In this regular feature in IAG to celebrate our 20th year covering the Asian gaming and leisure industry, we look back at our cover story from exactly 10 years ago, “Coming of age”, to rediscover what was making the news in March 2015!

The 2022 retendering process for Macau’s gaming concessions took a notably different route to the original tender 20 years earlier, with the government making it clear that a key consideration in issuing the new concessions would be how much each concessionaire committed to non-gaming investments.

In the end, the six concessionaires were awarded new 10-year concessions based in part on a promise to spend a combined MOP$108.7 billion (US$13.6 billion) during that time on non-gaming amenities.

In the end, the six concessionaires were awarded new 10-year concessions based in part on a promise to spend a combined MOP$108.7 billion (US$13.6 billion) during that time on non-gaming amenities.

But Macau’s non-gaming push is nothing new.

Ten years ago, the cover story of Inside Asian Gaming’s March 2015 issue, titled “Coming of age” explored the efforts of Macau’s operators to woo China’s rising middle class – and especially the sophisticated younger cohort within it – via the enhancement of unique non-gaming attractions.

There were, as we explained at the time, some ulterior motives: namely an opportunity for concessionaires to state a better case for a generous allocation of gaming tables from the government, which was subject to a market-wide annual cap. This meant that the concessionaires were essentially competing with one another to earn a higher allocation each year.

For example, Melco Crown’s Lawrence Ho said ahead of the opening of Studio City that the property was built “with a capacity for 500 gaming tables … but the truth of the matter is I have no idea how many tables we are going to get.”

Noting the government’s policy of basing the allocation of tables to each operator on how much they have invested in non-gaming amenities, Ho stressed that only 5% of Studio City’s completed space would be devoted to gambling.

However, it wasn’t all about gaming tables, with operators also recognizing that their businesses would increasingly depend on the strength of their non-gaming offerings given the clear trend, even a decade ago, of China’s mass market replacing VIP as the segment of the future.

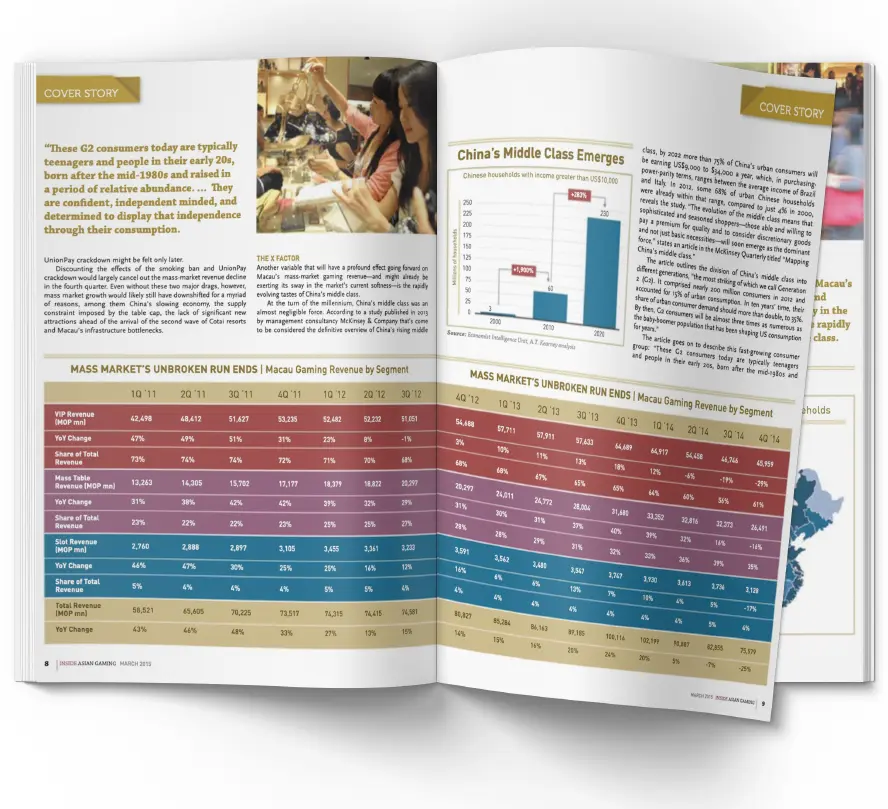

“The market has actually been rebalancing gradually toward the mass market since the end of 2011,” IAG wrote. “VIP baccarat’s share of total Macau gaming revenue peaked at 74% in the second and third quarters of that year and has been declining ever since, with its growth consistently outstripped by that of the mass market.”

That trend continued to the extent that it is now mass gaming revenue accounting for more than 75% of all GGR, completely reversing the dominance once enjoyed by VIP.

That trend continued to the extent that it is now mass gaming revenue accounting for more than 75% of all GGR, completely reversing the dominance once enjoyed by VIP.

While the collapse of the junket industry has accelerated the process, IAG noted in 2015 that a major variable in the evolution of the mass market was the rapidly evolving tastes of China’s middle class.

“At the turn of the millennium, China’s middle class was an almost negligible force,” we wrote. “According to a study published in 2013 by management consultancy McKinsey & Company that’s come to be considered the definitive overview of China’s rising middle class, by 2022 more than 75% of China’s urban consumers will be earning US$9,000 to $34,000 a year, which, in purchasing power- parity terms, ranges between the average income of Brazil and Italy. In 2012, some 68% of urban Chinese households were already within that range, compared to just 4% in 2000, reveals the study.”

Specifically, the McKinsley study stated, “The evolution of the middle class means that sophisticated and seasoned shoppers – those able and willing to pay a premium for quality and to consider discretionary goods and not just basic necessities – will soon emerge as the dominant force.”

Wise words it seems. Today it is the premium mass – and to a lesser extent the grind mass – customer that is driving Macau forward, and operators are increasingly looking to find truly unique and innovative non-gaming attractions to bring them in.

Wise words it seems. Today it is the premium mass – and to a lesser extent the grind mass – customer that is driving Macau forward, and operators are increasingly looking to find truly unique and innovative non-gaming attractions to bring them in.

Given the increasing competition for those same customers from regional rivals like Singapore and the Philippines, it will be interesting to see how such attractions evolve in the years ahead.