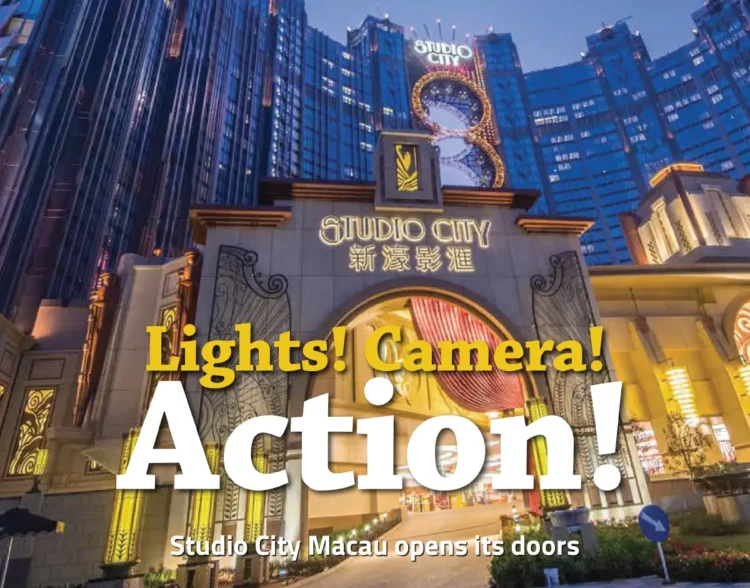

In this regular feature in IAG to celebrate 20 years covering the Asian gaming and leisure industry, we look back at our cover story from exactly 10 years ago, ““Lights! Camera! Action!”, to rediscover what was making the news in November 2015!

As it celebrates its 10-year anniversary in 2025, Melco Resorts & Entertainment’s Studio City integrated resort is performing better than ever – buoyed by a raft of new amenities that form part of its Phase 2 expansion and a vastly improved offering on its gaming floors.

But it hasn’t always been that way. Although Studio City has always been unique, early criticism typically centered around its entertainment offering which was at best a little erratic and at worst a poor fit for VIP-focused Macau. Perhaps that scene was set from the very beginning, when Melco spent a small fortune on an opening extravaganza that certainly caught the world’s attention but not so much the Chinese gamblers who would ultimately determine its success.

As IAG wrote at the time, Studio City “follows a new script for Macau IRs”, a property that opened with 250 purely mass market tables and – playing to its cinematic theme – was headlined by a US$70 million short film called The Audition, starring Academy Award winners Robert De Niro, Leonardo DiCaprio, director Martin Scorsese and Brad Pitt.

As IAG wrote at the time, Studio City “follows a new script for Macau IRs”, a property that opened with 250 purely mass market tables and – playing to its cinematic theme – was headlined by a US$70 million short film called The Audition, starring Academy Award winners Robert De Niro, Leonardo DiCaprio, director Martin Scorsese and Brad Pitt.

All but Pitt attended the star-studded opening night, as did James Packer – at the time still a major shareholder in Melco’s Macau partner Melco Resorts – and his then-fiancée Mariah Carey, who also performed at the launch.

Studio City’s movie-inspired theme was a throwback to its complicated past. The 13.1-hectare site in which it stands was originally slated to house a media training facility that would include film and broadcast production facilities, part of the government’s early efforts to diversify the economy. However, eSun Holdings – the subsidiary of entertainment specialist Lai Sun Group which acquired the land for US$38.7 million in 2001 – quickly recognized Cotai’s gaming potential and determined that it should add hotel, retail and casino components to the film and television facilities. The project was to be called Macau Studio City.

To make this dream a reality, eSun sold 40% of the project to US hedge fund Silver Point Capital – helmed by a group of former Las Vegas Sands executives – and another 20% to Singapore’s CapitaLand. But, following the global financial crisis of 2009 and years of delays caused by disagreements between the multiple investor groups, a deal was ultimately struck in 2011 for Melco-Crown to acquire eSun’s 40% stake and CapitaLand’s 20% stake for US$369 million.

To make this dream a reality, eSun sold 40% of the project to US hedge fund Silver Point Capital – helmed by a group of former Las Vegas Sands executives – and another 20% to Singapore’s CapitaLand. But, following the global financial crisis of 2009 and years of delays caused by disagreements between the multiple investor groups, a deal was ultimately struck in 2011 for Melco-Crown to acquire eSun’s 40% stake and CapitaLand’s 20% stake for US$369 million.

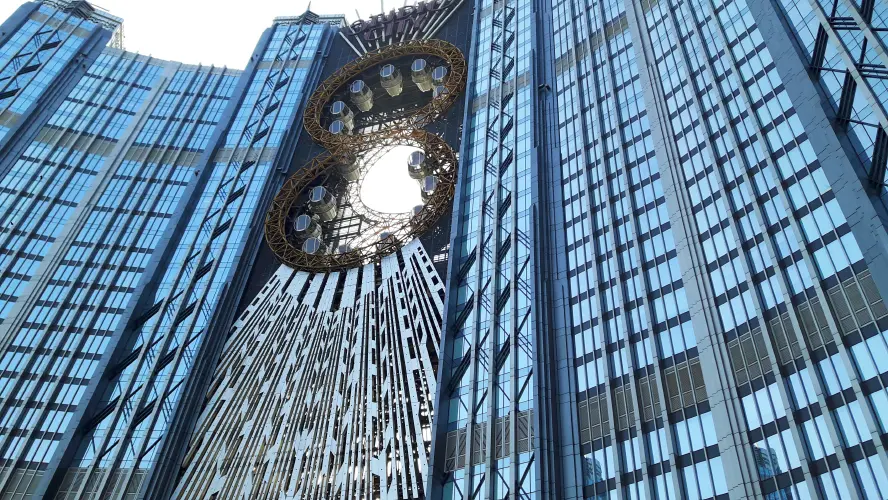

Upon finally opening four years later, Studio City billed itself as “Asia’s Entertainment Capital”, with non-gaming attractions including a world’s first Batman ride, a multi-stage magic show that no longer exists, Asia’s highest figure-eight Ferris wheel and a 5,000-seat arena that has only recently found its niche.

“A baccarat table is a homogenous product,” said Melco’s Chairman and CEO, Lawrence Ho, at the time. “What we really use to stand out from our competitors is entertainment and attractions.”

Ho added that the Melco-Crown partnership “understood what the government wanted” regarding more non-gaming activities and determined a movie-themed experience was the way to go … “Gotham City with an asteroid shot through it,” as he put it.

Ho added that the Melco-Crown partnership “understood what the government wanted” regarding more non-gaming activities and determined a movie-themed experience was the way to go … “Gotham City with an asteroid shot through it,” as he put it.

“We didn’t follow what the competitors did. We’re a young company. We’re willing to try new things.”

On the absence of VIP gaming, which in 2015 still accounted for well over 50% of the city’s gaming revenues, Ho noted that the company derived less than 10% of EBITDA from VIP players and was less reliant on that segment for earnings than any Macau casino operator except Sands China.

“We steered away from VIP gaming tables a long time ago,” he stated. “Since our IPO [on the US NASDAQ exchange in 2006] we believed mass tables would be leading the Macau market. At 250 tables, it was a no-brainer for us.”

In that regard, Ho was certainly ahead of the curve and it’s worth noting that, after a brief flirtation with VIP tables at Studio City, the property ultimately ceased its VIP rolling chip operations in late October 2024 as part of a strategic repositioning to focus on premium mass and mass operations. The positive results since then speak for themselves.

The Studio City story is unique in more ways than one. As an initial joint venture partnership with two US hedge funds through which Melco held a 60% stake, a 2018 IPO saw that interest revert back to a little over 50%. Ho has in the past hinted at his desire to acquire full ownership, but the pandemic put those plans on hold.

The Studio City story is unique in more ways than one. As an initial joint venture partnership with two US hedge funds through which Melco held a 60% stake, a 2018 IPO saw that interest revert back to a little over 50%. Ho has in the past hinted at his desire to acquire full ownership, but the pandemic put those plans on hold.

Likewise, Studio City’s location at the southern end of the Cotai Strip – somewhat isolated from its peers – was always viewed as a long-term strategic benefit given its proximity to the Lotus Bridge border crossing from neighboring Hengqin. Melco still sees this as an advantage, especially with the opening of the new Hengqin Port and constantly improving visa processes for those travelling from Hengqin, although it will likely be some time before visitor flow across the Lotus Bridge climbs substantially.

Nevertheless, Studio City has undoubtedly found its identity in recent years, aided by the opening of new attractions seemingly better suited to China’s mass market customer – including a spectacular indoor-outdoor water park – and on the gaming side a repositioning that targets premium mass.

And the proof is in the pudding. Despite the removal of all VIP gaming late last year, Studio City smashed estimates in the March 2025 quarter on a 6% year-on-year increase in GGR to US$336 million – including an 11% increase in mass GGR to US$303 million and 23% increase in slots revenue to US$33 million.

The June quarter brought similar results with GGR climbing to US$360 million and Adjusted EBITDA by 33% to US$105 million.

It seems it’s never too late for a tiger to change its stripes.