In this regular feature in IAG to celebrate 18 years covering the Asian gaming and leisure industry, we look back at our cover story from exactly 10 years ago, “The Last Resort”, to rediscover what was making the news in March 2014!

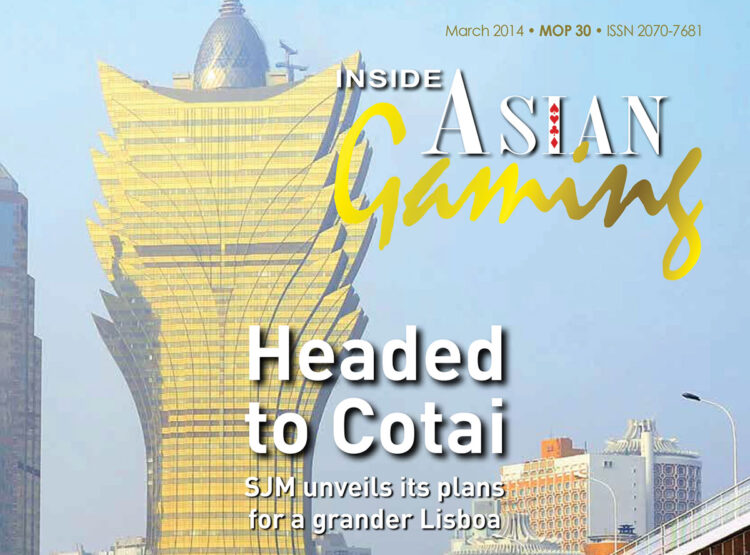

We’ve said it before and we’ll say it again – hindsight is a wonderful thing. Back in March 2014, our cover story featured none other than SJM’s Cotai integrated resort Grand Lisboa Palace after its owner, SJM, held a ceremonial ground-breaking in mid-February.

Little did we know at the time that GLP would not actually welcome its first guests until late July 2021 – it was initially forecast to launch by 2017 – nor that its early days of operation would face so many challenges.

Little did we know at the time that GLP would not actually welcome its first guests until late July 2021 – it was initially forecast to launch by 2017 – nor that its early days of operation would face so many challenges.

What is obvious looking back, however, is that early impressions were mixed.

Former Union Gaming Group analyst Grant Govertsen was an early fan, stating in a February 2014 note, “We believe that the Lisboa name has exceptionally high name-recognition with mainland visitors to Macau and should result in a natural attraction to the site.”

Adding that he would have been “disappointed” if SJM hadn’t brought its Lisboa brand to Cotai, Govertsen also praised the property’s design – a fanciful recreation of a palace in the grand style of Versailles, observing it is “certainly not the only new project with a French theme being constructed on Cotai [but] we think the theme resonates well with mainland consumers. Ultimately, mainland consumers view Europe in general and France in specific as very aspirational destinations.”

Adding that he would have been “disappointed” if SJM hadn’t brought its Lisboa brand to Cotai, Govertsen also praised the property’s design – a fanciful recreation of a palace in the grand style of Versailles, observing it is “certainly not the only new project with a French theme being constructed on Cotai [but] we think the theme resonates well with mainland consumers. Ultimately, mainland consumers view Europe in general and France in specific as very aspirational destinations.”

Others weren’t so sure. Morgan Stanley’s Praveen Choudhary said in a note that he was “concerned about SJM getting a proportionate number of tables to help maintain the return profile,” particularly if a neighboring site controlled by Angela Leong was to be developed into more non-gaming amenities.

This site [which was indeed to evolve into the non-gaming Lisboeta in the ensuing years]could add another HK$30 billion in capex and put further pressure on returns in the absence of a gaming element, he added.

Choudhary was also skeptical of the 2017 opening date – although even he didn’t expect a delay until 2021 – and of GLP’s location off the main Cotai Strip and therefore away from the action.

“It’s not that easy to get to,” he wrote.

Perhaps in some ways both analysts were right. Certainly, as Govertsen said, mainland customers have indeed shown they embrace European themes, although SJM may well have been beaten to the punch by Sands China’s triple treat in The Venetian Macao, The Parisian Macao and The Londoner Macao.

But Choudhary might have been closer to the mark in identifying concerns around timing and location. GLP ultimately opened in 2021 with a relatively small allocation of 150 gaming tables and fewer than 700 slot machines – since updated to 200 tables and 500 machines.

And ramp has certainly been slow, with the property still operating at a loss almost two years after launch. SJM reported a US$3.5 million EBITDA loss for GLP in 3Q23, albeit narrowed from a US$7.9 million in the prior quarter year, and continues to struggle with its off-strip location – as predicted so many years ago by Choudhary.

But management remains confident that things will improve, setting a market share target of between 5% and 6% compared to GLP’s 3Q23 share of 1.6%, as retail, F&B and event offerings continue to evolve. As always, time will tell!