Former Macau gaming executive David Bonnet takes a closer look at promo delivery across the Asian gaming industry and the trade-offs that drive today’s reinvestment strategies.

A few people have recently asked for my thoughts on player reinvestment. Since it’s a topic that’s often misunderstood in the casino business, I thought I’d take a moment to share some perspective.

Casino competition in Asia has entered a new phase. In the post-pandemic environment, the erosion of the junket segment has narrowed the addressable market to a smaller, more concentrated pool of players. This has led to greater overlap across customer segments and, in turn, a far more competitive promotional landscape. Where reinvestment levels were once relatively stable, operators are now phasing out past practices in favor of aggressive strategies designed to grow market share, often at the expense of margin. Recent earnings calls and industry commentary have placed this tension at the forefront of discussion.

So, what’s really going on? Let’s take a look.

So, what’s really going on? Let’s take a look.

Promos Background

So, what is reinvestment? In broad terms, it is customer rewards that build loyalty and encourage repeat business, like credit card points or airline miles. In casinos, reinvestment operates on another level, because the product is essentially a financial transaction with cash and gaming chips, wrapped in the excitement of wagering. The venue and experience are the differentiators, and in a commoditized market a dependable way to retain and grow the customer base is through the deployment of customer incentives.

Casino complimentaries, or “comps”, are the most visible form of reinvestment. They range from small items like free drinks and meals to larger benefits such as hotel rooms, airfares, entertainment tickets or cash rebates. From an operator’s perspective, comps serve two purposes:

- Reward past play, recognizing the value already contributed

- Incentivize future play, encouraging return visits and loyalty

The challenge is determining whether reinvestment is truly productive. That comes down to one key distinction: is it generating incremental revenue or merely displacing existing spend?

Incremental v displacement

Incremental v displacement

- Upside: Incremental revenue. Wagering that happens because of the offer: an extra trip, longer time on property or additional wallet share that grows theoretical revenue

- Risk: Displacement. The offer shifts spend from one bucket to another instead of creating new play. Mass may appear weaker and VIP stronger, but the overall total is unchanged. Costs rise, margins shrink and the operator ends up subsidizing revenue rather than expanding it

Understanding this difference is critical, because it explains why operators struggle to strike the right balance in their reinvestment decisions. This balancing act defines the core challenge in modern strategic casino marketing.

Incentives are as fundamental to the casino business as playing cards and gaming chips. The challenge lies in finding and setting the right level based on your changing customer base: over or under comping brings significant risk to the sustainable nature of the business. Striking the right balance is critical to optimizing profit. The dynamic nature of promotional strategies can be likened to managing an Italian restaurant and trying to reward your best customers with a free pizza. You might vary the toppings based on each customer’s expected value: pepperoni for occasional guests and prosciutto for frequent ones. In the same way, gaming operators set reinvestment levels by weighing factors such as patron spend, historic play and lifetime value and then end up providing a variety of comps based on expected revenue.

With that in mind, let’s turn to Macau and examine the recent market trends that are shaping today’s promotional strategies.

Industry growth

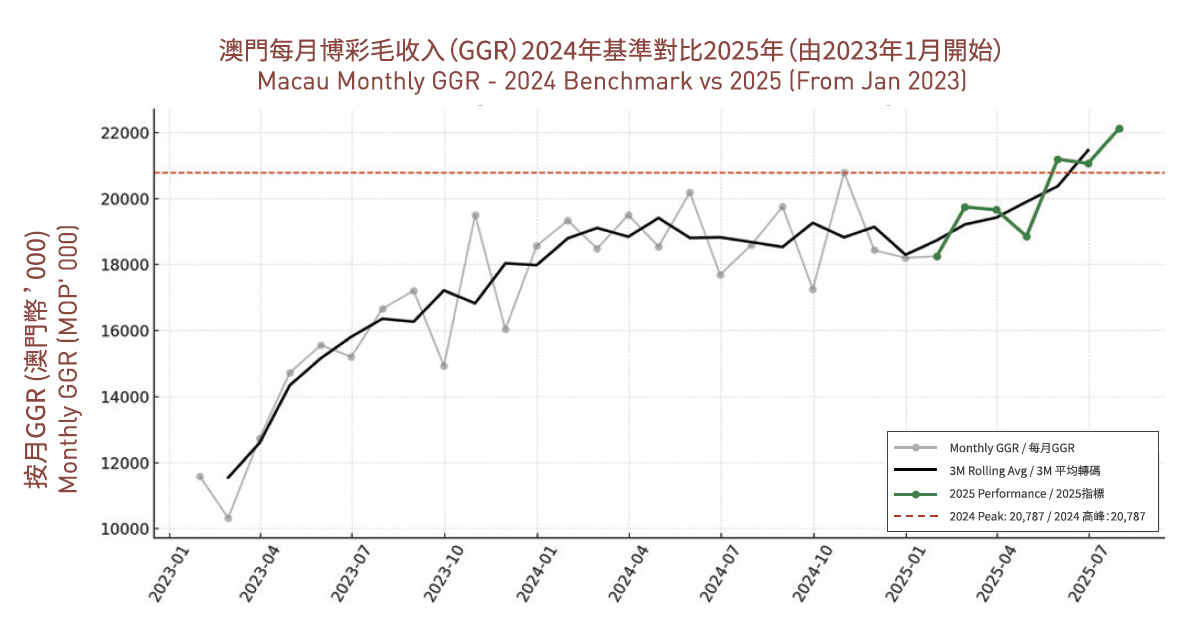

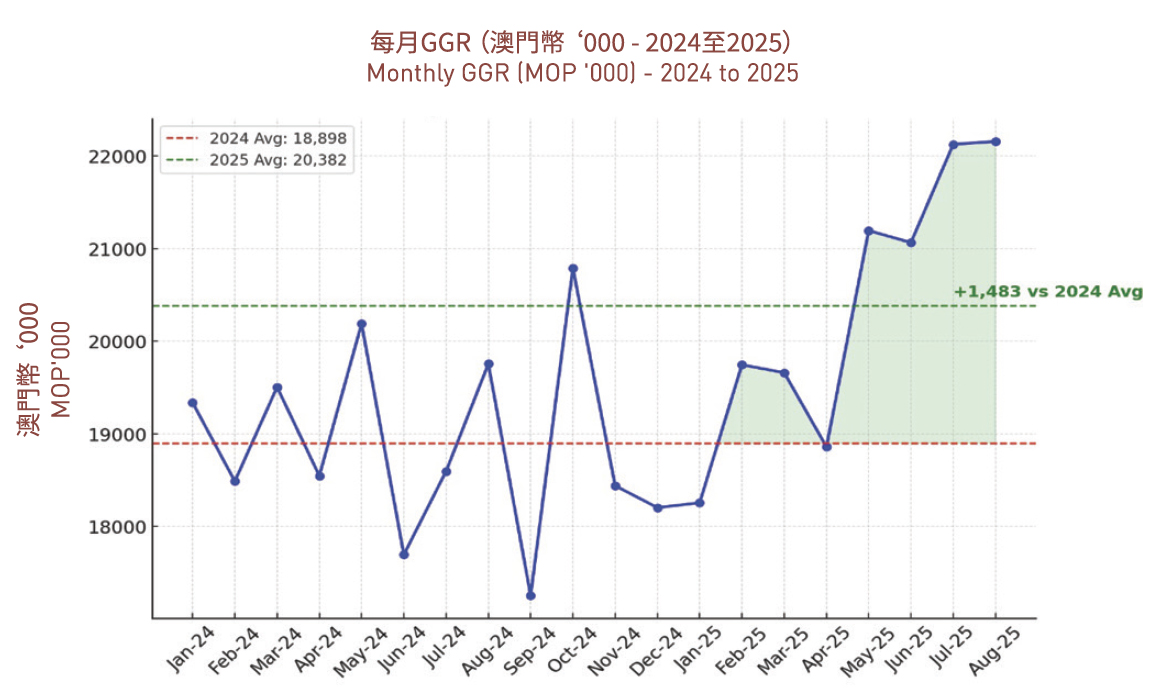

What was effectively a flat market for most of 2024 and early 2025 has suddenly shifted, with recent results breaking through the 2024 monthly peak of MOP$20.8 billion (US$2.6 billion).

In fact, as of August 2025, the year-to-date monthly average exceeds 2024’s by almost MOP$1.5 billion (US$187 million), an increase of nearly 8%. This incremental revenue above historic trends has been a wake-up call for operators, triggering a race to seize as much of this additional business as possible.

In fact, as of August 2025, the year-to-date monthly average exceeds 2024’s by almost MOP$1.5 billion (US$187 million), an increase of nearly 8%. This incremental revenue above historic trends has been a wake-up call for operators, triggering a race to seize as much of this additional business as possible.

So, what are the mechanisms being used to capture the added volume, and is it worth it to provide all these extra incentives? At a high level, operators are leaning into three broad strategies:

So, what are the mechanisms being used to capture the added volume, and is it worth it to provide all these extra incentives? At a high level, operators are leaning into three broad strategies:

- Expansion of existing programs

- Shift from soft to hard costs

- Mass to VIP-style rebate schemes

Each of these approaches carries distinct implications for margins and long-term customer behavior, raising the question of whether short-term gains are being traded for structural risk.

1. Expansion of existing programs

The first shift has been less about innovation than amplification. Operators are raising reinvestment in a prescribed fashion by scaling up familiar offers. One complimentary night becomes two, dining credits are extended and vouchers multiply. Promotions are issued in greater volume to stimulate wagering and extend customer time on property.

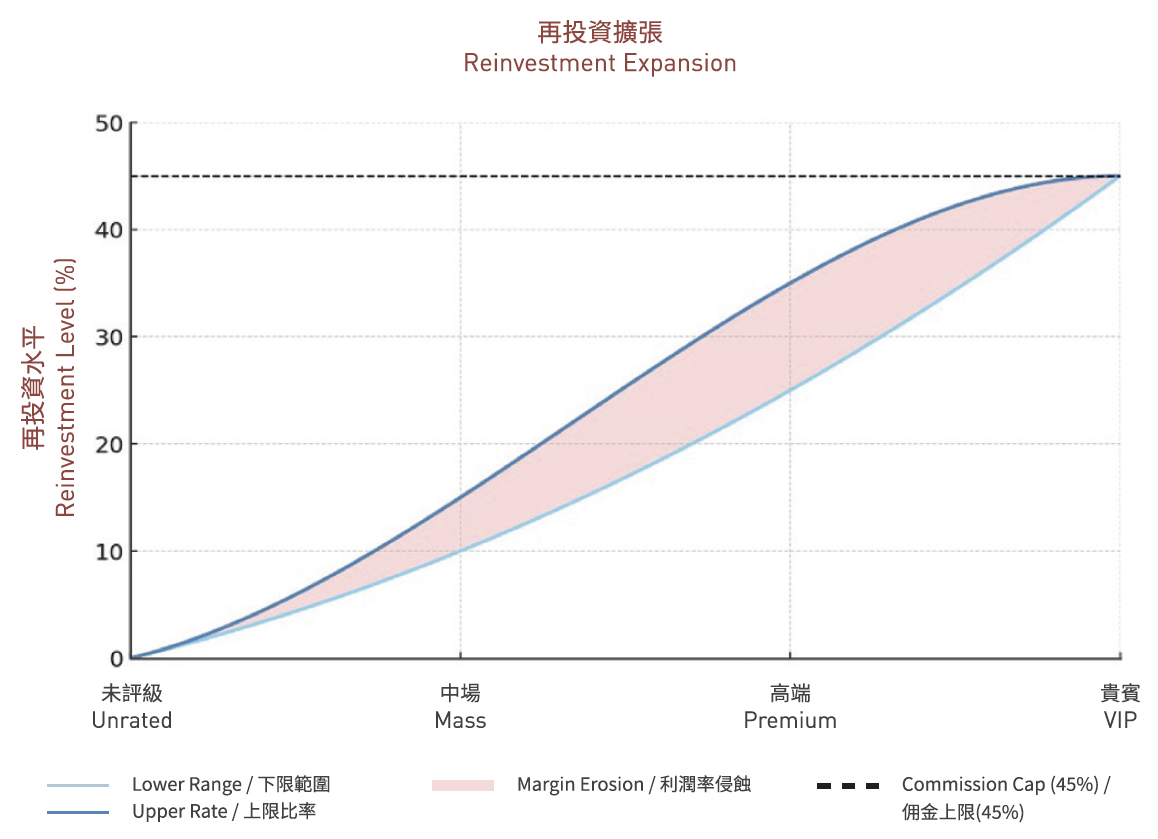

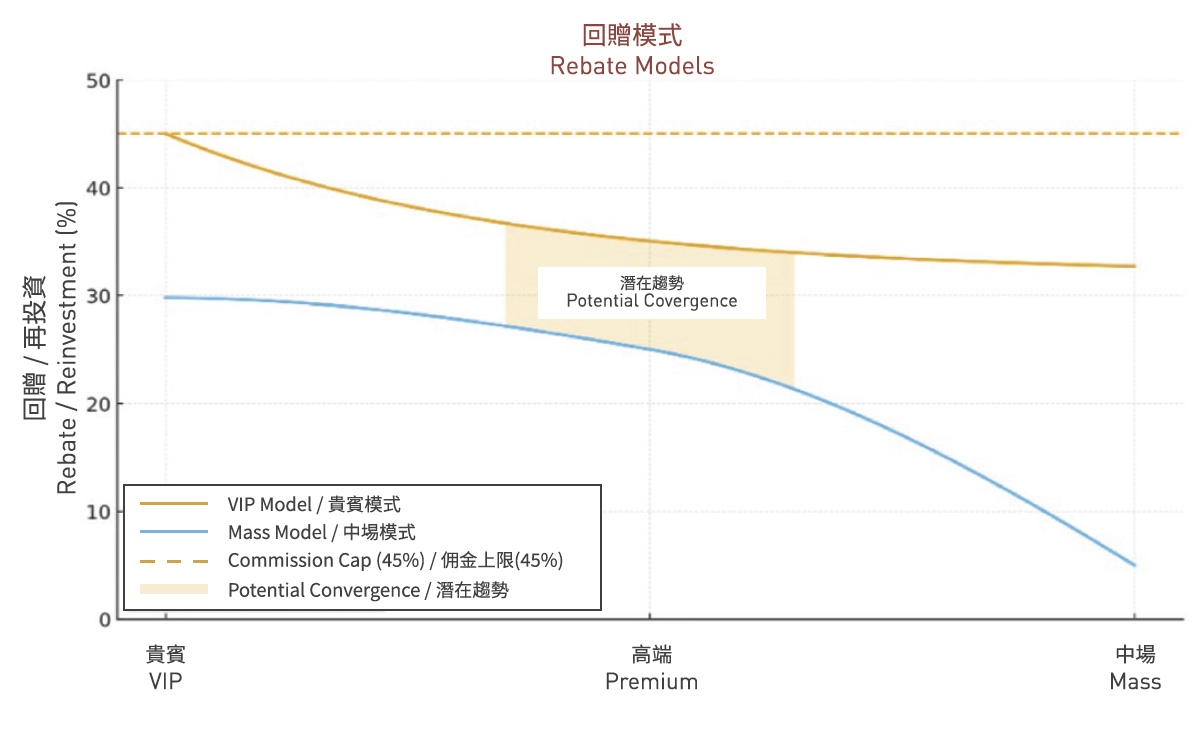

While the headline reinvestment percentage may not move dramatically, the underlying composition shows a widening range of outlays by segment. Mass players see 10% to 15% while VIP programs stretch from 35% to the 45% cap. The shaded band highlights the margin erosion created as offers push closer to the ceiling. At scale, this shift significantly lifts reinvestment while conditioning patrons to expect richer baseline rewards.

The expansion of existing programs is less about strategic modernization and more a reaction to hyper-competition. Stretching familiar offers to the maximum delivers short-term wins but erodes long-term margin discipline. Rewards steadily convert from discretionary incentives into entitlements. Anchored in soft costs, casinos can push harder without an immediate P&L hit. The trade-off is that what once felt like a privilege now risks becoming a baseline expectation.

2. Shift from soft to hard costs

2. Shift from soft to hard costs

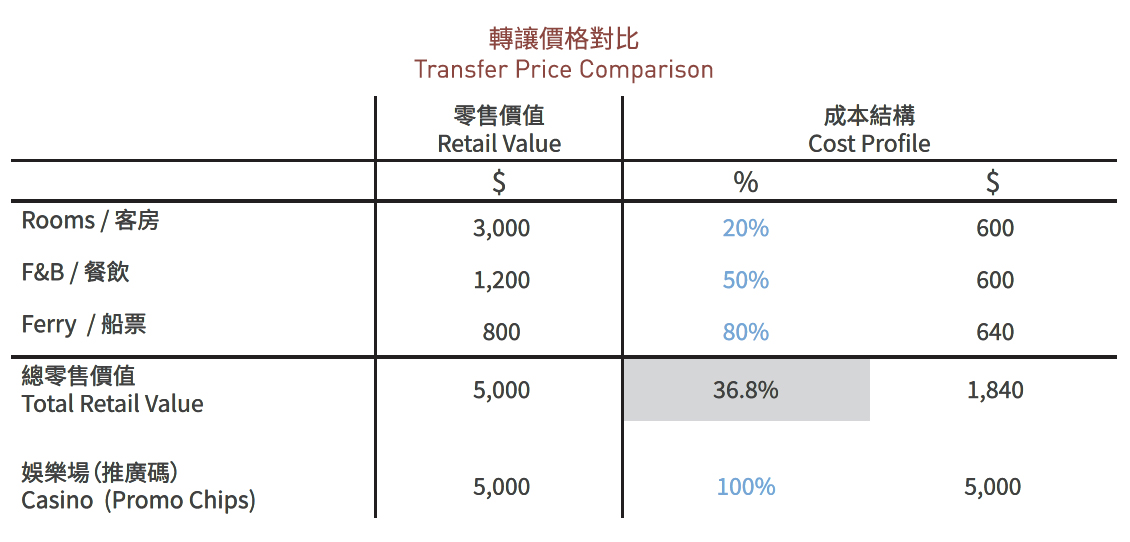

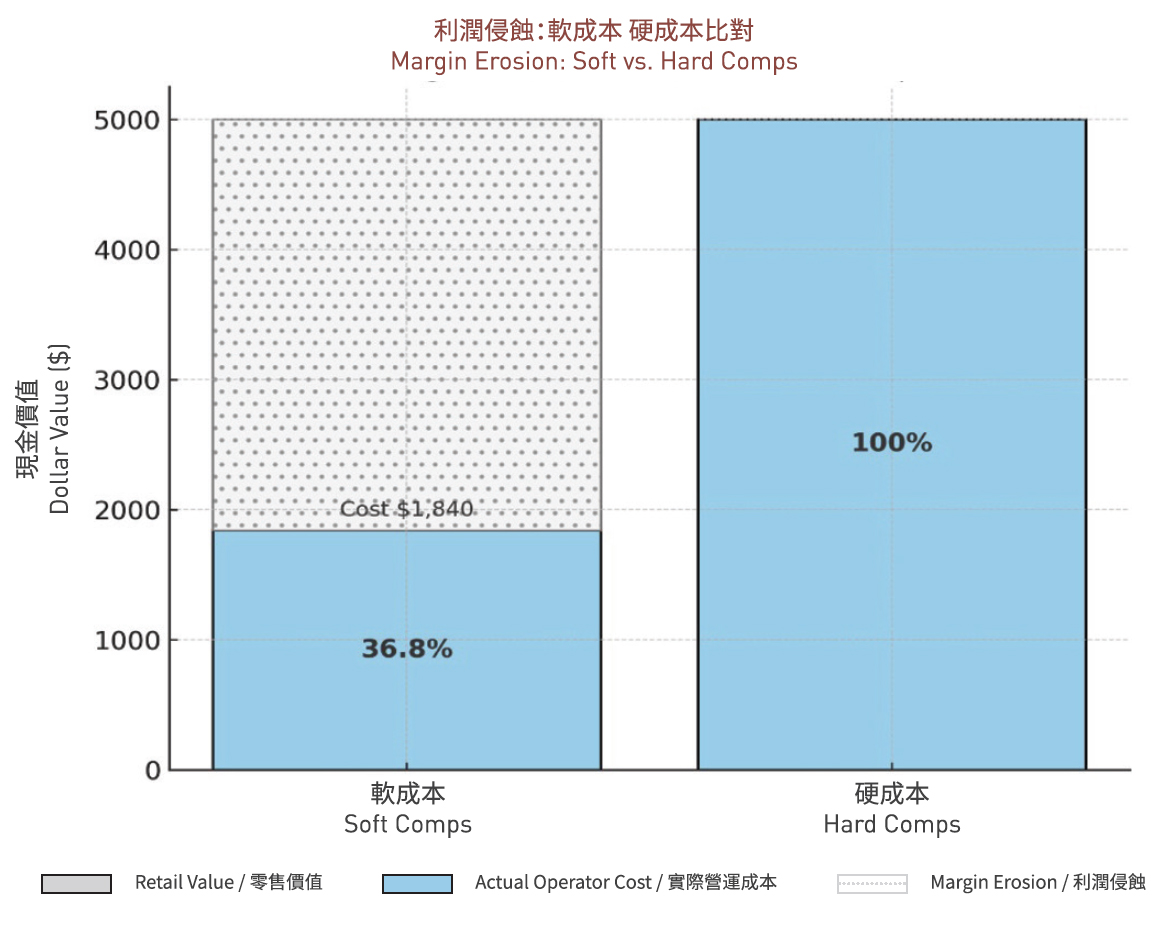

Historically, reinvestment was delivered through in-house channels such as hotel rooms, meals or show tickets. These soft comps were easier to absorb because properties already carried the fixed costs of staff and infrastructure, meaning the marginal expense was often only 20% to 30% of retail value. Today, however, operators are increasingly relying on hard costs such as promo chips and other cash-equivalent incentives. Unlike soft comps, these flow straight through the P&L at 100% of face value, eroding the cost advantage that once allowed reinvestment to be effectively bought down.

Consider two scenarios, each offering HK$5,000 in value. In the soft comp case, the operator’s actual outlay is only 36.8%, reflecting the difference between the retail price and actual cost. The perceived value allows the casino to buy down reinvestment and protect margin. By contrast, HK$5,000 in promo chips costs the full amount. With no built-in leverage, hard comps eliminate the cushion and magnify expense.

The shift from soft to hard costs represents more than just a change in accounting treatment. It erodes the structural advantage of reinvestment by replacing low-cost, high-perceived-value benefits with cash-equivalent outlays that hit the P&L at full force. What once enhanced segment margin now drains it, leaving operators with fewer levers to protect profitability. As competition escalates, the sustainability of this model becomes increasingly questionable.

3. Mass to VIP-style rebate schemes

3. Mass to VIP-style rebate schemes

Perhaps the most notable evolution is the migration of VIP-style tactics into the mass market. In addition to promo chips, mass patrons are now receiving VIP-like rebates, layered incentives and even referral programs once reserved for the top end. Casinos increasingly use agents to recruit and channel mass patrons, further blurring the traditional segmentation between premium and mass. Utilization of rolling programs on mass tables would allow patrons to potentially double dip: receiving both the soft incentives as well as capitalizing on the promo chip rebates. This overlap sparks escalation, as mass players adopt higher-tier perks and loyalty costs rise across the base.

The extension of VIP-style incentives into the mass market may drive short-term volume, but it undermines the very distinctions that once made the tiered system efficient. By collapsing the boundaries between premium and mass, operators risk creating an arms race of incentives that inflate costs without guaranteeing incremental play. What began as a tool to cultivate high-value patrons now threatens to reset expectations across the broader base, raising reinvestment burdens and eroding profitability. If left unchecked, this convergence could leave operators with few tools to defend margin in the next phase of competition.

Unintended consequences

Unintended consequences

Reinvestment is often justified as an engine of incremental revenue. But when misapplied, it can create distortions that erode margin without generating real consumption. More than once, I’ve walked into a fancy steakhouse in Macau, completely empty but “fully reserved”. Denied a seat, I didn’t have the heart to explain the comp expense model to the wait staff and instead politely assured them I would give up my table if any casino customers actually showed up.

Over-comping creates phantom demand: restaurants appear fully booked but sit empty, hotel occupancy is padded with unused room nights and revenue forecasts lean on benefits that were never consumed. Cash-based incentives like promo chips cut directly into profit, while escalating offers condition customers to value perks over the core product. Staff and operations are left managing the contradiction of venues that are simultaneously booked out and vacant.

The irony is that reinvestment, when pursued without discipline, risks consuming itself. As the very mechanism meant to drive growth, it could instead produce inefficiency and false signals. Most importantly, customer expectations skew over time. When comp levels drift upward, the perceived value of the underlying product diminishes, disenfranchising core patrons who no longer see genuine worth in what is being offered.

Doubling down

Doubling down

Casino reinvestment remains one of the industry’s most powerful tools but also one that’s easily misapplied. Expansion of existing programs, the shift from soft to hard costs and the migration of VIP-style rebates into the mass market have each pushed incentives to new extremes. In the short term, these tactics can drive volume and create the appearance of growth. Over time, however, they erode margin, inflate expectations and risk conditioning customers to value perks over the core product.

The lesson is not that reinvestment should be abandoned, but that it must be managed structurally and with rigor. Tactics that remain true to each customer segment should be continually refined with better data, ensuring that offers align with actual value. By contrast, over-comping and other aggressive tactics may generate short-term activity but carry long-term profitability risks that are difficult to reverse. True incremental revenue comes from aligning reinvestment with genuine customer behavior, not from chasing volume through ever-richer giveaways.

Without that control, reinvestment stops being a growth engine and becomes a cost spiral. That could be perilous in an environment where competition is already intense and the risk of an ebbing market would only magnify the consequences.