South Korea plans to solicit bids for destination-scale casinos capableof boosting visitor numbers and standing up to intensifying regional competition

South Korea says it will reopen bidding to “qualified” operators interested in developing resort casinos in the country’s Free Economic Zones.

After rejecting applications a few months back by Las Vegas-based Caesars Entertainment and Kazuo Okada’s Universal Entertainment, the government is taking a fresh look at foreigners-only gaming as a tourism driver, and a framework for regulating them in the FEZs will be unveiled next month, according to the Ministry of Trade, Industry and Energy.

In July, the administration of President Park Geun-hye announced a plan to invest a total of 82 trillion won (US$72 billion) to complete the development of eight FEZs by 2022, with a long-term goal of attracting as much as $20 billion in foreign investment.

South Korea’s foreigners-only casino market generates around US$930 million annually and consists of 16 relatively small casino hotels serving mostly Japanese and Chinese players.

Destination-scale casinos capable of boosting inbound tourism are viewed as an important part of the strategy, and to attract both foreign and domestic developers, the government is prepared to provide a friendly tax and regulatory environment sweetened with other incentives, according to a report in English-language daily The Korea Times.

As to why Caesars and Tokyo-based Universal failed to make the cut, no reasons were publicly given, but it was the Ministry of Trade that specified “qualified” in a statement on the new plan.

Caesars, the largest casino operator in the United States, is laboring under the industry’s heaviest debt load as a result of a 2008 buyout by private-equity interests. Universal is under criminal investigation in the Philippines and the US in connection with dealings related to its planned development of a resort casino in Manila.

The South Korean government has approved one FEZ casino proposal to date—a KRW800 million ($730 million) joint venture in Incheon between Paradise Group, one of the two operators that dominate the country’s foreigners-only market, and Japanese pachinko giant Sega Sammy Holdings. The resort is slated to open in phases beginning in 2016 with two hotels, a theme park, a convention center and a casino featuring 450 table games at full build-out. The joint venture company, Paradise SegaSammy, announced in July that rather than obtaining a separate license for the casino within the planned IR, it was going to develop the complex as an expansion of Paradise Casino Incheon’s current operations. This obviates the need to obtain a separate casino license for the IR.

Raising the Foreigners-Only Stakes

South Korea’s foreigners-only casino market generates around US$930 million annually and consists of 16 relatively small casino hotels serving mostly Japanese and Chinese players. There is also one large and lucrative casino in the remote northeast of the country that is open to Koreans called Kangwon Land that generates in excess of US$1 billion annually.

Paradise has led the country’s foreigners-only market since it was legalized in 1967, though in recent years, Grand Koerea Leisure, operator of the Seven Luck brand, has emerged as a serious contender for the biggest share.

The foreigners-only sector faces the twin threats of the opening of new integrated resorts across the region and looming legalization of casinos in Japan. The Paradise SegaSammy IR is designed to be of sufficient scale to meet the coming competitive challenges—its planned 450 tables is twice as many as Paradise operates now in all five of its casinos in the country.

Paradise has led the country’s foreignersonly market since it was legalized in 1967, though in recent years, Grand Koerea Leisure, operator of the Seven Luck brand, has emerged as a serious contender for the biggest share. GKL was set up by the government in 2005, through the Korea National Tourism Organisation, to boost tourism and generate income to fund tourism infrastructure and other government projects. Two of its properties are located in Seoul, one in Busan. In November 2009, GKL floated 30% of its equity on the Seoul Stock Exchange, and there has been talk of more stock being sold to private investors, but the company is still majority-owned by the government. GKL and Paradise Group together command around 93% of foreigners-only casino revenues.

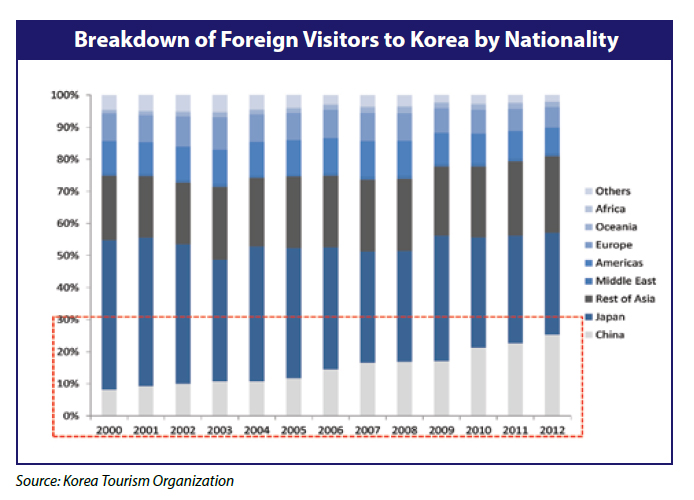

A big factor in Paradise’s favor in its market share tussle with GKL is that it is relatively more reliant on Chinese visitors, whose numbers are showing the strongest growth of all inbound markets. (South Korea is the third most popular destination, behind Hong Kong and Macau, for outbound Chinese travelers.) GKL is dependent more on Japanese patrons.

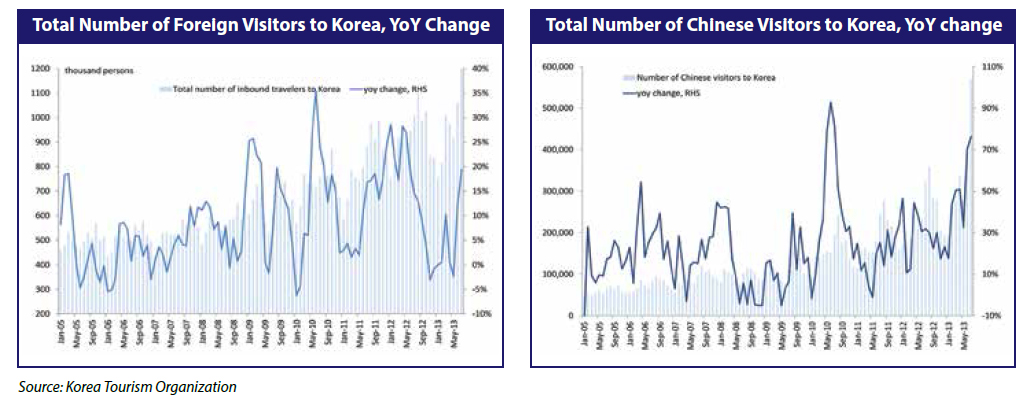

While the total number of all inbound travelers to South Korea was up 6% year on year over the first seven months of this year, the number of Chinese visitors surged 52% and the number of Japanese posted a 27% decline. As recently as last year, Japanese comprised the biggest group of inbound visitors to the country, but the most recent figures show Chinese visitors making up 34% of the total while Japanese constituted only 23%. The growth in Chinese visitation is expected to get an added boost from the South Korean government’s announcement in July of a further easing in visa rules for visitors from China and Southeast Asian countries.

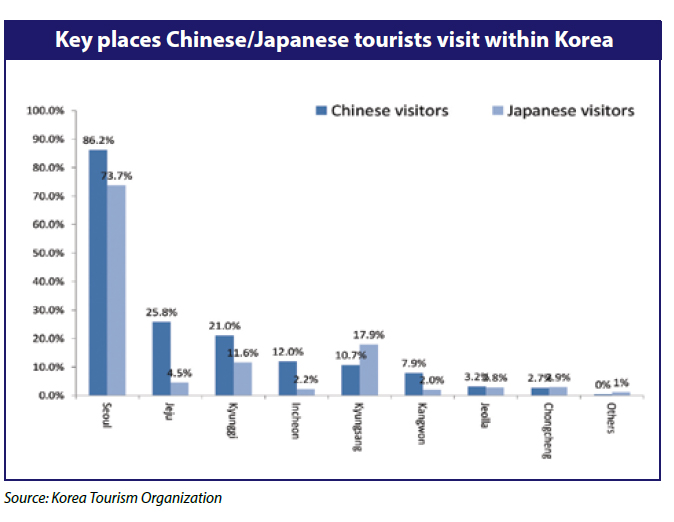

While the majority of Chinese visitors to the country are headed for Seoul, Jeju Island has emerged as a major hotspot. Since 2008, the island has offered visa-free entry to Chinese nationals and all foreigners for a stay up to 30 days, whereas Chinese need to obtain visas in advance to land in other parts of the country. Furthermore, all foreigners arriving in Jeju are able to travel on and stay elsewhere in South Korea for up to 72 hours, leading to a growing number of Chinese tourists stopping in Jeju in order to travel to other parts of the country without a visa.

Jeju also made amendments on permanent residency regulations in May 2011 allowing foreigners to receive a green card if they purchase over US$500,000 worth of resort facilities in Jeju. As a result, there has been a boom in property purchases by Chinese citizens on the island.

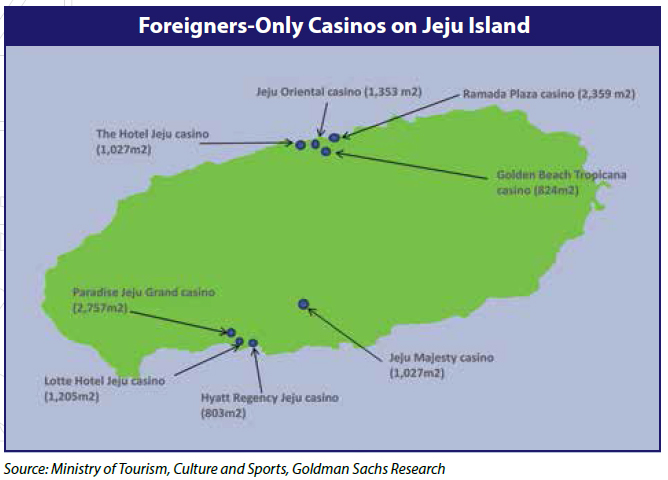

A Goldman Sachs report released last month noted: “The pace of growth in number of visitors and gaming revenues of casinos in Jeju is 3 to 4 times higher than what we see for overall foreigner-only casinos in Korea. While the total number of visitors to casinos in Korea increased to 2.4 million persons in 2012, up by 13% year on year, visitors to casinos in Jeju increased to 227,000, up 45% year on year. Gaming revenues are also rising at a fast pace in Jeju with aggregate sales of 8 Jeju casinos increasing by 55% vs. 11% year on year for total gaming revenues of foreigner-only casinos in Korea for 2012.”

Of the 8 casinos operating in Jeju, one is managed by the KOSPI-listed Paradise Co. and another by the privately-held group company Paradise Global. GKL does not have a presence on the island, nor does it have plans or government approval to build any new venues in the country.

Looking ahead, the expiration of Kangwon Land’s exclusive right to serve domestic gamblers in 2025 presents a major opportunity for the leading foreigners-only operators.

One thing weighing against all the country’s foreigners-only casinos is the imposition of a 4% casino consumption tax beginning in 2014. The government is also proposing an additional 10% leisure tax on Kangwon Land to raise funds for infrastructure development in its host Gangwon province ahead of the 2018 Winter Olympics. If that measure proceeds, some expect a leisure tax may also be imposed on the foreigners-only sector, though Goldman Sachs believes it will only apply to Kangwon Land while the country’s other casinos will be exempt.

Looking ahead, the expiration of Kangwon Land’s exclusive right to serve domestic gamblers in 2025 presents a major opportunity for the leading foreigners-only operators. When that happens it’s probable one or more licenses will be issued in what is already a massive and lucrative sector, and Paradise Group looks to be the odds-on favorite to secure one of them.