CLSA bullish on Singapore after opening of second integrated resort

CLSA Asia-Pacific Markets is raising its estimates on the size of the Singapore gaming market now that both

integrated resorts are partially open and it has a little more data to work with.

The independent brokerage and investment group says it is increasing its 2010 forecast in the part year for the whole market by 3.1% to US$2.15 billion, and by 4.1% for the full year in 2011 to US$3.69 billion. The report, Singapore casinos–Sector outlook from Aaron Fischer, Jon Oh and Huei Suen Ng, says the revised figures take account of higher than anticipated spending by day trippers from neighbouring Malaysia.

“The opening of MBS is generally considered successful, and the IR is set for a grand opening launch in June 2010. While we have every reason to be even more bullish on Genting Singapore based on recent operational performance, we are [only] mildly moderating our estimates now that we have more tangible data points to work with and to re-validate our initial assumptions.

| CLSA revised estimates on size of Singapore gaming market | |||||||

| Singapore gaming industry forecast | |||||||

| FY10 – old | FY10 – new | Delta % | FY11 – old | FY11 – new | Delta % | ||

| Singapore Annual Gaming Market (US$ mil) | 2,086.5 | 2,151.6 | 3.1% | 3,542.9 | 3,689.9 | 4.1% | |

| Annual visitors (mil) | 9.2 | 9.2 | 0.0% | 15.1 | 15.1 | 0.0% | |

| source: CLSA Asia-Pacific Markets | |||||||

“We raised our 2010CL Singapore gaming market size forecast marginally by +3.1% to US$2.15 billion, and +4.1% for 2011CL to US$3.69 billion,” states CLSA.

“This is to account for an increase in Malaysian day-tripper casino spending, which we increased from SG$70 to SG$100 based on our observation of the current gaming appetite,” say the authors after a research trip to Singapore in early May. The visit followed the soft opening of Marina Bay Sands on 27th April and also reviewed the progress made by Resorts World Sentosa since its first phase opening on 14th February during Chinese New Year.

CLSA estimated no change in its total IR visitor forecast of 9.2 million for 2010 and 15.1 million for 2011.

CLSA acknowledges, however, that some other analysts are more cautious on the outlook for the Singapore gaming segment, in light of some question marks over the prospects for VIP play in Singapore in the probable absence of junkets.

“Increasingly, consensus is turning more bearish on the prospect of the integrated resorts, and many are quick to conclude that initial gaming revenues for both RWS and MBS are disappointing and the casinos will not be successful,” states the CLSA research.

Sunny side

“It seems that CLSA is one of the few brokers still positive on the Singapore gaming market. Just as we believe consensus is too bearish on Macau’s rapid earnings growth, we believe that consensus have underestimated the potential of Singapore’s gaming market,” adds the report.

CLSA stresses that its position is based on its own experience from a day-long visit to both properties spread across different times of the day, combined with anecdotal evidence from other sources. As such, CLSA doesn’t claim its assessment to be entirely scientific, but regards it as a reasonably educated view based on available information and comparison with trends in Macau and other Asian gaming markets.

“We think it is too early to extrapolate early performance of both casinos, especially as we believe growth will

accelerate quite quickly over the first few years. Given uncertainty about timing of the openings for both IRs and as not all of the IR products are open, we believe a significant number of tourists have delayed holiday bookings. Also, some will book visits after some of the initial teething problems are ironed out. As a reminder, Macau gaming revenues have grown by around 30% per annum for the last six years; and the US and Australian gaming grew by between 10-15% per annum for more than ten years post-opening,” state the analysts.

Methodology

| CLSA forecast for RWS (gaming) | |||||||

| Genting’s gaming estimates | |||||||

| FY10 – old | FY10 – new | Delta % | FY11 – old | FY10 – new | Delta % | ||

| Revenue (S$ mil) | 1,788.0 | 1,788.0 | -0.6% | 2,775.9 | 2,384.8 | -14.1% | |

| VIP | 576.7 | 592.5 | 2.7% | 965.6 | 921.7 | -4.5% | |

| Mass Market | 1,121.9 | 1,096.6 | -2.3% | 1,694.9 | 1,368.7 | -19.2% | |

| Slots | 89.4 | 88.9 | -0.6% | 115.4 | 94.3 | -18.2% | |

| EBITDA (S$ mil) | 792.7 | 796.1 | 0.4% | 1,318.7 | 1,117.7 | -15.2% | |

| VIP | 98.3 | 116.5 | 18.5% | 200.7 | 214.1 | 6.7% | |

| Mass Market | 638.5 | 624.1 | -2.3% | 1,045.1 | 844.0 | -19.2% | |

| Slots | 55.8 | 55.5 | -0.6% | 72.9 | 59.6 | -18.2% | |

| EBITDA margin (%) | 44.3% | 44.8% | 0.4pp | 47.5% | 46.9% | -0.6pp | |

| VIP | 17.1% | 19.7% | 2.6pp | 20.8% | 23.2% | 2.4pp | |

| Mass Market | 59.9% | 56.9% | 0.0pp | 61.7% | 61.7% | 0.0pp | |

| Slots | 62.4% | 62.4% | 0.0pp | 63.2 | 63.2% | 0.0pp | |

| source: CLSA Asia-Pacific Markets | |||||||

| CLSA forecast for RWS (gaming and non-gaming) | |||||||

| Genting Singapore’s overall estimates | |||||||

| FY10 – old | FY10 – new | Delta % | FY11 – old | FY11 – new | Delta % | ||

| Revenue | 2,816.4 | 2,604.4 | -7.5% | 4,033.9 | 3,481.9 | -13.7% | |

| EBITDA | 978.9 | 931.7 | -4.8% | 1,581.3 | 1,339.4 | -15.3% | |

| Net Profit | 495.0 | 455.8 | -7.9% | 945.8 | 747.4 | -21.0% | |

| Gaming EBITDA Margin (%) | 44.3% | 44.8% | 0.4pp | 47.5% | 46.9% | -0.6pp | |

| source: CLSA Asia-Pacific Markets | |||||||

“Nonetheless, CLSA conducted a simple study to gauge the performance of the MBS casino versus the RWS casino. We visited the MBS casino on 1st May 2010, at 2pm, 6pm and 10pm. We spent about 1.0–1.5 hours each time at the casino and immediately then went over to RWS and spent about 0.5 hours each time to gauge the business in comparison.”

The authors cite as evidence in support of their bullishness their witnessing of resilience in Resorts World Sentosa’s massmarket performance in face of competition from MBS.

“RWS mass-market gaming continues to impress. Anecdotally, the RWS casino has not seen any decline of foot-traffic and table drop since the five days of MBS opening. In much similar fashion to Genting Highlands resort in Malaysia, RWS is starting to build a loyal base of mass-market customers. We expected a decline of [RWS] customers in the first week of MBS opening, and have been wrong,” say the CLSA analysts.

They issue a note of caution, however, on RWS’s mass market performance in coming months. “We still expect cannibalisation to happen in the mid-term, and think it’s a matter of time.”

The authors did note Resorts World Sentosa’s high limit tables appeared to be performing better than they had expected.

“RWS VIP could surprise consensus on the upside. With over 170-210 tables dedicated to VIP now across Crockfords and Maxims Club, our recent visit to the VIP floor suggests that the foot-traffic and gaming appetite could surprise the market on the upside. RWS is currently embarking on an expansion renovation at Maxims Club to include more rooms as the VIP tables are running at high capacity. We estimated VIP to be 37% of overall revenues.”

CLSA added, however: “We view the hardware of the RWS VIP as disappointing.”

The authors said they were unable to draw comparisons between RWS’s high roller offer and that of Marina Bay Sands during their trip.

“We were not privy to observe the performance of the VIP floors during our trip. As Sheldon Adelson [the LVS Chairman] has stated the strategy of not engaging junkets, we expect all VIP business to be direct. We have not formed any views on this segment of the [MBS] business, but are inclined to believe that it will be the stronger segment compared to RWS due to the higher quality of product offering and better VIP marketing.”

CLSA said LVS had been the more aggressive of the two operators in opening proportionately more of its gaming floor from day one compared to RWS.

“MBS launched with almost over 550 tables in total, a statement that the casino is fully fitted out from the first day. This is in comparison to the soft-launch strategy to RWS, which started with fewer than 300 tables and have since ramped up to circa 450 tables by now. Table split between both casinos are still around 20-30% VIP and the balance for mass-market,” states the research paper.

Downside surprise

| CLSA’s comparison of the Singapore IR’s gaming offer | ||

| Casino Profile Comparison | ||

| RWS | MBS | |

| Casino Tables | 250-300 | 550-600 |

| VIP | 80-90 | n/a |

| Mass Market | 170-210 | n/a |

| Total Floors | 2 | 4 |

| Gaming Space | 15,000sqm | 15,000sqm |

| Dedicated Singaporean and PR room | Orchid room | n/a |

| Minimum bet (afternoon) | SGD 25-50 | SGD 25-50 |

| Minimum bet (evening) | SGD 50-100 | SGD 50-100 |

| Maximum bet | SGD 50,000 | SGD 50,000 |

| source: CLSA Asia-Pacific Market | ||

The authors added, however, they were surprised by lower than expected numbers at the mass market tables at Marina Bay Sands during their visits throughout the day.

“MBS mass-market gaming was surprising. The under-utilisation of the mass-market gaming floor is perplexing, as we expected a stronger showing given the existing familiarity with gaming now that RWS has been open for over two months already. We possibly attribute [it] to [MBS] having too many tables upfront, and yields would have been better with 15-20% fewer tables based on the crowd we observed.”

CLSA added that if RWS has made effective use of its first mover advantage and managed to sign up Singapore citizens or permanent residents as table players under the S$2,000 annual entry fee or enrol foreign players under its loyalty card programmes, that could have an impact on MBS’s mass table performance.

“We hope that MBS VIP could be the swing factor,” state the authors.

In its summary of the IRs prospects, CLSA says it expects MBS’s proximity to the city centre, including the central business district and banking district, to help it do well with walk in visitors—especially in the retail and dining segments.

“MBS will see high overall foot-traffic. The iconic status of the building is a tourist attraction in its own right and will see a steady stream of visitors to the overall site over time. Many other attractions such as the SkyPark, museums, and conventions have yet to ramp up and will further boost traffic,” says the CLSA research paper.

Visitors

The analysts quote industry sources as estimating MBS’s daily traffic immediately after its soft opening as between 36,000 and 50,000 people per day.

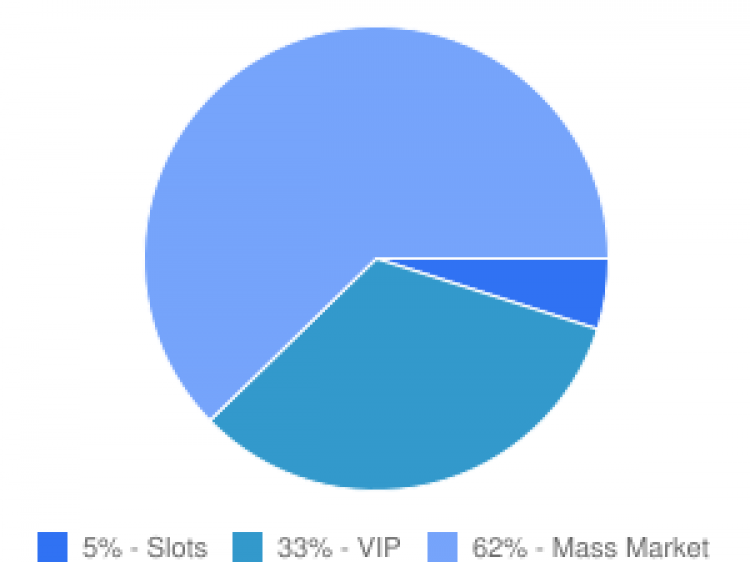

| CLSA estimates on contribution of gaming market segments to Singapore |

| source: CLSA Asia-Pacific Markets |

“MBS retail is impressive. The retail offering at MBS surprised on the upside with a slew of luxury brands and over one million square feet of retail space. Coupled with 16 restaurants in the IR, we believe that this will change the lifestyle of upper-middle class and above Singaporeans, and will be the centre of attraction for wealthy tourists.”

The report describes the decision of LVS to price entry-level rooms at the Marina Bay Sands Hotel at S$450 (US$322) for a relatively modest 300 square feet as “a high rate for Singapore”.

“We still expect high occupancy,” say the authors. CLSA expects RWS, located as it is on another island some distance from the CBD, will appeal particularly to lower end day-trippers arriving by bus.

“We are bullish that RWS’s product offering (especially gaming) is suited to the low to mid mass market while [the] MBS product offering is tailored to the higherend market,” states the report.

The authors do, though, issue a note of caution regarding uncertainties over the VIP segment.

“While we are more bullish than the consensus, we still see upside risk to our VIP estimate. We currently expect VIP to make up around 33% of the market, which compares to around 66% in Macau.

The report concludes in an upbeat mood.

“The IRs have completely transformed the entertainment landscape of Singapore. With average daily foot-traffic ranging from 25,000 to 50,000 per day in each of the two casinos, there is less of a doubt now that Singapore is truly a gaming market that was waiting to be unleashed. Both the casinos are ‘transformational’, unlike Macau where it has now become an ‘incremental’ market with stiff competition. While it would appear one of the most obvious points, we want to highlight that it is unheard of globally for governments to allow two very major casinos in the middle of a city’s CBD. Melbourne and Sydney [in Australia] do have large casinos, but not the scale of Singapore, a city that also attracts a larger number of tourists. The Singapore government is providing easy access to its five million population.

“We find the S$100 entry fee rather nominal compared to typical bet sizes. Also, the S$100 represents a light obstacle compared to the public of Hong Kong who have to travel over one hour to Macau via ferry; or for Malaysians living in KL [Kuala Lumpur] who have to travel to Genting Highlands or Singaporeans that currently travel to Genting or board gaming cruises. Also, [Chinese] mainlanders are restricted to visit Macau once very two months, which dramatically constrains the size of Macau’s gaming market.

Tourism boost

“The Singapore government’s STB [Singapore Tourism Board] has recently issued guidance for a 30% rise in visitor arrivals for 2010, on the back of the two IRs. The Singapore casino-resorts will offer more combined gaming and non-gaming activities than are available in Macau or elsewhere in Asia-Pacific.

“All these attractions will support more than 17 million tourist arrivals by 2015 (+70% from 2008). We expect average length of stay will increase to four days (from 3.2 days currently), which compares with Macau’s 1.3 days. Lastly, Singapore’s airport sees 38 million visitors per year—visitors that could be convinced to stop over for one to two days en route to further away locations. This could represent some low hanging fruit for the IRs.”

Finally, CLSA stresses the backing from Singapore’s government for the IR experiment as a big plus.

“There is strong government support, with no policy pushbacks. Gaming taxes are between 12-22% [inclusive of Goods and Services Tax] versus 39% in Macau and 25% in Malaysia. The success of the IRs is in the interests of the government as this initiative represents a tool to attract tourists, create jobs and add to the increasingly dynamic cultural landscape of Singapore.

Furthermore, unlike the regional gaming jurisdictions Macau (China visa policies) and Malaysia (religious backlash), Singapore IRs have the full support of the government, ranging from guaranteed duopoly to no immigration policy pushbacks for now.”