Australia’s Star Entertainment Group reported an EBITDA loss of AU$21 million (US$13.5 million) for the three months to 31 March 2025, reversing an AU$38 million (US$24.4 million) profit a year earlier and widened from an AU$8 million (US$5.1 million) EBITDA loss in the December quarter.

In the company’s quarterly activities report, filed with the ASX, Star said the results for the period reflect a seasonal softening in revenues, reduced levels of gaming visitation and the one-off impact of adverse weather events which forced property closures in Queensland in March 2025.

Group-wide revenues were down 35% year-on-year and 9% quarter-on-quarter to AU$271 million (US$174 million) as stricter regulatory requirements in the wake of recent inquiries into Star’s suitability continue to bite. The company has also pointed previously to the lack of similar requirements on pubs and clubs in NSW and Queensland – home to a majority of the respective states’ poker machines – as creating an uneven playing field.

The impact has been particularly notable at The Star Sydney, where Q1 revenues fell 26% year-on-year to AU$161 million (US$103 million) with an EBITDA loss of AU$9 million (US$5.8 million).

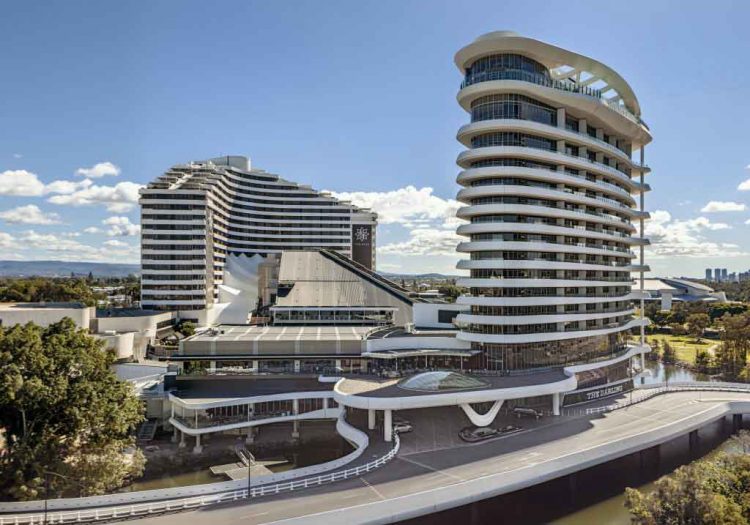

The Star Gold Coast saw revenues fall by 17% to AU$96 million (US$61.5 million) with EBITDA down 90% to AU$2 million (US$1.28 million), while The Star Brisbane – which opened in August 2024 – resulted in an EBITDA loss of AU$13 million (US$8.3 million).

Star noted that there remains material uncertainty regarding the group’s ability to continue as a going concern, with a number of key initiatives in the near term deemed critical to the group’s liquidity outlook.

These include completing a recently announced AU$300 million (US$192 million) strategic investment into The Star by US casino operator Bally’s and Bruce Mathieson’s Investment Holdings, securing access to the release of the Sydney Event Centre sale proceeds and completing the disposal of The Star Brisbane ans associated assets to the project’s joint venture partners – Hong Kong’s Chow Tai Fook and Far East Consortium.

Star said it had available cash of AU$44 million (US$28.2 million) as at 31 March 2025 although it has since received the first AU$100 million (US$64.1 million) tranche of the Bally’s investment.