Las Vegas Sands (LVS) Chairman and CEO Robert Goldstein has bemoaned the lingering impact of the US-China trade war, as well as increased domestic and regional competition and the rise of online gambling across Asia for sustained flatness in the Macau market.

Goldstein also expressed a desire to improve the performance of his company’s Macau subsidiary, Sands China, which he said had not lived up to recent expectations despite those expectations being dampened due to a raft of substantial renovation projects that have limited its hotel room supply.

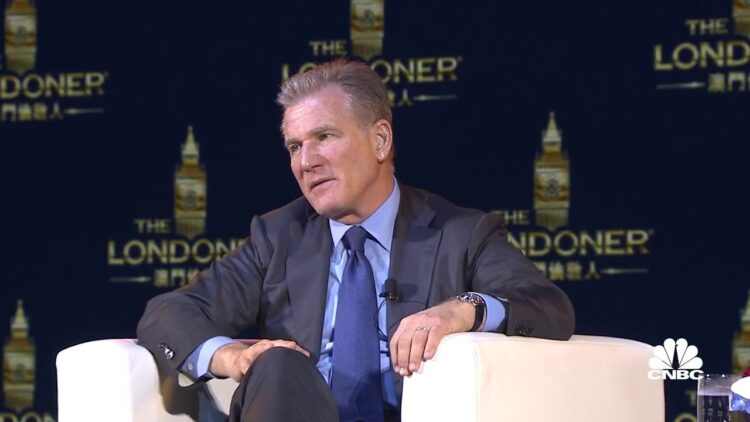

The long-time LVS executive was speaking at Bernstein’s 41st Annual Strategic Decisions Conference where he observed that one of the main challenges facing the Macau land-based gaming market in 2025 was falling spend per customer – a trend he attributed to a series of macro factors.

“Spend is different than it used to be,” Goldstein said. “Visitation used to be equivalent to the spend but they’ve decoupled now where visitation can be pretty good but the spend isn’t. The market has kind of peaked at around US$28 billion [in annual gross gaming revenue] and right now appears to be flat at that number.

“We had, I had, a false belief a couple of years ago that Macau would just keep moving up into the 30s and beyond and I think it’s a couple of factors. They include consumer sentiment – obviously global economic issues and tariffs don’t help – but there are other factors too.

“We can’t determine how much is tied to online gambling in Asia and if for whatever reason you want to assign that to Macau, which has definitely stalled out and it’s not where it was pre-COVID. The demise of the junket segment didn’t help either and of course competition is fierce there.

“Long-term I still believe Macau will be US$32 billion to US$34 billion but it’s not happening imminently, it’s not happening today or tomorrow, and we are kind of struggling in Macau with visitation having recovered while spend has not.”

While Goldstein said he expects to report strong revenues from the recently refurbished and relaunched The Londoner Macao when 2Q25 financials are released, internal performance at Sands China will be reviewed given what he describes as disappointing results in recent quarters.

“We still believe in Macau long-term and we believe in an asset-based strategy although this has not performed as well as we hoped it would,” he explained.

“We believe long-term that in the end, great buildings drive returns and we will be rewarded for the investments we have made. We are the biggest investor in Macau and we’ve not been rewarded with the returns we’d like to see. I’d like to see us do a lot better.

“We just have to wait for a better day in Macau and also help ourselves by performing better, by operating better. I’m going over to Macau in about 10 days and the whole week is about how we increase our visibility, our positioning, our incentives to drive more EBITDA into our buildings in Macau, because we’ve been outperformed by other people.

“We’ve not done as well as we could have done competitively and our last quarter was disappointing, so we’re hoping for improvement in our operating philosophy and approach to accelerate our own EBITDA within the confines of today’s Macau market.”

Goldstein said he fully expects that Macau will in the future see GGR soar above US$30 billion and back towards US$35 billion annually based on the “inevitable power” of the Chinese market.

However, he outlined a need to ensure a better quality of customer fills the company’s hotel rooms, stating that Sands must “work harder and make sure that mix is more favorable to our results and where we want to get to.”

This, he added, would be made easier if the US and China were able to put recent tension aside and work together to improve current trade conditions.

“The world is in an awkward place right now and there is confusion about the bilateral relationship between China and the US, there’s confusion about the tariffs, there’s confusion about China’s trajectory. It’s not an easy place to navigate,” Goldstein said.

“I think a lot of consumers here in the US and China are baffled or concerned about what the trajectory of these countries is and what’s going to happen.

“I believe if you don’t have a relationship with China and the US working together, the world economy suffers. We all suffer. This ridiculous idea that we’re going to exist on our own is insane. We’ve got to have trade and we’ve got to have a relationship with China and a relationship with the world. It can’t be America only or China only.

“So, I think the world is watching and waiting, concerned. You see it in equity prices, you see it hitting peoples’ consumer confidence and their spending habits. People need more certainty around what tomorrow’s going to bring because it’s painful to watch the China relationship not be stronger. It needs to be stronger because the whole world benefits when China and US work things out together.

“Hopefully there can be resolution and President Trump and President Xi can figure that out.”