Ryan Hong-Wai Ho is joined by Jenny Phillips to take a deep dive into Macau’s premium gaming markets following the recent transition away from the old junket model and towards premium direct and premium mass.

Macau casinos typically have two primary market segments: VIP gaming and mass market gaming. Within these two market segments, there are further subdivisions known as the premium direct and premium mass markets. While these two premium-oriented markets exhibit distinct characteristics, there are also areas of overlap between them.

Switch to premium

Switch to premium

The premium direct market, also known as the direct VIP program, is the in-house marketing arrangement driven by casino operators. VIP (premium) players possess higher financial resources and engage in more substantial gaming activities. They indulge in personalized services and privileges meticulously customized to their specific preferences. The presence of private VIP salons exclusively caters to these high rollers, ensuring an opulent and secluded gaming environment.

The enactment of new gaming laws has brought an end to third-party-managed VIP rooms. VIP gaming is progressively shifting toward a premium direct model; moreover, the new 10-year gaming concessions highlight the growing importance of focusing on the mass market. In contrast to the VIP business, the mass market segment offers considerably wider profit margins. Casinos serving casual players can achieve a table hold of 20% or higher, resulting in a more robust financial position.

The mass appeal

Macau casinos have placed great emphasis on expanding the mass market gaming offerings alongside their premium-direct business. In particular, the premium mass market encompasses high-limit gaming areas designed to cater to non-hosted players who predominantly engage in cash play. Macau’s aspiration of transforming the city into a prime tourist destination has further galvanized the local casino operators to rely less on VIP gaming. Considerable efforts have already been made by most casino operators to shift toward the premium mass market.

Defining “premium mass”

Defining “premium mass”

There is variation among casino operators in classifying players, resulting in a lack of standardized definitions for the term “premium mass” in the industry. Nonetheless, it is worth noting that the minimum bet for a baccarat table in high-limit areas typically ranges from HK$3,000 to HK$10,000 (US$385 to US$1,280). Even within this premium mass segment, multiple tiers are strategically designed to attract and accommodate players with diverse gaming budgets, habits and preferences (see industry snapshot). Despite the concept of “premium mass” being relatively new and adopted by local casinos in the 2010s, it has demonstrated significant potential for generating gaming revenue within the larger mass market segment.

Play like a millionaire

The premium mass market caters to a broader range of customers who prefer a higher-end gaming experience but mostly do not qualify for VIP status. These players are drawn to the posh amenities, high-quality entertainment and premium services provided by casinos. Since 2020, the general and premium mass markets have exhibited substantial growth and emerged as a key priority for most casino resorts.

As the industry landscape continues to evolve, industry executives and reports have indicated that the premium mass market has become the primary focus and core business of Macau casinos. This strategic pivot is a positive development for the Macau gaming industry, as it enables casino operators to protect their profits from potential cuts by junket promoters. The shift also generates optimism about the industry’s prospects, with a solid indication of growth in the (premium) mass market’s performance in the coming years.

Game recognizes game

The premium direct and premium mass markets are meticulously designed to meet the specific preferences and demands of each segment. The distinguishing characteristics include the provision of dedicated gaming areas, tailored marketing strategies and distinct loyalty programs. However, several factors differentiate these premium-oriented markets, including the level of play, financial capacity and the extent of personalized services and benefits offered.

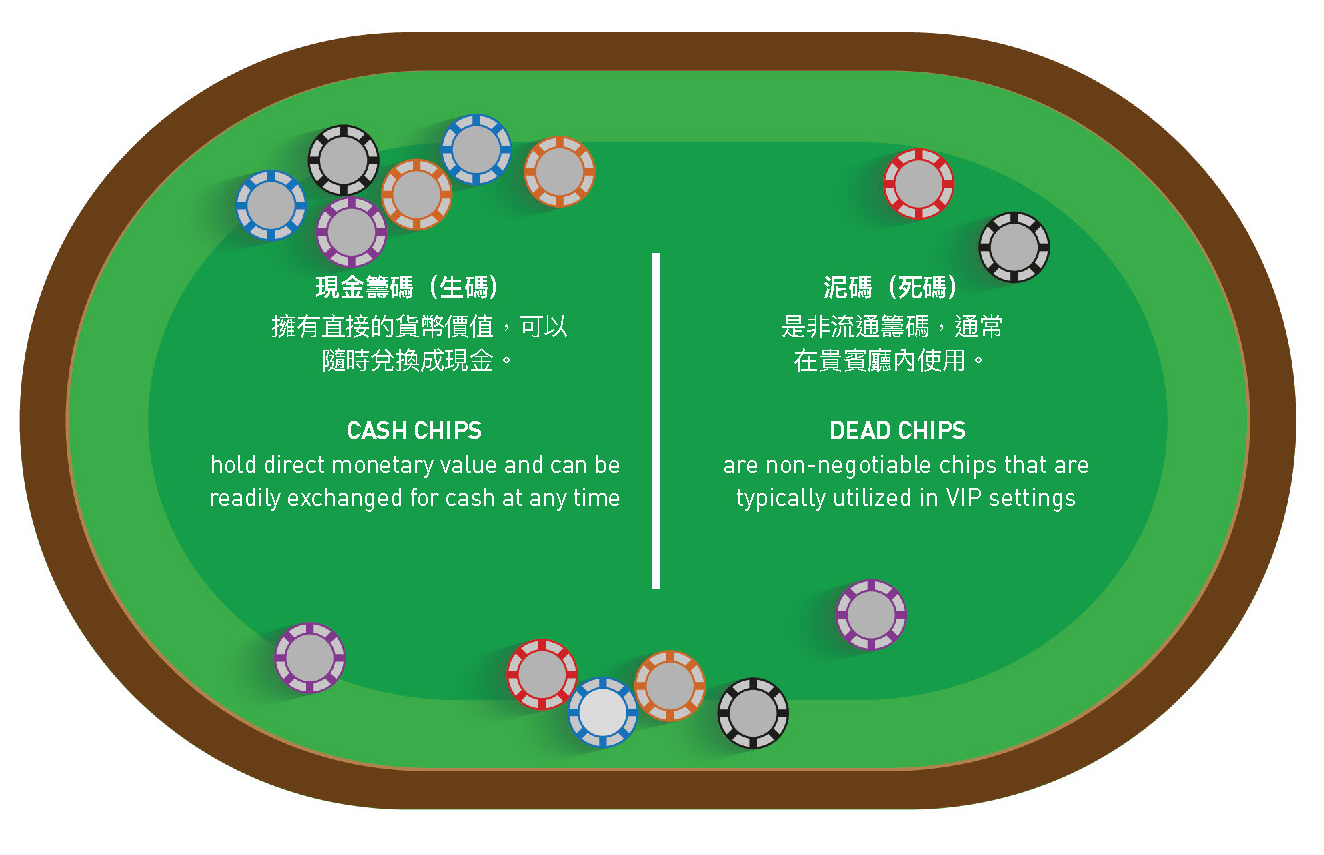

The most conspicuous distinction between the premium mass and VIP segments in Macau casinos centers around the use of different types of casino chips. As in mass gaming halls, cash chips are commonly used among premium mass players. These cash chips hold direct monetary value and can be readily exchanged for cash at any time. On the other hand, non-negotiable chips (dead chips) are typically utilized in VIP settings. Based on their financial background and credit history, certain VIP players are granted access to credit to facilitate their gaming activities.

Rewarded play

Rewarded play

Casinos offer rewards programs to foster customer loyalty and recognize players for their continued patronage. A crucial aspect involves determining the benefits for patrons based on their level of activity and engagement with casinos. Unlike VIP players, no cashback (commission) is provided to patrons in the premium mass market. Instead, premium mass players earn loyalty points and are actively rated during their casino visits.

A player-rating system is employed to gather data on various aspects of cash players’ behavior, including average bet, length of play and usage at gaming tables and machines. The accumulated points can be redeemed for various rewards, including hotel accommodation, resort amenities and other merchandise. The use of a “rating” by casinos to measure a player’s value highlights the significance of an accurate rating system in acquiring and retaining premium mass players, who gradually view casinos as a source of entertainment rather than a life-or-death situation.

Player migration

Player migration

In recent years, some local casinos have effectively redirected their business focus from VIP to a premium mass approach. This transition has resulted in business growth with minimal impact on their overall operational performance. Furthermore, a notable shift has been observed, with some VIP players transitioning to the premium mass market segment. This trend is evident as low/mid-end VIP players who previously frequented junket rooms gradually shift their gameplay to high-limit tables in the premium mass areas. It is also important to note that some of these players who used to be hosted by junkets do not meet the criteria to be classified as direct VIPs in casinos.

Supercharging the gaming industry

Supercharging the gaming industry

Macau’s new gaming laws bring about positive strategic changes within the local gaming industry. The advent of premium-oriented markets is ushering in a new era of opportunities for the sector. Despite the differences in organizational characteristics, the main objectives of the premium direct and premium mass markets remain consistent: attracting high-value players and enhancing both gaming and non-gaming experiences. By understanding the specific preferences, behaviors and expectations of both VIPs and upscale patrons, casinos can refine their operational strategies, attract a diverse customer base, and ultimately optimize their revenue potential.

Industry snapshot: premium-mass operations

While operational performance may differ among casinos, below is a snapshot of the operational aspects during a weekend in a high-end casino:

- In a general high-limit area open to the public, the average bet size per hand ranges from HK$18,000 to HK$20,000 (US$2,300 to US$2,555). Players typically have shorter gameplay sessions, lasting around half an hour.

- In the high-limit area reserved for members with higher member tiers, the average bet size per hand amounts to approximately HK$30,000 (US$3,835). In the area exclusively reserved for members of the highest tier, the average bet size is approximately HK$50,000+ (US$6,390+). Players in these areas tend to have longer gameplay sessions, averaging around two hours.