In this regular feature in IAG to celebrate 18 years covering the Asian gaming and leisure industry, we look back at our cover story from exactly 10 years ago, “Profitable plateau”, to rediscover what was making the news in June 2013!

It is certainly no understatement to suggest that the looming US$3.3 billion expansion projects in the works for Singapore’s integrated resort duopoly have been more than a decade in the making.

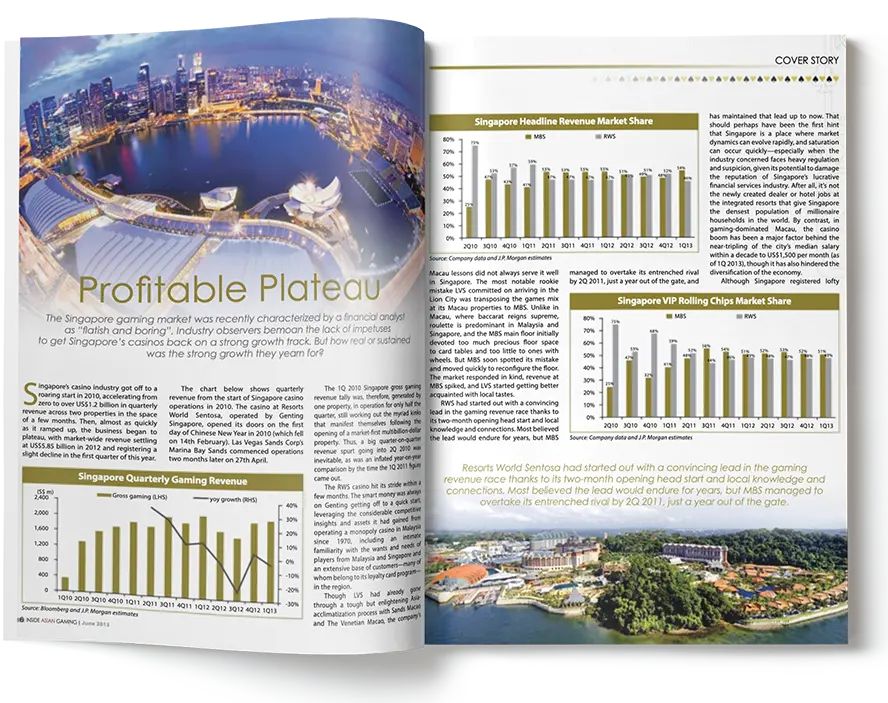

In the June 2013 issue of Inside Asian Gaming, published barely three years after Resorts World Sentosa (14 February 2010) and Marina Bay Sands (27 April 2010) first opened their doors, we bemoaned the fact that gaming revenues in the Lion City appeared to have plateaued.

Although working off a relatively small sample size at the time, we noted that year-on-year growth in the six quarters since 4Q11 had only ever climbed as high as 10% while overall market revenue had even contracted in two of the more recent quarters. This compared with the extraordinary growth trajectory of Macau, where industry-wide gaming revenues had climbed by double figures every year since liberalization including a 58% jump in 2010 and another 45% in 2011.

Although working off a relatively small sample size at the time, we noted that year-on-year growth in the six quarters since 4Q11 had only ever climbed as high as 10% while overall market revenue had even contracted in two of the more recent quarters. This compared with the extraordinary growth trajectory of Macau, where industry-wide gaming revenues had climbed by double figures every year since liberalization including a 58% jump in 2010 and another 45% in 2011.

One reason for the plateau, Union Gaming analyst Grant Govertsen suggested at the time, was the difficulty Singapore’s IRs were having in expanding their exposure to the premium mass market.

“The mass market story continues to be soft, and we believe will remain so for the foreseeable future,” Govertsen said. “With the local Singaporean market essentially maxed out, the focus on Malaysia and Indonesia continues – however, we believe that a significant portion of the high-value customers are likely already penetrated.”

However, just as challenging was capacity constraint – an issue that remains to this day and is ultimately at the heart of the 2019 negotiations that saw the Singapore Tourism Board grant each permission to expand.

Not that either MBS or RWS has ever struggled for profitability. In the first quarter of 2013, MBS reported Adjusted EBITDA of US$397 million while RWS reported Adjusted EBITDA of US$198 million. Adjusted for luck, those figures would have looked more like US$451 million and US$280 respectively. Both have consistently ranked among the most profitable casinos in the world.

Yet there is scope for much more, which is why MBS operator Las Vegas Sands (LVS) and RWS operator Genting Singapore are jumping at the chance to spend US$3.3 billion each to build more hotel rooms, gaming space and non-gaming amenities.

Yet there is scope for much more, which is why MBS operator Las Vegas Sands (LVS) and RWS operator Genting Singapore are jumping at the chance to spend US$3.3 billion each to build more hotel rooms, gaming space and non-gaming amenities.

Speaking with analysts on the company’s 3Q22 earnings call late last year, LVS Chairman and CEO Rob Goldstein said he expects MBS to soar well past the US$1.6 billion in annual EBITDA it was generating in 2019, reaching US$2 billion in the coming years and likely much more post-expansion.

“I think Singapore is just beginning,” Goldstein said. “Singapore is going to grow, for a couple of reasons. The destination is more powerful than ever, our building is getting better than ever and when you see a rebound from China and the rest of Asia, US$1.6 billion [in annual EBITDA] will look very small.

“I think we can grow to US$2 billion in the next couple of years if we get it right and the market recovers.”

Clearly the story of Singapore still has plenty to be told.