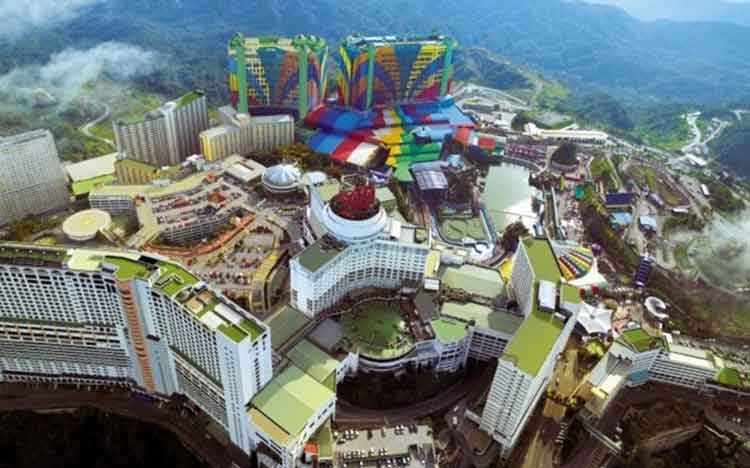

Last week’s revelation that Malaysia’s 2024 budget would include a 2% increase in service tax has seen Maybank Investment Bank trim Genting Malaysia’s FY24 earnings estimate by 4% and FY25 estimate by 5%. But there are measures the company can take at its Malaysian casino operation, Resorts World Genting (RWG), to minimize the impact, according to Maybank IB analyst Samuel Yin Shao Yang.

As reported by IAG, Malaysian Prime Minister Anwar Ibrahim announced last Friday that the nation’s service tax would increase from 6% to 8% as of 1 March 2024, a move that will directly impact RWG’s EBITDA margins given it has historically absorbed the tax on gaming activities.

However, in a Thursday note, Yin said the impact, while noticeable, could be minimal, particularly if RWG implements countermeasures available to it. The company could, he suggested, “cut junket commission rates or direct VIP rebates rates, raise hotel room rates, delay salary increments and ration water and energy consumption to moderate the impact of the service tax hike.”

Should the tax hike remain in place long-term, Yin said efforts by the government to boost tourism could also work in Genting Malaysia’s favor.

“Budget 2024 designated 2026 as a Visit Malaysia Year, targeting 26.1 million foreign tourists and MYR97.6 billion (US$20.5 billion) tourism expenditure,” he wrote.

“MYR350 million (US$73.4 million) will be set aside to boost tourism promotion and activities in 2024 and the issuance of visas-on-arrival, social visit passes and multiple-entry visas will be eased.

“We hope the current 15% shortfall in RWG visitor arrivals relative to 2019 will be narrowed with more tourists from major source markets like China and India. Pre-COVID, 40% to 50% of Chinese tourists visited RWG.”

Maybank IB is estimating Genting Malaysia, which has historically generated 80% of its revenues from RWG, will record core net profit of MYR576 million (US$121 million) in 2023, rising to MYR913 million (US$192 million) in 2024 and MYR1.01 billion (US$212 million) in 2025.