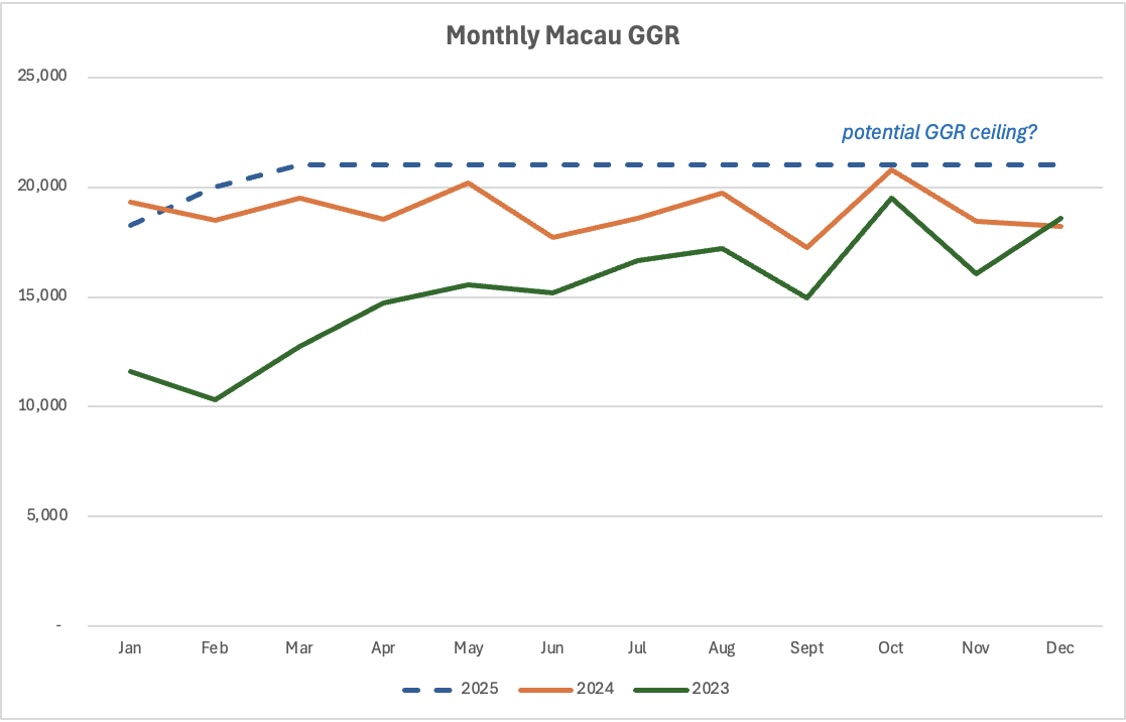

Macau casinos’ shrinking gross gaming revenue (GGR) may be a wake-up call, suggesting performance has hit a ceiling, and requiring new catalysts to stimulate growth.

Tourism’s comeback from the COVID scourge heralded a potential renaissance for Macau’s economic growth. Improved transportation infrastructure, a 10-year renewal on gaming licenses and a surge in post-pandemic “revenge travel” stoked optimism and expectations for a vigorous resurgence in Macau GGR.

However, the enthusiasm got a reality check last month when January’s GGR finished 5.6% lower year-over-year despite tailwinds from the Chinese New Year (CNY) holiday and even amid a more sophisticated operating environment, including fully revamped resorts, and deployment of smart tables across multiple properties.

GGR growth showed real traction during 2024’s first four months, peaking amid May’s Golden Week holiday, with a monthly performance of MOP$20.2 billion (US$2.50 billion). A similar trend occurred preceding the October Golden Week celebration, with post-COVID GGR approaching MOP$20.8 billion (US$2.59 billion). However, with the CNY holiday generally coinciding with peak yearly demand, 2025’s monthly GGR may have already crested and could eventually ebb to around MOP$18 billion (US$2.24 billion), adjusting with seasonality. What’s the rationale?

Macau’s government has made no secret of its intention to promote the gaming industry’s “healthy development”.

Similarly, it also annually forecasts its budget. In November, the government projected that 2025 yearly GGR could reach MOP$240 billion (US$29.9 billion), or about MOP$20 billion (US$2.49 billion) per month.

Could the not-so-subtle implication be that GGR productivity of up to approximately MOP$20 billion monthly is healthy, but anything more than that is unhealthy? A few clues may provide some insight.

Throughout 2024, there were several high-profile initiatives in China to combat the outbound money flow.

In June 2024, immediately following May’s Golden Week, policymakers unveiled a crackdown on illegal money exchange operators. Their presumed intent may have been to diminish the excitement surrounding 2024’s highest monthly GGR in Macau through May.

Then again, after what was – at the time, in October – Macau’s best post-Covid GGR performance, further crackdowns on illegal capital outflows came forth.

Not to leave any doubt, the Macau government made sure the gaming industry’s health wasn’t left to chance, announcing various arrests under the newly promulgated Illegal Gaming Law.

Very clearly, policymakers understand that tightening the tourniquet on China’s capital outflows reduces liquidity within Macau, with the commensurate effect of diminishing overall waging turnover, resulting in lower average bets. This will inevitably lead to lower GGR, based on casino games’ math and the normalized casino house advantage.

However, the implication is evident even despite increased government regulation and oversight: GGR levels could hold around MOP$20 billion monthly, consistent with the government’s GGR forecast and annual budget.

Given China’s size, economy and population, the presumption is that there’s sufficient latent demand to drive monthly GGR beyond MOP$20 billion. However, when implementing the above-mentioned anti-liquidity actions, authorities may not have anticipated their intervention measures would work so well. Additionally, the leadership may have not factored in a few broader challenges:

- Slower than expected economic growth. China is still suffering from a prolonged economic slump, exacerbated by debt overhang related to property values. This ties up significant liquidity if home values are underwater (i.e. worth less than the mortgage balance) and there is no available equity to draw from. Consequently, spending power is reduced.

- Unexpected tariffs. Trump Administration tariffs on China make Chinese goods more costly, and therefore less competitive overseas. The impact would be another blow to liquidity as Chinese companies’ profit margins get squeezed, and their cash flows constrained. The effect is probably marginal at this point, but the sentiment isn’t necessarily helping.

- Changing mix of visitors. Government infrastructure improvements in Hong Kong and China and even within Macau have helped tourist visits rebound to almost pre-pandemic levels. Macau ushered in 2.9 million monthly average visitors in 2024, almost pacing 2019, when the monthly average was 3.3 million. A good example of the upgraded public works is the newly opened Macau Bridge, making Cotai’s major integrated resorts more accessible. However, with these properties introducing more family-friendly products amid a heavy emphasis on economic diversification, it’s likely that hotel rooms once set aside for punters are now being occupied by families. Good for non-gaming revenue, but generally not helpful for GGR growth.

Macau visitor arrivals

All of these have the natural implication of at least indirectly reducing liquidity in the market, thereby diminishing wagering volume. To function and thrive, casinos need patrons with access to ample, readily available cash. So, what can be done to stimulate demand?

- Introduction of New Products. Baccarat tables generate most of Macau’s gaming turnover. The game provides one of the lowest house advantages, making it a player favorite. While there has been some technological progress in the form of stadium baccarat games, Macau could benefit from some evolution in casino games offered rather than clinging to a one-dimensional execution strategy. This would involve cooperation with both gaming manufacturers and the regulator to have a speed-to-market approach, and iterate through innovation based on the best products available in the industry.

- Player Cultivation through Education. Other gaming markets take steps to cultivate players through education and instruction. Games such as blackjack and poker require skills that must be practiced, and refined. Having some simulated game rooms or areas where customers can “sample” the games before risking real cash might help drive consumption.

- Introduction of Non-Traditional Forms of Payment. While potentially antithetical to the overall approach of reducing liquidity in the market, allowing for more forms of cashless gaming, either via cryptocurrency or deploying the much-anticipated digital renminbi could help to solve the prevailing liquidity problems while addressing regulators’ concerns.

Macau remains the world’s top gaming market by overall casino revenue. However, if the industry has reached maturity, and is in the early stages of decline, it will take a decisive commitment to making essential changes to promote its long-term sustainability and prosperity. This will mean new rules and close collaboration between gaming operators, regulators and banking officials. But, if implemented correctly, could go a long way in preserving the “healthiness” of the industry while driving sustainable growth.

David Bonnet worked in the Asia regional casino gaming industry for over 15 years. He has also contributed as a featured writer to leading business publications including Inside Asian Gaming.