Marina Bay Sands Pte Ltd, the immediate parent of Singapore integrated resort Marina Bay Sands (MBS), said overnight that it has cleared all loans and commitments under a longstanding facility agreement after last week securing a new SG$12 billion (US$9 billion) credit facility agreement for its IR2 expansion project.

The facility agreement in question was originally dated 25 June 2012.

In a filing, parent company Las Vegas Sands said MBS has, in connection with the consummation of the 2025 Singapore Credit Facility Agreement, prepaid all outstanding Facility A Loans and Facility D Loans, prepaid all ancillary outstandings, reduced the available facility for each facility to zero and cancelled the whole of the ancillary commitment of each ancillary lender under the facility agreement.

The transactions were completed last Friday 28 February.

“Accordingly, all outstanding amounts under the finance documents have been discharged in full and no commitment of any lender under the existing facility agreement is in force,” MBS explained.

The company’s new US$9 billion facility comprises a SG$3.75 billion (US$2.8 billion) term loan, a SG$750 million (US$560 million) revolving credit facility and a SG$7.5 billion (US$5.6 billion) term loan facility.

MBS revealed last year that its “Marina Bay Sands IR2” expansion project will cost around US$8 billion and include construction of a fourth hotel tower at its iconic Singapore resort.

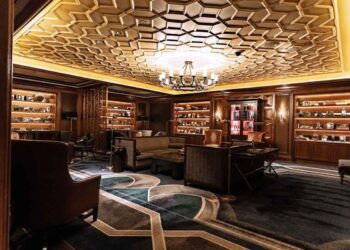

The fourth tower will boast its own casino amenities, including a main casino area in the podium plus “sky gaming” in the new tower, as well as 570 luxury suites, a 15,000-seat arena, 110,000 square feet of MICE space, its own SkyPark and high-end F&B.

The US$8 billion costing is two-and-a-half times more than the original US$3.3 billion investment announced in 2019.

Construction is slated to begin by June this year with an estimated opening date of 1 January 2031.