In this regular feature in IAG to celebrate 20 years covering the Asian gaming and leisure industry, we look back at our cover story from exactly 10 years ago, “Putting Cambodia on the map”, to rediscover what was making the news in May 2015!

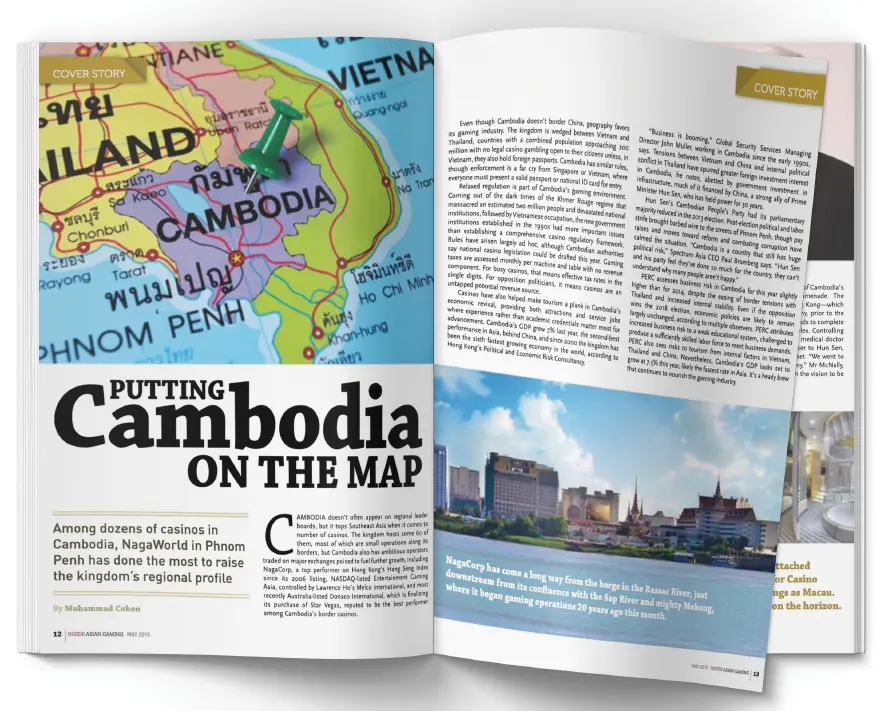

In the cover story of our May 2015 issue, titled “Putting Cambodia on the map”, Inside Asian Gaming delved into a potential rising star of the Asian gaming scene: Cambodia – home to the NagaWorld phenomenon and dozens of smaller casinos dotted mostly along the country’s borders with Vietnam and Thailand.

Not unlike today, Cambodia was at that time a study in balancing a steadily growing economy with ever-present business and political risk.

Not unlike today, Cambodia was at that time a study in balancing a steadily growing economy with ever-present business and political risk.

Yet NagaWorld, thanks to the monopoly it held – and will continue to hold until at least 2045 – on casino gaming within a 200km radius of Cambodia’s capital city Phnom Penh, was poised to enjoy massive growth in the years ahead.

As IAG wrote at the time, the property’s monopoly positioning, a favorable tax regime that allowed it to offer hugely attractive commissions to its junket partners, and its standing as the first true integrated resort in Indochina gave NagaWorld a leg up that no other operator in Asia was enjoying.

“While Macau experienced a historically bleak first quarter this year, NagaCorp’s gaming revenue grew 48% and VIP roll rose 79%. A major expansion of NagaWorld (Naga 2) and a new resort in Russia’s Far East are expected to fuel further growth,” we observed.The property was also benefiting in the mass gaming segment, thanks in part to the government-forced closure of all Phnom Penh slot parlors in early 2009. NagaWorld’s slots revenue subsequently increased from US$3.1 million in 2008 to US$34.3 million in 2009.

NagaWorld has always been a unique proposition on the Asian gaming scene. Parent company NagaCorp, led by its Malaysian founder Dr Chen Lip Keong, began life on a barge in the Bassac River in 1995, only moving to land in 2003 with a modest offering of 44 tables and 211 machines at NagaWorld’s present location – not far from Cambodia’s Royal Palace.

An initial public offering in 2006 not only raised US$95 million to fund the first phase of the new and improved NagaWorld hotel and entertainment complex but also made NagaCorp the first gaming company to be listed on the Hong Kong Exchange.

While Dr Chen could have funded the development out of his own pockets, NagaCorp chairman Tim McNally told IAG, “We went to the marketplace to become an international company. Dr Chen did it with the vision to be the best gaming destination in Indochina and to be poised to move into other opportunities in Indochina.”

The company’s growth was, we noted in 2015, somewhat aided by Cambodia’s relaxed regulation – a byproduct of the nation’s troubled history that left it with “more important issues than establishing a comprehensive casino regulatory framework.”

The company’s growth was, we noted in 2015, somewhat aided by Cambodia’s relaxed regulation – a byproduct of the nation’s troubled history that left it with “more important issues than establishing a comprehensive casino regulatory framework.”

There have been more recent efforts to fix that, including the introduction of a new Law on the Management of Integrated Resorts and Commercial Gambling Rules in 2021, although full implementation remains slow.

Nevertheless, we wrote back in 2015 that, “Casinos have also helped make tourism a plank in Cambodia’s economic revival, providing both attractions and service jobs where experience rather than academic credentials matter most for advancement.”

The opening of NagaWorld’s Naga 2 expansion in late 2017 – which doubled gaming capacity – provided yet another boost, with the first quarter post-launch seeing VIP rolling chip grow by 51% and mass table drop by 56%.

But like many in the region, the impact of the COVID-19 pandemic and the collapse of the Macau-based junket industry put a halt to NagaCorp’s momentum, and after years of phenomenal growth it now finds itself in a rebuilding stage. A pause on development of a second casino resort in Vladivostok, Russia as a result of the Ukraine conflict aside, NagaCorp has also postponed the opening date of its much-vaunted Naga 3 development – originally scheduled for 2025 but now put back until 2029 at the earliest.

More recent concerns around the company’s ability to meet debt payments have been allayed, but it seems NagaWorld will have to focus on more subdued long-term growth as it follows the lead of regional rivals by pivoting away from junket VIP and focusing instead on premium mass and direct.

A reality check perhaps, but likely only a stumbling block on the long road ahead.