Inside Asian Gaming takes a deep dive into the new, post-COVID Macau where a revenue environment that seems to be stabilizing has resulted in more competition between the city’s six concessionaires than ever before.

More than a decade on from the peak of the VIP junket sector and two years since its pandemic reopening, Macau finds itself in the midst of an evolution.

Gaming revenues, while unlikely to reach the dizzying heights of times gone by, appear to have stabilized even as the market shifts its high-end focus from VIP to the new belle of the ball – premium mass. It is also an era of unrivalled competition between the city’s six concessionaires, who for years could trip and fall into a bed of cash but must now scrap and fight for every dollar.

Gaming revenues, while unlikely to reach the dizzying heights of times gone by, appear to have stabilized even as the market shifts its high-end focus from VIP to the new belle of the ball – premium mass. It is also an era of unrivalled competition between the city’s six concessionaires, who for years could trip and fall into a bed of cash but must now scrap and fight for every dollar.

Yet Macau remains the undisputed king of the land-based gaming world. Last year, gross gaming revenues came in at MOP$226.8 billion (US$28.3 billion), up almost 24% year-on-year. That’s almost double the GGR of Nevada and more than four times that of the Philippines, now a clear No.2 in Asia.

While the 2024 GGR figure was only back to 77.5% of 2019 (pre-COVID) levels, EBITDA paints a different picture – reaching 84.5% of pre-COVID levels at MOP$64.8 billion (US$8.10 billion) and reflecting the shift away from commission-based junket play and towards the higher-margin mass market segments.

In anyone’s language that means a healthier, more sustainable Macau gaming industry – even if the longer-term potential of this “new Macau” remains largely untapped. Short-term, however, headwinds are building.

Since late 2024, Macau’s monthly gaming revenues appear to have leveled out at a little below MOP$20 billion (US$2.5 billion), with any incremental movements mainly attributable to seasonality and calendar influence.

In a recent column for Inside Asian Gaming, industry expert David Bonnet noted that GGR appears to have hit a ceiling and may require new catalysts to stimulate growth. Specifically, he observes that the recent MOP$20 billion per month run rate just happens to be in line with the Macau government’s own 2025 GGR budget projection of MOP$240 billion (US$30 billion).

“Could the not-so-subtle implication be that GGR productivity of up to approximately MOP$20 billion monthly is healthy, but anything more than that is unhealthy?” Bonnet asked, acknowledging the role that recent crackdowns by Macau and mainland authorities on capital outflow and money exchange activities have played in moderating gaming revenues.

Industry analysts have broadly outlined their expectation that gaming revenues will accelerate somewhat in the second half of 2025, enough to result in year-on-year GGR growth of between 3% and 6%. However, there is little visibility on any of the new catalysts Bonnet references that might result in more significant gains, such as stronger recovery of the highest-margin base mass segment, which continues to lag premium mass.

It is within this prism that Macau’s concessionaires have been realigning their priorities, as they look to gain a competitive edge and eke out a greater slice of today’s gaming pie.

Perhaps the best example of this is Sands China’s redevelopment of the old Sands Cotai Central into The Londoner Macao, adding a third themed property to its portfolio alongside The Venetian Macao and The Parisian Macao. Aside from the considerable mass appeal that the property’s replica Big Ben and Houses of Parliament brings, a feature of the US$2 billion transformation has been the introduction of many more suites across its hotels, particularly Londoner Court, Londoner Hotel and Londoner Grand.

Londoner Grand, previously Sheraton Grand Macao, is the last piece of the puzzle and when complete in the next few months will offer a total of 2,405 rooms comprising 1,500 suites and just 905 standard rooms, down from a total of 4,000 rooms in its former life.

Explaining the company’s reasoning for such an investment, Patrick Dumont – President and COO of Sands China’s parent Las Vegas Sands – told investors on an earnings call last year, “It will make us more competitive in the market and actually drive additional high-quality tourism from both traditional markets and other markets. It will also help provide high quality tourism from our core customer base and allow for more repeat visits from our high-value customers.”

Similar moves can be observed market-wide, with all concessionaires investing considerable resources into their gaming and accommodation offerings with the goal of tapping the lucrative premium mass customer.

A prime example is Galaxy Entertainment Group’s Galaxy Macau Phase 3 development, opened in 2023, which includes the all-suite Raffles at Galaxy Macau and new premium gaming space – described by some as the best in the business.

Another new hotel brand, Capella at Galaxy Macau, will launch in mid-2025 as an even more exclusive offering, with its 36 Sky Villas and 57 Suites providing the property’s best customers with amenities such as transparent infinity-edge pools, outdoor lounges, butler pantries, karaoke rooms with a cigar lounge, private cocktail bars and private games lounges.

Likewise, MGM China will soon complete the conversion of 160 standard rooms at MGM Cotai into 60 suites – growing its suite inventory by 25% – and is concurrently converting old VIP junket areas at peninsula property MGM Macau into high-end villas.

MGM, more than any other single company, makes for a fascinating example of the new-look Macau in 2025. Once considered one of the smallest, if not the smallest, of the six concessionaires, the company has seen its market share grow significantly from 9.5% in 2019 to 15.8% in 2024.

This has been aided by the addition of around 200 new gaming tables to its inventory under the 10-year gaming concessions that came into effect on 1 January 2023 but is also a testament to innovation, with MGM leading the way on a number of meaningful initiatives in recent years. The most obvious of these was the introduction of smart gaming tables as early as 2016 – years ahead of its rivals – with MGM playing a central role in helping perfect the technology. Sands China followed suit in 2019, while the remaining concessionaires, prompted by the government, fast-tracked rollout across their mass gaming floors last year. Smart tables are seen as a means of providing a faster and more secure baccarat game due to being able to offer gaming chip attribution and fraud detection while also allowing for accurate player ratings and greater table layout flexibility. This is largely why Macau’s DICJ has recently approved a series of new side bets like “Lucky 7” and “Super Lucky 7”.

MGM also garnered the attention – some would say the ire – of its fellow concessionaires last year, when it began handing out free snacks and ice creams on its main gaming floor. The practice was eventually limited amid concerns over the potential negative impact on local SMEs, but all reports indicate it was extremely successful in attracting new visitors to experience what MGM’s properties have to offer.

It was also the best example yet of the ultra-competitive environment of today’s Macau, and, for a while at least, it saw some rare shots publicly fired between concessionaires.

A year ago this month, Melco Resorts Chairman and CEO Lawrence Ho highlighted what he described as the “crazy behavior” of some rival operators when it came to promotional activity, adding, “I’m hoping that everybody will start being more rational and realize … it’s not healthy for the whole industry.”

MGM Resorts President and CEO Bill Hornbuckle later acknowledged the comments were likely aimed at MGM but rejected the notion, citing his company’s healthy Macau margins as proof.

Most concessionaires have since observed a more stable promotional environment, shifting their attention instead to the combined MOP$130.4 billion (US$16.3 billion) they are committed to spend by the end of 2032 on non-gaming initiatives as per their 10-year concession contracts.

It’s an extraordinary commitment for sure, and one not lost on those tasked with thinking up attractions that can drive meaningful return on the investment. That’s easier said than done, although there has been some early success via investment into the so-called “concert economy”.

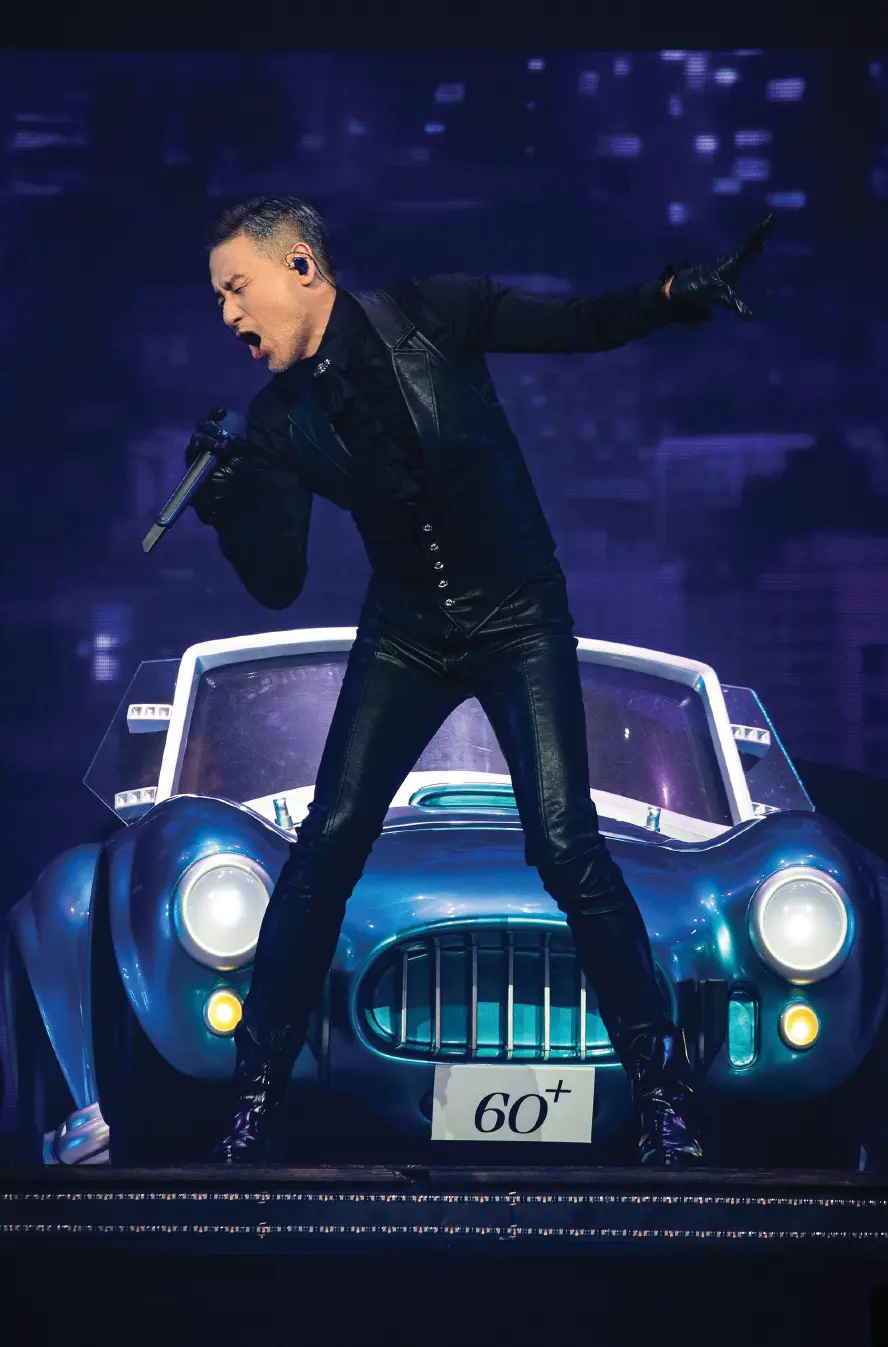

In mid-2023, analysts noted that a recent concentration of high-profile concerts and residencies from the likes of Cantopop legend Jacky Cheung, K-pop group BLACKPINK and Hong Kong performer Leon Lai appeared to have moved the needle when it came to gaming revenues. The Jacky Cheung residency in particular “continues to attract the right type of (high-value) players, including those from the database of Sands’ sister property MBS, which in turn helps to lift overall industry GGR,” investment bank JP Morgan wrote at the time.

Little wonder then that Sands responded by shutting down its Cotai Arena for nine months last year to embark on major upgrade works aimed at providing a standout venue on the world stage.

Asked about the project during an earnings call last April, Dumont said, “We made a decision that if we take the arena offline and do it and make it one of the highest quality arenas in Asia, in the long run we will benefit from the entertainment, so we decided to do it as quickly as possible,” he explained.

“Once we do that, we’re going to have an incredibly high-quality arena with amenities that we never had before.”

Residency theater shows have also come back into vogue, despite few having enjoyed any great success in the past – the obvious exception being Melco’s House of Dancing Water, which returns in its newly upgraded City of Dreams theater from 7 May. MGM, SJM and Wynn have all either launched or are planning to debut their own residency offerings as well, although most concessionaires have still barely touched the surface when it comes to fulfilling their multi-billion non-gaming investment pledge.

Says Bonnet, “The operators can hopefully utilise the required non-gaming contribution to strategically support their overall businesses, and I am really hoping it will be used to drive innovation in both property upgrades and product offerings. Something new, exciting and state-of-the art.”

Time will tell.

One thing that’s clear, however, is that investors continue to remain wary on Macau’s post-COVID trajectory, with gaming stocks still sluggish almost two-and-a-half years since borders reopened, impacted by ongoing geopolitical headwinds.

It was noted upon US President Donald Trump’s “Liberation Day” tariff announcement in early April that the Hong Kong-listed stocks of Macau’s concessionaires had all fallen by more than 10%, and at time of writing there was little sign of recovery. Sands China, for example, was sitting at HK$12.82 ahead of the Easter weekend – barely a third of the post-COVID high of HK$30.80 (July 2023) and a fraction of the company’s all-time high of HK$64.90 in 2014.

Galaxy was at HK$26.00 pre-Easter, down from a post-COVID high of HK$57.65 in April 2023 and an all-time high of HK$77.85 in February 2014. And on the story goes.

Galaxy was at HK$26.00 pre-Easter, down from a post-COVID high of HK$57.65 in April 2023 and an all-time high of HK$77.85 in February 2014. And on the story goes.

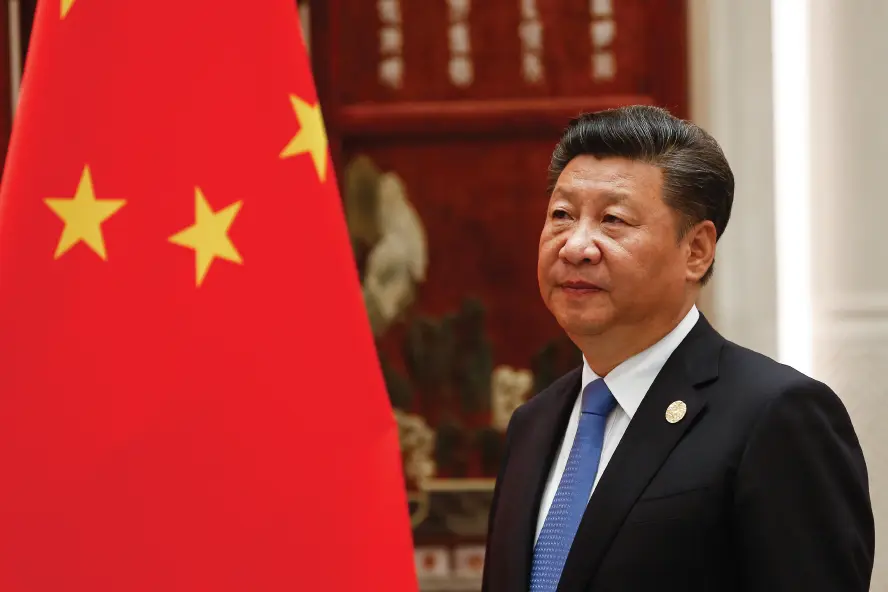

Although a recent crackdown on an illegal money exchange operation that was said to have been operating out of eight jewelry stores in Macau IRs may have negatively impacted sentiment, the general consensus is that investor concerns mainly center around China’s economy – particularly now given the uncertainty surrounding the tariff war. Morgan Stanley pondered in a recent note that investor sentiment is unlikely to improve until the base mass segment returns to Macau in force, providing a boost to margins.

Most analysts, however, continue to insist that Macau names are drastically underpriced, trading at an “unwarranted discount”. Luxury spending, they argue, remains as strong as ever while base mass could finally move in the right direction if Beijing follows through on its pledge to introduce broad stimulus measures.

Most analysts, however, continue to insist that Macau names are drastically underpriced, trading at an “unwarranted discount”. Luxury spending, they argue, remains as strong as ever while base mass could finally move in the right direction if Beijing follows through on its pledge to introduce broad stimulus measures.

In an April note, Seaport Research Partners senior analyst Vitaly Umansky said he fully expects China to focus in the short-term on shoring up the economy and providing further stimulus to improve economic activity and consumer confidence in 2025.

“With an increasing tariff regime in the US, we expect China policymakers to more forcefully implement stimulative measures to help drive consumption and improve consumer confidence,” he wrote. “Such policy initiatives should have a positive tailwind to Macau revenues. Fiscal stimulus (higher government spending) and regulatory easing measures will be important in building consumer and business confidence.

“An area of central focus remains shoring up the real estate market, which has contributed to a drag on the economy and has significantly weakened consumer confidence (although there are signs of this improving). Our view is that China’s economic improvement and the corresponding uplift in consumer sentiment could lead to stronger base mass recovery – with continued premium growth – in 2H25 and into 2026.”

The concessionaires themselves have also been bullish, as evidenced by four of them – Galaxy, MGM, Wynn and Sands – having resumed the payment of dividends. Sands joined Galaxy and MGM in announcing the return of dividends to shareholders for the first time in five years in February, while MGM in March increased its dividend payout ratio from 35% to as much as 50% of profits.

The concessionaires themselves have also been bullish, as evidenced by four of them – Galaxy, MGM, Wynn and Sands – having resumed the payment of dividends. Sands joined Galaxy and MGM in announcing the return of dividends to shareholders for the first time in five years in February, while MGM in March increased its dividend payout ratio from 35% to as much as 50% of profits.

JP Morgan said this action alone “indicates management’s growing confidence in its free cash flows, which we view as marginally positive.”

All of this suggests that while the investment world has yet to come to grips with the realities of this “new Macau”, the concessionaires themselves have accepted it and embraced it. And although it is unlikely topline GGR will ever reach junket-level highs again – certainly not for many, many years at least – margins and profits are bubbling along at respectably healthy levels (for most).

All of this suggests that while the investment world has yet to come to grips with the realities of this “new Macau”, the concessionaires themselves have accepted it and embraced it. And although it is unlikely topline GGR will ever reach junket-level highs again – certainly not for many, many years at least – margins and profits are bubbling along at respectably healthy levels (for most).

As they say in the movies, “We’re doing just fine, thanks for asking.”