The transition period for Macau’s 11 satellite casinos is set to expire at the end of this year, after which time they will only be permitted to operate as management companies and will no longer be allowed to share in gaming revenues. With just six months remaining until the deadline, Inside Asian Gaming takes a deep dive into the current state of the satellite casino saga.

The term “satellite casino” refers to properties that, while operating under the gaming license of one of Macau’s concessionaires, are promoted and managed independently by third-party companies. In essence, satellite casinos operate their own venues by utilizing the gaming tables of a licensed operator.

This business model dates back to the pre-handover era when Sociedade de Turismo e Diversões de Macao (STDM) held a monopoly on casino operations. Examples include the now-closed Central Casino and the former Kam Pek Casino, both considered early forms of satellite casinos.

Following Macau’s return to China in 1999, the city entered its first revision of the Regime Jurídico da Exploração de Jogos de Fortuna ou Azar em Casino (Legal Framework for the Operations of Casino Games of Fortune), commonly referred to as the “Gaming Law”. However, the old Gaming Law did not regulate satellite casinos, thereby indirectly allowing the “table leasing” model to flourish.

Following Macau’s return to China in 1999, the city entered its first revision of the Regime Jurídico da Exploração de Jogos de Fortuna ou Azar em Casino (Legal Framework for the Operations of Casino Games of Fortune), commonly referred to as the “Gaming Law”. However, the old Gaming Law did not regulate satellite casinos, thereby indirectly allowing the “table leasing” model to flourish.

When the Macau government issued the first concessions, in 2002, to Galaxy Entertainment Group, Wynn Macau and SJM, it also issued sub-concessions to Venetian Macau Ltd (under Sands China), MGM Grand Paradise (MGM China) and Melco Crown (now Melco Resorts). This marked the beginning of a dual-structure system, with satellite casinos continuing to thrive under the umbrella of these “licenses”.

Although satellite casinos once raised concerns due to their proximity to residential areas – prompting the government to prohibit casinos near housing estates – they also provided small- and medium-sized operators with a viable entry point. Their existence contributed to the development of surrounding sectors such as hotels and food & beverage.

Moreover, satellite casinos – with their lower minimum bets – have proven attractive to patrons with modest spending ability. With a minimum bet of just HK$200 (US$25), these casinos successfully filled a market gap and expanded the overall customer base.

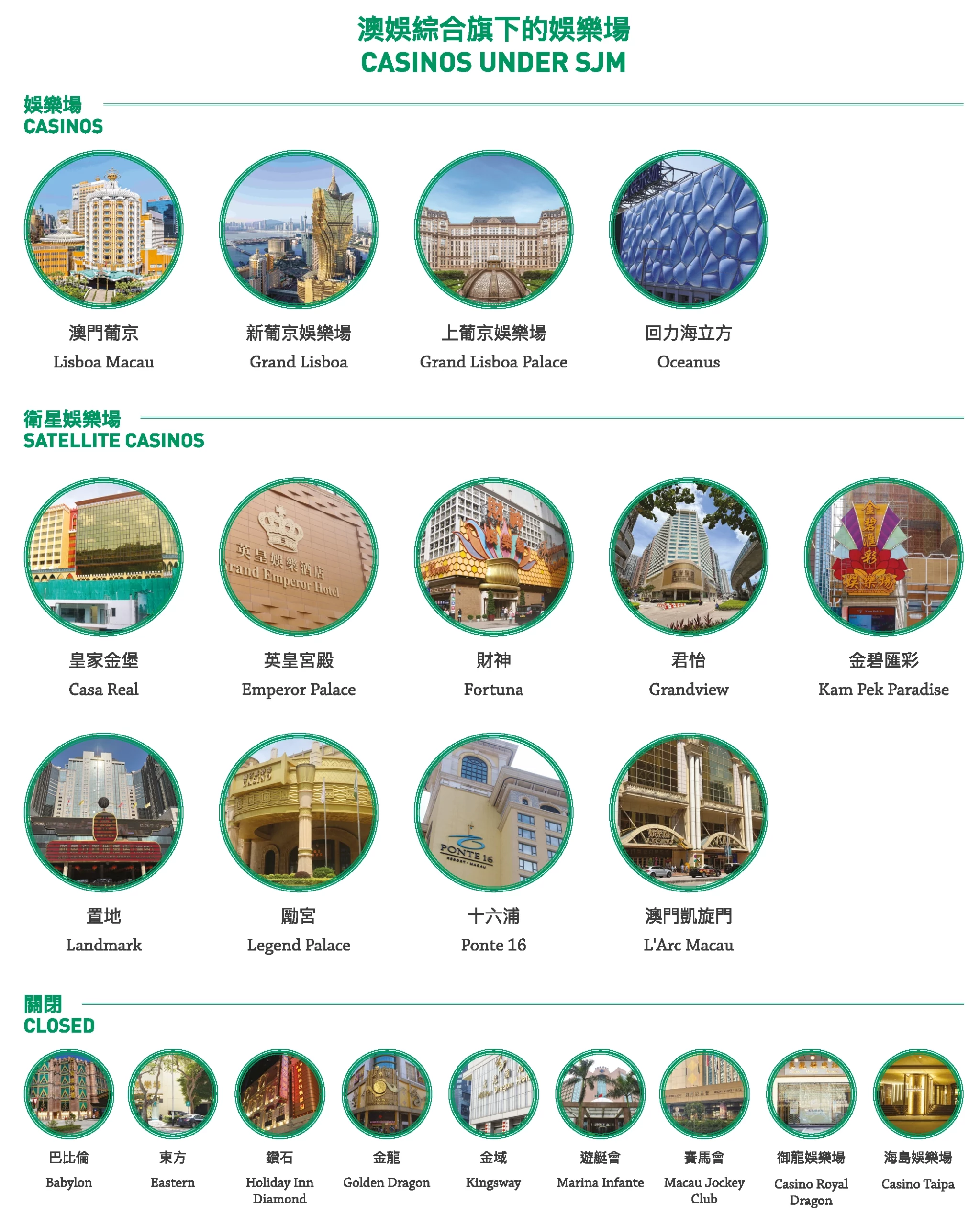

Before recent amendments to the Gaming Law in 2022, the number of casinos in Macau peaked at 41 in 2018. Based on past financial reports from SJM and data from the Gaming Inspection and Coordination Bureau (DICJ), 22 of these were satellite casinos, including 18 under the concession of SJM, three under GEG and one under Melco.

Casino numbers plunge

Casino numbers plunge

In 2022, the Macau SAR Government announced its plan to amend the Gaming Law in preparation for the signing of new concession agreements. As part of the amendment, Article 5 introduced a new clause stating that “casinos must be located within immovable properties owned by the concessionaire.”

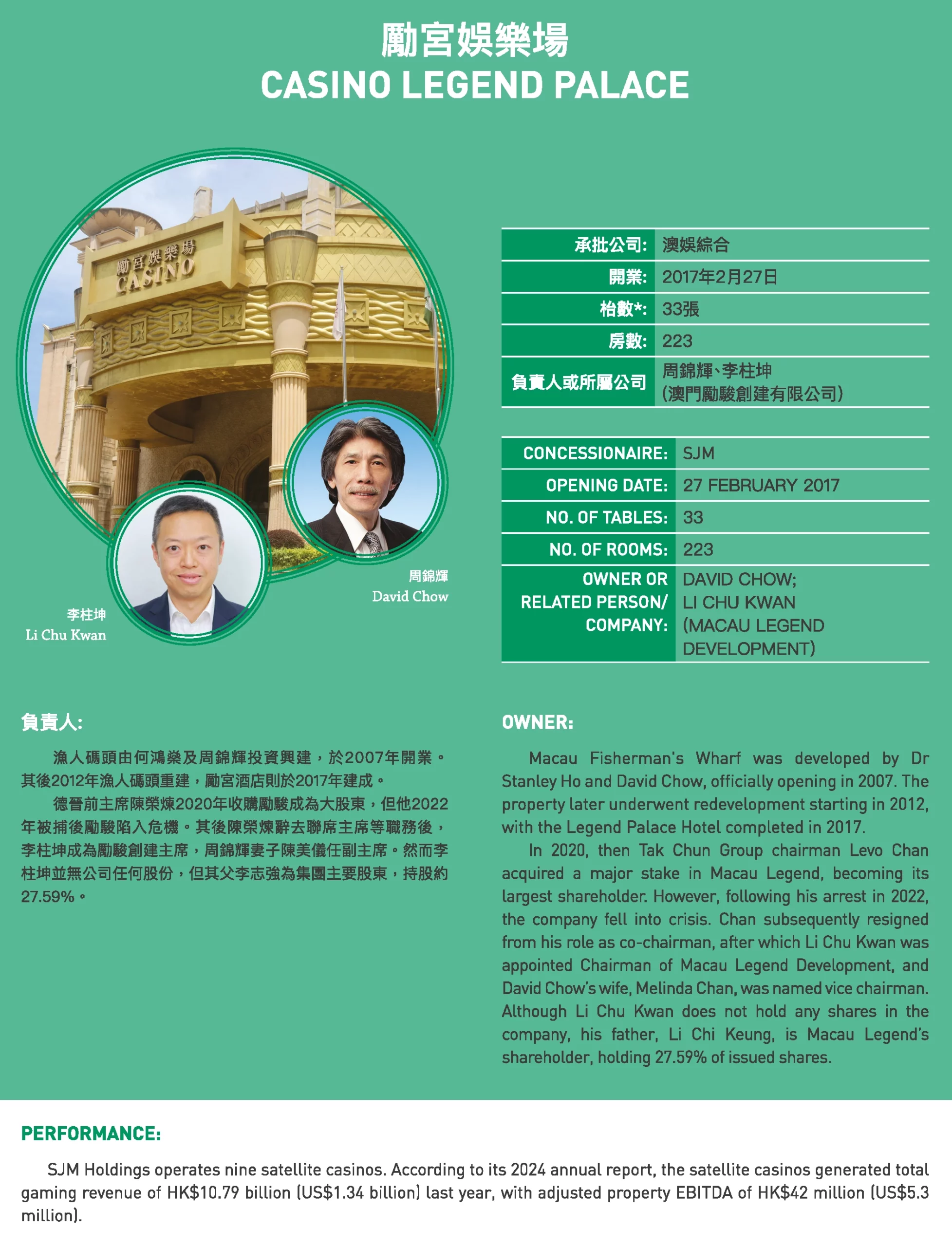

This clause effectively ended the longstanding “table leasing” model adopted by satellite casinos and immediately sparked widespread concern within the industry. At the time, David Chow, then Co-Chairman and Non-Executive Director of Macau Legend, warned that local banks had extended loans amounting to MOP$20 billion (US$2.48 billion) to satellite casinos and gaming investors. He urged the government to support the industry’s development, cautioning that a mishandled transition could trigger a domino effect.

Initially, the government did not provide a grace period, mandating that all satellite casinos must cease operations upon the law’s implementation on 1 January 2023. However, this stance later softened with the introduction of a three-year transition period, which is due to end on 31 December 2025. After this period, satellite casinos will be permitted to continue but their operators must convert into management companies. They will no longer be entitled to a share of gaming revenue and will only be permitted to collect a management fee from the concessionaire. If the casino premises is not owned by a concessionaire, the property may continue to operate under a lease arrangement.

Furthermore, any concessionaire intending to contract a management company for casino operations must obtain approval from the Macau Chief Executive. A draft of the management agreement must be submitted for authorization and a bank guarantee is also required.

Furthermore, any concessionaire intending to contract a management company for casino operations must obtain approval from the Macau Chief Executive. A draft of the management agreement must be submitted for authorization and a bank guarantee is also required.

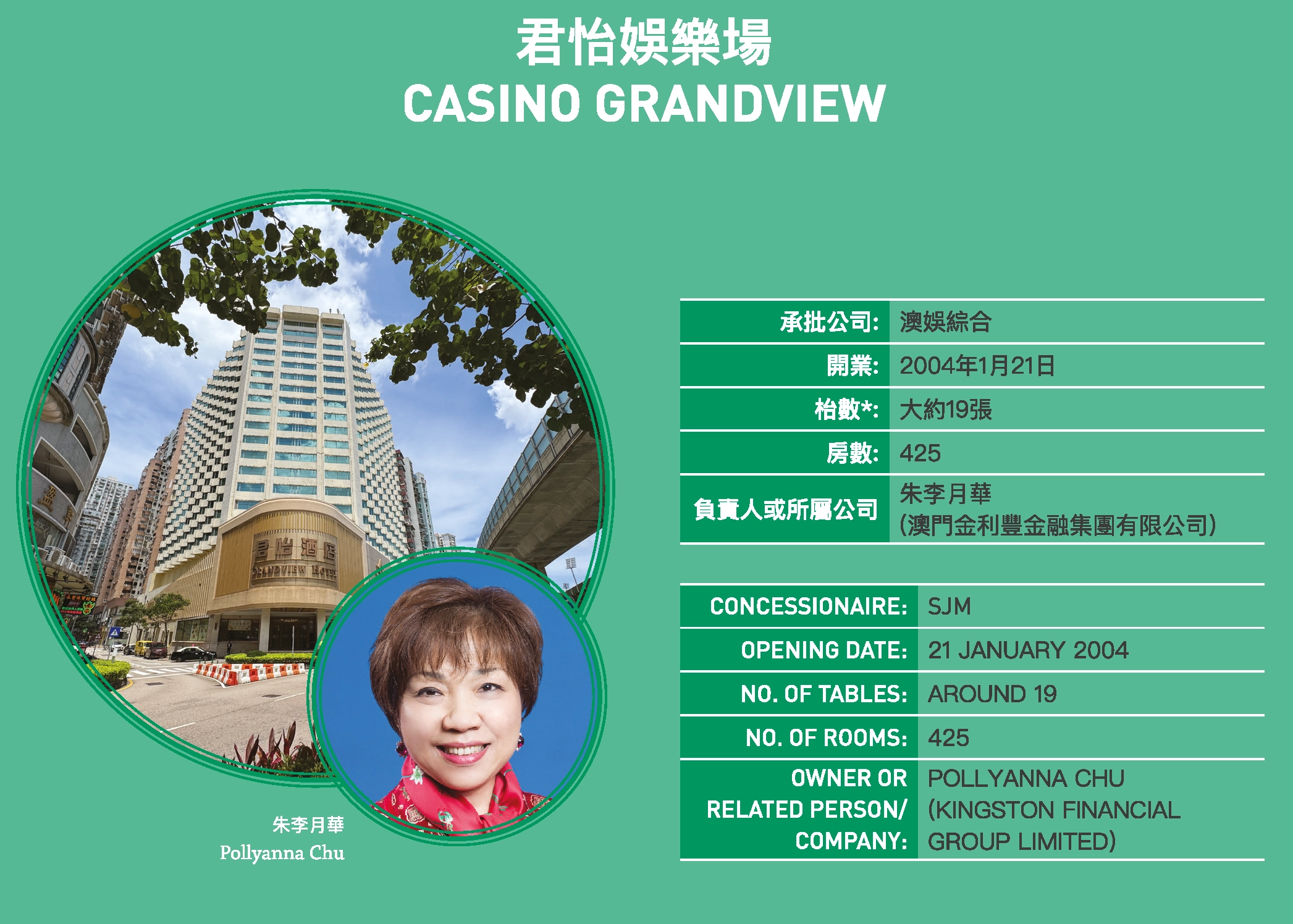

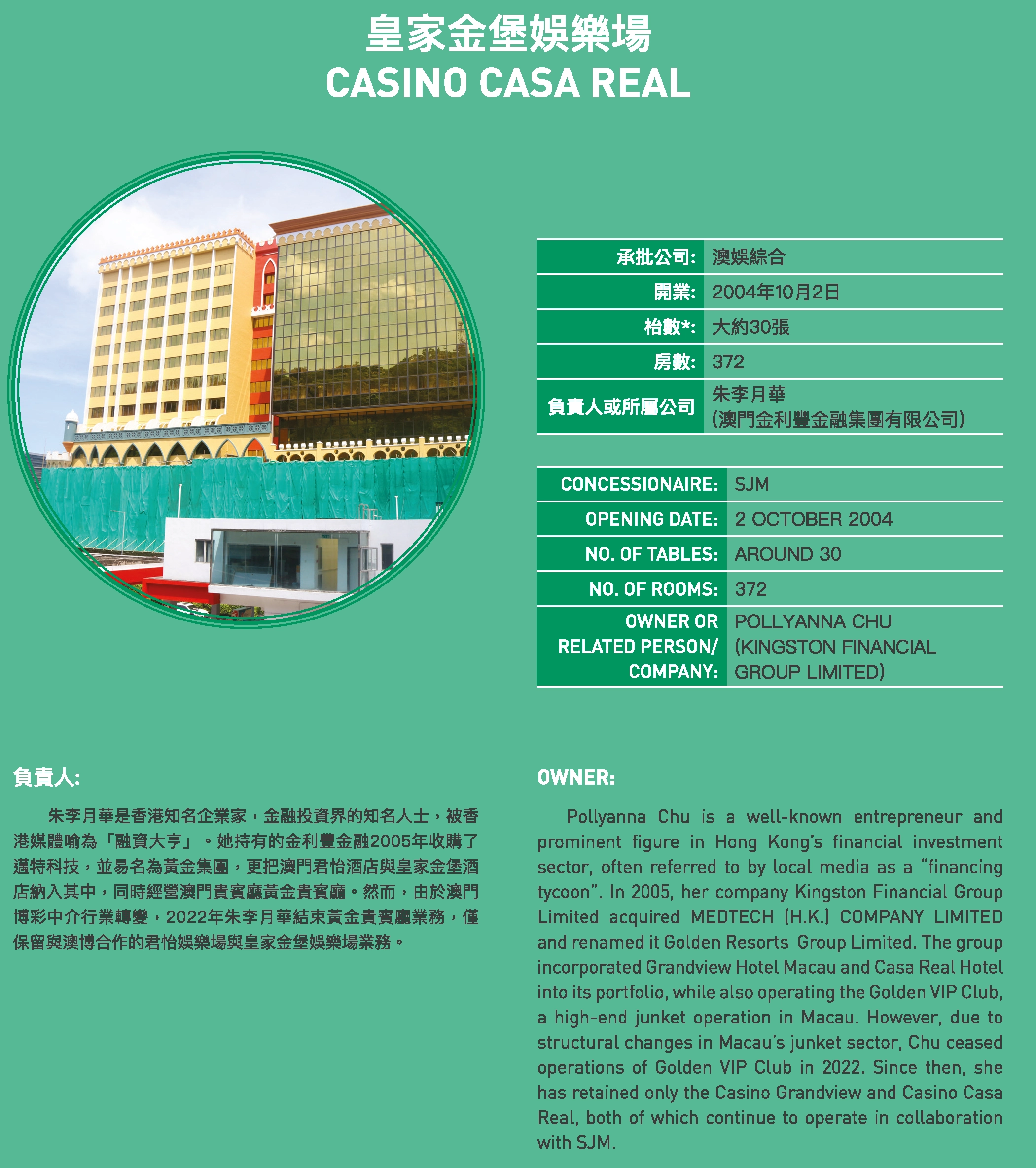

The new legal framework has led to a significant drop in the number of casinos in Macau. From 2Q22, the total count has dropped from 37 to 30 following the implementation of the new law in Q4 of that same year. The number has since remained stable. Of the 11 remaining satellite casinos, nine are affiliated with SJM Resorts and one each with Galaxy Entertainment Group and Melco Resorts.

In the past, the revenue-sharing structure for satellite casinos allocated 40% of gross gaming revenue (GGR) to gaming taxes, 5% to the concessionaire and the remaining 55% as revenue for the casino itself. Since 2022, however, concessionaires have reduced the revenue share for satellite casinos to 50%, further narrowing their profit margins.

Speaking with Inside Asian Gaming in January, a manager of one satellite casino revealed that the reduced 50% revenue share had left the business with very limited room for profit.

“Satellite casinos are housed within properties that also include hotels, restaurants and retail spaces, all of which rely heavily on gaming revenues to stay afloat,” he explained. “After accounting for staff salaries and property maintenance costs, there is very little profit left for the casino.”

For example, Landmark Casino recorded an average monthly GGR of between MOP$220 million and MOP$230 million (US$27.3 million to US$28.5 million) in 2024. Under the 50% revenue-sharing arrangement, the casino’s actual monthly income is around MOP$110 million (US$13.6 million).

Debt pressure

The issue of debt among satellite casinos has become a growing concern within the industry, particularly as these properties face mounting operational pressures and financing needs. A notable example is New Orient Group, which acquired Landmark in 2018 through a MOP$3.8 billion (US$470 million) loan from the Bank of China Macau Branch. The company is still in the repayment phase.

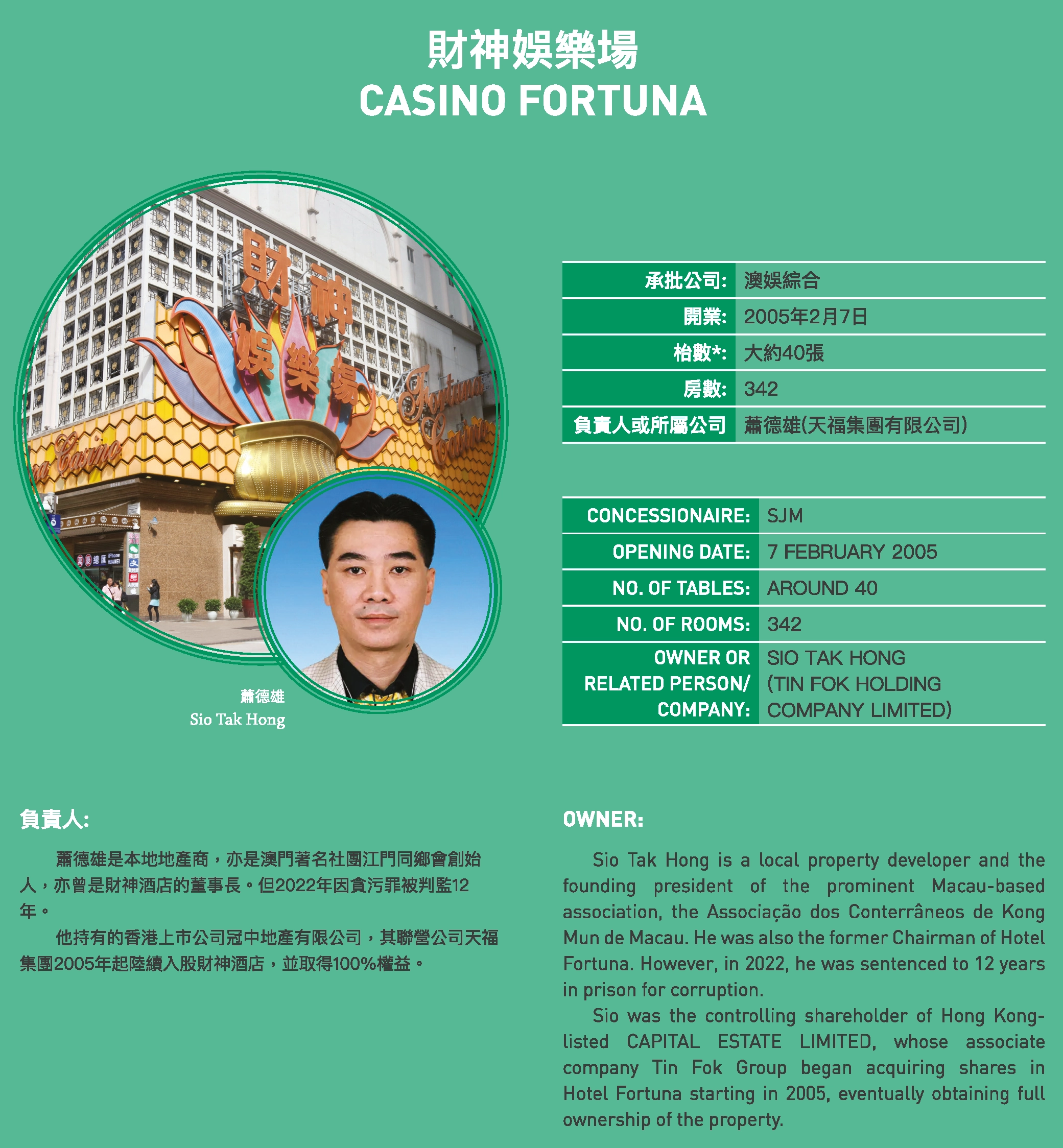

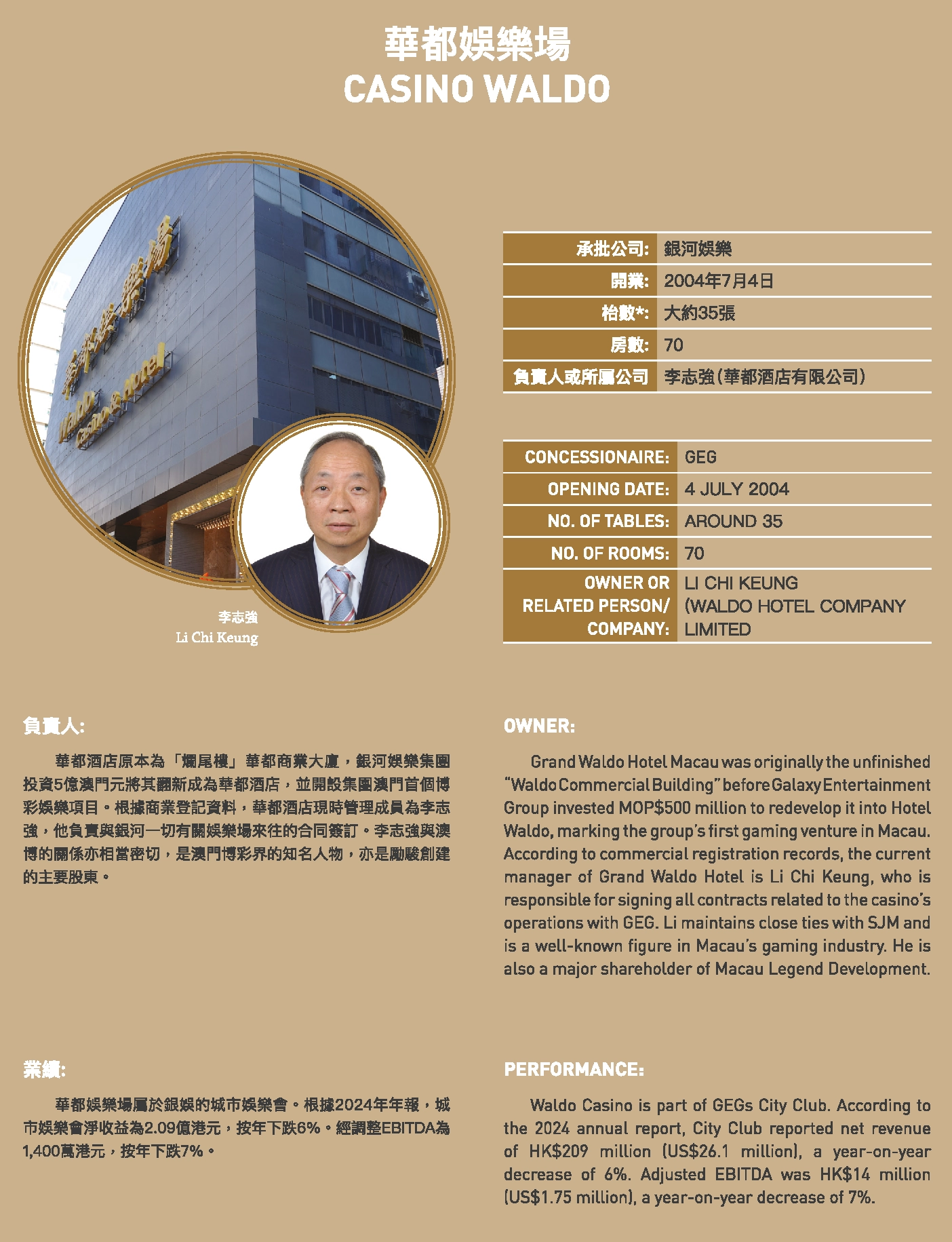

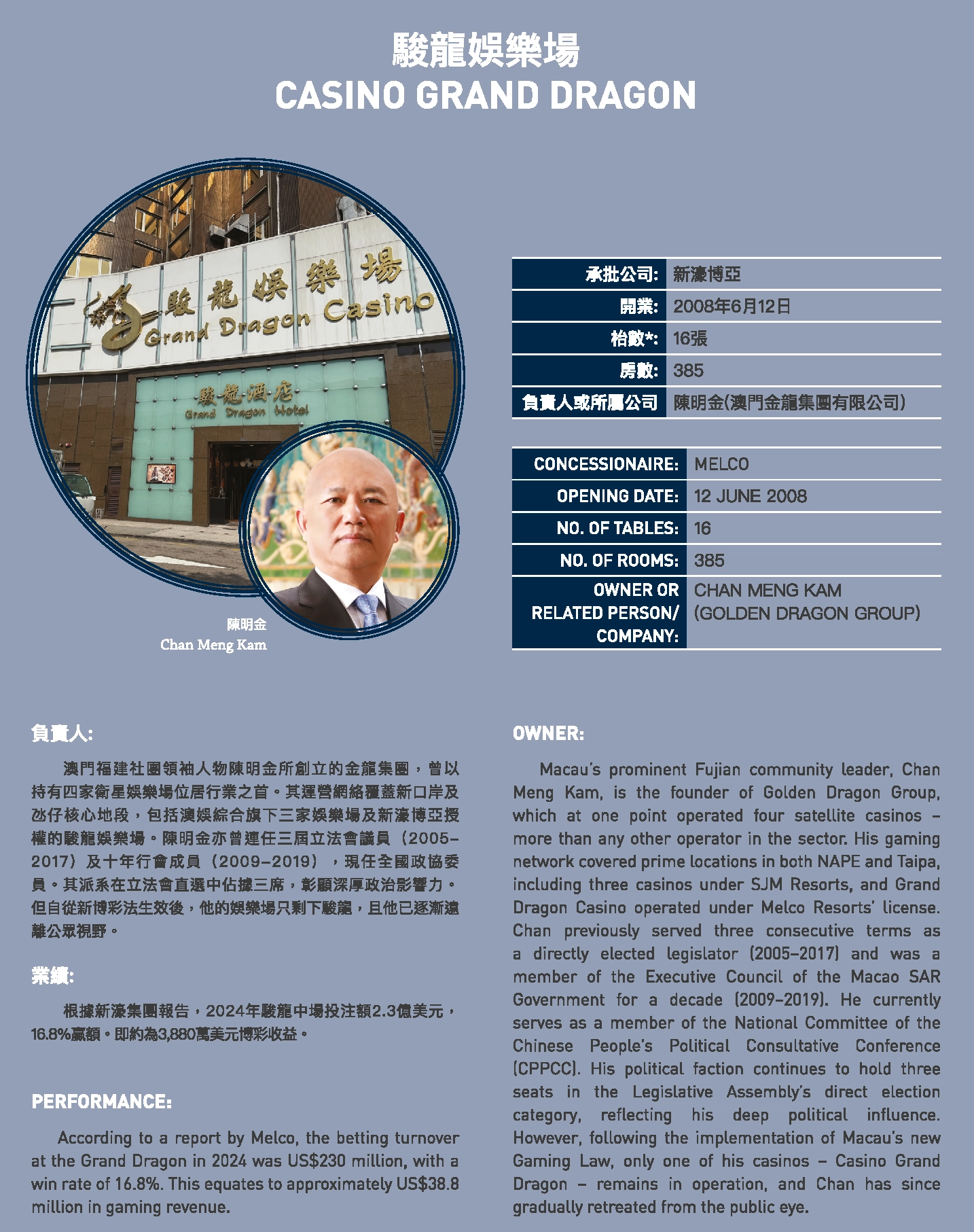

Industry sources estimate that monthly repayments for this project, including both principal and interest, exceed MOP$10 million (US$1.24 million). Other satellite casinos such as Tin Fok Holding Company Limited’s Hotel Fortuna, Waldo Hotel Company Limited’s Waldo Hotel and Golden Dragon Group’s Grand Dragon Hotel are also known to have taken out substantial loans from local banks.

Franco Liu, Managing Director of Savills (Macau) Limited, noted in a March interview with Macao Daily News that, based on estimates compiled from land registry data, the total outstanding debt tied to satellite casinos and their surrounding commercial properties amounts to between HK$25 billion and HK$39 billion (US$3.13 billion to US$4.88 billion).

David Chow also previously stated that Macau banks had extended up to HK$20 billion (US$2.5 billion) in loans to satellite casinos and gaming investors.

David Chow also previously stated that Macau banks had extended up to HK$20 billion (US$2.5 billion) in loans to satellite casinos and gaming investors.

If satellite casinos struggle to maintain stable gaming revenue in 2026, after the transition deadline, their incoming management fees may be insufficient to cover fixed costs such as employee salaries, property maintenance and loan repayments. In such cases, they could face a heightened risk of closure.

Financial ripple effects

Liu warned that, with the rising delinquency rate on commercial property loans in recent years and declining bank profitability, any issues involving satellite casino properties and surrounding retail spaces could trigger a chain reaction of loan defaults.

“This poses a significant risk and serious challenge to local financial institutions and the stability of the financial system,” he said, adding, “According to our internal estimates, if a satellite casino ceases operations and loses its gaming revenue support, the valuation of its associated hotel property could drop by more than 60%.

“In the past, banks granted higher loan amounts on hotel properties because of the presence of satellite casinos. Should these casinos shut down, the original loan amounts would far exceed the new asset valuations, pushing the loan-to-value (LTV) ratio on some properties up by as much as 150%.”

Legislator Lam U Tou also warned in March that, “The draft management contracts between satellite casinos and concessionaires must be submitted for approval by the Chief Executive, and this administrative process takes time. If no resolution is reached by mid-year, it is virtually certain that satellite casinos will disappear from Macau.”

He continued, “It’s undeniable that most businesses surrounding satellite casinos benefit from the customer traffic these venues attract. If the casinos are forced to close, it will likely result in a sharp decline in footfall, directly impacting retail business and negatively affecting the local community economy.”

He continued, “It’s undeniable that most businesses surrounding satellite casinos benefit from the customer traffic these venues attract. If the casinos are forced to close, it will likely result in a sharp decline in footfall, directly impacting retail business and negatively affecting the local community economy.”

Lam further pointed out that many satellite casino properties are already mortgaged to banks for operational financing.

“If these properties close, a large number will become non-performing assets, further undermining the financial system and overall economic stability,” he said.

Unemployment concerns

Unemployment concerns

The potential closure of satellite casinos also raises serious concerns about unemployment. In February, a manager from one of Macau’s satellite casinos told local media that the city’s 11 satellite casinos collectively employ over 10,000 staff, including transportation, hotel and F&B personnel.

However, gaming industry estimates place the actual number of casino staff between 3,000 and 5,000, with the total exceeding 10,000 only when including employees associated with hotel operations.

It is worth noting that dealers and cashiers working inside the casinos are employed directly by the concessionaires and are therefore not considered satellite casino staff. If satellite casinos are forced to exit the market entirely, these employees would revert to the concessionaires’ internal management – though this could result in surplus staffing.

As an example, SJM Resorts, which saw the number of satellite casinos under its concession fall from 14 to nine following passage of the new Gaming Law, revealed during its August 2023 earnings call that government restrictions preventing the dismissal of surplus gaming staff had at that time left the company with an excess of 2,150 employees. This led to approximately HK$169 million (US$21.6 million) in “redundancy payroll” expenses for 2Q23 alone, although it has since been able to absorb many of these into other roles.

As an example, SJM Resorts, which saw the number of satellite casinos under its concession fall from 14 to nine following passage of the new Gaming Law, revealed during its August 2023 earnings call that government restrictions preventing the dismissal of surplus gaming staff had at that time left the company with an excess of 2,150 employees. This led to approximately HK$169 million (US$21.6 million) in “redundancy payroll” expenses for 2Q23 alone, although it has since been able to absorb many of these into other roles.

In contrast, the concessionaires with only one satellite casino – GEG and Melco – would face significantly less pressure in absorbing additional staff. Employees not affiliated with a concessionaire may be forced to re-enter Macau’s general labor market.

Industry insiders estimate that, should all satellite casinos shut down, Macau’s unemployed population could rise from 7,300 in 1Q25 to between 10,000 and 12,000, pushing the unemployment rate from 1.9% to around 3%. This shift would further intensify the city’s employment pressure and pose a threat to broader social stability.

Current state of satellite casinos

Current state of satellite casinos

The fate of Macau’s satellite casinos post-2025 remains unresolved, with the issue entangled in broader concerns over financial stability, property valuations and employment. One of the most crucial elements is the determination of management fees. All stakeholders hope that, following the end of the transition period, these fees will be sufficient to cover basic operating costs.

Chong Sio Kin, Chairman of New Orient Group, stated in a January interview with Macao Daily News, “At present, satellite casinos are in a wait-and-see phase with no final decisions made.

“Everyone wants to continue operations – as long as there is profit, we will consider staying on. But it depends on the terms of the management fee. We’re waiting for the government’s final stance, since contracts signed with concessionaires require official approval.”

Jay Chun, Chairman and Executive Director of Paradise Entertainment Limited, echoed similar sentiments in an April interview with Inside Asian Gaming.

“There has been dialogue with the concessionaire, but no firm terms have been established. It would help all parties if discussions could proceed more quickly,” he said. “Regardless of whether operations continue, we need time to prepare.”

Chun noted that under the new legal framework, satellite casinos can only operate as management companies reliant solely on management fees to stay afloat. He said he hopes the fees will at least be sufficient to cover all operating costs – particularly staff salaries.

Macau Legend Development Limited, which is already under serious debt pressure, stated in its 2024 Annual Report that it continues to hold regular discussions with SJM Resorts regarding post-transition cooperation plans but intends to continue operating all core businesses for the foreseeable future.

However, a manager from one satellite casino told IAG that as early as February, letters had been sent to the concessionaire seeking clarification, yet responses have remained in the “under review” stage. Even after follow-up communications in March and May, no substantial progress has been made.

Government and concessionaire stances

Lawrence Ho, Chairman and CEO of Melco Resorts & Entertainment, responded to questions regarding the future of satellite casinos during a media interview in April.

“We only have one satellite casino, with just over a dozen tables, so the impact is minimal,” he said. “The future of satellite casinos depends on the government’s position. We will align ourselves with the long-term development direction of both the Macau SAR Government and the Central Government.”

However, the Macau Government has also made its stance clear – that the fate of satellite casinos should be determined through coordination between the concessionaires and the satellite casino operators themselves. In his Policy Address, Chief Executive Sam Hou Fai stated, “Satellite casinos are not a new issue. The new Gaming Law has already laid out clear provisions for their handling. What matters most is how the stakeholders address the matter in accordance with the law.”

The Secretary for Economy and Finance, Tai Kin Ip, further elaborated on 13 May during a Legislative Assembly session, stating that the government has conducted a comprehensive assessment of the operational status of satellite casinos, the number of surrounding commercial tenants and employment conditions. Contingency plans have already been formulated.

“If satellite casino operations result in employment changes, the Labour Affairs Bureau will follow up in accordance with the law to protect the legal rights of employees and provide affected local workers with vocational training and job placement support,” he added.

As for who is willing to make any final determination on the future of Macau’s satellites – the government, concessionaires or the satellites themselves – it seems all are currently pushing responsibility onto others.

More than just management fees

Under the revised Gaming Law, after the transition period satellite casinos may only operate as management companies, relying solely on fixed management fee income. However, the industry widely hopes to adopt a new model combining both “management fees and rent” to remain viable.

Management fees are paid by the concessionaire, subject to approval by the Chief Executive, and are fixed in amount. Rent, on the other hand, falls under the Tenancy Law and is determined by market conditions, offering more flexibility – including the possibility of adopting a floating rent structure.

Management fees are paid by the concessionaire, subject to approval by the Chief Executive, and are fixed in amount. Rent, on the other hand, falls under the Tenancy Law and is determined by market conditions, offering more flexibility – including the possibility of adopting a floating rent structure.

Discussions around the concept of “rent” already emerged as early as 2022 during the amendment process of the Gaming Law. Chan Chak Mo, Chairman of the Second Standing Committee of the Macau Legislative Assembly, remarked during the legislative hearings that, “If the satellite casino operator is also the property owner, they can lease the venue under the Tenancy Law. The Gaming Law does not regulate leasing arrangements.”

A gaming industry insider told Inside Asian Gaming, “Currently, the industry’s preferred arrangement is a model combining a fixed management fee with rent. The management fee is a fixed sum, while the rent can be pegged to market dynamics. Overall, rent offers relatively more flexibility.”

Stakeholders in satellite casinos hope that a combination of fixed management fees and more lenient, performance-linked rent – calculated, for example, on a monthly basis using rolling turnover as a benchmark – can effectively replace the revenue-sharing structure of the past.

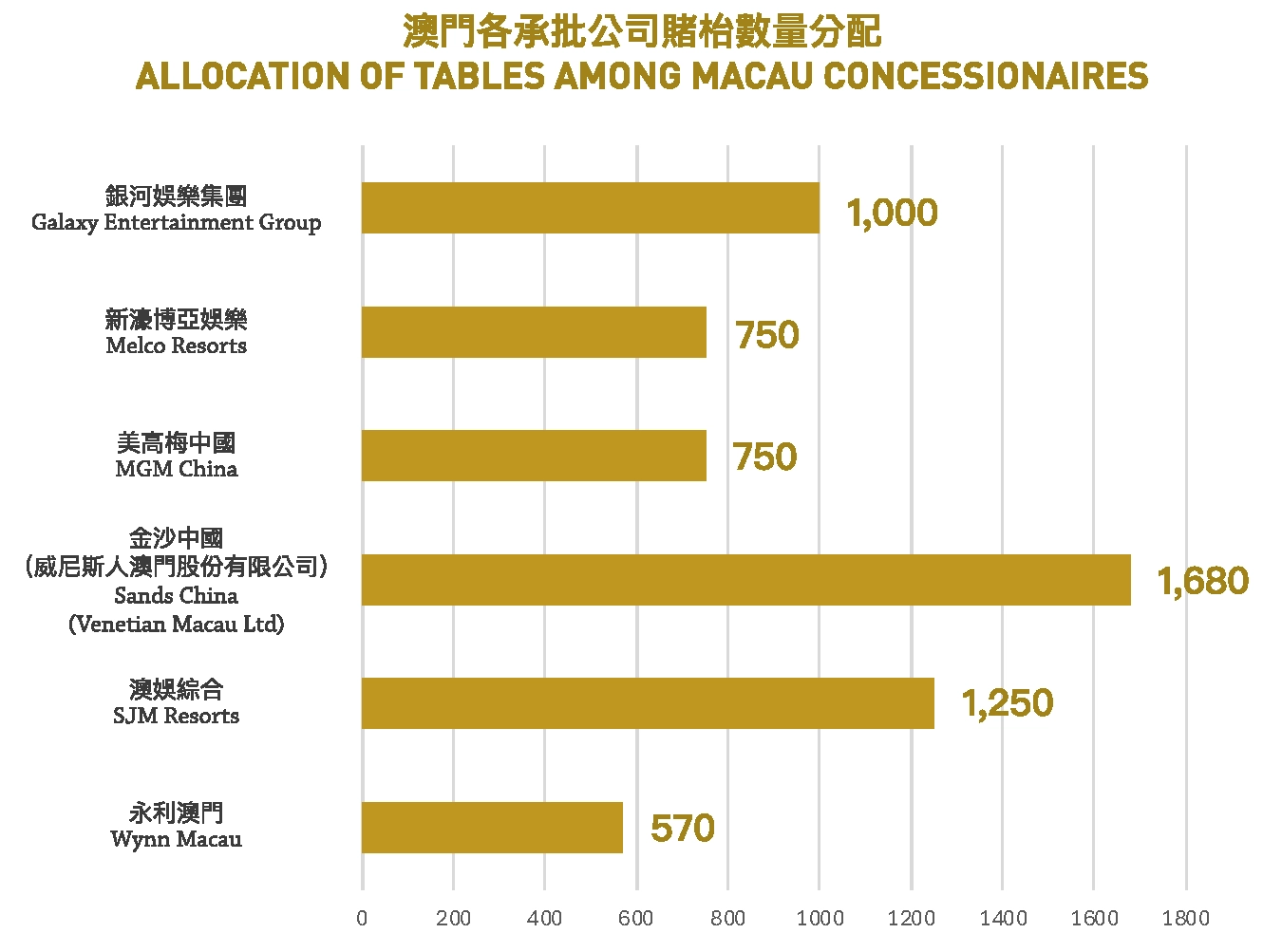

Table redistribution

Macau currently enforces a cap of 6,000 gaming tables and 12,000 slot machines market-wide. Among the concessionaires, SJM Resorts has been allocated 1,250 tables, Galaxy Entertainment Group 1,000, Melco Resorts 750, Wynn Macau 570, MGM China 750 and Sands China’s Venetian Macau Ltd 1,680 tables.

Based on industry data and financial disclosures from individual satellite casinos, the current number of tables operating within satellite casinos is estimated to be around 500. In 2024, these venues collectively generated GGR of approximately MOP$11 billion (US$1.36 billion), representing about 4.5% to 5% of Macau’s total GGR.

At present, the decision regarding the future of satellite casinos lies in the hands of the concessionaires. Should all satellite casinos cease operations, the gaming tables and equipment they utilized will, by law, be returned to the Macau government for redistribution – not automatically reassigned to the original concessionaires responsible for their operation.

At present, the decision regarding the future of satellite casinos lies in the hands of the concessionaires. Should all satellite casinos cease operations, the gaming tables and equipment they utilized will, by law, be returned to the Macau government for redistribution – not automatically reassigned to the original concessionaires responsible for their operation.

Who will survive?

Although the government, concessionaires and satellite casino operators have yet to release any official updates – and with only six months left before the final deadline – Inside Asian Gaming has compiled analysis and insights from multiple industry insiders and concessionaire sources, concluding that at least four satellite casinos are likely to be retained. These are closely affiliated with SJM Resorts and have shown relatively strong gaming performance.

In with a chance

Time will tell how many other satellites survive, but there are at least two more that may boast either the performance or the connections to continue:

Although the government maintains that the fate of satellite casinos is a commercial decision to be made between concessionaires and stakeholders, these properties have deep historical roots in Macau and have developed into a unique business ecosystem. As such, the issue goes beyond mere commercial negotiation – it may ultimately require further government guidance and direction to ensure that the interests of all parties are balanced and protected.