mahjong and distribution of lucky red packets of money to business associates and family friends (known as lai see in Cantonese or hóng bāo in Mandarin).

Seasonality

It’s risky to make too many assumptions about Macau’s holiday visitors based on raw statistical data. The casinos themselves have more detailed information, but are generally reluctant to make it publicly available. Oneoff or seasonal visitors pose a particular challenge even for the casinos’ professional marketing teams, given that casual visitors are less likely to sign up for customer loyalty schemes than regular visitors.

As one Macau gaming executive told IAG: “Before you can market products and services effectively to customers you need to know who those customers are. Chinese New Year is different from other times of the year from my experience because you have a lot of visitors who aren’t necessarily gamblers. As a casino operator however you can’t just sit by and wave them off on a trip to St Paul’s [the ruins of a 17th century Catholic cathedral built by Jesuits] or to Hac Sa Beach. You need to engage them, hold on to them long enough to find out who they are and generate some revenue from them. Once you’ve done that you have a better chance of converting them into repeat customers.”

In January, City of Dreams, Melco Crown Entertainment’s integrated resort on Cotai, started a three-month campaign covering Chinese New Year and designed to bring new customers through its doors.

The ‘Let’s Get Lucky’ campaign is the first of several events to be launched by City of Dreams in 2010. It includes the presentation of direct marketing material to passengers aboard Shun Tak’s TurboJET ferries from Hong Kong. Travellers are given a coupon in the shape of a ‘Lucky Wheel’ and then invited to open the coupon along a perforated edge to reveal prize information. Rewards include instant cash prizes or a free spin on a lucky wheel machine at CoD.

SJM Holdings, Dr Stanley Ho’s casino operating company, looks well placed to have a strong performance this Chinese New Year, as much because of the strategic position of its latest offering, Casino Oceanus, as any marketing effort. The property is rather ‘belt and braces’—it had a modest capex of HK$1.5 billion (US$190 million) and looks substantially like what it is; namely a gutted and converted shopping centre. Crucially, however, it is only a three or four-minute walk from Macau Maritime Ferry Terminal. When the property opened in mid-December, an SJM executive told Inside Asian Gaming that the strategy was precisely to grab visitors and hold on to them for three to four hours.

Positioning

Casino Oceanus is served by a bridge direct from the Maritime Terminal, thus conveniently funnelling customers away from the free shuttle buses of rival operators. IAG has been told that next year, an airconditioned link complete with moving walkway may be built to make the journey even simpler and more comfortable during Macau’s hot and humid summers.

Ponte 16, the gaming and hotel resort at Macau’s Inner Harbour near the historic old town, has also got in on the mass marketing act in time for Chinese New Year. Although not as naturally blessed in terms of strategic positioning as Casino Oceanus, Ponte 16 has managed to purchase at auction a sizeable collection of memorabilia once used as stage props by the late singer Michael Jackson. It includes a white glove covered in rhinestones worn by Mr Jackson in 1983 at Motown’s 25th anniversary TV special, where he sang ‘Billie Jean’ and performed his famous ‘Moonwalk’ for the first time.

Ponte 16—half- owned by Dr Stanley Ho’s casino holding company, SJM—paid US$350,000 for the glove at a New York auction last year. That sounds like a lot of money, but if it draws in a new crowd to the property it will be considered cash very well spent. It could be that when the history of post-liberalisation Macau is written, the opening of Ponte 16’s ‘MJ Gallery’ on 1st February on the eve of the Year of the Tiger will be seen as a turning point. That turning point could prove to be the city’s transition from high roller fiefdom to all-year-round holiday haven in the manner of Las Vegas.