Wynn Macau Ltd has surprised to the upside by declaring an interim dividend of HK$0.185 per share for 1H25 – on par with its 1H24 final dividend despite reporting a year-on-year decline in both operating revenues and profit.

In a note, Citigroup analysts George Choi and Timothy Chau said that by maintaining its interim dividend at FY24 dividend levels, Wynn was “effectively setting a progressive dividend policy”. As such, the company’s FY25 dividend per share is also likely to stay at HK$0.185, implying FY25 dividend payments of around US$250 million.

Citi had expected an interim dividend per share of HK$0.120.

Publishing its financial results on Wednesday, Wynn Macau Ltd revealed a 7.5% year-on-year decline in total operating revenues in 1H25 to HK$13.6 billion (US$1.74 billion) which it explained was primarily due to lower VIP table games win as a percentage of turnover and mass market table games win, as well as lower Average Daily Rate at its Macau operations. Casino revenue fell 5.8% to HK$11.4 billion (US$1.46 billion).

Adjusted EBITDA was down 20.4% to HK$3.47 billion (US$444 million) while profit attributable to owners dropped from HK$1.59 billion (US$200 million) a year ago to HK$230.6 million (US$29.5 million) in 1H25. Factors for the decline included the lower operating revenues, lower finance revenues and a HK$177.3 million (US$95.6 million) loss from change in derivatives fair value versus a gain in the prior year period.

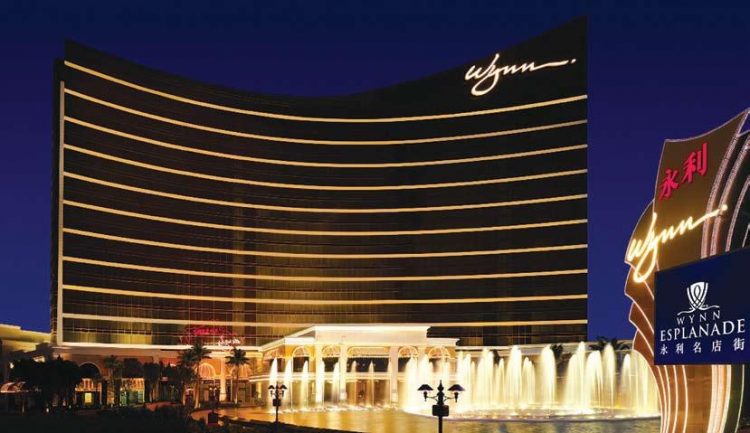

Wynn, which recently outlined plans to invest US$750 million into enhancement and expansion of its Macau resorts over the next 18 months, earlier this week completed a US$1 billion senior notes offering that it plans to use to pay down existing debt.